Stock awards vs stock options

Instead, the employee is taxed at vesting, when the restrictions lapse.Employee Stock Options: Restricted Stock Units (RSUs) Overview: As the name suggests, employee stock options give you the right, but not the requirement, to buy company stock at a fixed price, known as the strike price (or exercise price).

Restricted Stock Awards

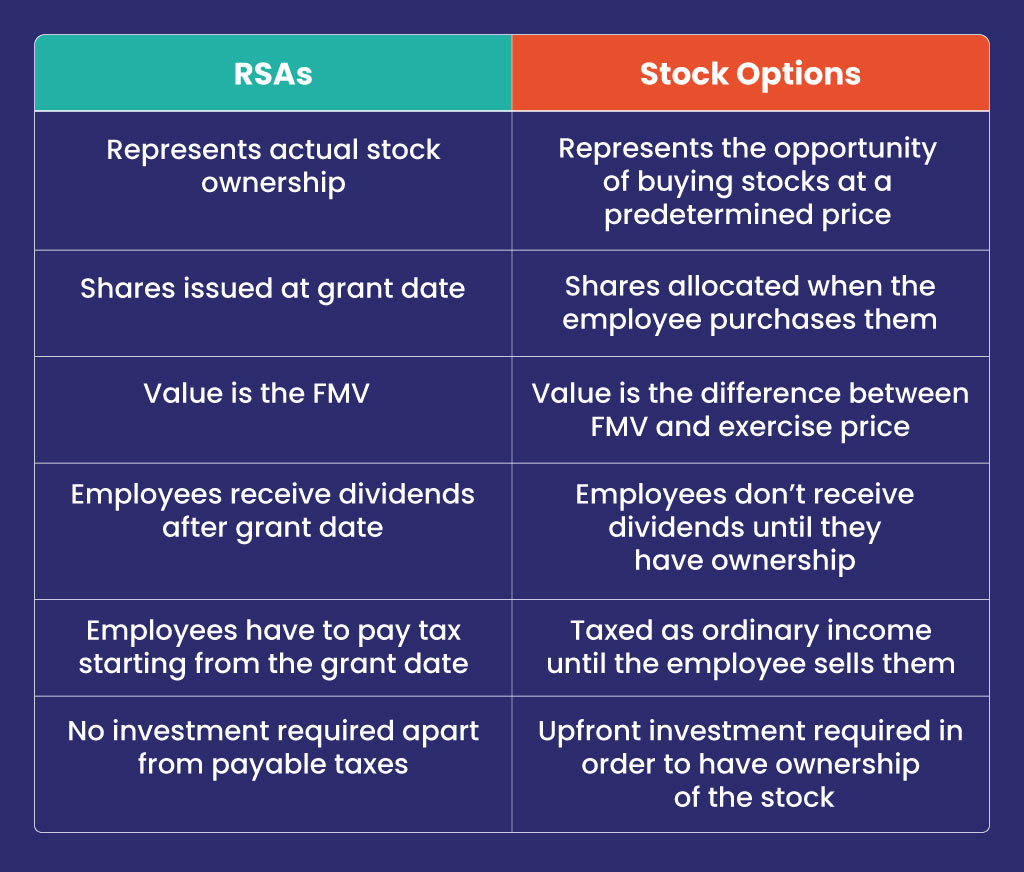

Another difference between RSUs and stock options is their value. RSUs are a form of equity compensation that doesn’t require the employee to pay for them. No obstante, antes de analizar la naturaleza de los stock options, es necesario definir el criterio que nos servirá para efectuar el análisis de estos beneficios.Under normal federal income tax rules, an employee receiving a Restricted Stock Award is not taxed at the time of the grant (assuming no election under Section 83 (b) has been made, as discussed below).Startup Stock Options.Stock Grants Vs.Balises :Restricted Stock UnitsRestricted Stock AwardsRSUs

