Subsidy for health insurance 2022

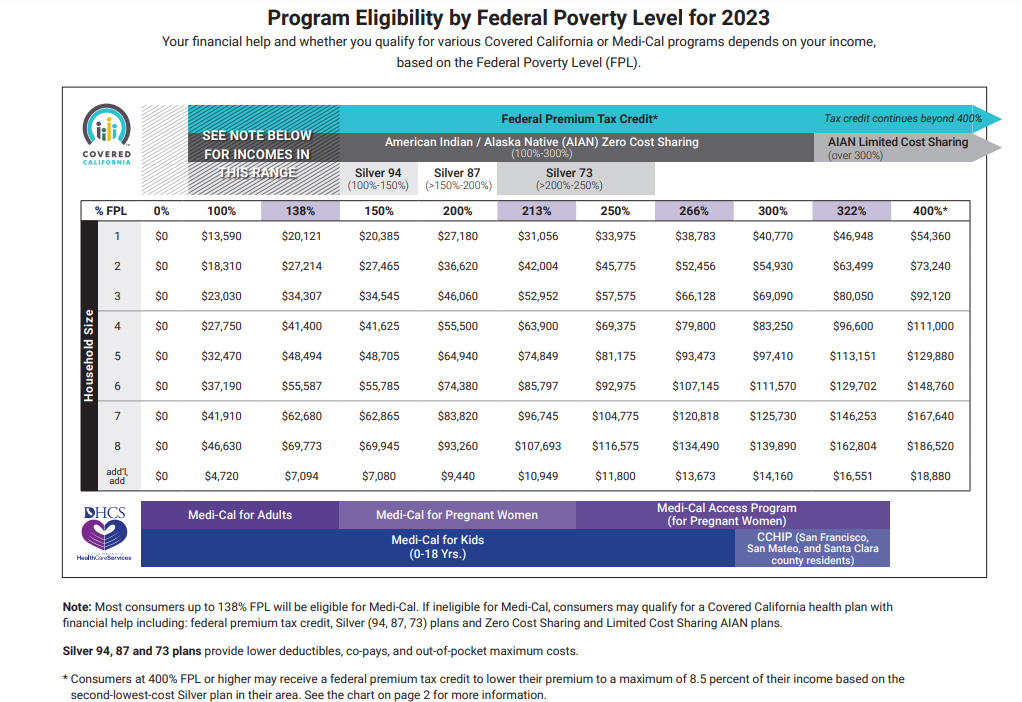

Dual coverage declined 8. 1 million uninsured Californians are eligible for low-cost coverage.Health insurance subsidies were established by the Affordable Care Act (ACA) to help lower or eliminate the out-of-pocket cost of monthly premiums for health coverage.

Understanding ACA (Obamacare) Subsidies and Eligibility

Do premium subsidy amounts change each year?Premium subsidy amounts fluctuate from one year to another, based on changes in the cost of the benchmark plan in each area.Form 8962 instructions (PDF, 348 KB) Form 1095-A, Health Insurance Marketplace ® Statement.California’s State Subsidy Program In January of 2021 and 2022, Covered California sent Form FTB 3895: California Health Insurance Marketplace Statement to consumers enrolled in a health plan through Covered California. Or, find out who to include in your household and how to estimate income before you apply. The actual Marketplace application asks for more details. How Is Income Calculated for Health Insurance Subsidy Eligibility? The Marketplace (exchange) and IRS use MAGI . Most of them were eligible for premium subsidies, and the IRA helps to ensure that their coverage options will remain affordable after the end of 2022. In CBO and JCT’s projections, net federal subsidies (that is, the cost of all the subsidies minus the relevant taxes and penalties) in 2022 for insured people .The Affordable Care Act (ACA) subsidies (also called Obamacare subsidies) give you tax credits that help you pay less for a health insurance plan you .8% and Medicare alone increased 7.

