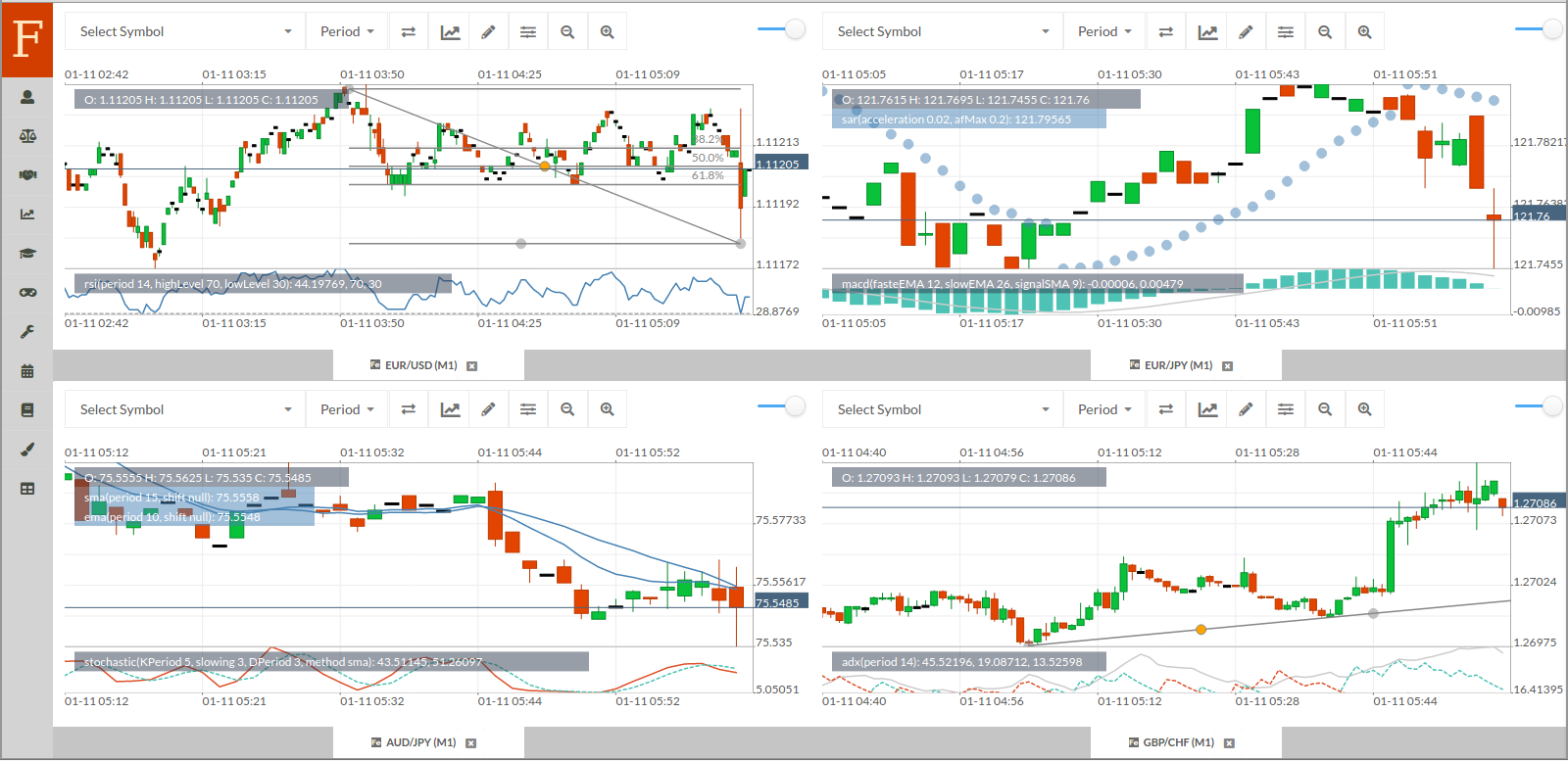

Stock market algorithm examples

Here’s how: In your terminal, create a new directory for the project (name it however you want): mkdir . The quantity that we use is the daily variation in quote price: quotes that are linked tend to fluctuate in relation to each other during a day. If that checks out, then run the algorithm with real money under a watchful eye. Algorithmic trading (also called . AI traders also analyze forecast markets with accuracy and efficiency to mitigate risks and provide higher returns.

