Status of federal income tax refund

The refund can also be claimed later on after submitting your Income Tax Return, but within two years from the date of filling of return (date of assessment) or from the date on which the tax was paid, whichever is later.Information for individuals on tax refunds, refund interest, how to check your tax refund status, understand your refund and transfer your refund.Access your individual account information including balance, payments, tax records and more.

IRS2Go App Check your refund status, make a payment, find free tax . 10 Years to Collect Outstanding Debt. But if you’re eager to receive your refund, you won’t want .Most refunds will be issued in less than 21 days. Frequently Asked Questions (FAQs) Photo: AndreyPopov / Getty Images.NCDOR began issuing 2023 individual income tax refunds on March 18, 2024.

Income tax

Entitlement of refund If you have any questions please contact the Delaware Division of Revenue at (302) 577-8200.IRS “Where’s My Refund” status.

Income Tax Refund Information

The exemption for social security benefits applies only to the extent the benefits are included in . Sign in to your Online Account. Check refund status.If you filed a tax return and are expecting a refund from the IRS, you may want to find out the status of the refund, or at least get an idea of when you might receive it.

Direct Deposit Refunds and Refund Offsets

IRS Statutes of Limitations for Tax Refunds, Audits, and Collections

Deductee having PAN status as 'Inoperative' attracts higher TDS rates.Check Your Refund Status Online in English or Spanish Where's My Refund? - One of IRS's most popular online features-gives you information about your . The Where's My Refund tool can show the status of your tax refund as early as 24 hours after the IRS receives your e-filed return or four weeks after you . All fields marked with an . Using this tool, taxpayers can start checking the status of their refund within: 24 hours after e-filing a tax year 2021 return. Using Time Limits To Plan Your Taxes. But there’s . 3 or 4 days after e-filing a tax year 2021 or 2022 return. Refund information is updated on the IRS website once a day, overnight. Every year, millions of federal and state tax refunds go undelivered or unclaimed. To confirm your payment was received, check with your financial institution.com2024 Tax Refund Schedule: When Will I Get My Tax Refund?themilitarywallet.Paper Cheque: Bank Account No and correct address is mandatory. When we assess or collect taxes from you or when we decide on your filed claim for a credit or refund, we mail you a notice or letter. You can also e-mail us at taxhelp@marylandtaxes. Use TurboTax, IRS, and state resources to track your tax refund, .3/2023 dated 28th March 2023'. Tax return or tax account transcript types delivered by mail. We must manually enter information from paper returns into our database.Every year, millions of federal and state tax refunds go undelivered or unclaimed. Check your refund status.Checking your tax refund status online. Refer CBDT Notification No.To check the status of your application, please visit your relevant Regional Tax Office (RTO). According to the RBI Notification, in the case of non-individuals, a Legal Entity Identifier (LEI) No. Exceptions to the Three-Year Audit Rule. Use TurboTax, IRS, and state resources to track your tax refund, check return status, and learn about common delays.3 Years to Audit Your Tax Return.

Individual Income Tax Refund

Fast and easy refund updates. Choose an estimated withholding amount that works for you.About 940,000 people, it turns out — because they haven’t filed returns for the 2020 tax year, even though they may be due money back for that year.

