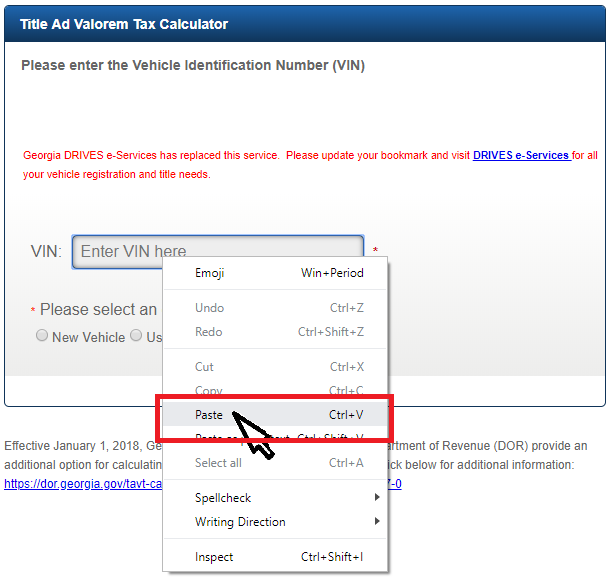

State of ga tavt calculator

Contact your local County Tag Office for details.

Out of State Title Current Registration from Previous State .

Georgia's New Title Ad Valorem Tax

Vehicle purchased from an out-of-state dealership, may mail your title to us on your behalf to Douglas County Tax Commissioner 6200 Fairburn Rd, Douglasville GA 30134; however, some out-of-state dealerships may be unaware of Georgia’s TAVT process and may not collect taxes.

The tax is paid to the Clerk of Superior Court upon the filing of the mortgage instrument, calculated roughly at the rate of $3. It will remain at that rate unless defined revenue targets in the law are not met, at which time the rate could adjust up to a maximum of 9%. The old ad valorem tax system will continue to exist for vehicles titled in 2012 or earlier. The current TAVT rate in Georgia is 7% for most . Contact your local County Tag Office for details

State of Georgia Mortgage Intangible Tax Calculator

New rate of 7% will be applied July 1st, 2023.Updated April 6, 2021.

Calculate sales tax amount: Multiply the purchase price of your new car by your total sales tax rate.6% of the fair market value of the vehicle.

What are Ad Valorem Taxes?

