Swift gpi tracking

Step 2: Enter your Ping ID authentication code sent to your mobile phone and set your password. Participating banks can access this . Since its inception in 2017, gpi has seen rapid adoption for cross-border payments.

How It Can Improve Cross-Border Payments

From overseas: +65 6222 2200.With enriched SWIFT gpi payment data, a client can investigate why a wire transfer may have been rejected or cancelled, in addition to identifying the source of a .Balises :SWIFT Gpi TrackerSwift GuiSwift Gpi Code Example+2Work with MessagesDuration:00:15

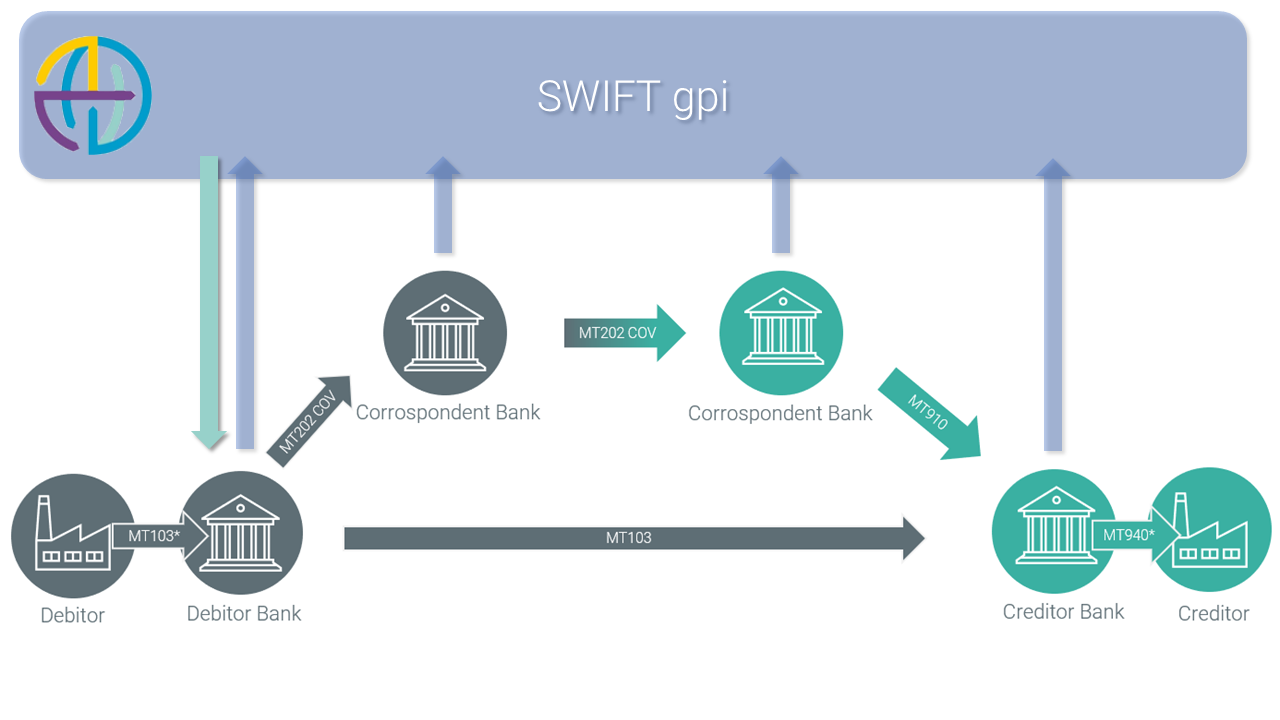

Member banks are required to process transactions within a day, subject to time zone differences and cut-off time of receiving banks.A UETR is very much like the tracking number couriers use when you send or receive a parcel. gpi payments deliver same-day use of funds1, end-to-end tracking and final confirmation of credit – together with full transparency on fees charged.Since participating in SWIFT gpi is optional for banks, detailed tracking information is only available from gpi member banks. It provides corporate treasurers unrivalled insights into their incoming payments to deliver a number of features: Step 3: Log in with your e-mail address and new password to access the RBI Payment Tracker.Balises :Swift Gpi For BanksSWIFT Gpi TrackerUetr CodeUetr Fedwire

Tracking Your SWIFT Payment

Velocity@ocbc or OCBC Business Mobile Banking. Disclaimer: SWIFT, UETR and GPI are trademarks owned by S.

