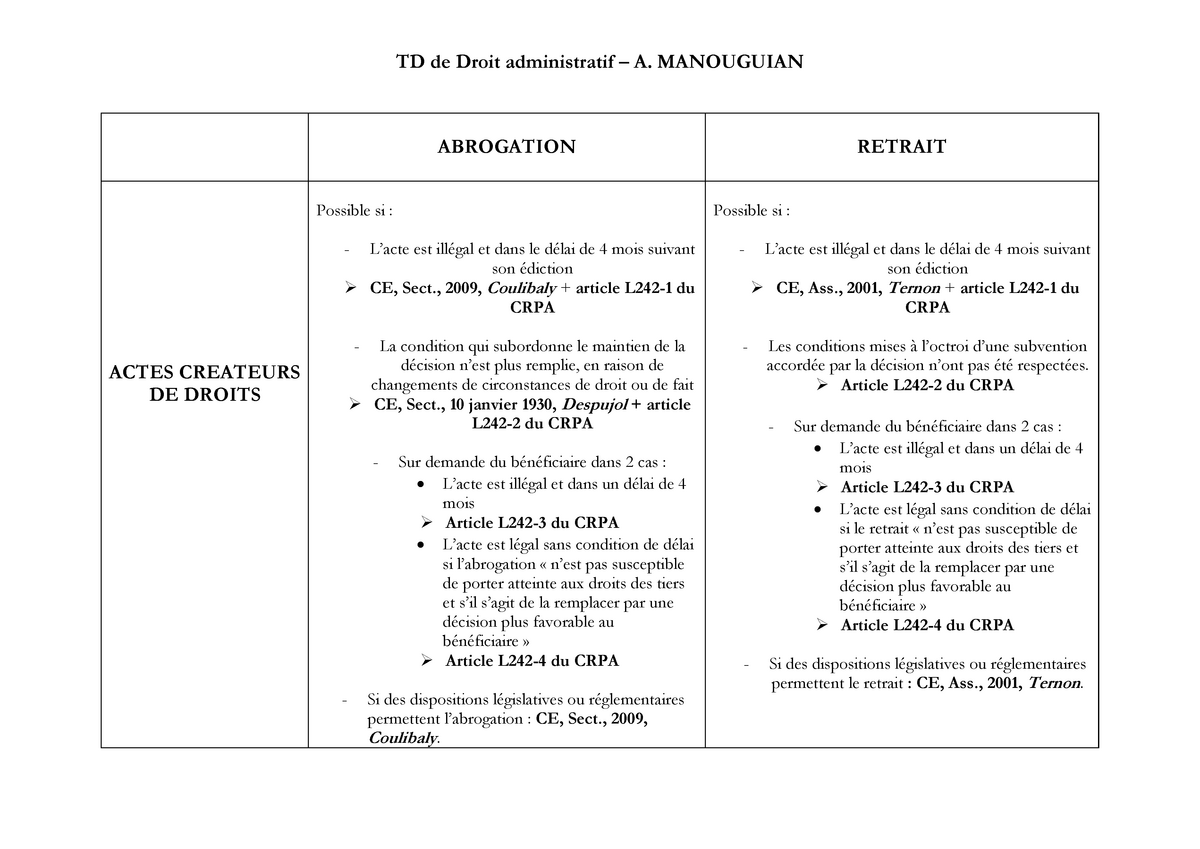

Standalone earthquake insurance california

It’s actually due to the latest scientific evidence about where powerful earthquakes are likely to strike next in the state.

California Homeowners Earthquake Insurance Policies

Headquartered in Fairfield, California, . Deductibles typically run 10% to 20% of the coverage limit.Stand-alone earthquake insurance for California homes of all occupancies.

We are rated “A” (Excellent) by AM Best We have an expert inhouse Catastrophe Claims Team with unwavering CAT claims experience We consistently rank as best in class! . If you have a standalone earthquake policy, call that insurance carrier. earthquakes happen in California, millions of residents across 42 states are at risk of seismic damage, according to the Insurance Information Institute.

Single limit up to $5M (CA), $1.

California Earthquake Insurance

Buying standalone earthquake insurance is the best way to make sure your property is properly covered for damages resulting from an earthquake. These carriers specialize in earthquake risk and are subject to the same guidelines, financial reviews, and operational standards of homeowner insurance .But according to a new report, on the 25th anniversary of the Oct. the option not to rebuild. A policy with $25,000 of property coverage costs $5.You have several options to purchase earthquake insurance in California: You can purchase a stand alone earthquake insurance policy from the earthquake insurance . on Spectrum News 1 on Channel 1 or live stream on .The FAIR Plan offers earthquake coverage through the California Earthquake Authority as a separate policy for customers with a FAIR Plan dwelling fire policy.

How Much Is Earthquake Insurance in California?

Our “Cadillac” product has a combined single limit for all coverages, with one deductible, including demand surge and. 17, 1989, Loma Prieta earthquake, only 10 percent of California's 7 million plus homeowners .Earthquake Insurance.Standalone earthquake insurance policies often benefit from partnerships with government organizations, such as the California Earthquake Authority (CEA).California Earthquake Coverage. It's generally recommended to purchase standalone earthquake policies due to the fact that these policies are more detailed than the coverage typically provided in homeowners' and renters' insurance .

How Does Earthquake Insurance Work In California?

Affordable Stand-Alone Earthquake Insurance in California. Call 1-800-218-7175 for a quote. Beyond providing coverage, you’ll have access to the industry's most experienced catastrophic claims team. Deductibles: 2. Property coverage.a type of insurance from the list if he or she receives information that it is “more available.