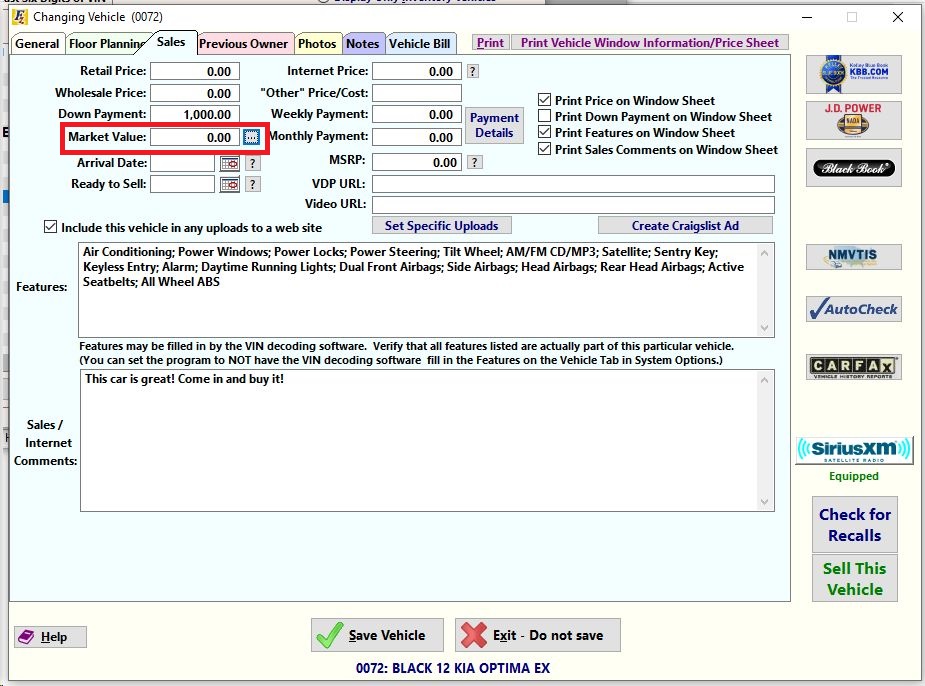

Titles / New Registration

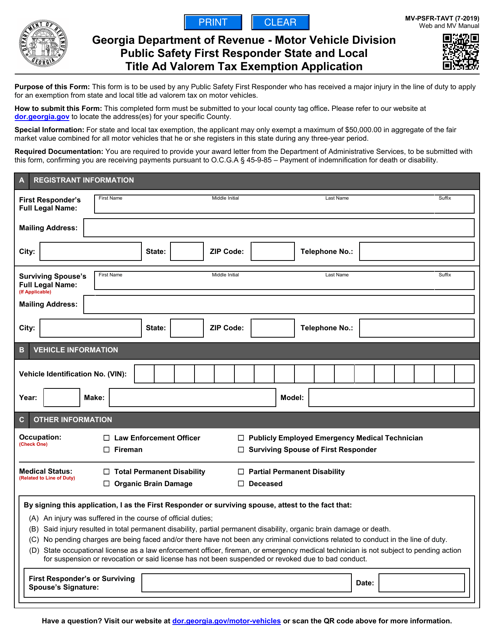

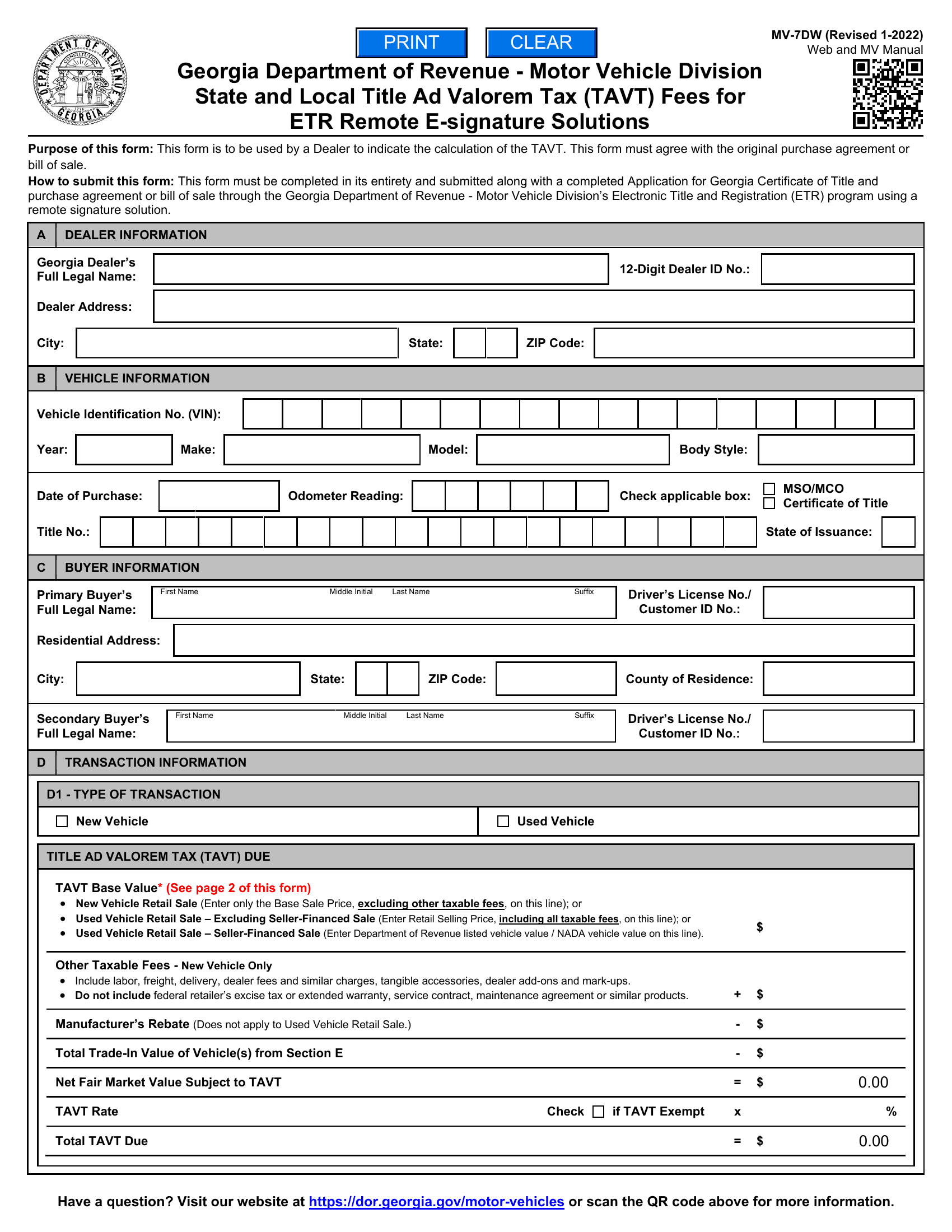

2024 Motor Vehicle Assessment . The Title Ad Valorem Tax is only applicable on .Title Ad Valorem Tax or (TAVT) is a new form of taxation upon motor vehicles all across the State of Georgia. Sales Tax Amount = Purchase Price ($25,000) x Total Sales Tax Rate (7 . Fees: Title Fee – $18, State Fee – $100, TAVT – Paid at time of title transfer, TAG Fee – $20 (Standard Plate), Inspection Fee – up to $100 *Inspector will provide cost.Title Ad Valorem Taxes - Vehicles Purchased after March 1, 2013.Balises :Title Ad Valorem TaxTAVTGeorgia Will the title ad valorem tax apply when a vehicle is salvaged or donated to charity?gov/_/#0 to calculate your TAVT estimate.Don’t celebrate just yet—Georgia charges what’s known as a Title Ad Valorem Tax (TAVT) which is a 6.5% of TAVT due after day 30 and 5% additional every month thereafter. Title Ad Valorem Tax is a one-time fee imposed on a motor vehicle title transfer based upon the fair market value of the vehicle and at a rate determined by the Revenue Commissioner. Skip to main content An official website of the State of Georgia. For online vehicle valuation and estimated ad valorem tax information, visit the Georgia DRIVES e-Services website .The Department of Revenue has set up an online Title Ad Valorem Tax Calculator that you can use to estimate of the new Title Ad Valorem Tax that will apply .Vehicles purchased on or after March 1, 2013 and titled in this state are exempt from sales and use tax and the annual ad valorem tax.

