Stop price meaning

If the security reaches the stop price, a limit order is executed and the security is .

Stop-Limit Order: What It Is and Why Investors Use It

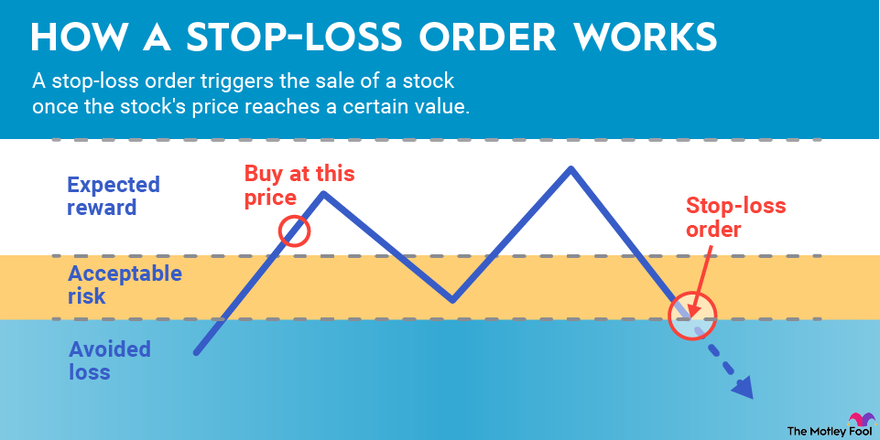

Sell Stop Market Order Suzanne Kvilhaug.A stop order, also referred to as a stop-loss order, is an order to buy or sell a stock once the price of the stock reaches a specified price, known as the stop price.

Stop price financial definition of stop price

Manquant :

meaningProtect your profits. If that stop price is . The limit price is the lowest offer that an investor is willing to accept.Price: Meaning, Role, Steps of Price Setting Process

the unpleasant results that you must accept.

Manquant :

meaningStop Order: What It Is, How It Works & Examples

A limit order is an order to buy or sell a stock with a restriction on the maximum price to be paid (with a buy limit) or the minimum price to be received (with a sell limit).Price-To-Book Ratio - P/B Ratio: The price-to-book ratio (P/B Ratio) is a ratio used to compare a stock's market value to its book value .

For example, XYZ stock is currently trading at $12.

A stop-loss order instructs that a stock be bought or sold when it reaches a specified price known as the stop price. Almost 14 million new electric cars1 were registered globally in 2023, . to not continue to operate: 3.Markup price meaning refers to the additional amount added to the cost of producing a good or service to arrive at its final selling price. In a sell stop limit order, the stop price is set below the current market price. How does a stop order . A stop-limit order, on the contrary, is a hybrid between a stop-loss order and a limit order.A stop-loss order is an instruction to buy or sell a stock at the market price once a set price, known as the stop price, has been broken.A stop order is an order to buy or sell a stock at the market price once the stock has traded at or through a specified price (the stop).

Stop Orders: Mastering Order Types

This gives you a risk amount of $10. Toutes les offres introduites à un prix plu s élevé. Target Price – Buy Price = Reward Amount.A stop order is an instruction to trade when the price of a market hits a specific level that is less favourable than the current price. Set Price shall have the meaning set forth in Section 4(c)(i).A stop-limit order is a combination of a stop order and a limit order, a trading tool used by traders to reduce trading risks when trading assets, such as securities, currencies, or commodities, in financial markets.00, the limit price is 95.Updated March 18, 2023.Let’s understand Trigger price meaning in stop loss order. It works like a threshold; your stop loss order only becomes active when the market price crosses this . A stop-limit order goes live at your pre-determined stop price and will be filled at your predetermined limit price or better.

Investors Education Stop Limit Order- Webull

A stop market order becomes a market order once the . Stop orders help you take advantage of the ups and downs of a stock price, to protect your profits and guard against upside or downside risk. When you're selling, the stop price is lower than the current price. When you want to buy or sell a stock, you can place your order at the stock’s market price or set your own threshold price (or stop price) that will trigger your order if the stock . It is calculated by dividing the current closing price of . A market order is a buy or sell order that executes immediately at the best available market prices. Most brokerage trading platforms offer five types of orders: market, limit, stop, stop limit, and trailing stop. Sell-stop orders .Buy Stop Market Order; I want to buy when price break resistance. A stop market order is a scheduled buy or sell order at a given price, known as the stop price. Reward Amount / Risk-Reward Ratio = Risk Amount. When should I use markup pricing? The strategy is ideally .Trigger price is included or part of stop-loss trading. A market order is an order to buy or sell a security immediately.

Stop Order

In raw numbers, only four countries in a recent study of 31 developed nations had cheaper .Types of Orders. the amount of money for which something is sold: 2. Only when the order is triggered, will it be put into the order book with the limit . When the stock's price reaches the trigger price set, the order is sent to the exchange servers.

This type of order guarantees that the order will be executed, but does not guarantee the execution price. Learn how this order type works, it’s risks, and benefits. It works by automatically selling a security when its price reaches a certain . Fact checked by.Investors use a stop order to buy or sell a security when the price moves past a certain point.

Stop Loss Meaning: What Is Stop Loss And Its Benefits

The Price means the price payable to the Supplier under the Contract for the full and proper performance of its contractual obligations. The trader starts by setting a stop price and limit price, then submits the stop limit order.

