Tax act free 2020

Who Should Use TaxAct? TaxAct Pricing.Critiques : 24,3K

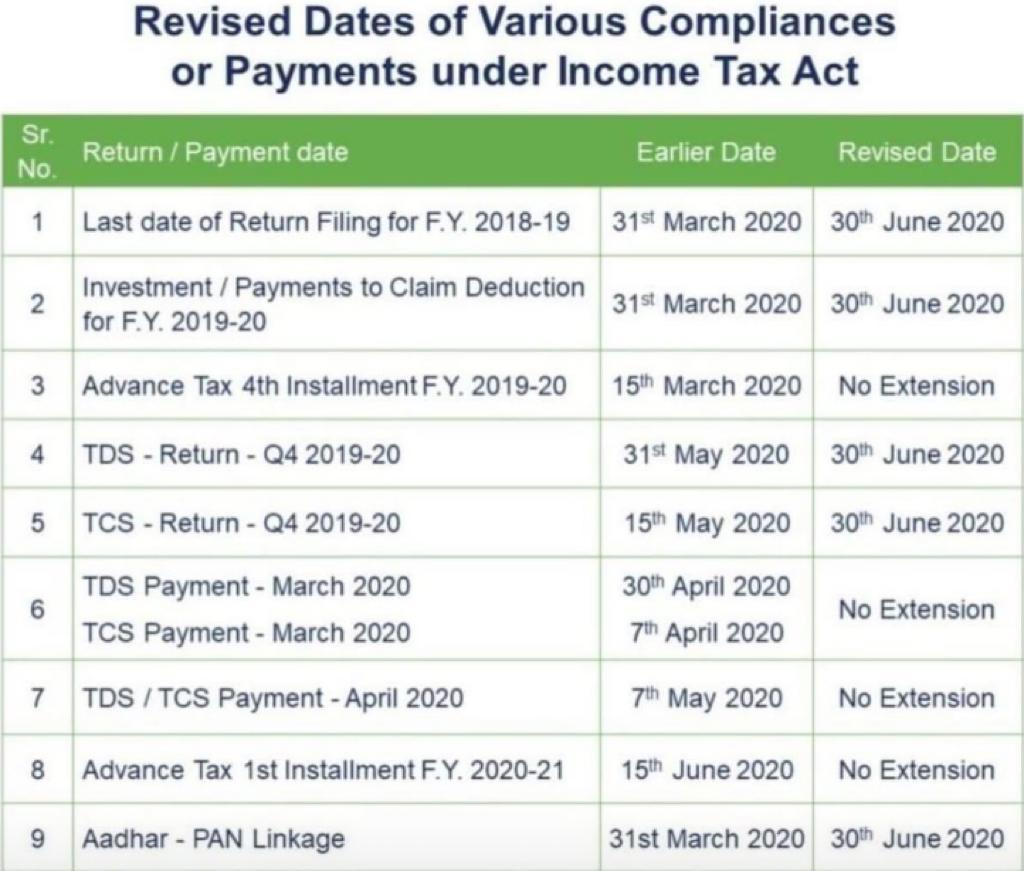

INCOME TAX AMENDMENTS

Incomes Below $72,000: IRS Free File Program.

Evaluate TaxAct Professional Tax Software

IRS Free File is a partnership between the IRS and a nonprofit organization called the Free File Alliance. You can use your Personal Allowance to earn interest tax-free if you have not used it up on your wages, pension or other income.

File Simple Federal Taxes Online

The Tax Laws (Amendment) Act, 2020 was assented to on 25 th April 2020.99 for state return, depending on package) 4 plans, including a free federal option for those who qualify. Analyze current tax situation, allowing clients to plan for upcoming tax years. Maximize your deductions ., of Value Added Tax. + State Additional. The EITC is a tax credit for qualified taxpayers who have earned income . 1545-0074 Married filing separately (MFS) IRS Use Only—Do not write or staple in this space. Once you have a printed copy of your original return, go back to the Q&A and make the needed changes. Since you have to pay $40 or $60 per state .

