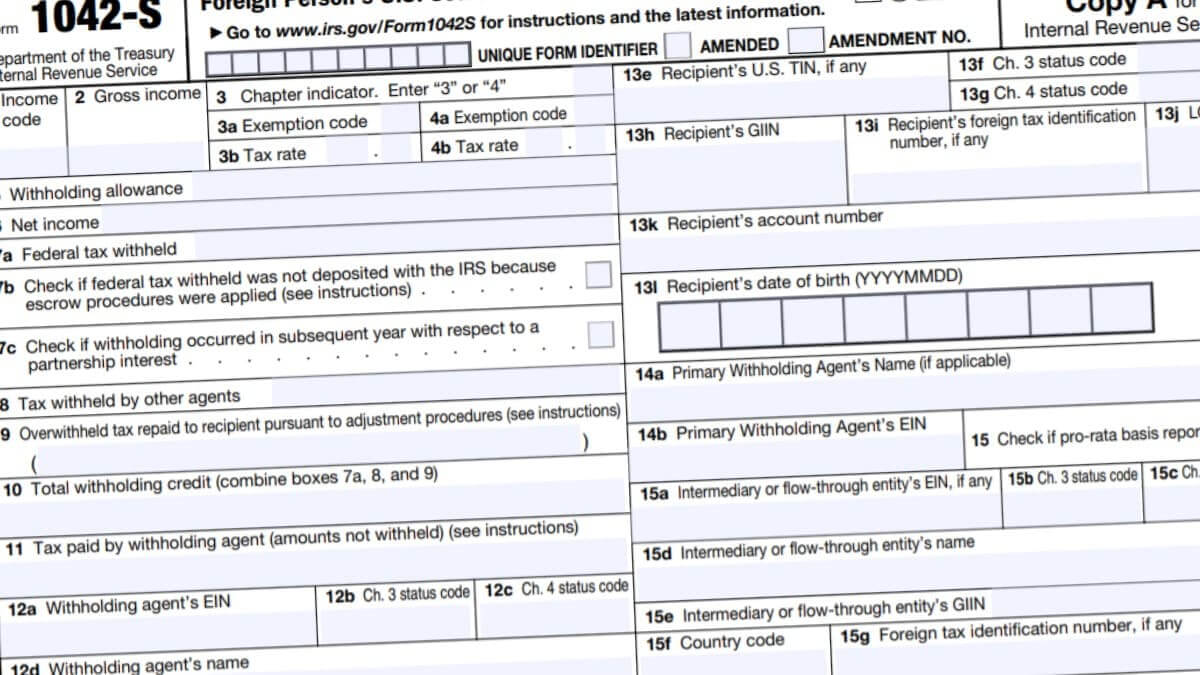

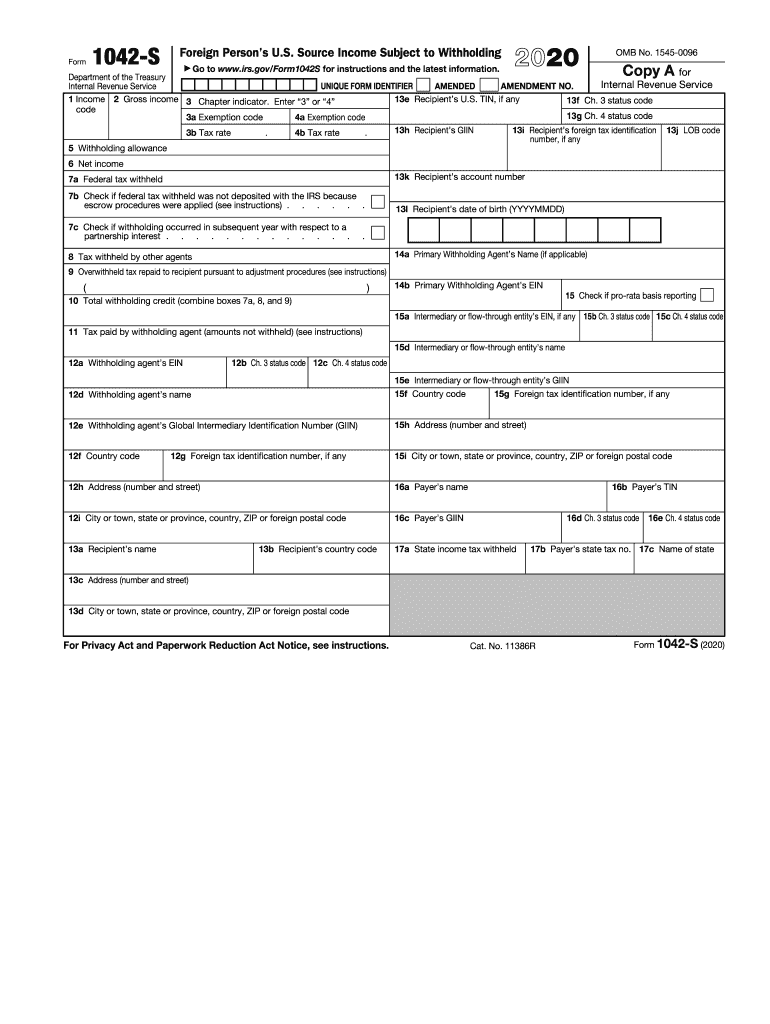

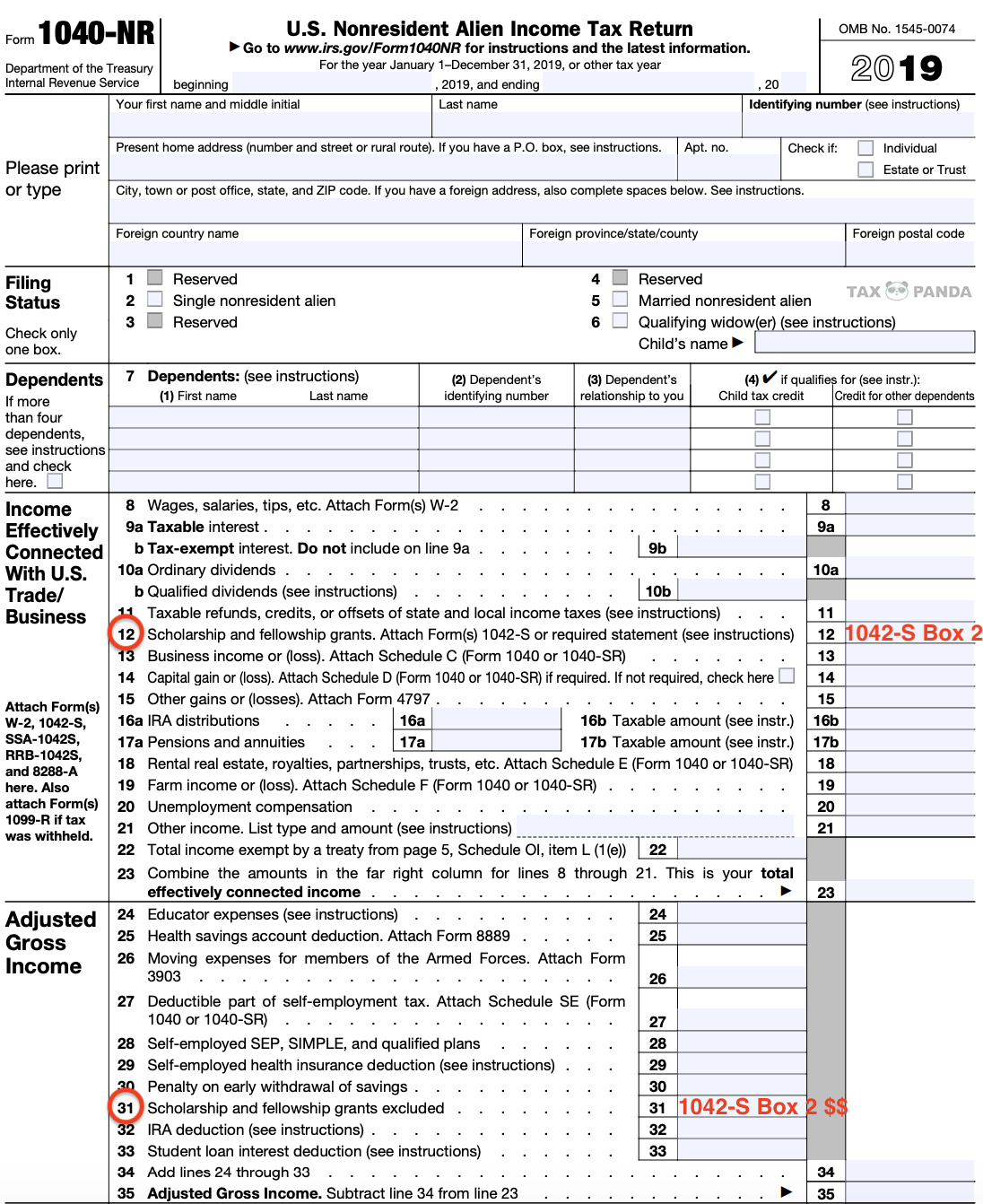

Tax form 1042 s

Form 1042-S is a vital IRS tax document used to report income paid to foreign persons by U. Se pasará a explicar lo que .” Form 1042-S applies even if filers didn’t withhold any income tax.The IRS Form 1042-S should be filed by a U. residents, partnerships and corporations. It reports the liability of the withholding agent on the tax they have withheld or should have withheld.The 1042-S form – Foreign Person’s U. Generally, a recipient Taxpayer Identification Number (TIN) is required on Form 1042-S, to reduce the tax rate of withholding that a withholding agent must apply tax to less than 30%. Box 3a,4a - Exemption Code.

Instructions for Form 1042-S (2024)

Instructions for the 2023 return reporting nonresidents’ US-sourced income were released March 3 by the Internal Revenue Service. You are informing the IRS of the total cumulative amount of payments which you have paid to a non-US person during the tax .