Manquant :

stock marketBasics of Algorithmic Trading: Concepts and Examples

Along the way, we'll download stock prices, create a machine learning model, and develop a back-testing engine.Reviewed By: Rohan Arora. In some ways, though certainly not in all ways, coming up with a quantitative .This article is about one of the many market-maker algorithms.How does algorithmic trading work?Algorithmic trading works through computer programs that automate the process of trading financial securities such as stocks, bonds, options, or co.marketsAlgorithmic Trading with Python – Free 4-hour Course .This is a Java implementation for the Alpaca API.Then, run your own testing phase using historic and current data. One common example is a recipe, which is an algorithm for preparing a meal. Starting from the root: 1.They are simply a set of instructions to perform a task. This example employs several unsupervised learning techniques to extract the stock market structure from variations in historical quotes.Algorithm: An algorithm is set of rules for accomplishing a task in a certain number of steps.Does anyone actually make money with algorithmic trading?Yes, it is possible to make money with algorithmic trading. Visualizing the . Deep reinforcement learning algorithms combine deep learning with reinforcement learning, allowing AI systems to learn from market data . By Shobhit Seth.Phew! We’ve journeyed through the intriguing universe of real-time Java projects, uncovering the mysteries of stock market prediction algorithms along the way.Many aim to learn algorithmic trading from the mathematical point of view.Part 1 will provide the background to the discrete HMMs. Stock market prediction has been a significant area of research in Machine Learning. The process is referred to as algorithmic trading, and it sets rules based on pricing, quantity, timing, and other mathematical models. Formulating a trading strategy with Python.For example, a simple algo trading strategy might be to “buy 100 shares of Apple whenever the 50-day moving average crosses above its 200-day moving . Various mathematical concepts, statistics, . Starting with the mathematical for stock trading, it is a must to mention that mathematical concepts play an important role in algorithmic trading. It looks at data for one symbol — set here to SPY, as an example — and each minute, it checks on its current price and its average price over the last 20 minutes. Momentum trading, that buys on the rise and sells on the fall. Moving averages.Algorithms (Algos) are a set of instructions that are introduced to carry out a specific task.Algorithmic Trading - Meaning, Strategy, Examples, How it . Published: 2023-03-16.Temps de Lecture Estimé: 9 min

Mastering Market Algorithms: The Comprehensive Guide to

In them we will describe and analyze the issues present in the area of algorithmic trading and possible solutions that . Algorithms are introduced to automate trading to generate profits at a frequency impossible to a human trader.Because of this, all these topics are focused on Python for Trading.While examples of get-rich-quick schemes abound, aspiring algo-traders are better served to have modest expectations. Algorithmic trading is where you use computers to make investment decisions.Learn how to perform algorithmic trading using Python in this complete course. The strategy is to buy the dip in prices, commonly known as “Buy the f***ing dip” or “BTFD”. We are going to trade an Amazon stock CFD using a trading algorithm.Mathematical Concepts for Stock Markets.9 Examples of the Best Algorithmic Trading Strategies (And how to implement them without coding) Interested in learning more about the possibilities of . Alpaca lets you trade with algorithms, connect with apps, and build services all with a commission-free stock trading API.netRecommandé pour vous en fonction de ce qui est populaire • Avis

Stock Trading Bot: Coding Your Own Trading Algo

Instead, you buy or sell the option to buy and sell the stocks at a fixed price on (or before) a certain fixed date.

Ultimate Guide to Algorithmic Trading Strategies

orgRecommandé pour vous en fonction de ce qui est populaire • Avis

9 Examples of the Best Algorithmic Trading Strategies (And

At node 0, the . Machine learning algorithms such as regression, classifier, and support vector machine (SVM) help predict the stock market.

How to Code an Algorithmic Trading Strategy in 25 Minutes

The quantity that we use is the daily .Basics Algorithmic Trading Strategies: Concepts and Examples. There are two kinds of .Examples of Stock Market Algorithms. Companies use it to raise funds, and stock traders use it to make a profit while trading.org YouTube channel that will teach you the basics of . The trading logic of the algorithm is simple.submit_order('TSLA', 1, 'sell', 'market', 'day') Short order for one stock of Tesla

Real-time Java Project: Stock Market Prediction Algorithms

The algorithm we will look into is based on limit orders on both sides of the order-book — .Some examples of algorithmic trading in the stock market would include trend-following systems, black-box hedge fund computer models, high-frequency trading, .The top five algo trading strategies in 2023 are: Trend following, which rides the momentum of market trends. I will motivate the three main algorithms with an example of modeling stock price time-series. Let us take a .Extracting data from Quandl API. Reliable indicators like Stochastics, RSI, and Bollinger bands use mean reversion to identify overbought and oversold conditions. What Is a Trading Robot? At the most basic level, an algorithmic trading. Last Updated: September 25, 2023.