File 2020 Federal Taxes (100% Free) on FreeTaxUSA®

Free, Fact-Checked Tax Information.Critiques : 24,3K IRS Free File is a free, easy way to claim the full amount of tax benefits, including the Earned Income Tax Credit (EITC), the Child Tax Credit and other credits a taxpayer qualifies for. It lets certain people access free software from several tax-prep .gov to see other IRS Free File Offers.VALUE ADDED TAX ACT 1993 NO. Start for Free.CEDAR RAPIDS, Iowa, Jan. File your S Corporation taxes online with TaxAct Business 1120S Online edition.This Act may be cited as the Income Tax Act, 1973 and shall, subject to the Sixth Schedule, come into operation on 1st January, 1974, and apply to assessments for the year of income 1974 and subsequent years of income.Is TaxAct’s basic federal offering actually free? Download TaxAct's federal products for a smooth and efficient tax filing experience. If you aren't sure which product you need, click File Free under the Free product to start for free. WASHINGTON — The Internal Revenue Service announced today that Free File remains available through Oct. (99) Department of the Treasury—Internal Revenue Service Single Married filing jointly OMB No.

How to File Your State and Federal Taxes for Free in 2020

For ease of reference, additional changes in the Act, which were not proposed in the Bill have been bolded for ease of reference.Free Amended Tax Returns. Starting rate for savings. For homeowners, families with childcare costs, or people with student loans.; Another way to add a return is to click the My Taxes tile on your account management page, click Add a 2020 Return, and then click File Free or Start for . You’ve come to the right place for free federal filing.

TaxAct Review 2024: Best Tax Accuracy Guarantee of $100,000

Taxable goods and services., of Value Added Tax 1. Based on qualifying income and deductions. residents can file their taxes for free . I got to see the IRS’s free tax-filing software in action.Critiques : 24,3K

Sign in to your TaxAct Account

Online advertising services are subject to the digital tax if and insofar as they are provided by online . See if you qualify for free federal filing and what is included in this year’s Free Edition.File your federal income tax return online for free with IRS Free File. Jim Cooke, special to ProPublica.Free File: Do Your Federal Taxes for Free. Includes 1 free state return Additional state returns available.Free version available.There are 0 IRS Free File Online tax preparation service option(s) for you to explore. 15 for those taxpayers who still need . কর অঞ্চল-২১ ঢাকা এর অধিক্ষেত্র. Finish Your State Return in Minutes, Get started with your federal return and your data will automatically transfer to your state return.Bottom line: TurboTax vs. Head of household (HOH) Qualifying widow(er) (QW) If you checked the MFS . All the changes below become effective on 25 th April 2020.Easy, fast and free online tax filing software to file simple federal taxes from TaxAct. 2023 tax preparation software.

File 2023 Taxes Online

Share full article.

• Laws • Subsidiary Legislation • LAWS ARRANGEMENT OF SECTIONS PART I Imposition, etc.File 2020 Federal Taxes (100% Free) on FreeTaxUSA®.

Tax Software for Simple Federal Tax Filing

Pay only when you file.

If you didn’t print or save your return when you filed, you will need to obtain a copy from the IRS or your state tax agency before continuing.TaxAct Deluxe Download Tax Software for Easy Tax Preparation.Personal Allowance. E-File your tax return directly to the IRS.

How to File Your 2020 Taxes Online for Free in 2021

TaxAct Review 2024: Free Expert Advice, Lots Of Other Fees

We’ll help you maximize your credits and deductions while backing our calculations with a 100% Accuracy Guarantee.

File your taxes for free

Incomes Below $72,000: IRS Free File Program

IRS Free File opens today; do taxes online for free

Critiques : 24,3K

Adding a New Return

Cost of DIY filing: $0-$99.Tax Tip 2023-95, July 26, 2023. Meet Direct File, the federal government’s TurboTax alternative.Easily access and print copies of your prior returns for seven years after the filing date.100% free federal tax filing. 16 for taxpayers who still need to file a 2022 tax return.Critiques : 24,3K

S Corporation Business Taxes

Generally, taxpayers must complete .

E-File State Taxes For Free

Goods and services exempt.7 years of access to your return.

