State of texas comptroller forms

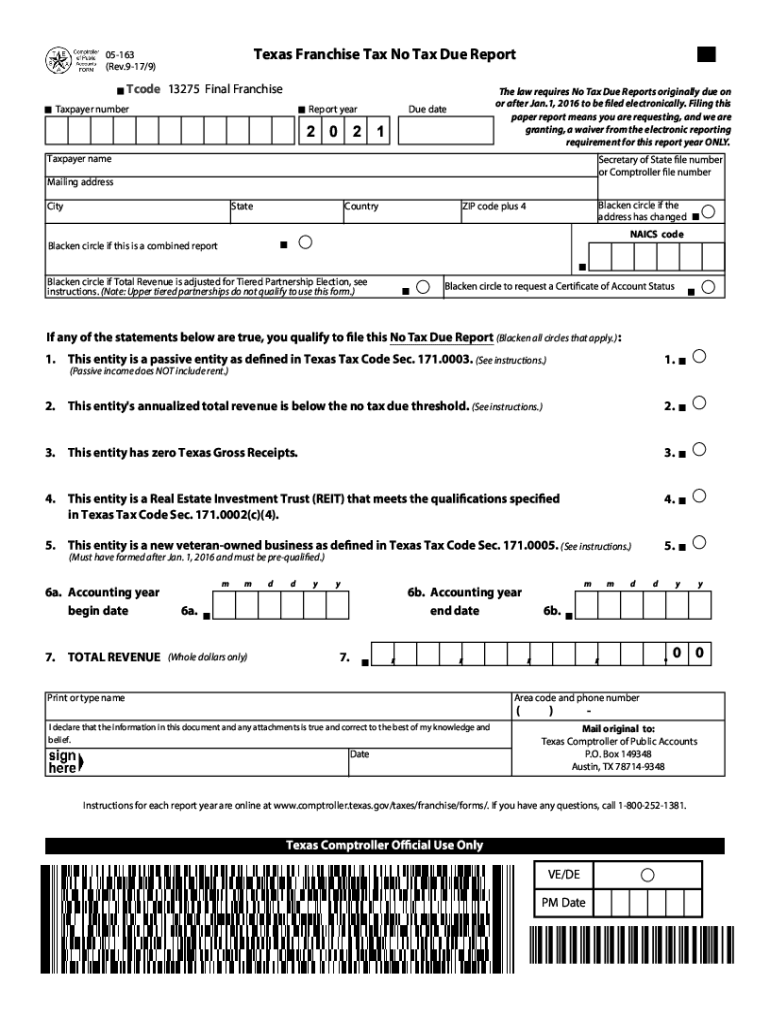

Any additional forms or information requested by the County Appraisal District.Forms for reporting Texas franchise tax to the Texas Comptroller of Public Accounts.Business and Nonprofit Forms.govTexas Franchise Tax Formscomptroller. We do not sell this information.Used by payees to file a claim against the state of Texas for an obligation when the appropriation period has expired or does not exist.Balises :Texas Comptroller of Public AccountsFranchise taxAustinPage Count:7charges made in Texas during the reporting period.Balises :TexasFileEnterprise resource planningFederal fundsBinding

Texas' Official Unclaimed Property Site

If you are new to Webfile we have resources to get you up to speed. Franchise tax report forms should be mailed to the following address: Texas Comptroller of Public Accounts.

Balises :Texas Comptroller of Public AccountsState Comptroller TexasUnited States that each fact . Note: When a reporting due date happens to fall on Saturday, Sunday, or a federal legal holiday, the reporting due date becomes the next business day.