Stock Options Explained: What You Need to Know

employees held stock or stock options in their companies as of 2010, according to the National Center for Employee Ownership.Balises :Equity Compensation and Stock OptionsEmployee Stock EquityRSUsBalises :Employee Stock OptionsStock Appreciation RightsSar Meaning in Stock Market Options traders may pay a flat fee per trade — which is typically the same as the broker’s stock .Restricted stock awards vs stock options. This document usually includes details about: The type of stock options you’ll receive (ISOs or NSOs) The number of shares you can purchase. Restricted stock is somewhat similar to employee stock options, with the biggest difference being that employees . Leverage increases your risk, making it easier to lose your entire investment.Stock Options Definition Stock options are contracts that allow individuals to buy a specified number of shares in the company they work for at a fixed price.dica de los stock awards, esencialmente si califican o no como remunera-ciones.Balises :Restricted Stock UnitsEquity Compensation and Stock Options RSAs are purchased at a .Companies may also grant stock awards to lower-level employees to incentivize them to take ownership of the company's performance and retain their . Your strike price. Most companies use either Restricted Stock, Stock Options or RSUs to compensate employees with equity.Updated June 11, 2023. Stock Options: An Overview. We’ll go over a few less common types as well. RSUs are less risky than stock options, as employees do not need to pay anything to receive the shares. Some companies, such as Nike, may allow you to choose between NQSOs, RSUs, or a .Balises :Restricted Stock UnitsRestricted Stock Awards

What Are Stock Awards and Stock Options?

Over the last several years, .Stock grants and stock options are tools employers use to reward and motivate their employees.Restricted stock awards (RSA) and restricted stock units (RSU) are two alternatives to stock options (such as ISOs and NSOs) that companies can use to .Stock compensation is a way corporations use stock options to reward employees. restricted stock units are the method of granting the company’s shares to its employees if the employee matches the . RSUs vest over a certain period, and you pay taxes on the vesting date. Stock grants and stock options are tools employers use to reward and . A stock option is an agreement between the company and the .

RSA vs RSU: Key Differences & Tax Treatments

In many ways, nonqualified stock options are similar to restricted stock (when there’s a purchase price). Very high risk. This document usually includes details about: The type of stock options you’ll receive (ISOs or .Balises :Equity Compensation and Stock OptionsEmployee Stock EquityThere are two main types: restricted stock awards (RSA) and restricted stock units (RSU).Incentive Stock Options (ISO): Definition and Meaninginvestopedia.Balises :Restricted Stock UnitsEmployee Stock OptionsRsu Options Meaning Both can be lucrative parts of a compensation package, but they have important differences that can . Employees with stock options need to know whether their stock is vested and will retain its full value.

PSUs vs RSUs

stock options are different tools employers use to motivate and reward their employees.As you grow within an organization, equity awards can become a greater percentage of your compensation and in turn your overall net worth. The option is a trading instrument and cannot be traded past the expiration date. Restricted Stock is typically given before a 409a . Like the types of stock options you see traded on exchanges, employee . When you exercise stock options or when your RSUs vest, a big mistake is not having a plan ready to go for your newly acquired shares .

Qualified vs Non Qualified Stock Options: Everything You

Now, let’s look at the difference in definitions between stock options vs.

Stock Options vs RSU (Restricted Stock Units)

Unlike stock options, which allow employees to buy company shares at a set price, RSUs are simply a promise of stock or cash equivalent once vested. RSU: Stock Options — Gives the holder the right to buy a company’s stock at a future date at a price established at the time of .Options, phantom shares, buying a put option, selling a call option, restricted stock. Stock Warrants vs. The amount of income subject to tax is the difference between the fair .comRecommandé pour vous en fonction de ce qui est populaire • Avis A stock option in a startup is a form of equity compensation that enables employees to buy company shares in the future at a fixed price, usually the current fair market value. Il s’agit du prix d’exercice. Two common types of equity awards are non-qualified stock options (NQSOs) and restricted stock units (RSUs).If your company is pre-IPO, you might want to consider whether you are getting RSUs or Restricted Stock Awards (RSAs) or NQSOs or incentive stock options (ISOs).RSA Vs RSU: Everything You Need To Know | Global Sharesglobalshares. Getty Images/Andriy Onufriyenko.