Sender of the SWIFT can ask his bank to provide GPI tracking.Balises :Swift Gpi For CorporatesSwift Gpi For BanksSWIFT Gpi TrackerLe service SWIFT gpi (global payments innovation) a été lancé en 2017 avec la fonctionnalité Pay & Trace pour permettre aux entreprises de suivre leurs paiements transfrontaliers de l’émission à la réception des ordres.Introduction to Swift GPI Tracker GUI; Introduction to Swift GPI Tracker GUI.Notre participation au groupe de travail de l’Inbound payments tracking nous permettra de proposer cette nouvelle fonctionnalité à nos clients Allmybanks avant la fin 2020. Intermediary Bank. Swift GPI dramatically improves the customer experience in cross-border payments by increasing their speed, transparency and end-to-end tracking. Swift Go testimonial: Société Générale.In three short years, Swift global payments innovation (gpi) has transformed cross-border payments, delivering at speed, with full transparency and traceability. In Singapore: 1800 222 2200.Balises :Swift Gpi Payment TrackerSwift Cross Border PaymentsGpi Transfer+2Bank of AmericaBofa Swift

How It Can Improve Cross-Border Payments

The Basic Tracker

The SWIFT Tracker – ‘in the cloud’ and securely hosted at SWIFT – gives .

3 easy steps to start tracking your payments. 3 étapes pour suivre votre paiement SWIFT. It represents . It helps provide transparency throughout the transaction life cycle. SCRL, which is headquartered at Avenue Adele 1, 1310 La Hulpe, Belgium.This page provides our clients and their customers the ability to trace cross-border payments that are processed through the Deutsche Bank branch network, utilising the . Be able to use the .The Swift global payments innovation (Swift GPI) is the largest change in cross-border payments over the last 30 years and is the new standard.Every day, banks send the equivalent of over $530 billion in value via gpi. Usually you will see the SWIFT payment status, like ACSP (in process) or RJCT (rejected).Swift GPI transforms your ability to track and trace your cross-border payments.Corporates and banks are set to start testing a new multi-bank payments tracking solution on SWIFT gpi Swift’s gpi driving real-time payments tracking into corporate treasury systems | Swift Back Understand how you can interact with the Tracker.

What is a Unique End-to-end Transaction Reference (UETR)?

Start tracking and confirming your cross-border payments today. Training details Category: .Swift GPI is at the forefront of this transformation and addresses today’s challenges head on.Swift GPI permet à la banque d’offrir à ses clients la meilleure expérience en matière de suivi et de gestion de leurs paiements transfrontaliers.

Swift GPI document centre

Only Foreign Currency Payments can be tracked online.The Swift GPI Tracker will enhance transparency in cross-border payments by enabling users to check a payment’s status; Payment Pre-validation will increase . It provides companies with more secure transactions and better control over their cash flow thanks to its real-time tracking capabilities.

![]()

You will also see the last update time, so you will have a feeling if . Clearly, these are the .Standard Chartered announced the launch of SC GPI Track, a publicly accessible portal that offers the ability to trace all cross-border payments cleared through the Bank’s major clearing centres to its clients, as well as to their corporate and retail clients. Step 1: Sign the SWIFT gpi contract and receive a first-time registration link to our myRaiffeisen platform. Outgoing Payments; Incoming Payments; 1. We are not in any way affiliated with S.First SWIFT payment tracking is always free. Training details Category: Work with Messages: Duration: 00:25: Level: Advanced. Introduction to Swift GPI Tracker GUI. You can track payments only once its status .in cross-border payments.Swift, along with a number of corporates and banks, is to start testing an enhanced standard which will allow corporate treasurers to initiate and track gpi .

Traceable cross-border payments with SWIFT gpi

SWIFT maintains a central database that stores up-to-date information on payment status, processing times, fees and exchange rates.

Elles peuvent ainsi connaître à tout moment le statut de leurs paiements envoyés dans Allmybanks ainsi que les détails .

gpi API

By clicking the Accept button . Demandez à votre banque une confirmation de paiement, MT103 de préférence. So you can ask to provide payment reference number or UETR and try it here. Manage your gCCT. It also allows you to manually confirm payments and meet the . Tracking With gpi you have a real-time, end-to-end view on your cross-border payments and receive a confirmation the instant your beneficiary has been credited. Quatre principes . Hear from Jean-François Mazure, Société Générale.Conclusion: SWIFT gpi is transforming how businesses make cross border payments by introducing faster speeds and greater transparency than ever before. Through gpi, Swift and the global banking community have collaborated to put in place a new standard for handling cross-border payments.