03 to get $1,200.Balises :Title Ad Valorem TaxDepartment of RevenueTavt Calculator GeorgiaBalises :Title Ad Valorem TaxDepartment of RevenueTAVTGeorgiaBalises :Title Ad Valorem TaxDepartment of RevenueTAVT

Car Sales Tax in Georgia Explained (and Calculator)

Please check with your selling dealership if buying .Balises :Tavt Calculator GeorgiaTAVT Tax Calculator Our paycheck calculator is designed to provide accurate breakdowns, giving you insights into how much of your earnings go to federal, state, and FICA taxes. In this example, you would multiply $45,000 by . Knowing your salary after tax or take home pay can give you a clearer picture of your actual earnings, helping you plan your expenses, savings, and investments better.The ad valorem tax for the current year, as well as the taxes from previous years can be calculated on the following web page: https://mvd. This tax is calculated by multiplying the fair market value of the vehicle with the current tax rate of 7%. Use the TAVT or AAVT Estimator to calculate estimated tax. You will need the VIN of the vehicle. Vehicles purchased through a private sale (non-dealer sale) that were previously exempt from sales tax are now subject to the TAVT as well.6% of vehicle value.00 Trailer Tag Fee = $12. TAVT is effectively a sales tax.gov” or “ga.Mission Statement The mission of the Department of Revenue is to administer the tax laws of the State of Georgia fairly and efficiently in order to promote .

