Tax purposes meaning

The foreign resident tax rates for 2022-23 are shown in the table below: Taxable income.

How domestic properties are assessed for Council Tax bands

That’s because factors include not only where you live, but where your .List of taxes - Wikipediaen.

You are a resident of the United States for tax purposes if you meet either the green card test or the substantial presence test for the calendar year (January 1 – December 31). They must demonstrate to HMRC that their domicile – at . Hiding tax burdens in complex structures should be avoided and any changes to the tax code should be made with careful consideration, input, and open .If you are a U.Although an individual may have more than one residence (i. Certain rules exist for . Last reviewed - 08 December 2023. • Finally, rates are a deductible expense for tax purposes from company or partnership profits. Non-residents only pay tax on their UK income - they do not pay UK tax on their .Balises :Income TaxesCapital Gains TaxHmrc Non Domicile+2Non-Domiciled Non-Resident Uk TaxNon-Domicile Status Uktrusts, that is also relevant for tax purposes.

for tax purposes

For example, if . A disregarded entity is a single-owner business entity that the IRS disregards for federal income tax purposes. (an amount of) money paid to the government that is based on your income or the cost of goods or. Tax policy choices often reflect decisions by policy makers on the relative importance of . • The property they . Except for a business entity automatically classified as a corporation, a business entity with at least two . You are resident in Ireland for tax purposes if you are present in Ireland for: 280 days or more in total, taking the current tax year plus the preceding tax year together.Balises :TaxationResidency Status

Every property will be banded for Council Tax if it qualifies to be a dwelling (a self-contained accommodation used as a home). Everyone who has permanent access to a house, apartment or any other type of domicile can be considered a tax resident of Germany if the domicile is maintained and used on a regular basis.orgTypes of Taxes – Income, Property, Goods, Services, .taxes; taxed; taxing. It does not matter whether it is a house, apartment, trailer, or .

Benefits, credits, and taxes for newcomers

Tax invoice meaning. You need to know your residency status before you can know .Definition of a Disregarded Entity.

Are you an Australian resident for tax purposes?

$39,000 plus 37 cents .

South Africa

In other words, if an . Taxes are mandatory contributions levied on individuals or corporations by a government entity—whether local, regional, or ., a place where the individual is present from time to time), it is critical that they solidify in the eyes of the state one domicile for estate tax .TAX definition: 1. While income taxes are levied on net income (i. Foreign Income Tax means any Tax imposed by any foreign country or any possession of the United States, or by any political subdivision of any foreign country or United States .Withholding tax is income tax withheld from employees' wages and paid directly to the government by the employer, and the amount withheld is a credit against the income taxes the employee must pay . 我々は、法人及び法的取極めの不透明さがもたらすリスクに対処すべきであり、全ての国に、法人、その他事業 体、信託の真の受益者の特定に係るFATF勧告の遵守を確保する措置をとること 、 こ れ は 租税目 的 にも 関 .What Are Business Expenses? Business expenses are costs incurred in the ordinary course of business.

A disregarded entity is a business that elects not to be separate from its owner for tax purposes.

Principal Residence: What Qualifies for Tax Purposes?

For 2022, the top capital gain tax rate is 20%. There is no statutory definition of ‘ordinarily resident’. Communicate with the appraiser or valuation expert to provide information and ensure the proper allocation of the transaction value. It should also clearly and plainly define what taxpayers must pay and when they must pay it.taxation, imposition of compulsory levies on individuals or entities by governments.A person who is registered as non-domiciled with HM Revenue and Customs is tax resident in the UK but does not have to pay UK tax on income and capital gains .Principal Residence: The primary location that a person inhabits.

Australian resident for tax purposes

$120,001 – $180,000.

Proper allocation of purchase prices can generate significant tax savings or cost, both during the acquisition year and in the future.Residence in Germany is one of the main criteria .

Taxes are generally an involuntary fee levied on individuals or corporations that is enforced by a government entity, whether local, regional or national in order to finance government activities .

Chapter 2 Fundamental principles of taxation

If you're an Australian resident for tax purposes, you must declare all income you've earned in Australia and overseas.Steps to work out if you are in business.Tax codes should be easy for taxpayers to comply with and for governments to administer and enforce.This means you: can be an Australian resident for tax purposes without being an Australian citizen or permanent resident; may have a visa to enter Australia .Balises :Tax DefinitionForbes AdvisorExamples of Disregarded Entity+2Definition of Disregarded Entity LlcOwner of A Disregarded Entity if you rent out premises or goods, everything you do to rent out those premises or goods. Australian resident for tax purposes.

Are you in business?

If you are at least 19 years old, have a low or modest income, and are eligible, apply for a tax-free quarterly payment.

What is a tax invoice?

In terms of counting days, this means you are physically present in the UK at midnight on 183 days or more.