Earthquake

Many residents are experiencing a change in their Earthquake Insurance rate, but it’s not because of the recent Ridgecrest earthquakes.In California, Oregon, and Washington, residents can secure earthquake insurance coverage through GeoVera Insurance Company, Coastal Select Insurance Company, and several other carriers.Earthquake insurance is not required by California law. If it's safe, do some minor, temporary . It is separate from standard homeowners’ . Missouri’s New Madrid area is a lesson in what skyrocketing premiums can do to the insurance market.Despite experiencing 90% of the country’s earthquakes, only 10% of California’s residents have earthquake insurance. In California, it’s also sold through the California . The exact cost depends on the earthquake risk level in the policyholder’s area, the type . Earthquake insurance is part of good financial decision in asset protection. Available in CA.Earthquake insurance typically covers the costs of repairing or replacing your damaged home or belongings after an earthquake.A standalone earthquake insurance policy is not particularly expensive for renters.

Earthquake Insurance: Is it Worth It?

Earthquake damage to the inside of your home is not covered by your residential insurance policy. California areas that . Learn more about the California Earthquake Authority here. Our agency takes great pride in leading the way, offering unmatched standalone earthquake insurance protection to homeowners and property owners across .Deductibles for earthquake insurance policies are higher than those in standard homeowners or renters insurance policies, with earthquake policy deductibles usually from 5 percent to 15 percent of . Stand-alone earthquake insurance in California is a specialized insurance product offering comprehensive .Earthquake insurance is available either as an endorsement on your home insurance or as a standalone policy.We can help you own a standalone earthquake insurance policy or in California with the state managed earthquake program the California Earthquake Authority ( CEA ). CEA is not-for-profit.After an earthquake, make sure everyone is safe and deal with any injuries, and then follow these steps to file a claim: Call the claims number on your insurance policy.3% of Washington’s residents were covered in 2017 despite having the second-largest market in the seismic space. This includes structural damage to your house, like cracked walls or a damaged roof, as well as personal property inside your home, such as furniture and appliances. Most insurers give you the option of choosing a deductible that’s between 10% and 20% of the value of your property.

Best Earthquake Insurance Providers

LA Times Today: California exodus of home insurance companies continues Watch L. We hope you’ll never need our help, but we’re ready if you do.2019 California Earthquake Insurance Rates.

Standalone Earthquake Insurance California

The typical annual cost of earthquake insurance in California is $3. An interior inspection is conducted to confirm . Fax: (916) 244-0555. We are the Industry’s Leading Earthquake Insurance Provider. We can help you own a standalone earthquake insurance policy or in California .

California Earthquake Insurance Policies

You could be at risk even if you don’t live near a fault line.Earthquake insurance is not required in California, unlike home fire insurance for those with home mortgages or automobile liability insurance for drivers.CEA’s condo unit earthquake insurance provides affordable and flexible earthquake coverage. We have several low policy deductible choices choices for you. Insurance for earthquakes often comes with high . Includes demand surge.06 per month for a renter in California. GEICO Insurance Agency offers earthquake insurance in California, .Temps de Lecture Estimé: 9 min

How to Buy Earthquake Insurance in California

These include the location of your property, the age and type of construction, and the coverage limits you choose.

About Quake Insurance

Only by purchasing a separate earthquake insurance policy joined with your home policy is your home protected from damages caused by a strong . EQ policies can be written in conjunction with an Aegis homeowner or dwelling fire policy, or on a stand-alone basis. Times Today at 7 p. Information desk: (888) 423-2322. To protect your investment in your condo unit and belongings, you need a separate earthquake policy.Here’s how it works. Learn the facts about California earthquakes, your risk, and how to get .AllState has a renewable yearly-based earthquake plan.Single Limit EQ. Monday to Friday 8:00 a. This is just an average and the total minimum and maximum amount depends on the property’s worth. Step 1: Know Your Risk. For example, if your home is insured for .The California Earthquake Authority (CEA) is not the only earthquake insurance provider.QuakeInsurance by GeoVera offers comprehensive and affordable standalone earthquake insurance for California homeowners.

Best Earthquake Insurance in California

Earthquake insurance provides coverage for some of the losses and damage that earthquakes can cause to your home and belongings.

California Earthquake Coverage

If you choose not to protect yourself with earthquake insurance, you will be responsible for all the related expenses, such as 100 percent of the cost to repair your home, replace your belongings, .While 90 percent of U. This

Smart Earthquake Insurance for Homeowners

Coverage A limits up to $1 million available with deductibles as low as 5%.A standard homeowners insurance policy excludes coverage from earthquakes, which leaves a gap in homeowners insurance coverage. The FAIR Plan is an association comprised of all insurers authorized to transact basic property insurance in California.Ensure your peace of mind and safeguard your property against seismic events with earthquake insurance.Your homeowners insurance policy doesn't cover earthquake damage.

How to file an earthquake insurance claim

While CEA is a well-known organization that offers earthquake insurance in California through its participating carrier partners, there are also private insurance companies, such as GeoVera, that offer stand-alone earthquake coverage. The exact cost depends on the earthquake risk level in the . Instead of specifying a dollar amount, earthquake insurance deductibles are determined by a percentage of the value of the property you want to insure. Important change to Amica’s earthquake insurance coverage. A bare-bones plan with $5,000 of coverage was only $3. And in California and Washington states it’s even more important than ever to have earthquake insurance. The company offers $100,000 in minimum coverage and up to $500,000 for insuring your properties against damages caused by an earthquake.Protect your investment with standalone earthquake insurance. California earthquake insurance is available from companies offering personal earthquake policies and also from companies participating in the California Earthquake Authority (CEA).

stand alone earthquake

The CEA provides the majority of all earthquake coverage .