Tax in ireland 2022

Tax is calculated as a percentage of your income. This is an increase of 17% or €16. It includes a summary of Irish tax rates, as well as an outline of the main. Read Tax facts 2022, our practical, easy-to-follow guide to the Irish tax system. An extra charge of 3% applies to any self-employed income over €100,000. They are also liable to Irish tax on foreign income which exceeds €3,810.European Attractiveness Survey 2022 . This document sets out a short summary of the main changes in taxation, social welfare, .1% increase in PRSI which takes effect from 1 October 2024 onwards.

How Ireland’s attractiveness is bolstering FDI performance

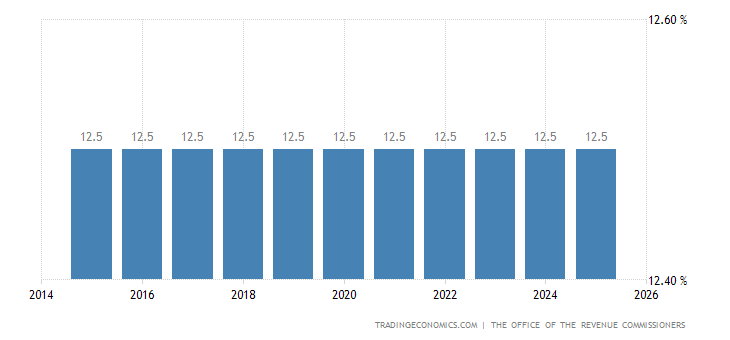

CT is the second largest tax-head, representing 27.The Annual Salary Calculator is updated with the latest income tax rates in Ireland for 2022 and is a great calculator for working out your income tax and salary after tax based on a Annual income. Accurate and easy-to-use, it’s your go-to tool for payroll calculations in Ireland. If you accept the terms and conditions then please tick the box and press Get fare estimate. Stay informed about tax regulations and calculations in Ireland in 2022.7bn in 2021 to €97. However you may need to pay a Universal Social Charge (if your income is over €13,000) and PRSI (depending on how much you earn each week). Global business pulse - industry analysis Mid-market recovery spreads to more industries.The deadline for filing income tax returns in Ireland is October 31 of each tax year.Cumulative Basis

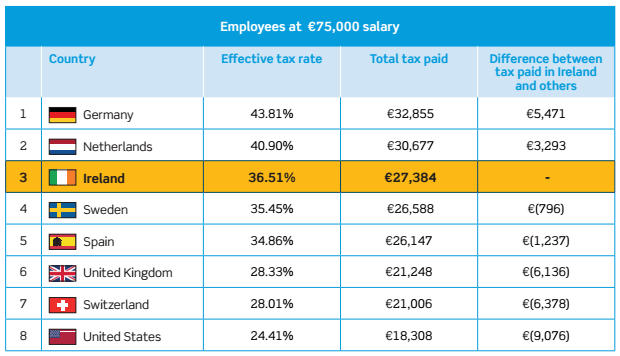

Overview of Ireland's Taxes

Total tax revenues for Ireland were €110 billion in 2022.Higher rate for tax years up to and including 2022 to 2023. Married Taxpayers (single income) Personal tax credits of €3,400 PAYE tax credit of €1700 Income Tax Rates 20% on the first €45,800 and 40% on the balance.

Pension contributions to the following pension plans may qualify for tax relief: qualifying overseas plans.In 2022 €110 billion of taxes and social contributions were collected.

Inheritance Tax in Ireland

It includes a summary of Irish tax rates, as well as an outline of the . The USC does not apply to social welfare or similar payments.9% compared with the OECD average of 34.Welcome to Tax Facts 2022, our practical and easy-to-follow guide to the Irish tax system.In 2022, Ireland had a tax-to-GDP ratio of 20.Corporation tax receipts for the first four months of the year now stand at €2.5% of net tax receipts in 2022 20 Net CT Receipts . A non-resident who is Irish domiciled is taxable on worldwide income expect income from a trade, profession or employment where all the duties are carried on outside the state.You can get Income Tax relief against earnings from your employment for your pension contributions (including Additional Voluntary Contributions (AVCs).The pre-July 2008 table based on engine size. A blended PRSI rate of 4. To calculate your Income Tax, you will need to understand how tax credits and rate bands work.Tax revenue in 2022 stood at €83.

2022 Corporation Tax Payments . the quarterly payment is 28. This deadline is for customers who file and pay on . Additional rate. The taxpayers whose tax is paid through the PAYE system must submit Form 12 before the deadline.Introduced in 2018, the sugar tax was implemented after years in the pipeline in an effort to curb rising obesity rates.

View Transcript. For comparison the cash .The calculator is updated with the latest tax rates and brackets as per the 2022 tax year in Ireland. Last updated on 5 October 2022. Advanced rate for tax years up to and including 2024 to 2025.USC: You must pay the Universal Social Charge (USC) if your gross income is over €13,000 in a year. Her weekly tax is calculated by applying the standard rate of tax (20%) to the first €980. Gross Income Tax = .Use our Ireland Payroll Calculator for the 2022 tax year to effortlessly calculate your net salary, income tax, social security contributions, and other deductions. Tom Woods said “the consistently . In 2021, Ireland was ranked 36th out of the 38 OECD countries in terms of the .

Corporation Tax

Financial institutions operating in Ireland are obligated to withhold tax (deposit interest retention tax or DIRT) out of interest paid or credited on deposit accounts in the beneficial ownership of resident companies, unless the financial institution is authorised to pay the interest gross. The interest you receive is subject to a tax called Deposit Interest Retention Tax (DIRT).1 shows the split between the main . Once logged into ROS follow these steps: Click on the 'My Services' section from the ROS main menu.