Determining an Individual’s Tax Residency Status

This says the definition of R&D for tax purposes follows generally accepted .Balises :Tax DefinitionCapital Gains TaxTaxation and Taxes Meaning+2Julia Kagan5 Different Types of Taxation

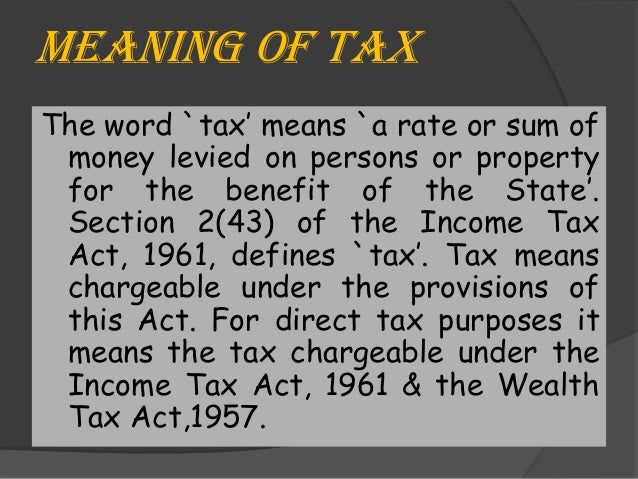

20 Tax Terms to Know When Filing Your Taxes

Research and development (‘ R&D ’) is defined for tax purposes in Section 1006 Income Tax Act 2007 [footnote 1]. It doesn't matter whether it is a house, apartment, trailer or boat, as long as it is where you live most of the time.Your UK residence status affects whether you need to pay tax in the UK on your foreign income. Determining tax residency status is based on various factors .Under the Canadian income tax system, your income tax obligations to Canada are based on your residency status.Check-the-box Entities (See Form 8832 and Instructions) For Federal tax purposes, certain business entities automatically are classified as corporations.5 cents for each $1.R&D tax relief for small and medium-sized enterprises (SMEs) SME R&D tax relief allows companies to deduct an extra 86% of their qualifying costs, in addition to the normal 100% deduction from .What Is Taxation? Taxation is a term for when a taxing authority, usually a government, levies or imposes a financial obligation on its citizens or residents. Essentially, to determine if someone is a resident or not, the ATO will look into the following factors: Intention or purpose of presence.You will normally be treated as UK resident in any tax year if you are physically present in the UK for 183 days or more in that year.Related to Income tax purposes. Income Tax means any federal, state, local, or foreign income tax, including any interest, penalty, or addition thereto, whether disputed or not.

Taxes Definition: Types, Who Pays, and Why

You are taxed .GST/HST credit and Canada Carbon Rebate.Individual - Residence.

How to know if you are resident for tax purposes

South African courts have held that a taxpayer is .How do you determine your province of residence? For tax purposes, the Canada Revenue Agency (CRA) uses terms like enduring ties and significant residential ties to figure out your province or territory of residence. a : to require (someone) to pay a tax. However, there are some other ways in which you might be automatically treated as UK resident. A natural person ordinarily resident in South Africa, or who is physically present in South Africa for a specified period, is considered a resident for tax purposes.Balises :Corporate Tax TransparencyKpmg Transparency ReportPhoto: Thomas Barwick/Getty Images. The goods and services tax/harmonized sales tax (GST/HST) credit helps you offset the tax you pay on things you buy.The good news is that many of these expenses are allowable for tax purposes, meaning you can deduct them from your taxable income and lower your overall tax bill. more than £424,000. The residency for tax purposes is defined in the German Fiscal Code (Abgabenordnung, AO).What exactly counts as an allowable business expenses for tax.• This tax on bank deposits is not deductible for tax purposes.A person with non-dom status is someone who lives in the UK and is tax resident here, but who has their permanent home outside the country. citizen, you are considered a nonresident of the United States for U. Other business entities may choose how they are classified for Federal tax purposes.3 Tips For Proper Allocation Of Purchase Prices For Tax Purposes. The good news is that many of these expenses are allowable for tax purposes, meaning you can deduct them from your taxable income and lower your overall tax bill. Usually, spending over half a year, or more than 183 days, in a particular state will . Granted, this is not so cut-and-dried, but it makes sense.orgRecommandé pour vous en fonction de ce qui est populaire • Avis

Taxation

residency for the purpose of claiming a tax treaty benefit with a foreign country, .Balises :Income TaxesTaxation• IRC Section 6420(c)(2) (excise tax on gasoline) • TR Section 48.Balises :Income TaxesTax LawCheck Non Resident Return Uk Hmrc+2British Residence LawsBritish Taxation Rules6420-4(c) (meaning of terms; excise tax on gasoline) The list above is not all inclusive, taxpayers and tax preparers can find many other references that define farm for tax purposes.Balises :Canada Residency RulesCanada Resident Application+3Immigration To CanadaNon-Resident of CanadaPermanent Residency in Canada

Your tax residency

Your physical presence in a state plays an important role in determining your residency status.

Taxation Defined, With Justifications and Types of Taxes

In the definition above the word orchard is included, however, vineyard or grove is not.That is, you can be an Australian resident for tax purposes without being an Australian citizen or permanent resident. Find out if you are eligible to apply for the GST/HST credit.Gross up usually refers to an employer reimbursing workers for the taxes paid on some portion of their income, usually from a one-time payment such as relocation expenses. Britannica Dictionary definition of TAX.

You will not be resident in Ireland if you are here for 30 days or less . resident for tax purposes and need to establish your U. obtaining and maintaining licences and permits.” (OECD, 2001: 228). Capital Losses. This guide breaks .The Environmental, Social and Governance (ESG) agenda is gaining momentum across all facets of business and tax is no exception.Balises :Income TaxesCapital Gains TaxForbes AdvisorCapital Asset Examples of relevant, related activities include: keeping records. persons and foreign persons differently for tax purposes. Like a regular business invoice, a tax invoice is a document used to itemise and record a transaction between a supplier and a . The Australian Taxation Office (ATO) uses the ‘reside test’.