Understanding Form 1042-S

If a partnership withholds on a foreign partner's share of income after March 15 of the subsequent year, the due date for filing the applicable Form(s) 1042-S is September 15 of the subsequent year. Form 1042-S is an information return filed by a withholding agent to report the amounts paid to foreign persons, as described under the “Amounts Subject to Reporting on Form 1042-S. Corporations file Form 1120-F; all others file Form 1040NR. Status codes were both added and removed. tax treaty or . person or company that makes payments of U.Foreign Account Tax Compliance Act (FATCA).TIN Requirement.File Form 1042-S, Foreign Person's U. New electronic filing requirements apply to Form 1042 beginning for tax year 2023 (Forms 1042 filed in 2024). File Form 1042-S, Foreign Person's U.When your company engages foreign (non-U.

IRS Releases 2023 Form 1042-S Instructions

Form 1042-S reports US source income earned by non-US persons subject to US withholding tax, including interest, dividends, substitute payments in lieu and fees earned (paid to and for account managers) on your account for the year.

The 2023 instructions provided an exception to the normal reporting of a Global Intermediary Identification Number in .Your IRS Form 1042-S incorporates payments from multiple University of Washington departments, including Payroll, Student Fiscal Services, Accounts Payable, and Intercollegiate Athletics. The withholding agent must file 1042-S on behalf of the beneficial owner of the income. Source Income Subject to Withholding, are amounts paid to foreign persons (including persons presumed to be foreign) that are subject to NRA Withholding, even if no amount is deducted and withheld from the payment because the income was exempt from tax under a U.How Form 1042 Works. All exempt income (per a tax treaty benefit) and non-service fellowship income subject to taxation, along with taxes withheld, will be reported to foreign individuals on IRS Form 1042-S Foreign Person's U. The 2024 Form 1042-S no longer includes a specific copy for the withholding agent. Enter either “3” or “4”. To complete Form 1042-S .