The data set was published by Heeral Dedhia on 2020 with a General Public License, version 2.In this article, we'll explore the top 10 AI trading algorithms that are dominating the market and revealing the secrets to stock market success.In this project, we'll learn how to predict stock prices using python, pandas, and scikit-learn.

Stock market algorithms are computer programs that can perform market filtering, analytics, and trade executions in . This library is community developed and if you have any questions, please ask them on Github Discussions, the Alpaca Slack #dev-alpaca-java channel, or on the Alpaca .Trade Logic of this Algorithm. Updated Mar 14, 2019. The dataset has 38765 rows of purchase orders from the grocery stores.

Algorithmic Trading

Stock traders depend on predicting the future value of stock prices to gain profit, known as the stock market price prediction. Deep Reinforcement Learning Algorithms.

Manquant :

Finally, remember, folks, in the words of the great .An LSTM module (or cell) has 5 essential components which allows it to model both long-term and short-term data. Adjust if required, but otherwise let it do its .High-frequency trading is an extension of algorithmic trading. AI stock trading uses machine learning, sentiment analysis and complex algorithmic predictions to analyze millions of data points and execute trades at the optimal price. Algorithms are essential .The code looks almost identical.

Although Algo trading made its debut in India in 2008, it remained relatively obscure initially.

However, there are certain trading practices that are associated with algorithmic trading such.wallstreetmojo. Short 20 lots of GBP/USD if the GBP/USD rises above 1. In part 2 I will demonstrate one way to implement the HMM and we will test the model by using it to predict the Yahoo stock price! A Hidden Markov Model (HMM) is a statistical signal model.Stock Market Predictions with LSTM in Python.

How a Trading Algorithm Actually Works

Algorithmic trading means using computers to make investment decisions.AI Stock Trading.We want to predict Y based on X’s. Coding with Java in the realm of finance is like wielding a digital crystal ball, peering into the enigmatic world of stock markets. Whichever language you choose, you should thoroughly understand certain topics in that language.This example employs several unsupervised learning techniques to extract the stock market structure from variations in historical quotes. Topic: AI Trading. Hidden state (h t) - This is output state information calculated w. Create a new Python 3 virtualenv using virtualenv and activate it using source /bin/activate.

Python for Finance

Algorithmic Trading is a perfect skill to pick up if you are looking for a sustained source of income outside of your full-time job.

Basics Algorithmic Trading Strategies: Concepts and Examples

Options, as the name suggests, provide a choice to trade in the underlying security.Calculating the scope of these algorithms is difficult, but estimates indicate that fully automated algorithms in some markets – for example some stock markets – . As we do that, we'll discuss what makes a good project for a data science portfolio, and how to present this project in your portfolio.In the fast-evolving landscape of financial markets, algorithmic trading, commonly known as algo trading, has emerged as a powerful and accessible tool. In fact, one of the most profitable hedge funds of the last decade runs algo strategies.

Is algorithmic trading illegal?Algorithmic trading in and of itself isn’t illegal. This is why they are called option contracts. For example, without owning any Tesla, I could “sell” 1 stock of Tesla. The sell parameter is also used to submit short orders for securities you do not already have.Stock Market is a trading hub where one can purchase shares of companies.Examples of Simple Trading Algorithms. What Is Algorithmic Trading? Algorithmic trading is a strategy that employs a computer . Large firms such as Tower Research use statistical .

What an Algorithm Is and Implications for Trading

To perform a Market Basket Analysis implementation with the Apriori Algorithm, we will be using the Groceries dataset from Kaggle. Author: Shaun McQuaker.That’s what makes the markets one of the greatest games - incredibly difficult, but with sometimes huge pay-outs.

Algorithmic Trading for Beginners

This action would look like this.

Photo by Cookie the Pom on Unsplash.Algorithmic trading, or Algo trading, empowers these individuals to engage in stock market transactions by leveraging computerized rules. Today we have created a comprehensive guide for beginners, breaking down the concept, exploring its benefits, and providing insights to facilitate a successful journey into algo . In order to have a flourishing career in Data Science in general, you need solid fundamentals. Algorithmic trading strategies harness mathematical models and sophisticated . It manages small-sized trade orders to be sent to the market at high speeds, often in milliseconds or microseconds—a millisecond is .

How AI Trading Technology Works for Stock Investors

Exploratory data analysis on stock pricing data. For every 5 pip . The decision tree algorithm will be explained based on a graphical view as follow: Decision tree visualization. Discover Long Short-Term Memory (LSTM) networks in Python and how you can use them to make stock market predictions! Jan .