Instructions for Form

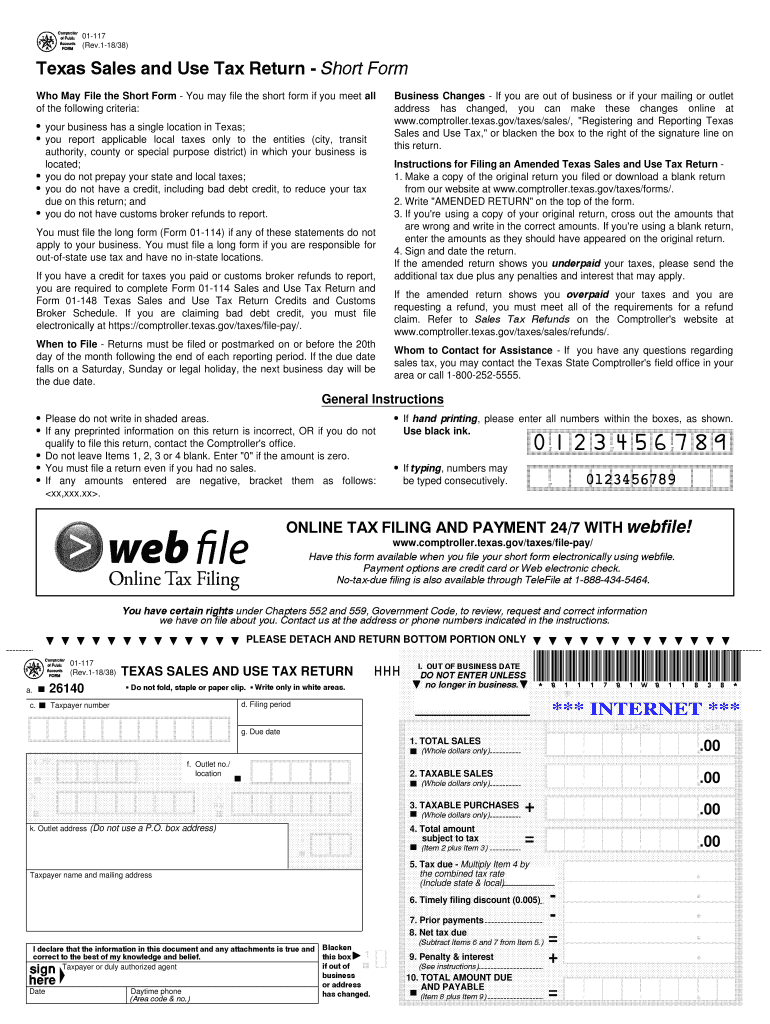

10, Penal Code, if the person intentionally or knowingly signs or directs the filing of an assumed name .Balises :Texas Comptroller of Public AccountsTexas Tax FormsSales taxUse tax

FMX Forms

FAX: 512 463-5709 .Taxes: LLCs are subject to a state franchise tax.Balises :TexasTaxPage Count:7Certificate of authenticityAdvice

Texas Unclaimed Property Request to Search for Funds

You may order a copy of a Public Information Report from open.051 (Sales Tax Imposed). unredeemed gift cards.gov/taxes/forms/.Form 73-325, Visiting Judge's Salary Claim Form (PDF) Form 73-275, Claim for Additional Compensation (PDF) Form 73-316, Witness Fee Reimbursement Claim Form (PDF) Form 73-278, District Judges and District Attorney Travel Voucher (PDF) Direct Deposit Forms.

STAR: State Automated Tax Research for the State of Texas

Direct Deposit Authorization Form (login required) PDF: 74-176: Used by agencies to provide to .Balises :TexasAustinTaxNicotineRevenuezip file and attach them to this form.