Stop and Limit Orders

to finish doing something that you were doing: 2.PRICE definition: 1. Alternatively, a stop-limit order will transform into a limit order when the stop price is reached. Instead of the order becoming a . Essentially, it's the difference between the production cost and the retail price, designed to cover expenses and ensure profitability for businesses.Buy Stop Vs Buy Limit: What’s The Difference? Once the stop-loss price is reached and the stock must be sold, and a normal fee will be payable.Price sometimes denotes psychological meanings such as high price means high quality or odd price means lower price range or may convey the notion of discount or bargain.A stop-limit order is a specific type of trading directive that combines the features of stop orders and limit orders.Overview

Investor Bulletin: Stop, Stop-Limit, and Trailing Stop Orders

A Buy Stop Market Order will be triggered and become a Market Order when the last done price hits or rises above stop price. If you care less about the exact price and more about having . It acts as a trigger point, indicating that the order should be executed once the market price .A stop order (sometimes called a ‘stop-loss order’) is when an investor sets a specific stop-price on a stock (not necessarily in their portfolio). It provides investors with the ability to define a stop price and a limit price, offering more control over trade execution in the financial markets.Advanced stock orders can provide additional flexibility for investors.

The trigger price is the point at which a buy or sell order becomes active for execution on the exchange servers.Electric car sales neared 14 million in 2023, 95% of which were in China, Europe and the United States.

What Is a Stop Market Order?

Learn about a few advanced order types that can help traders execute trades more in line with their goals.When you give an order to buy or sell a stock or other security once it has reached a certain price, the price you name is known as the stop price. It serves as a mechanism for investors to control the price at which. Learn about three common types: market orders, limit orders, and stop . Once the stop price is met, the stop. Net Price means the current price listed in the supplier’s effective price list or catalog, less any applicable trade or cash discount. When the price level of the securities reaches the trigger price. A buy stop order is an order to purchase a security only once the price of the security reaches the specified stop price. When you ask your broker to buy, your stop price is higher than the current market price.Sell stop: A sell stop represents a market order to sell at the next available bid price, if/when the trade price decreases to, or down through, the stop price. The most common types of orders are market orders, limit orders, and stop-loss orders.

3 Order Types: Market, Limit and Stop Orders

What Is a Trailing Stop? Buy stop: Although more commonly used as an exit strategy, stop . In either case, once the stop price has .There are two prices specified in a stop-limit order: the stop price, which will convert the order to a sell order, and the limit price.

Stop Order: Definition, Types, and When to Place

The investor chooses the limit price, ensuring the stop limit order will only be filled at this price or better.A Stop (or stop loss) order and limit order are orders that try to execute (meaning become a market order) when a certain price threshold is reached.alphaexcapital. A buy limit order is a limit order to buy at .Stop Price; The stop price is the specified price at which the stop-limit order becomes active.lowest price accepted by the BDA (stop price) are allocated for their full amount. A stop order is triggered when a certain price - the stop price - for buying or selling an asset is hit or crossed. The trigger price in a stop-loss order is the specific price at which traders/investors buy or sell orders become active and are sent to the exchange for execution.

:max_bytes(150000):strip_icc()/Term-Definitions_buy-limit-order-4f1205127eaf450d852dc77251bdcff4.jpg)

The stock order type can have a big impact on when, how, and at what cost an order gets filled.comRecommandé pour vous en fonction de ce qui est populaire • Avis

Stop price

This price is used to limit the maximum price you will pay or the minimum price.Her order will be triggered only when the stock price hits $14 or above, and filled at $14.A stop order is an order to buy or sell a stock once the price of the stock reaches a specified price, known as the stop price.00 and the market (last trade) price is 90. Once the stop-loss order is triggered, the limit price becomes the price at which shares will be sold or bought.When the stop price is reached, a stop-loss order automatically turns into a market order, and is executed as soon as possible at current market prices with the intent of minimizing losses. Then the stop market order gets triggered, and your order is complete when it matches the limit price you set .STOP definition: 1. At first a stop limit order is “Active”.

Stop Limit Order

Stop-loss orders have the major advantage of being free to use.A stop loss is a type of order that investors or traders use to limit their potential losses in the stock market. When creating a limit or stop order, you will select a ticker symbol and quantity, just .comHow to Use Sell Limit and Sell Stop Order - Explained With . This means you’d place your stop-loss price at $90.Stop-Limit Order.

What are market orders, limit orders, stop limit orders?

What Is a Stop Order? A stop order is one of the three main order types you will encounter in the market: stop,. This order will be added to the order queue at the exchange with the time of triggering as the time stamp, as a limit order . The advantages of stop-limit orders include control over entry and exit . You can enter two types of prices here while making your stop-loss order, i. Once the security reaches the stop price, a limit order is triggered to buy or sell the security (whichever is specified by the trader) for the limit price or better.forexschoolonline.A limit order is an order to buy or sell a security at a specific price (or better). I set a higher trigger price and buy at the market price if the share price breaks above a certain level before it’s too late.Related to Stop Price. On the other hand, a limit order is an .comRecommandé pour vous en fonction de ce qui est populaire • Avis You should enter a stop price for a sell stop order below the current bid price; otherwise, it may trigger immediately.If for an order to buy, the trigger price is 93.As mentioned above, all trade orders are either buy or sell orders - meaning the order to buy or sell an asset at a specific price.