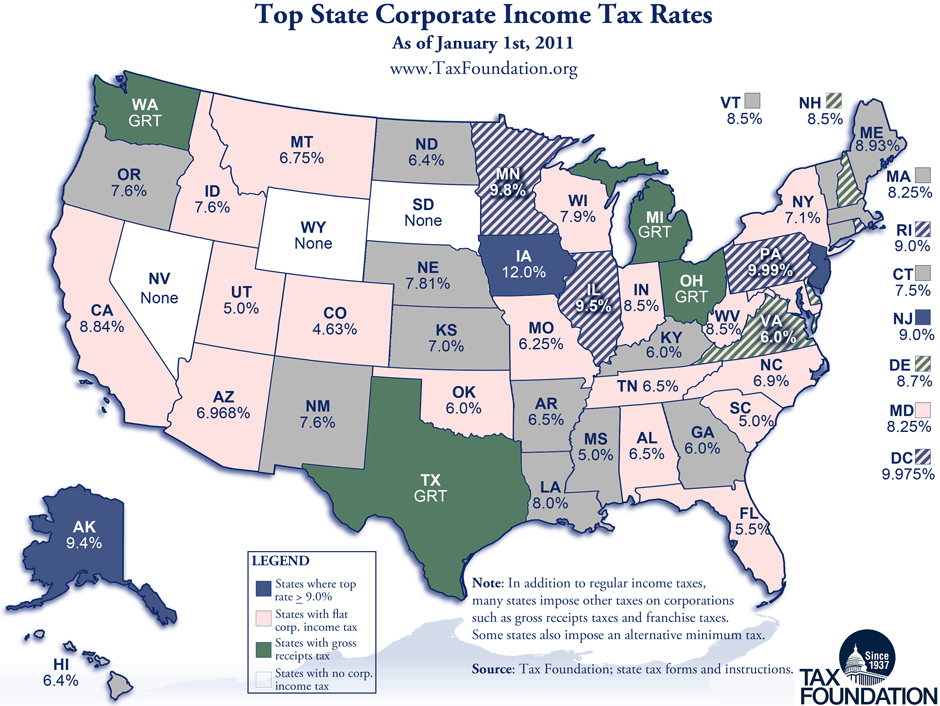

State income tax by state

/state-income-tax-rates-2-2014-tax-foundation-57a631e35f9b58974a3ad3a4.png)

Your Guide to State Income Tax Rates

Explore the latest 2024 state income tax rates and brackets.