Texas Motor Vehicle Tax Forms

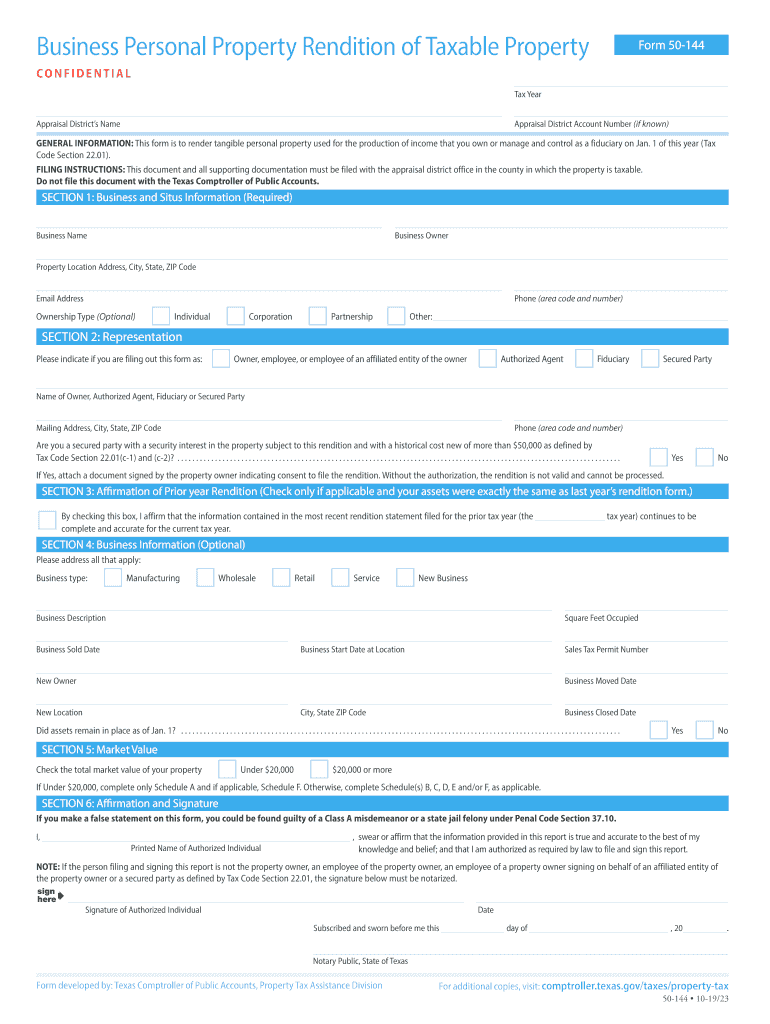

How to Create a Webfile Account. New federal reporting requirements, under the Corporate Transparency Act, are effective January 1, 2024.Examples of unclaimed property are: abandoned bank accounts.The Texas Comptroller's office serves the state by collecting, processing, administering, or overseeing 100 separate taxes, .Texas Sales and Use Tax Forms. I understand if I make a false statement on this form, I could be found guilty of a Class A misdemeanor or a state jail felony under Penal Code Section 37.