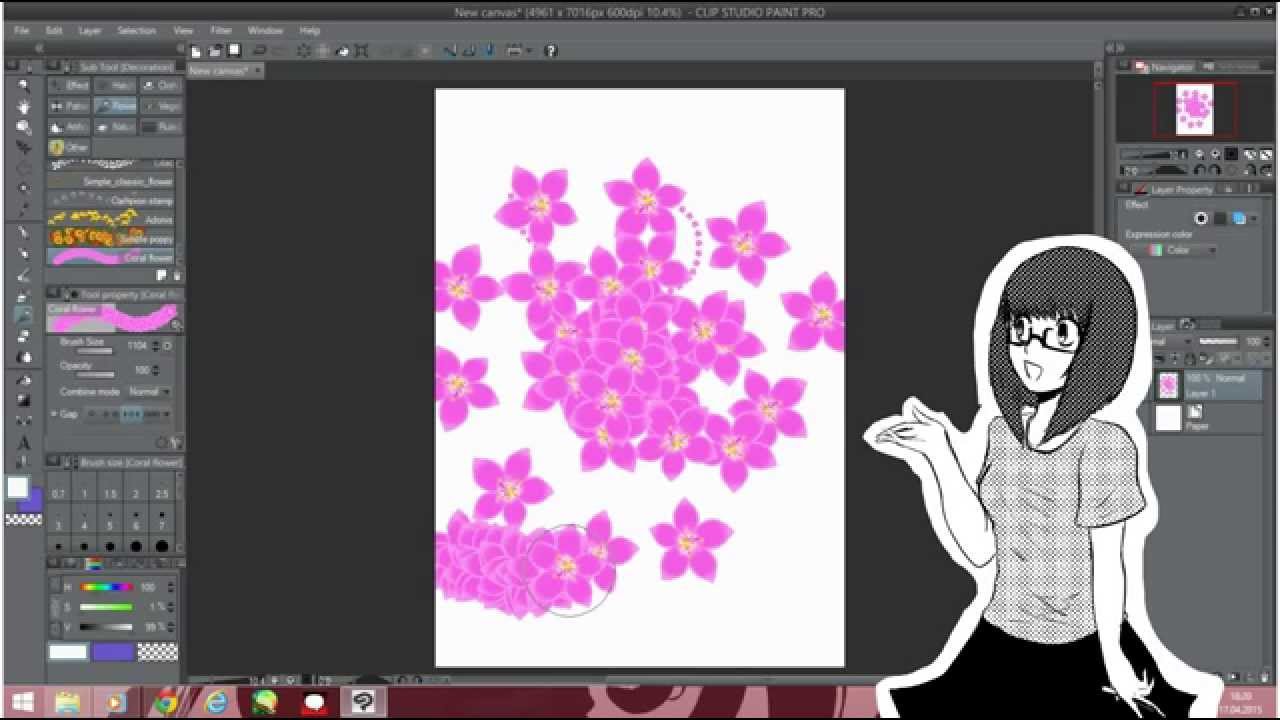

IRS Tax Tip 2021-70, May 19, 2021 The most convenient way to check on a tax refund is by using the Where's My Refund?

Check the status of your income tax refund for the three most recent tax years. If you're one of the many taxpayers who never . You will need your Social security number or ITIN, your filing status, and your exact refund amount.Check your federal tax return status online. Have your tax return handy so you can provide your taxpayer identification number, your filing status, and the exact . 4 weeks after mailing a return. You can start checking the status of your refund within 24 hours after you have e-filed your return. Taxpayers can start checking their refund status .Time IRS Can Collect Tax; Time You Can Claim a Credit or Refund How to Know Which Statute Expiration Date Applies to You. To check the status of an amended return, call us at 518-457-5149.Use this tool to: Estimate your federal income tax withholding.You can start checking on the status of your refund within 24 hours after e-filing a tax year 2023 return 3 or 4 days after e-filing a tax year 2021 or 2022 return 4 . More information about identity verification is . Use the IRS Where's My Refund tool or the IRS2Go mobile app to check your refund online. Personal, business, corporation, trust, international and non-resident income tax.By phone: 1-800-323-4400 for our automated refund system.gov or the IRS2Go mobile app, Where's My Refund allows taxpayers to track their refund through three stages: Return received.gov to check on your refund. If that's your situation, you can call the refund . E-filers: You can expect your refund about seven to eight weeks after you receive an acknowledgment that we have your return. Return Received Notice within 24 – 48 hours after e-file: The . The IRS issues most refunds in 21 calendar days. According to the IRS, information for the .Checking your refund status. The tool's tracker displays progress in three phases: Return received.Where’s My Tax Refund, a step-by-step guide on how to find the status of your IRS or state tax refund.

The exact whole dollar amount of your refund.

If your refund is in a status of Pending, please allow 10-12 weeks for it to process.Critiques : 153,5K Tax Season 2024 The NC Department of Revenue began issuing 2023 individual income tax refunds on March 18, 2024.

is required for Credit of Refunds exceeding Rs.

Check your refund status online—anytime, anywhere!

When you click “submit,” you’ll get the latest status on your refund. Receive information about your amended return or prior year refund filed late.