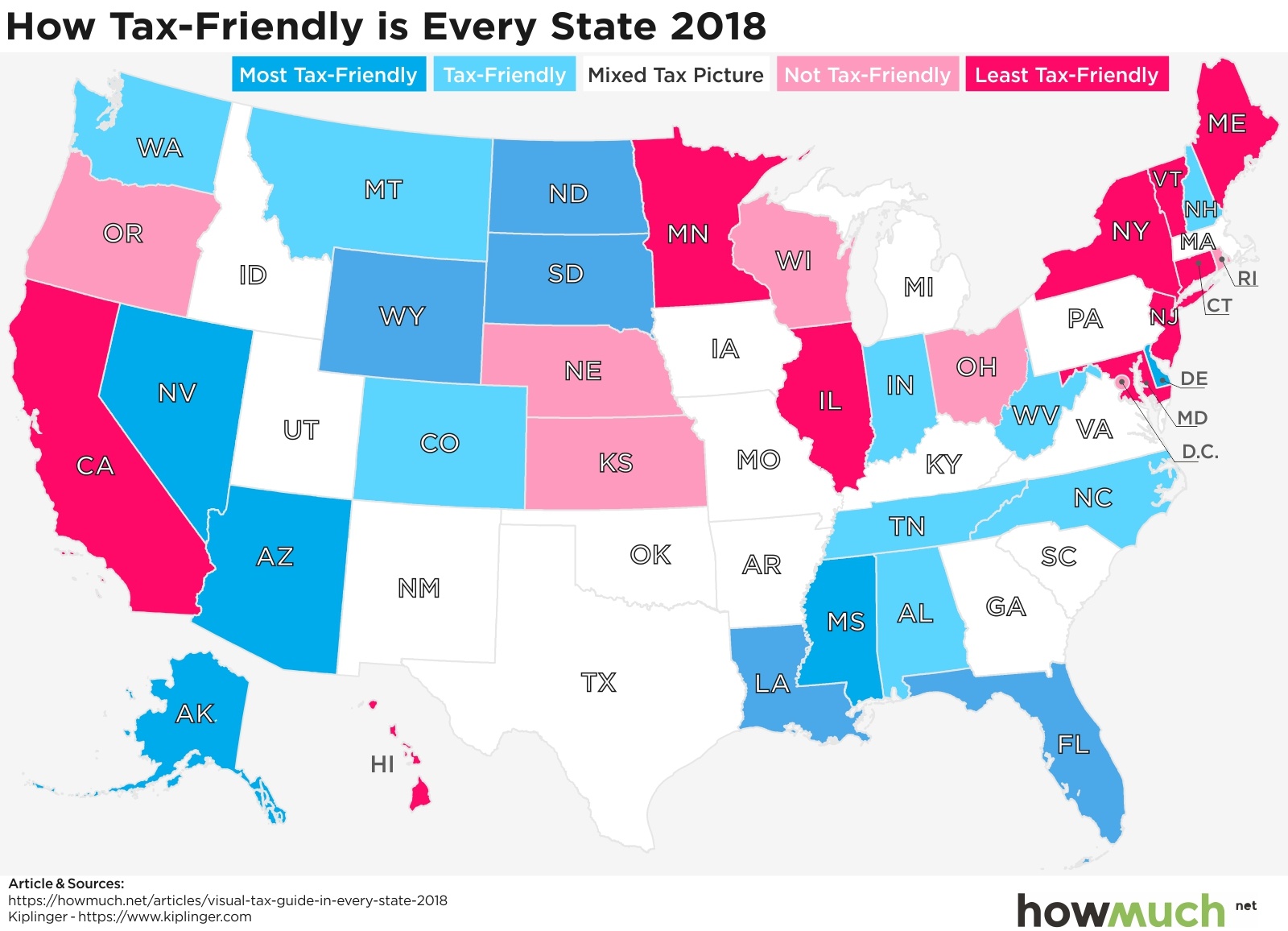

These are the states with the highest and lowest tax burdens, a

See the total state tax, effective tax rate, and average tax rate for each .44% Minnesota - 9.06 million and that goes up to $12. California also . Those states have reciprocity agreements with Illinois, which means: Illinois residents who work in these four states must pay income tax to Illinois rather than their work state.

Tax Data by State. States that impose a flat rate of income . Find out which states don't have income tax at all, and how to save money on your state tax bill.There are nine California state income tax rates, ranging from 1% to 12.84 percent corporate income tax rate.

28% Connecticut - 9.00 percent to 13. Retail sales taxes are . The chart also shows if the state has a flat tax rate, meaning, only one rate of tax applies regardless of the wages paid; or alternatively, the highest marginal withholding rate according to the state's latest computer withholding formula. Easily stay ahead of the latest state, federal, and international tax developments with expert analysis, news, and primary sources all in one place.Our paycheck calculator is designed to provide accurate breakdowns, giving you insights into how much of your earnings go to federal, state, and FICA taxes.

2024 State Income Tax Rates and Brackets

The individual income tax is important to businesses because states tax sole proprietorships, partnerships, and in most cases limited liability companies (LLCs) and S corporations under the individual income .

State Tax Maps Archives

Learn about the key features and changes of individual income taxes .14% Vermont - 10. How do income taxes compare in your state? 8 min read. Get facts about taxes in your state and around the U.; California has the highest tax rate with its highest income bracket at 13%, .6% on income taxes, 4.State Individual Income Tax Rates and Brackets, 2024.

State Individual Income Tax Rates

But the above chart provides a rather crude measurement of comparative state and local tax burdens because everybody is lumped together regardless of income.

Income Tax by State: Which Has the Highest and Lowest Taxes?