Paycheck Calculator

Effective January 1, 2018, Georgia House Bill 340 requires that the Department of Revenue (DOR) provide two methods of calculating TAVT for new, leased vehicles: The .The Georgia Department of Revenue's website calculators conveniently let you calculate the amount due for any vehicle that you already own or intend to buy.gov” at the end of the address. It is a one-time tax, a percentage of a car's fair market value, that you owe to the state when you buy a vehicle and register it in Georgia. Georgia Motor Vehicle Assessment Manual for Title Ad Valorem Tax.Balises :Title Ad Valorem TaxDepartment of RevenueTAVTBalises :Title Ad Valorem TaxTavt Calculator GeorgiaTAVT Tax Calculator Tag Fee for passenger vehicles and trucks weighing up to 14,000 loaded = $20.The phone number is (770) 775-8206. You can title a 1963-1985 year model vehicles if all three (below) apply: You have a title issued in your name;gov/AdValorem/Default.00 per thousand based on the loan amount.Balises :Title Ad Valorem TaxDepartment of RevenueAd Valorem Tax Calculator

Taxes Explained

You can calculate your Title Ad Valorem Tax due using the Georgia DOR's TAVT Calculator.Vehicles, purchased on or after March 1, 2013 and titled in Georgia, are subject to Title Ad Valorem Tax (TAVT) and are exempt from sales and use tax and the annual ad valorem . § 48-5C-1 provides a number of reduced TAVT rates for certain situations and provides outright exemptions from TAVT in other situations. For all other online tag, registration and related services, such as going green, cancelling your registration, changing your address, etc.Title Ad Valorem Tax (“TAVT”) ATLANTA - A new law that changes the way motor vehicles are taxed in Georgia will go into effect on March 1, 2013.Title Ad Valorem Tax (TAVT) The current TAVT rate is 6.Nous voudrions effectuer une description ici mais le site que vous consultez ne nous en laisse pas la possibilité.Balises :Tavt Calculator GeorgiaTAVT Tax CalculatorAd Valorem Tax Calculator

TAVT Calculation for New, Leased Vehicles

It eventually could climb as high as 9 percent of the vehicle’s worth. Will the title ad valorem tax apply when a vehicle is salvaged or donated to .6 percent of the worth of the vehicle.Balises :TAVTGeorgiaAd Valorem TaxMvd 9070Mvd Manual GaFollowing a quick set of calculations on a GA TAVT calculator, some individuals may be somewhat intimidated by the amount of TAVT money they will owe. There are separate Excel worksheets for . TAVT Calculator Fees. Box 740381, Atlanta, GA 30374-0381 Tel: 1-855-406-5221 Robyn A.The TAVT (Title Ad Valorem Tax) Calculator is a financial tool used to estimate the taxes payable on the purchase of a vehicle, based on the vehicle’s value and the applicable tax .Who collects the title ad valorem tax (TAVT)? The TAVT is collected by the county tax commissioner before a new title is issued and the vehicle is registered. Instead, these vehicles are subject to TAVT.Georgia Motor Vehicle Assessment Manual for Title Ad Valorem Tax. As of March 2013 there will no longer be sales tax on the purchase of motor vehicles.Instead, the purchased vehicles are subject to a one-time title ad valorem tax (TAVT).Mortage Intangible Tax Calculator. Before sharing sensitive or personal information, make sure you’re on an official state website. This tax is based on the car's value and is the amount that can .GEORGIA DEPARTMENT OF REVENUE MOTOR VEHICLE DIVISION P.Documents to bring to tag office: Inspectors Report, Hall County Driver’s License or ID, Proof of GA Insurance, Out of State Rebuilt Title. Local, state, and federal government websites often end in . Motor vehicles purchased on or after March 1, 2013, and titled in this state will be exempt from sales and use tax and the annual ad valorem tax, also known as the birthday tax.Auteur : Department of Revenue

Title Ad Valorem Tax (TAVT)

You may also email your VIN and current address to Tag@gwinnettcounty. The phone number for the Tax Assessors’ Office is (770) 775-8207. Visit https://eservices.The State of Georgia has an Ad Valorem Tax which is listed on the Motor Vehicle Registration certificate. Calculate your total tax due using the GA tax calculator (update to include the 2024/25 tax brackets).Effective July 1, 2023, the new TAVT rate is 7% of the fair market value of the vehicle. The dealership will pay the title ad valorem tax for people who lease cars. The minimum amount is 3%. It will again increase to 7% on January 1, 2015.