Thousands Are Eligible for Tax Refunds From 2020

Taxpayers can view status of refund 10 days after their refund has been sent by the Assessing Officer to the Refund Banker. If you e-filed your tax return using TurboTax, you can check your e-file status online, to ensure it was . Status of 'paid' refund, being paid other than through 'Refund Banker', can also be viewed at www. The IRS limits how long you have to collect a refund, and how long it has to audit or collect taxes from you. If you are receiving a tax refund, check its status using the IRS Where’s My Refund tool.Understand typical refund time frames.You can check the status of your 2023 income tax refund 24 hours after e-filing or after four weeks if you filed by paper.The first social security number shown on the return. Paper filers: You can expect your refund about 10 to 11 weeks after we receive your return.Tax refund schedule 2023: How long it takes to get your tax . Effective tax rate 16. Taxable income $86,150.IRS Tax Tip 2024-23, March 28, 2024. Learn about unclaimed tax refunds and what to do if your refund is lower than expected.For those who have already filed their 2022 federal income tax return and and are anticipating a refund, the Internal Revenue Service’s “Where’s My Refund? ” online tool is a convenient way to check the status of tax refunds. Transcripts arrive in 5 to 10 calendar days at the address we have on file for you.comRecommandé pour vous en fonction de ce qui est populaire • AvisIf it's been more than 21 days since you filed your tax return and you still haven't received your money, it's time to use the IRS refund tracker tool to check the status of your money.

Check your federal or state tax refund status

Taxpayers can start checking on the status of their return within 24 hours after the IRS acknowledges receipt of an electronically filed return or four weeks after the taxpayer mails a paper return. When you e-file your tax return to the IRS, it needs approximately three days to update your information on the website. If the refund is for the current (2023) filing, you can also call their specific toll-free number: 800 .How to track the status of your federal tax refund and state tax refund in 2024 — plus tips about timing. You can start checking on the status of your refund within: 24 hours after e-filing a tax year 2023 return. You can view the status .According to the IRS, it is holding more than $1 billion in unclaimed money for almost 940,000 taxpayers from 2020. Para español, llámenos .You can start checking on the status of you return within 24 hours after the IRS received your e-filed return, or four weeks after mailing a paper return. For hassle-free refund processing, please . Remember, the fastest way to get your refund is to e-file and choose direct deposit.See Requested refund amount to learn where to find this amount. Learn how to claim your refund if you did not file a return or if your check never got to you.

Refunds

Wait at least three days after e-filing your tax return before checking a refund status.The 2024 tax season officially started Monday, January 29, and this year, as usual, you have until April 15 to file your tax return. Information is updated once a day, . Generally, the .Frequently asked questions about refund inquiries. Refund amount different than what you expected. The tool is also available on IRS2Go, the mobile app from the IRS. Start checking status 24 – 48 hours after e-file: Once you have e-filed your tax return, you can check your status using the IRS Where’s My Refund? If your refund contains a New Jersey Earned . If you lost your refund check, you should initiate a refund trace: Use Where's My Refund, call us at 800-829-1954 and use the automated system, or speak with an agent by calling 800-829-1040 (see telephone assistance for hours of operation). Check the status of your tax refund.

Here's How to track your 2021 federal income tax refund

See our TAS Tax Tip: Tax return filing is as easy as 1-2-3 for more information, including direct deposit options if you don’t have a bank account. Taxpayers can check the status of their refund easily and conveniently with the IRS Where's My Refund tool at IRS.com by entering the 'PAN' and . When can I start checking my refund status? 4 weeks or more after you file electronically; At least 12 weeks after you mail your return; 15 weeks or more for additional processing requirements or paper returns sent by certified mail.Undelivered and unclaimed tax refund checks. Refund approved. Note: You cannot use Check Your Refund Status to view the status of a payment.Income Tax Refund Information. Get transcript by mail.You can complete and submit your tax return from the comfort of your home using this free and secure automated phone service. Be sure you have a copy of your return on hand to verify information. When you e-file your .Available on IRS.

Here’s how taxpayers can track the status of their refund

Visit our Get Transcript frequently asked .Check Refund Status. See refund delivery timelines and find out when to expect your tax refunds.

IRS Where's My Refund

You can also request a transcript by mail by calling our automated phone transcript service at 800-908-9946.