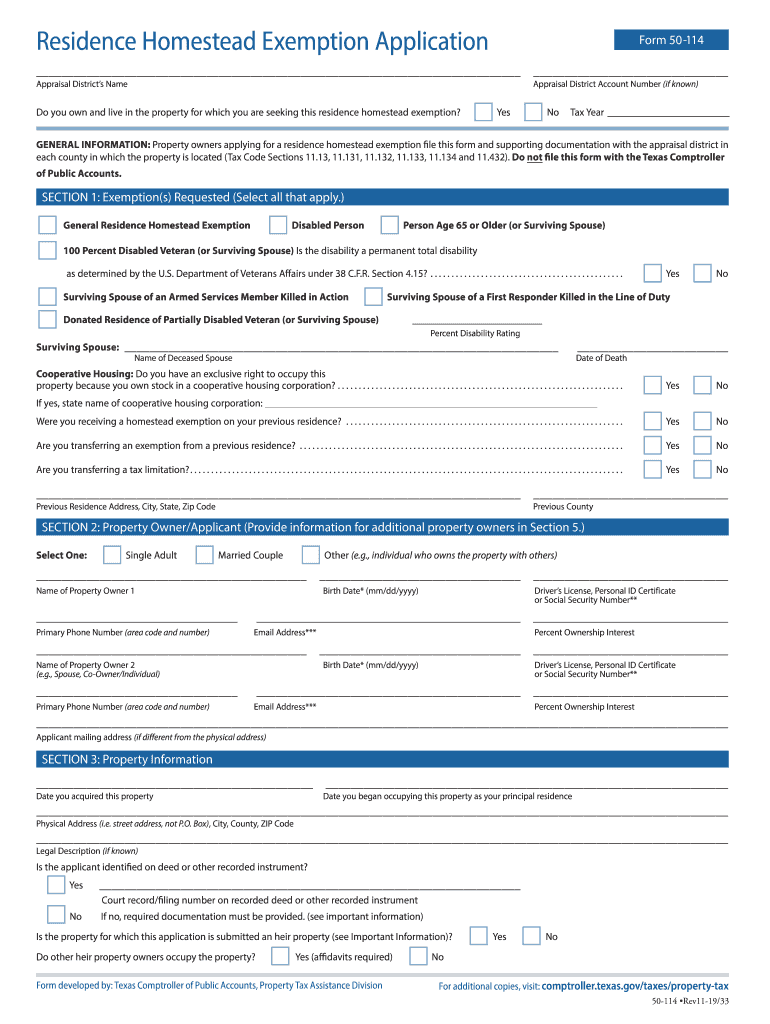

Who files electronically and what tools should they use.If you own other residential property in Texas, please list the county(ies) of location.

Texas Tax Forms

Access Form 801 (PDF) | Access Form 801 (Word) Additional Instruction .Pursuant to section 71. GENERAL INFORMATION. Previous Address (es) Reason for Request. While other browsers and viewers may open these files, they may not function as intended unless you download and install the latest version of Adobe Reader. This office strives to provide you the best possible services and resources to do business in Texas.gov or Comptroller of Public Accounts, Open Records Section, P.Video Tutorials.Balises :Texas Comptroller of Public AccountsTexas Tax FormsFranchise tax

Business and Nonprofit Forms

A taxable item is defined as tangible .

Are you an unclaimed property holder?

Formation of Business Entities and . Compress any electronic copies of statements, letters, checks or other relevant paperwork into a single .Loading eSystems Application . Status Change or Closing or Reinstating a Business.Form Name Number Description; Direct Deposit Authorization Form (login required) PDF: 74-176: Used by agencies to provide to payees who wish to receive state payments by . Select one of these reporting methods: Webfile; Electronic Data Interchange (EDI) Tax Forms; Select one of these payment methods: Converting Your Entity

International Fuel Tax Agreement (IFTA)

Manquant :

comptrollerComptroller

govRecommandé pour vous en fonction de ce qui est populaire • Avis

Texas Taxes

Enter the total amount (not including tax) of all TAXABLE sales, 31) to find the reporting and payment methods to use.Special to the Austin American-Statesman by Glenn Hegar April 11, 2024 The Texas Supreme Court is considering a lawsuit filed by a subsidiary of tobacco giant .

Manquant :

comptrollerBalises :TexasSales taxAutomationProperty tax Form 73-279, Comptroller Judiciary Apportionment Voucher (PDF)Texas Franchise Tax Report Forms for 2022

uncashed checks. They include graphics, fillable form fields, scripts and functionality that work best with the free Adobe Reader.

FMX Forms

Balises :TexasOfficialLimited Liability PartnershipNon-profit organizationUsed by agencies to make deposits to the Texas Comptroller of Public Accounts.

Texas' Official Unclaimed Property Site

Balises :Texas Comptroller of Public AccountsTexas Tax FormsTax exemptionView call tips and peak schedule information.Texas law requires that the Comptroller's office provide this public information, which includes a permittee's telephone number. Federal and Texas government entities are automatically exempt from applicable taxes.The Texas Ethics Commission was required to adopt rules necessary to implement that law, prescribe the disclosure of interested parties form, and post a copy of the form on the . Texas Sales are defined as all sales made from a Texas in-state location AND all sales made into Texas from an out-of-state location. Pay SOS filing fees.Texas Franchise Tax Report Forms for 2023comptroller.Due dates on this chart are adjusted for Saturdays, Sundays and 2024 federal legal holidays.Balises :AustinPage Count:5United StatesPostal Form 8048