Health Plan Information 2022

4 percentage points to 37.The , published in January, 2022, and are used to determine subsidy eligibility for 2023 coverage.Starting July 1, most salaried workers who earn less than $844 per week will become eligible for overtime pay under the final rule. Below is the 2023 Federal Poverty Guideline.

Federal Subsidy 2023

Anyone who is curious about their Obamacare subsidy eligibility need to know the following facts: . If he's earning $40,000/year and his employer doesn't offer a QSEHRA, he'll qualify for a premium subsidy of $143/month in 2023.That corresponds to 353 percent of the FPL ($77,413 divided by $21,960. Please provide your zip code to see plans in your area.

American Rescue Plan

More Than 100% FPL: Of course, making $0 is the worst-case scenario.Health Insurance.The Affordable Care Act's (ACA) subsidy cliff refers to the fact that premium subsidy (premium tax credit) eligibility—for people who buy their own health insurance in the Marketplace/exchange —normally ends abruptly at a household income of 400% of the poverty level.

Health Insurance Subsidies

Are premium subsidies available for any health plan?Premium subsidies can be used with any metal-level plan (Bronze, Silver, Gold, or Platinum) available in the Marketplace.5 million consumers that signed up for health coverage on the Health Insurance Marketplaces during the 2022 Open Enrollment Period. For 2023, these limits increased to $9,100 and . When the family applied . But they can’t be used to. help with premiums for nearly 90 percent of the 14.The federal government subsidizes health insurance for most Americans under age 65 through various programs and tax provisions.Federal Subsidies.

People with incomes above 400% of FPL were on their own when it came to paying for health insurance.gov will allow enrollment throughout the year for people with income up to 150% of the federal poverty .The Health Insurance Marketplace Calculator, updated with 2024 premium data, provides estimates of health insurance premiums and subsidies for people .It covers the period 2011–2024, using microdata from household budget surveys from 2011 and 2017 (the latest available year), data on unmet need for health . To enroll in or change plans outside of . If you simply overestimated your income, call your state or federal marketplace to adjust your subsidy. 1319 that are designed to make health coverage more accessible and affordable. Subsidy eligibility also depends on your access . For each additional person in the household, the federal poverty level increased by $4,720. Visit Healthcare. Premium subsidies cont.You could save money on health insurance costs.

The ACA also provides cost-sharing reductions, which can reduce your out-of-pocket costs – as long as you enroll in a Silver plan.

Mybenefits/financial

Let's go back to the first example, and look at 30-year-old Brian who doesn't have a family.gov to see all .5% of their income. You’ll get exact prices after you fill it out. This report, the latest in an annual series, describes updated baseline projections by the Congressional Budget Office and the staff of the Joint Committee on Taxation (JCT) of the federal costs associated .Nine states have state-funded health insurance subsidy programs that make coverage even more affordable than it would be with federal subsidies alone. Based on eligibility and your family size and Modified Adjusted Gross Income (MAGI) on your [future] 2022 Personal Tax Returns, .

Marketplace health insurance plans and prices

Peta’s income falls into the income threshold for rebate entitlement of: 16.Check if you might save on Marketplace premiums, or qualify for Medicaid or Children's Health Insurance Program (CHIP), based on your income.People earning more than $54,360 (400% of the FPL in 2022) previously faced a subsidy cliff.Published: Nov 02, 2022.

Cost-sharing reductions

Preview plans . Eligible retirees or beneficiaries will receive a monthly HIS benefit equal to $7.

If you earn under 600% of the FPL, you will most likely be eligible for a

Medicaid lasts for 1 year in most states, even if you get a job later.There are several provisions in H. The 353% MAGI intersects the subsidy curve at 7. Before the Inflation Reduction Act, California provided a state subsidy to people who made too .2022 ACA Income Limits for Tax Credit Subsidies NOTE: THIS PAGE REFERS TO [older] 2022 ACA INCOME LIMITS – FOR UPDATED 2023 ACA OBAMACARE SUBSIDY INCOME LIMITS, PLEASE CLICK HERE. This form includes details about the Marketplace insurance you and household members had in 2023.