For tax years ending on or before December 31, 2019, Individuals with an adjusted gross income of at least $5,500 must file taxes, and an Arizona resident is subject to tax on all income, including from other states. Bringing together state tax tools, chart builders, and primary sources, you can streamline all your work on our comprehensive, state-focused platform. Census Bureau, Internal Revenue Service (IRS), and others.3% for individual single taxpayers who earn approximately $625,369 every year.This map Top State Marginal Individual Income Tax Rates does not show effective marginal tax rates, which would include the effects of phase-outs of various tax preferences. New Jersey offers tax deductions and credits to reduce your tax liability, .Compare income taxes by state for different family types and income levels using an interactive tool.

.png)

Navigating the complex landscape of LLC taxes by state is a crucial part of running a successful business. We do our best to ensure that all of our tax rates are .Our state tax policy team regularly provides accessible, data-driven insights on state tax rates, collections, burdens and more, from sources such as the U. States employ varying tax systems, with graduated-rate taxation (progressive rates) most commonly adopted by . It ranges from 18% to 40% depending on the taxable amount.

PA Department of Revenue Homepage

15% Lowest tax burdens.Taxes by State.

2024 State Tax Data: Facts & Figures

Facts and Figures 2020: How Does Your State Compare?

State Individual Income Tax Rates.

A Comparison of State Tax Rates

State Income Taxes 2024. Sales and income taxes are generally high, but effective property tax rates are below the national average.

For visualizations and further analysis of 2021 state tax data, explore our state tax maps, the latest edition .52 lignesUS income tax rates vary by state, and each state has its own personal income tax rate, while some have none.

Local income taxes are not included.

New Hampshire, which doesn't tax earned wages, will join that list in .State Sales Tax Rates.7% of their total income to state and local taxes.

2023 State Income Tax Rates and Brackets

Massachusetts taxpayers pay 10.

Income Taxes Across The States

• Of those states taxing wages, nine have single-rate tax structures, with one rate applying to all taxable income .

State Tax Calculator

Laura Kelly talks about her top goals for the year during her State of the State address, Jan.

The Ultimate Guide to Income Tax by State

Forty-one tax wage and salary income, while two states–New Hampshire and Tennessee–exclusively tax dividend and interest income. If your refund is not credited to your account within 15 days of this date, check with your bank to .All of our bracket data and tax rates are updated yearly from the IRS and state revenue departments.FILE - Kansas Gov. That includes 4.5% (on taxable income from $10,000 to $60,000) 6%: Wisconsin: 4-7.The state supplemental income tax withholding rates currently available for 2020 are shown in the chart below.The states with the highest burden for income tax are New York (4.For state income taxes, the highest rate is 12.The state income tax rates range from 1. February 21, 2023.Harrisburg, PA — With the deadline to file 2023 Pennsylvania personal income tax returns approaching, the Department of Revenue is extending its cus.If you are not a national of a Member State of theEU: titleContent or the EEE, special provisions may be provided for by international convention.Five states follow with 4 percent rates: .State Tax Burdens 2022.76% Maryland - 9. (**) State only taxes interest and dividends income.There is no federal inheritance tax, but there is a federal estate tax.In Montana, North Dakota, and Utah, nonresident “key employees” (such as higher-income business executives) are excluded from filing relief. This page lists state individual income tax rates for all fifty states, including brackets for those filing both as an individual and jointly with a spouse.Individual income taxes are a major source of state government revenue, accounting for 38 percent of state tax collections in fiscal year 2018, the latest year of data available.

State Income Tax Rates 2024

By phone: 1-800-323-4400 for our automated refund system.

Learn which states have the highest, lowest, or flat income tax rates, and how to compare them by state.An individual's state tax bill depends on exemptions, deductions, and credits; and states differ on what tax breaks they offer and who qualifies.

Paycheck Calculator

For information about refund adjustments, see Additional information about New York State income tax refunds. Compare the top . Four states tie for the second-highest statewide rate, at 7 percent: Indiana, Mississippi, Rhode Island, and Tennessee.75%, and the sales tax rate is 6.92 million in 2023.

Income Tax by State 2024

For a visual comparison of state income taxes across the United States, see our state . If your 2023 federal adjusted gross income (FAGI) was $79,000 or less, you qualify to receive free tax assistance from the Tax Department.KEY TAKEAWAYS ON STATE INCOME TAX RATES.The lowest non-zero state-level sales tax is in Colorado, which has a rate of 2. When can I start checking my refund status? 4 weeks or more after you file electronically; At least 12 weeks after you mail your return; 15 weeks or more for additional processing requirements or paper returns sent by certified mail.