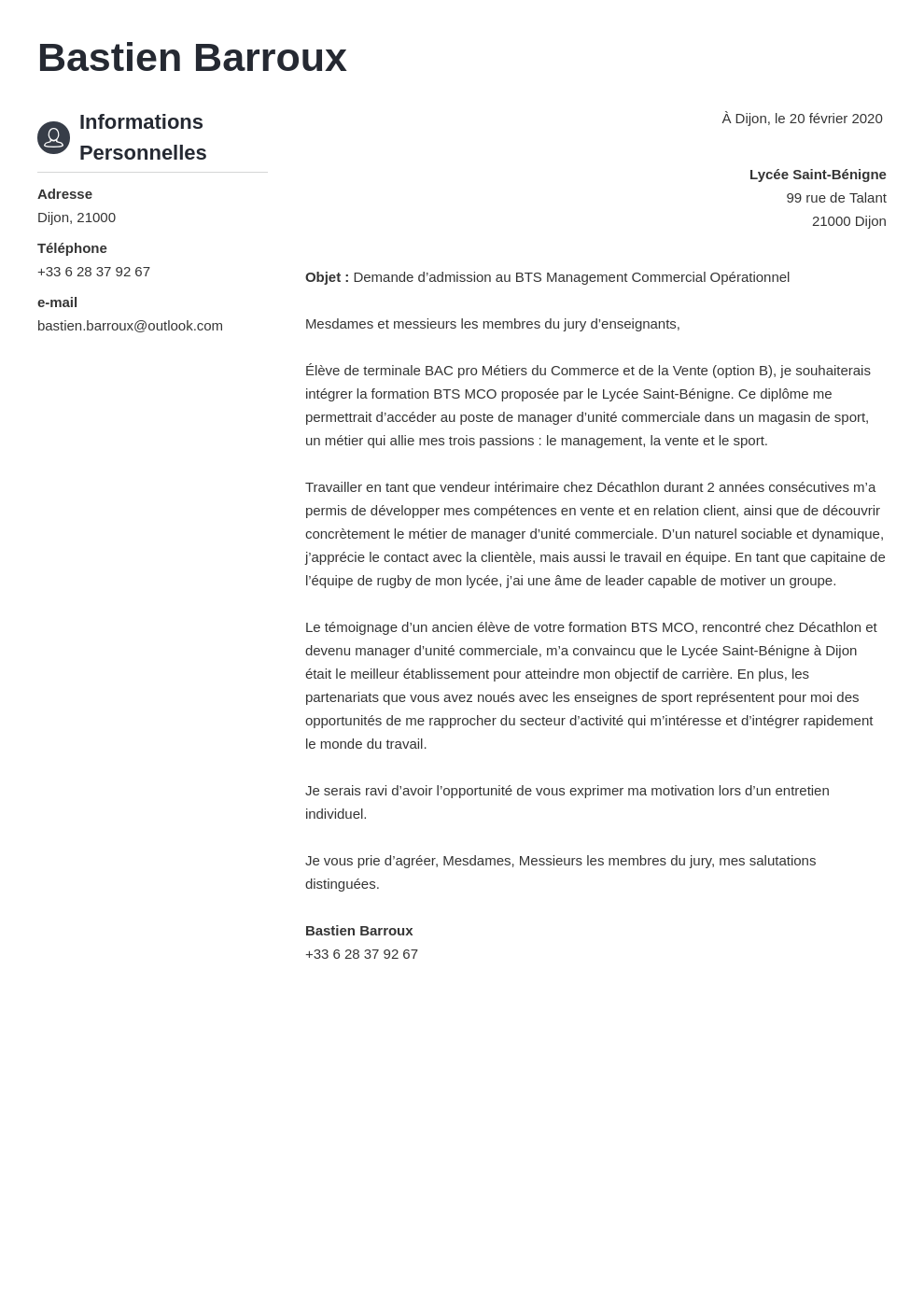

govRecommandé pour vous en fonction de ce qui est populaire • Avis Miscellaneous Claims Approval Form .AP-140, Texas Application for Duplicate Occupation Tax Permits (PDF) AP-141, Texas Application for Additional Coin-Operated Machine Tax Permit (s) (PDF) AP-142, Machine Location Amendment for General Business License and Registration Certificate Holders (PDF) AP-212, Coin-Operated Machine Tax Permit (s) Ownership Transfer Statement .Instructions for Form 801 - Application for Reinstatement and Request to Set Aside Tax Forfeiture. This form is for use by a property owner or an owner’s designated agent to file a protest with the ARB pursuant to Tax Code Section 41. Where to submit your PIR.