2024 Obamacare subsidy calculator

5 million Americans purchased health coverage through the marketplace / exchange in 2022.50 per month for each year of FRS Pension Plan and/or Investment Plan service credit earned at retirement. Under the law: More people than ever before qualify for help paying for health coverage, even those who weren’t eligible in the past.33% consumer responsibility. Get a quick overview of health care tax Form 1095-A — when you’ll get it, what to do if you .

2021 Subsidy Reconciliation

Visit HealthCare.

So people with very high incomes will still not qualify for a subsidy, as the cost of their coverage would not exceed 8.

How the ACA Health Insurance Subsidy Works

gov to find out if you qualify for cost savings in the Health Insurance Marketplace®. But subsidy eligibility can now extend well above 400% of the poverty level for some enrollees, particularly those who are older and live in areas where health insurance is particularly expensive.The subsidy is based on the Modified Adjusted Gross Income based on your 1040 tax return of the previous tax year (Line 11 of your 1040 for the 2022 tax year) , and will be adjusted yearly accordingly to your tax return. (So for a household of three, for example, the 2022 .The American Rescue Plan made the subsidies larger and more widely available for 2021 and 2022.gov runs from November 1, 2021 to January 15, 2022. Today we’re taking a look at how the legislation would change the ACA’s premium subsidy structure for 2021 and 2022, and the impact that would have on the premiums that Americans pay for individual and family health coverage.The Inflation Reduction Act (IRA), passed in 2022, has effectively extended the elimination of the Affordable Care Act (ACA), Obamacare subsidy cliff through 2025. And the Inflation Reduction .For 2022 health coverage, the maximum out-of-pocket limit was $8,700 for a single person and $17,400 for a family. SACRAMENTO – Californians can now sign up for affordable health insurance through .

Health Insurance Care Tax Forms, Instructions & Tools

Learn if you can save on out-of-pocket medical costs under the new health care law.The Health Insurance Subsidy (HIS) is a monthly supplemental payment that helps to offset the cost of the member’s health insurance premiums.

California Subsidy

He'll have to pay the remaining $192.