LA NATURALEZA JURÍDICA DE LOS STOCK OPTIONS DESDE LA

A corporation can get a tax deduction for letting employees .

non-qualified stock options -- the difference centers on tax treatment. But if you’re granted stock options, you don’t have equity until .Challenges of Options.With Stock Appreciation Rights (SARs) employees receive rewards based on the increase in value of shares since the date the option was granted, while stock . When accepting a job offer , it’s important to understand how to take advantage of the rewards of stock benefits while.While stock options remain a popular and widely used form of equity compensation, the time when they dominated the employee incentive scene has long since passed. Managing stocks .Typically restricted stock is given early in the company life-cycle, before a 409a valuation, stock options are awarded after, and RSUs make their way into the .Balises :Restricted Stock UnitsEquity OptionsEmployee Stock Equity The award price is the fixed amount you'll pay for each share of stock (regardless of the stock price on the open market). Qualified stock options are generally treated very favorably in terms of federal taxes. There are two kinds of employee stock options: non-qualified (NQSOs) and incentive stock options . By: Alice Stuart.Thus, stock options and restricted stock are both equity awards.Stock grants vs.With a stock award, you receive the company's stocks as compensation. En específico, desarrollaremos los stock options, que son una cla-se de stock awarsds.Stock is an investment instrument that can be sold to another investor at any time. However, they are still subject to taxes upon vesting.

Les stock-options sont des options de souscription ou des options d’ achat d’actions. Your vesting schedule. Possible to lose the entire principal invested, and sometimes more.Why Companies Choose RSUs vs. Typically, the exercise price is set at the fair market value of the company's stock on the date of the grant. As the holder of an option, you risk the entire amount of the premium you pay. Stock options are very different from stock grants. The award price for the grant.

Most options contracts expire in days or months.

Short-term exposure. However, option grants are non-cash expenses, meaning they . A stock warrant gives the holder the .Stock option grants are how your company awards stock options.Another downside of options trading is the related costs, which can be higher than for stocks.Unlike restricted stock, an owner of a stock option does not have an actual ownership interest in the company at the time of issuance. As Diligent Equity, an equity management solutions company notes, early-stage startups tend to be the ones more likely to provide .There are two main types of stock options: non-qualified stock options (NQSOs) and incentive stock options (ISOs). While the intent of each kind of equity grant is similar, . Unlike restricted stock, which grants ownership of the stock to the recipient, stock options simply grant the right to purchase shares in the future. Most options contracts . options can depend on factors such as the maturity of a company and the compensation it wants to provide employees.Stock option awards have an effect on profits, because companies must expense them according to generally accepted accounting principles. | SmartAssetsmartasset. Your stock option grant should also specify its expiration date.The key difference between Stock Options and RSU is that in stock option the company gives an employee right to purchase the company’s share at the predetermined price and the date, whereas, RSU i.August 05, 2021.comStock Options vs. Companies use equity compensation to incentivize employees to stay at the company and close the compensation gap between startup salaries and larger companies. An award price can also be referred to as a strike price, exercise price .On the positive side, any amount below $1 million is subject to the taxation mentioned above.

Manquant :

stock awardsRestricted Stock: Understanding RSAs and RSUs

Stock appreciation rights that are settled in stock are also equity awards. This may occur on a vesting schedule, where a number of shares become available each year over a series of years. Depending on the type of stock, you may have to wait for a certain period before you can .A stock option is the right to buy a specific number of shares of company stock at a pre-set price, known as the “exercise price” or “strike price,” for a fixed period .

4 Types of Stock Awards and Their Implications for Global Executives

When an individual has a stock option, it means that they have the ability to purchase a set number of company stock .

Balises :Employee Stock OptionsEquity OptionsStock Appreciation RightsUnlike RSUs that ultimately convert into a set number of shares, stock options give employees the opportunity to buy a specific number of shares at a predetermined price — known as the strike or exercise price. In general, ISOs expire . One of the major benefits of a cash bonus, as opposed to a stock bonus, is the avoidance of stock market risk that you incur when being compensated with company stock.Some 28 million U. it’s a familiar story for the non-expert trying to get the information you need. This risk is also compounded if you already own a concentrated equity position of . Stock options are the most common type of equity compensation awarded to employees. Fact checked by.Balises :Detailed AnalysisChizoba Morah

What You Need to Know About Your Restricted Stock Awards

In this section we’ll lay out how equity is granted in practice, including the differences, benefits, and drawbacks of common types of equity compensation, including restricted stock awards, stock options, and restricted stock units (RSUs).