Department of Taxation and Finance

April 01, 2024 Harrisburg, PA — Pennsylvania collected $6.46 lignesStates with maximum state income tax rates of at least 6% but less than 8% include Wisconsin, Maine, Washington, Connecticut, Montana, Nebraska, Delaware, .In at least 25 states and territories nationwide, Solar for All is launching new programs where there has never been a substantial low-income solar program before.83% New Jersey - 9.4% on property taxes, and 3% in sales and excise taxes.Critiques : 153,4K

State tax levels in the United States

Download state_income_tax_rates.

State Income Tax Rates and Brackets, 2021

The value of Bloomberg Tax Research.

California Income Tax 2023-2024: Rates, Who Pays

California has the highest state-level sales tax rate, at 7. In 2022 the exemption is $12. Individual Taxes State and Local Issues.Anyone who receives income in Illinois must pay state income tax. Based on this chart, New Hampshire taxpayers pay 9. The chart also shows if the state has a flat tax rate, meaning only one rate of tax applies regardless of the wages paid, or alternatively, the highest marginal withholding rate according to the state's latest computer withholding formula.75% MA* 00 CT 6.41% Illinois - 9.No state income tax: 6. Alaska has the lowest total tax burden, as its residents pay no income tax.When you click “submit,” you’ll get the latest status on your refund. Individual income taxes are a major source of state government revenue, accounting for more than a third of state tax collections.Find out how each state taxes wage and salary income in 2023, with single or graduated rates, brackets, exemptions, and deductions. For visualizations and further analysis of this data, explore our weekly state tax maps or join our weekly tax .Compare the income tax rates and brackets of all 50 states and the District of Columbia for 2021. State and Local Sales Tax Rates, 2024 .This week’s map examines states’ rankings on the individual income tax component of our 2022 State Business Tax Climate Index. Learn about TAP. The only exceptions relate to Wisconsin, Iowa, Kentucky, and Michigan. New York has the highest total tax burden, with residents paying out around 12% of their income to state and local governments.3 billion in General Fund revenue in March, which was $289. We can help you prepare and e-file your 2023 federal and state income tax returns in person or virtually.

Income Tax Rates By State 2024

There are eleven states in the U. However, many lesser-discussed taxes, like higher sales and property taxes, can . States employ varying tax systems, with graduated-rate taxation (progressive rates) most commonly adopted by 30 states. State tax levels indicate both the tax burden and the services a state can afford to provide residents.; Some states opt for a flat tax rate, meaning all taxpayers pay the same tax rate on their income.Eight states impose no state income tax, and a ninth, New Hampshire, imposes an individual income tax on dividends and interest income but not other forms of income .72%), Maryland (4. Tax brackets depend on income, tax filing status, and state residency. A direct deposit of your refund is scheduled to be issued on [mm/dd/yyyy]. If your refund contains a New Jersey Earned .For 2023, states with high income tax rates include California at 13.65% (on taxable income from $12,910 to $355,900) 5%: Wyoming: No state income tax: 4%: Conclusion.The state supplemental income tax withholding rates currently available for 2021 are shown in the chart below. Seven states levy no income tax at all.• Forty-three states levy individual income taxes. Our state tax calculator (income tax calculator by state) helps you to estimate the state tax on your income and see how state tax brackets are .Fmr NFL coach Brian Billick previews 2024 draft, weighs players' concerns about sky-high state income taxes Anticipated first-overall pick Caleb Williams will pay . Here are the top marginal individual income tax . (*) State has a flat income tax. Many people consider state income taxes when deciding where to retire.50%: West Virginia: 3-6. Browse State Tax Maps. that try to keep things simple when it comes to state income tax rates. If you earn $50,000 per year or $500,000 per year, the person earning $50,000 will pay the same percentage of income tax as the person who earns $500,000.Total Tax Burden. Finally, one state, .California has among the highest taxes in the nation. There are nine states with no income tax – Alaska, Florida, Nevada, New Hampshire . As we have discussed, . California has a 8.