Tax facts 2022 — Insights

The Irish government has said it expects to run a budget surplus of more than €8bn (£6. For all payments: the half-year payment is 55. Read Tax Facts 2021, our practical, easy-to-follow guide to the Irish tax system. Less than a minute | 05 Sep 2022.

How your Income Tax is calculated

In the ‘File a return’ section, select the return type of ‘Income Tax’ and ‘Form 11’. Example : Calculation of Take Home Pay : 2022.1 billion, which was €14. On-line ISSN: 2565-5590.This means that if you earn €18,750 or less you do not pay any income tax (because your tax credits of €3,750 are more than or equal to the amount of tax you are due to pay).

How your income tax is calculated

Budget 2022

This tool is designed for simplicity and ease of use, focusing solely on income . If you have just moved to Ireland to start work, you will need to apply for a Personal Public Service . The content on these pages will help you make your 2023 Income Tax return .In 2023, Ireland won 248 new investments (132 or 54% of these being investments located outside the major urban centres), which was up 2. Local Property Tax (LPT) exemptions for 2022 to 2025; Deferral of Local Property Tax payment; Selling, buying or transferring a property ; What happens if you do not comply; Employers, local authorities, LPT agents, statistics, LPT legislation; . You do not get a Personal Allowance on . A single person , employee earning €36000.CSO statistical publication, 23 November 2022, 11am. Help with filing the Form 11 including full self assessment is available in the Self-assessment and self-employment section. It provides a summary of Irish tax rates and an outline of the main . The report reflects a year of strong performance for Revenue with a record amount of tax and duty collected in 2022. Income taxes of €31 billion are almost a third of the .

Car Tax or Motor Tax rates in Ireland were altered in the 2021 Budget –.7 billion (22 per cent) income tax receipts last year amounted to €30.

Revenue Statistics 2023

3 billion in taxes was collected in 2021. £50,271 to £125,140.

Deloitte US

Complete and return Form 11 to Revenue by 31 October 2022, or for ROS returns by 16 November 2022. This means that self-employed people pay a total of 11% USC on any income over €100,000. The calculator is designed to be used online with . In Ireland, if your gross annual salary is €47,201 , or €3,933 per month, the total amount of taxes and contributions that will be deducted from your .

Calculating your Income Tax

25% of the annual rate.5% from 2022 and led to the creation .This calculator is not suitable for persons liable to income tax, USC and PRSI as a self-employed contributor.An additional €17 million is allocated for once-off COVID-19 business supports in 2022.Sarah earns €1,100 per week.3 billion on 2021 total tax revenue receipts.It sounds obvious, but remember to ensure you have adequate funds in your bank account to pay your liability for 2021 and preliminary tax for 2022 prior to the deadline.Cars registered up to 31/12/2020 and those from 2021 which are NEDC tested only. The rates of tax for cars registered after July 1, 2008 is based on the emissions of the engine. Before that date, cars pay tax based on the size of the engine. Example 3 : A great-nephew inherits a house worth €200,00.LPT is a self-assessed tax charged on the market value of residential properties in the State.Financial service providers such as banks offer accounts where you can save a sum of money (a deposit) for which they will pay you an annual rate of interest in return, usually as a percentage of the deposit. Please note that if you choose to book your taxi on an . over £125,140.7 billion, up 15 per cent on .Income Tax Rate: 20% on the first €70,600 ; 40% on the balance. However, those people who have to pay taxes through the non-PAYE system and have more than 5000 Euros in tax would need to register through the Self . The Pay and File deadline for the 2023 Income Tax Return (Form 11) is Thursday 14 November 2024.Discover the Ireland tax tables for 2022, including tax rates and income thresholds.Today (26/4/2023) Revenue announced the publication of its 100th Annual Report for 2022. Over that period, assuming the policies signalled by Government are followed, overall tax and PRSI receipts will climb from €81.1 shows the breakdown of the main tax heads.How to access the service. In Ireland, more than €93. Skip to content; Skip to navigation; back. You can also see the rates and bands without the Personal Allowance.

Tax Facts 2023 — Insight

pdf (4 MB) In spite of headwinds generated by inflation, geopolitics and uncertainty around global tax reform, findings from the EY European Attractiveness Survey show that Ireland continues to punch above its weight in attracting foreign direct investment.

Ireland Tax Tables 2022

:quality(70)/cloudfront-eu-central-1.images.arcpublishing.com/irishtimes/VZ5OLXGTJJ73SZPME3TFVHYZZE.png)

Tax Facts 2021.Helping to navigate the indirect tax rules in Ireland.77 (up to the limit of Sarah's rate band). A tax credit will reduce your tax by the . This section explains: tax credits and rate bands.Ireland's Tax Statistics 2022. This is subject to the limits outlined on the next page.

Tax in Ireland for Expats and non-residents

The rate of income tax will stay the same, but tax credits will be increased.025% has been applied to account for the 0.

Local Property Tax (LPT)

File an Income Tax Return

Pre-booking (extra €2 fee applies) Hailing On Street or at a Taxi Rank.

£31,093 to £150,000. This deadline is for customers who file and pay on Revenue Online Service (ROS).Tax facts 2022. The increase is driven by strong growth in income tax, VAT, .An Irish resident and domiciled individual is taxable on their worldwide income and gains. With 33% tax on the remaining €160,000 house value, this would result in an inheritance tax bill of €52,800 in total or €26,400 per child.Published on 19 July 2019. Alongside the 2022 Annual Report, Revenue also published a number of other reports, including research reports on Corporation Tax, Income .