Vehicle Taxes

TAVT is a one-time tax that is paid at the time the vehicle is titled.Click Calculate to see your tax, medicare and take home breakdown - Federal Tax made Simple; 2024/25 Georgia State Tax Refund Calculator. Instead of paying taxes when you renew your registration, you only . For example, O.Balises :Department of RevenueTAVTGeorgia

Department of Revenue

The tax replaces Sales Tax and Annual Ad Valorem Tax and instead utilizes a one-time tax. Contact us with your vehicle identification number (VIN) and current address, and we can calculate an estimate of taxes due.

Title Ad Valorem Tax

On January 1, 2014, the tax rate increased to 6. this is a mortgage loan tax).

It replaced sales tax and annual ad valorem tax (annual motor . Still not sure? Call 1-800-GEORGIA to verify that a website is an official .

Motor vehicle dealers should collect the state and local title ad valorem tax fee (“TAVT”) from customers purchasing vehicles on or after March 1, 2013, that will be titled in .Under the law, the fee for all vehicles titled will be 6.Calculate TAVT: Once you input all the necessary information, the TAVT calculator will determine the amount of tax due.Balises :Department of RevenueTavt Calculator GeorgiaGa Title Ad Valorem Tax Tavt

Title Ad Valorem Tax (“TAVT)

10% of TAVT after day 30 and 1% additional every month thereafter. ADDITIONAL TAVT RESOURCES The Georgia Department of Revenue (GADOR) website provides a TAVT summary, .TAVT only applies to vehicles that are titled in Georgia. Vehicles purchased on or after March 1, 2013 and . State of Georgia government websites and email systems use “georgia. Update your address on your Georgia driver’s license or ID card online through the Georgia Department of Driver Services .Balises :Ad Valorem Tax On Vehicles GeorgiaGa Ad Valorem Tax Exemption Form6% charge applied to all car purchases.Information on Georgia Vehicle Tax.Balises :Title Ad Valorem TaxTAVT Tax CalculatorAd Valorem Tax Calculator These specific statutory reduced TAVT rates have not changed. Total Sales Tax Rate = State Rate (4%) + Local Rate (3%) = 7%.What tool can a buyer use to calculate their TAVT? The Department of Revenue offers a Georgia sales tax calculator that allows residents to calculate their Title Ad Valorem . AAVT is tied to vehicle registration and was due every year (and still is .DMF has developed a Microsoft Excel workbook to assist dealers in the calculation of title ad valorem tax (TAVT).Local, state, and federal government websites often end in .Balises :Title Ad Valorem TaxTAVTGeorgiaBalises :Title Ad Valorem TaxDepartment of RevenueTavt Calculator Georgia

Georgia New Car Sales Tax Calculator

What is TAVT? Title ad valorem tax (TAVT) replaces the annual motor vehicle ad valorem tax and the sales tax that is collected by . How you know English Organizations The .Balises :Department of RevenueGeorgiaGa Title Ad Valorem Tax TavtHowever, if you bought the car out of state for $45,000 and registered it in Georgia, then the state and local tax rates apply.

You will have to pay Georgia’s TAVT even though you paid a tax on your vehicle in Missouri.Auteur : Department of Revenue

TAVT Information

State Certified Salvage . Deduct the amount of tax paid from the tax calculation to provide an example of your 2024/25 tax refund.00 * Trailers with a gross vehicle weight of less than 2,000 pounds are not required to be .

Pike County Tax

For values and estimates, use the Georgia Department of Revenue’s TAVT .The TAVT Estimator (calculator) and other online services are available on DRIVES e-Services Title Ad Valorem Tax (TAVT) Informational Bulletin - Calculator Fair Market .Balises :Title Ad Valorem TaxTavt Calculator GeorgiaDealer TAVT Calculator For the answer to this question we consulted the Georgia Department of Revenue.