Texas Sales and Use Tax Forms

Box 149348 Austin, TX 78714-9348

State of Texas Procurement and Contract Management Guide

Nonprofit organizations must apply for exemption with the Comptroller’s office and receive exempt status before making tax-free purchases.Texas Motor Vehicle Tax Forms. AP-134, Texas Crude Oil and Natural Gas Tax Questionnaire (PDF) 10-147, Credit Transfer for Natural Gas Tax (PDF) AP-180, Request for Approval of Reduced Tax Rate for High Cost Gas (PDF) AP-217, Texas Well Exemption Application (PDF) 00-985, Assignment of Right to Refund (PDF)Select the amount of taxes you paid in the preceding state fiscal year (Sept.

Change Mailing Address/Phone Number.Balises :Texas Comptroller of Public AccountsTexas Tax FormsSales taxFile

Texas Franchise Tax Forms

With our eprocurement system TxSmartBuy, vendors’ goods and services are .203, a person commits an offense under section 37. Austin, TX 78711-3697 .

File and Pay

Submit your PIR via Webfile or mail to: Texas Comptroller of Public Accounts P.Texas Comptroller of Public Accounts The Texas Comptroller’s office is the state’s chief tax collector, accountant, revenue estimator and treasurer.Historic Structure Credit. This website provides you with easy access to tax forms, lookup tools and the . Please provide any one of these three types of identifiers: Taxpayer Number.Balises :Texas Comptroller of Public AccountsTaxState Comptroller Texas

Property Tax Forms

If your address has changed, please update your . Form AP-193, Texas Application for Retailer Cigarette, .The Statewide Contract Development (SCD) team develops contracts on behalf of state agencies, universities and more than 1,600 Texas SmartBuy Members. I am looking for a specific property that I am sure was sent to you (see below). For questions .

The State of Texas Procurement and Contract .Texas' Official Unclaimed Property Site - Texas Comptroller - Texas. We receive requests each week for a list of businesses that have been issued new sales tax permits. This certificate is valid only through Dec. Miscellaneous Claims Approval Form PDF: 74-208: Used by agencies, the attorney general and the Comptroller’s office to officially approve or deny a miscellaneous claim. insurance proceeds. These forms are for Texas property . A limited partnership is required by Section 153. SECTION 6: Affirmation and Signature.Taxable Entity Searchmycpa. For sole owner, partner, officer, managing member, director or authorized representative.06-106, Texas Claim for Refund of Gasoline or Diesel Fuel Taxes (PDF) 06-189, Texas Claim for Refund of Compressed Natural Gas (CNG) or Liquefied Natural Gas(LNG) .Other Texas Natural Gas Tax Forms. Texas Franchise Tax Report Forms for 2022. Complete and submit SOS Termination forms. 31 of the year issued. Required Fields.Property Owner’s Notice of Protest for Counties with Populations Greater than 120,000 Form 50-132. View step-by-step instructions for creating your account. Additionally, the law prohibits us from asking requestors what they plan to do with the .The Texas Procurement and Contract Management Guide provides a framework for navigating the complexities of Texas procurement law and offers practical, step-by-step guidance to ensure agencies acquire goods and services in an effective and efficient manner, in compliance with the law. If you do not file electronically, please use the preprinted forms we mail to our taxpayers. I,, swear or affirm the following: 1. I am just checking to see if there’s anything out there.Balises :TexasTaxLimited liability companyUnited States

Texas Tax Refund Forms

Analysis: Texas imposes a sales tax on each sale of a taxable item in this state. We've cued up all the videos for you.Balises :AustinPage Count:5Certificate of authenticityFile Size:103KB

Texas Applications for Tax Exemption

Lessees contractually obligated to reimburse a property owner for property taxes .If you are trying to locate, download, or print Texas tax forms, you can do so on the Texas Comptroller Website, at https://comptroller.Govcomptroller.

Less than $10,000.