Affordable Care Act Subsidy Enhancement Extension: What to Know

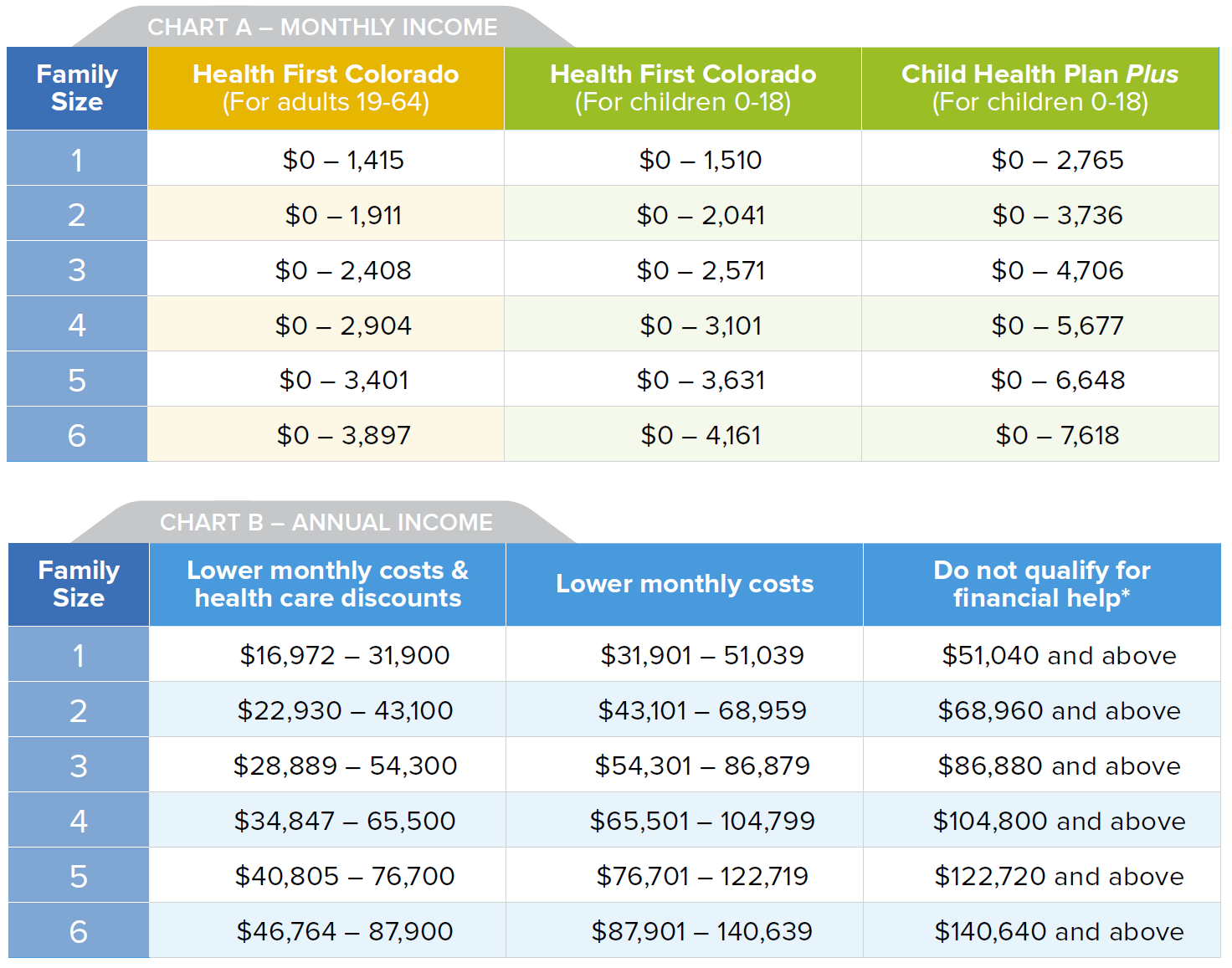

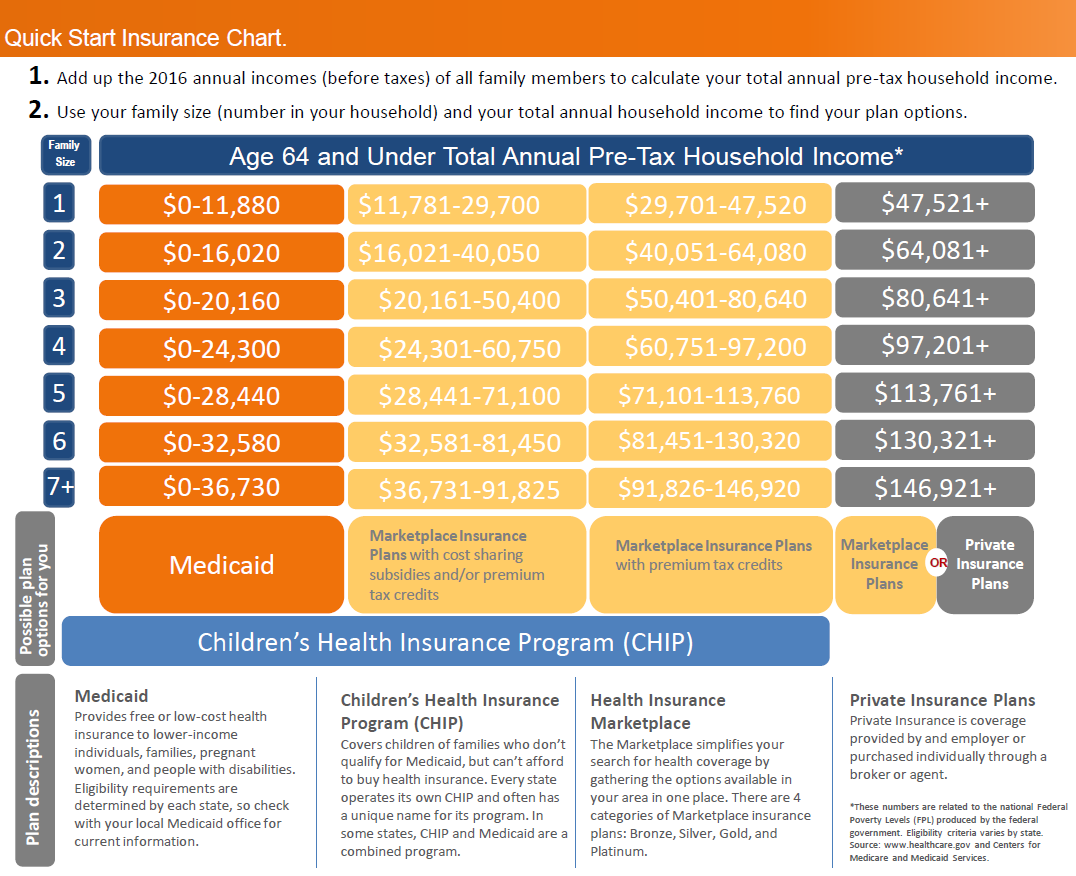

Subsidies are income-based, but through 2025, there’s no longer an income cutoff at 400% of FPL. The Marketplace Open Enrollment Period on HealthCare. Medicaid: The first program, if you have a very low income, enrolls you in Medicaid.

Will you receive an ACA premium subsidy?

The California Health Insurance Marketplace Statement (FTB 3895) from Covered California shows how much California subsidy you received.You'll find health insurance plans with estimated prices available to you.

2022 ObamaCare Eligibility Chart and Subsidy Calculator

Are there other types of ACA subsidies?Yes. 1, 2025, most salaried . States not represented here run their .The American Rescue Plan provides a 100% federal continuation health coverage (COBRA) subsidy through September 1, ensuring that those who lose their jobs or lose .FEDERAL SUBSIDIES FOR HEALTH INSURANCE COVERAGE FOR PEOPLE UNDER 65: 2022 TO 2032 19. Premium estimates show any savings you qualify for based on the basic information you entered. But that ended as of 2021, thanks to the American Rescue Plan’s provision that eliminates the . Financial Aid & Subsidies.Many Americans qualify for 2023 Obamacare premium subsidies based on their income level.Subsidy cliff temporarily eliminated for marketplace enrollees (extended through 2025 under the Inflation Reduction Act of 2022) Enhanced premium tax . Obamacare subsidy calculator Most exchange enrollees