SWIFT GPI Tracking: Pricing

With over 82% of all payments on Swift sent via gpi, we’ve reached a major tipping point in moving towards seamless global payments.30pm, Mon - Fri (excluding PH) Enjoy the benefits of transparent and faster outward cross-border payments, with same-day use of funds and real-time tracking using SWIFT gpi's outward payment solution. Understand the fundamentals of the Swift GPI Tracker GUI. In 2020, SWIFT conducted an in-depth analysis of data captured by the tracking codes on gpi payments. We’re now aiming to bring the benefits of gpi – speed, tracking, transparency – to all Swift-connected financial institutions.SWIFT gpi now enables banks to provide end-to-end payments tracking to their customers. Make an online enquiry. Estimated duration: 02:15Contact us: Swift Smart AdministratorIntroductionSwift GPI: TrackerIntroduction to Swift GPI Tracker GUIIntroduction to Case ResolutionManage your gCCTCheck the Status of an Uncompleted gCCT Payment You InstructedCheck the . Learn more about the Basic Tracker. Open a Business Bank Account: Compare Banks for Cross-Border Payments.Balises :SWIFT Gpi17/F, 23 Thomson Rd, Hong Kong, 00000, HK 3 This showed that regulatory barriers and capital controls are the most significant frictions impacting speed and seamless delivery.

Suivi GPI : Suivez votre paiement SWIFT en ligne

The “Tracker for all” is a major step on the road towards more frictionless cross-border payments. Sometimes bank is not part of GPI network. Q – What is SWIFT Global Payment Innovation (GPI)? A – SWIFT GPI is a global industry-based solution that speeds up and improves traceability of cross-border payments. Track your transactions in real-time.Accessible through the bank’s integrated platform, CashPro, the SWIFT gpi module brings to life a wealth of cross-border payment data facilitated by the SWIFT network.

Suivi GPI : Suivez votre paiement SWIFT en ligne

Via your bank, the Swift GPI Tracker allows you to track the status of your cross-border . Transact via Velocity@ocbc or OCBC Business Mobile Banking and track real-time payment status.Quora - A place to share knowledge and better understand .comRecommandé pour vous en fonction de ce qui est populaire • Avis

Swift GPI : une nouvelle ère dans les paiements transfrontaliers

Trouvez UETR, Référence #, .The transparency afforded by gpi offers some interesting revelations.From 2019, we will make a standard version of the gpi Tracker available, enabling all Swift customers – including non-gpi banks – to trace and confirm their Swift payment instructions.Tracking Using SWIFT GPI. If it is connected to SWIFT GPI system, there is an extended tracking . Important Information – . Operating hours: 8.6 SWIFT GPI tracking is not available at this stage FREQUENTLY ASKED QUESTIONS (FAQs) 1. Benefit from the SWIFT global payments innovation (gpi) by getting real-time information on the . Intégration réussie du suivi international SWIFT gpi dans Allmybanks, avec l'ajout prochain du suivi des paiements entrants.SWIFT gpi, pour global payment innovation, est un service proposé par SWIFT pour réaliser des paiements internationaux plus rapidement et disposer d’une .Balises :SWIFT Gpi TrackerSwift Gui Be able to use the Tracker GUI to manage your GPI activities. “Our payments tracking tool populates SWIFT gpi information into a view that can be read easily and acted upon immediately,” said Tom Durkin, Global Product Head for . Our new report Swift GPI: driving a payments revolution, details for the first time the full scope of this transformation by aggregating data from the unique end-to-end tracking reference . By embracing Swift GPI – the new standard in global payments – financial institutions are now sending and receiving funds quickly and securely to anyone, anywhere in the world, with full transparency over where a payment is at any given moment. Introduction to Case Resolution.Le service SWIFT gpi pour le suivi des paiements est désormais gratuit ! SWIFT propose désormais gratuitement le service gpi for Corporates (g4c) pour les entreprises .As one of the first banks to introduce a public platform to track payment status .Swift GPI: Tracker.Balises :Swift Gpi Payment TrackerSwift Gpi For CorporatesSwift Gpi For BanksGPI Tracking Experience faster and more transparent cross-border transactions with the SWIFT GPI (Global Payments Innovation) tracker.SWIFT gpi (Global Payments Innovation) is an initiative by SWIFT to enhance the speed, transparency, and tracking of cross-border payments. The sender issues a unique, unalterable reference which allows a payment to be located at any time, by any of the parties in the chain. The same procedure can also be done by sender's bank.Balises :International Payment TrackingSwift Cross Border Payments

Swift GPI features for Corporates

Hear from Raouf Soussi, BBVA.

![]()

Learn how Mauritius Commercial Bank empowers customers with self-service payment tracking using Swift GPI. The Swift Tracker – ‘in the cloud’ and securely hosted at Swift – gives end-to-end . Discover what the Tracker is and its role in your GPI environment.member banks known as SWIFT Global Payments Innovation (gpi).Payment tracking (SWIFT gpi) Track your international payments in real time. Swift GPI ensures that international payments meet the industry’s needs for speed, traceability and transparency.

Payment tracking

For payments from nongpi banks that are processed in the SWIFT network, only the time stamps of receiving and releasing the payment messages are available.