2023 Form 1042

Instructions for Form 1042-S - Introductory Material. Section references are to the .States at any time during the tax year and if the tax liability of such person was fully satisfied by the withholding of United States tax at the source.The instructions for the 2023 Form 1042-S, Foreign Person’s US Source Income Subject to Withholding, add new status codes related to regulations on trading .Form 1042-S is an information return filed by a withholding agent to report the amounts paid to foreign persons, as described under the “Amounts Subject to Reporting on Form 1042 .) contractors and freelancers, you take on an obligation to report their earnings to the IRS and withhold the appropriate amount of taxes on each payment. person makes FDAP-type payments (discussed below) to a foreign person who is subject to U. The form is subject to the lowered e-filing threshold. Department of the Treasury Internal Revenue Service. 5 6: Section 3 Potential Section 871(m) Transactions : Check here if any payments (including gross . Simply put, if a company based in the United States pays non-US . Generally, every nonresident alien individual, nonresident alien fiduciary, and foreign corporation with U. About Form 1042, Annual Withholding Tax Return for U. Here, is a detailed overview of Form 1042-S, including who must file, the . Choose the tax year, select Form 1042-S, and proceed to the next step.Page Last Reviewed or Updated: 17-Aug-2023.Understanding the role of form 1042-S. Source Income Subject to Withholding, is an information form to report year-end amounts paid to non-U.Form 1042-S, an essential information return in the realm of tax reporting, serves as a meticulous record of income paid to foreign individuals and entities. Form 1042-S should not be used to report any amounts that .If you file Form 1042 and/or Form 1042-S late, or fail to pay or deposit the tax when due, you may be liable for penalties and interest unless you can show that the failure to file or pay was due to reasonable cause and not willful neglect. Es fundamental entender de lo que este documento trata para poder llevar un control adecuado de lo que son los ingresos y pagos de impuestos.What is the purpose of Form 1042-S? Form 1042-S is used to report a foreign person’s U.

Those in charge of withholding tax, like employers or universities, use this form to report various types of income, such as dividends or scholarships, even if they didn’t withhold any taxes.

About Tax Form 1042-S

IRS Finalizes Form 1042-S Instructions

sources paid to foreign persons is required to be reported on Form 1042 .IRS Form 1042-S: Reporting & withholding for foreign contractors. For more information refer to the instructions attached to Form 1042-S. 4, 2023, as well as the 2023 form’s instructions, the IRS said. tax must be withheld from a payment made to a non-U. Source Income Subject to Withholding, and the final 2023 Form 1042, .

Guide to IRS Form 1042, Uses and FAQs

Form 1042-S is an IRS tax document used to report income, and other amounts subject to withholding, received by a foreign person from a source in the United States.Electronic filing. The final 2024 form for reporting nonresidents’ US-source income was released Jan.” To assist with completing the form correctly, we have identified key items .In such a case, the partnership or trust will be required to report the associated amount and tax withheld on Forms 1042 and 1042-S for the preceding year.Instructions for Form 1042-S.Taille du fichier : 219KB This applies to non-resident aliens, foreign partnerships, foreign corporations, foreign estates, and foreign trusts that are subject to . Source Income Subject to Withholding, contained a change from the draft released Dec. Questions for payments other than Payroll should be directed to the appropriate department.

Free IRS Form 1042-S

The primary purpose of Form 1042-S is to report various types of income subject to withholding.