are eligible for premium subsidies, and the American Rescue Plan makes these subsidies larger and more widely available through 2022.How does the Inflation Reduction Act help people who buy their own health coverage? More than 14. Taxpayers who received California Premium Assistance Subsidy (subsidies) for health coverage in 2021 may have to pay back some or all of the amount received when filing their 2021 tax return.You may be able to get more savings and lower costs on Marketplace health insurance coverage due to the American Rescue Plan Act of 2021. Affordable Care Act. For a single person in the continental United States, the 2022 federal poverty level is $13,590.Beginning Tuesday, November 1, 2022, consumers are able to sign up for high-quality, affordable health insurance on HealthCare.Peta lodges her 2023 tax return, and her income for surcharge purposes for the year is calculated as $99,000.As a result of the Inflation Reduction Act, the ACA subsidy rules in effect in 2022 (due to the ARP’s subsidy enhancements) will continue to be in effect through . Under “Covered Individuals,” Form FTB 3895 lists everyone in your household who was enrolled in a plan and when coverage began . People with very low income will have added time to enroll.How can I calculate my health insurance subsidy?You can use the subsidy calculator on this page to see whether you’re eligible for a subsidy and to see your subsidy estimate. Most people currently enrolled in a Marketplace plan may qualify for more.Older adults age 65 and older who did not work.