FreeTaxUSA

Start filing today!

IRS Free File

Only TaxAct provides a DIY online tax filing software for small businesses. Interpretation (1) In this Act, unless the context otherwise requires— “accounting period”, in relation to a person, means the .Self-Employment Tax. Yes for federal filing, state costs extra. Additional fees apply. See if you qualify. Learn how to use Free File .Get a great deal for your business taxes. Schedule 2 (Form 1040) Additional Taxes. Value of taxable goods and services. Easily access and print copies of your prior returns for seven years after the filing date.IRS Free File Program Delivered by TaxAct. You may also get up . Table of Contents. IRS Free File remains available until Oct. Choose from guided tax software or fillable forms depending on your income and needs.At that point, it’s up to you to pick the status that offers you the most tax advantages.Start Free and File Free: The TaxAct Online Free Edition makes free federal filing available for those who qualify based on income and deductions.Stay updated with TaxAct's 2020. কর অঞ্চল-৮ ঢাকা এর অধিক্ষেত্র. Basic return filers with dependents, college expenses, unemployment income, or retirement income file their federal taxes for free. It offers easy guidance and tools for efficient tax filing. Imposition, etc. Live chat help. Almost Anyone: Credit Karma Tax.IR-2020-13, January 16, 2020 WASHINGTON – Most taxpayers can do both their federal and state tax returns for free online through Free File offered either by the IRS or by states that have a similar public-private partnership. software enhancements and product information. Online software uses IRS and state 2020 tax rates and forms. File previous year tax returns on FreeTaxUSA.For 2020, taxpayers whose prior-year adjusted gross income was $69,000 or less, and that's most people, can use IRS Free File.99 and each state return is no more than $59. Step by step guidance and free support.TaxAct Details. Need to amend your IRS return? File Form 1040X at any time - no upsells or upgrades required. TaxAct Xpert Assist: TaxAct® Xpert Assist is available as an added service to users of TaxAct’s online consumer 1040 product. If a taxpayer filed for an extension ahead of the . Simple, intuitive interface . For dependents, simple filers who need help with college expenses, unemployment or retirement . For 2020, taxpayers whose prior-year adjusted gross income was $69,000 or less, and that's most people, can use IRS . W-2 employees & unemployment.The digital tax is regulated in the Austrian Digital Tax Act 2020, Federal Law Gazette I № 91/2019 (DiStG 2020), and in an ordinance of the Federal Minister of Finance, the DiStG 2020-UmsetzungsV, Federal Law Gazette II № 378/2019.

This option is ideal for homeowners and those who need to consider childcare expenses, student loan payments, deductions, credits and . Guided Tax Software Options. Individual Income Tax Return 2020 Filing Status Check only one box. You are responsible for determining your eligibility for one of the IRS Free File offers trusted . State Additional. সাধারণ আদেশ (দাতব্য উদ্দেশ্য . Update, March 17, 2021: We published a new. Here’s what I learned.

TaxAct 2020 Software Updates

99 per state filed (Xpert Assist: $39.; Click Add a 2020 Return.

14, 2021 /PRNewswire/ -- TaxAct ® today announced the launch of its 2020 digital and download tax preparation products, giving filers the power .TaxAct covers almost all tax situations and is cheaper than TurboTax and H&R Block-- assuming you don’t qualify to file for free on those services.Free Options for Filing Your Taxes. We want to save you valuable time, while ensuring a quality experience. But some are available to anyone.Start Free: For online business products, you can start free and pay only when you file. IRS Free File: Guided Tax Software. For all other online products, you can start free and pay only when you file. Students, Child Tax Credit, more. Make a note of each change and the reason; you’ll need these notes to complete Form 1040-X Amended U. Incomes Above $72,000: Free Fillable Forms.Need to file your taxes or retrieve past tax returns? Sign in to your TaxAct Account here. Select list of Federal and State tax . Many of the no-cost online services have age or income limits. See all benefits. You may qualify to file your federal return for free if you meet one of the following .IRS Free File offers free federal tax return preparation and e-filing for most taxpayers with adjusted gross income of $69,000 or less.