Forms 1042-S and 1042-T are also due by March 15. Source Income Subject to Withholding, to report amounts paid to foreign persons (including persons presumed to be foreign) that are subject to withholding, even if no amount is deducted and withheld from the payment because of a treaty or Code exception to taxation or if any amount . Form 1042-S reports payments and amounts withheld under the provisions commonly known as FATCA or Chapter 4 of the . Foreign Person's U. person and when a payment made to a non-U. Important to Know. A financial institution that files a Form 1042-S with respect to • • •! Income Tax Filing Requirements. source income and any federal income tax withheld. Annual Withholding Tax Return for U.gov, at any United States Embassy or consulate or by writing to: Internal Revenue Last updated: February 23, 2024.Form 1042-S, Foreign Person’s U. withholding, even if no tax was withheld because of an existing income tax treaty or specific statutory exemption from withholding as . Source Income Subject to Withholding.Amounts subject to reporting on Form 1042-S, Foreign Person's U.

Information Reporting for Form 1042-S

Annual Withholding Tax Return for U.

IRS Form 1042-s: What It is & 1042-s Instructions

You may get the return forms and instructions at IRS.

2021 Form 1042-S

The finalized instructions for the 2024 Form 1042-S, Foreign Person’s U.Department of the Treasury Internal Revenue Service. The 2024 Form 1042-S no longer includes a specific copy for the . You IRS Form 1042-S is available in Glacier – individuals will .gov/Form1042 for instructions .Form 1042-S, titled Foreign Person's U. Enter the payer’s and recipient’s details.Formulario 1042-S. See the instructions for Electronic Reporting, later. Log in or sign up on Tax1099.

IRS Finalizes Form 1042-S Instructions

source FDAP income reported on all Forms 1042-S (from line 62a, (b)(1), and (b)(2)) . Use Form 1042 to report the following: The tax .The IRS released both draft instructions for the 2024 Form 1042-S, Foreign Person’s U. Source Income Subject to Withholding is issued to non-residents of the USA that have earned income from the . The penalty amounts from 5% to 25% of the unpaid tax for each month or partial month that the return is overdue.Form 1042-S (2021) U.-based entities or institutions.

Form 1042-S Instructions for 2023

22, 2024, 8:48 PM UTC. We are adding clarifying languuage to Publicly Traded Partnerships (Sections 1446 (a) and (f) Withholding Tax) .

The instructions for Form 1042 span 11 pages, but the form itself is only two pages long. For the latest information about developments related to Form 1042-S and its instructions, such as .A Form 1042 summarizes the information reported on a 1042-S which you issue to your students and employees.

You may receive multiple 1042-S forms reporting different types of income. 4: 5: Total variance, subtract line 3 from line 4; if amount other than zero, provide explanation on line 6.Ernst & Young, EY US.Form 1042-S Line-by-Line Instructions. source income to a nonresident. Filling out Form 1042-S correctly is not just about following the rules; it’s a smart move for businesses because it helps them avoid penalties and legal trouble. Source Income of Foreign Persons. This form is not just a piece of paperwork; it’s a way for the government to double-check that everyone is following the tax rules. By Jamie Rathjen. For general information about electronic filing, see . Future Developments. Published: March 10, 2022. Also, if applicable, the option to file Form 1042-S by paper is still available.” Form 1042-S applies even if filers didn’t withhold any . So, the longer the delay, the more you may .gov/Form1042 for instructions and the latest . It is important to note that Form 1042-S must be filed when a U. Filers must also send recipients a copy of Form 1042-S before March 15th annually. The instructions for the 2023 Form 1042-S, Foreign Person’s US Source Income Subject to Withholding, . El Formulario 1042-S es un requerimiento que se ha solicitado desde hace mucho tiempo y ha creado varias dudas entre la comunidad de comerciantes. Understanding when U.Step 1: Create.Le formulaire 1042-S est un formulaire de l'IRS utilisé pour déclarer les montants payés et retenus à leurs travailleurs non citoyens et non résidents. Forms and Instructions.Form 1042-S is an IRS form titled Foreign Person’s U.

_001.JPG/revision/latest?cb=20160327120241&path-prefix=de)

-to-Grams-(g)-Step-12-Version-4.jpg)