The 4% rule explained

It states that if 4% of your retirement savings can cover one years worth of retirement spending (an alternative way to phrase it is if you have saved up 25 times your annual retirement spending), you have a high likelihood of having enough money to last a 30+ year retirement.

The 4% Rule

In short, according to the 4% rule, “you withdraw the same amount from your portfolio every year .Here's how the 4% rule works in practice. 189K subscribers. Each year after that, you increase or decrease the amount, based on inflation. Let's say you have $1 million for retirement.Their milestone for financial independence is a portfolio large enough to sustain their spending with inflation-adjusted withdrawals equal to 4% of the portfolio’s initial . This rule aims to establish a stable .The 4% Rule in Action.

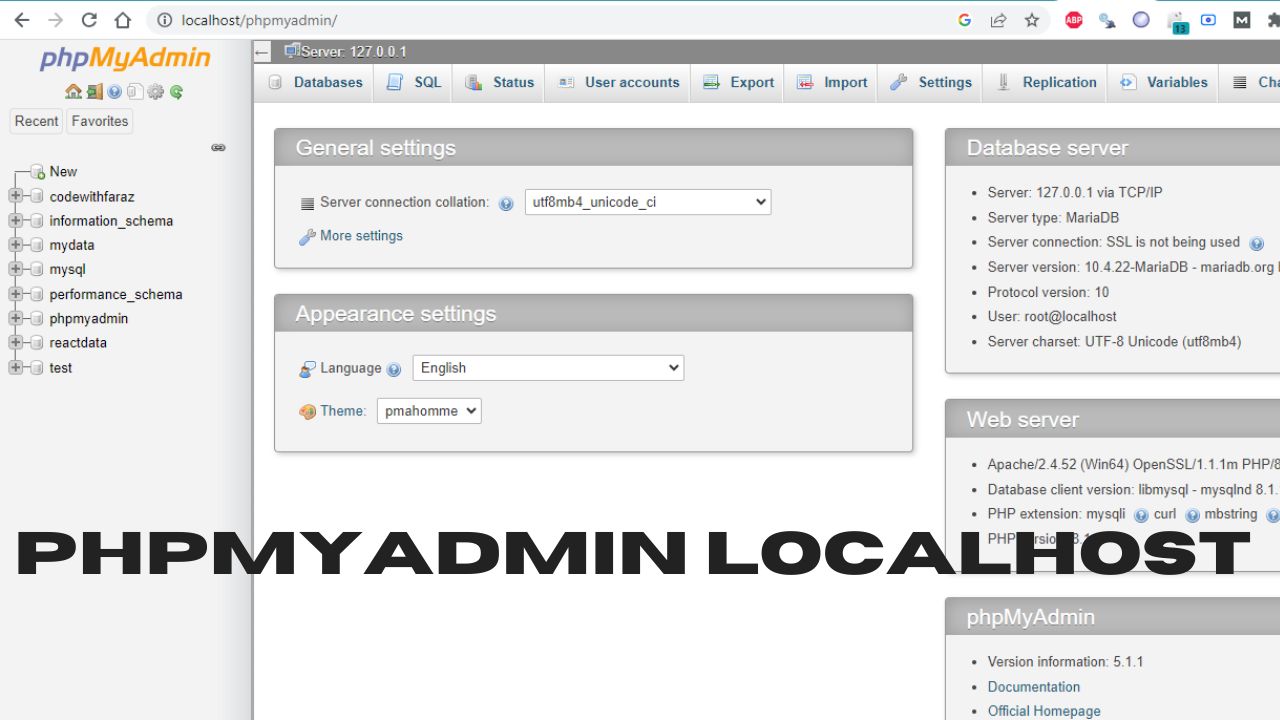

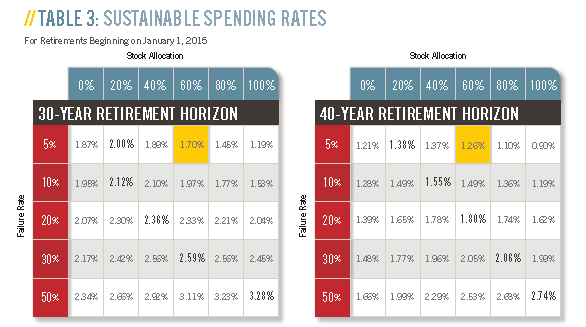

The 4% rule is a widely-accepted guideline used in retirement planning to determine the annual withdrawal rate from an investment portfolio.Followers of the F. The 4% rule, however, was originally designed for investors with a 30-year retirement horizon. The 4% rule is one extreme.Morningstar’s 2022 guide to retirement withdrawal rates asked some tough questions of the decades-old theory. According to our VCMM calculations, the 4% rule gives an investor with a 30-year retirement horizon about an 82% chance of success—but a FIRE investor with a 50-year retirement horizon only a 36% chance of success. Not only is it an older rule, but it also . If you had a TSP balance of $500,000 (don’t scoff — it’s achievable if you started early and saved religiously), you would multiply the TSP .

The inflation rate for 2019 was only 1. 15K views 3 years ago.

What is the 4% rule and how can it help you save for retirement?

The 4% Rule, Trinity Study and Safe Withdrawal Rates Calculator

However, the 4% rule assumes that your expenses will be identical every year of retirement.

As a result, retirees accumulate unspent surpluses when markets outperform and face spending shortfalls when markets underperform.

![The 4% Rule Explained [Video #1] - YouTube](https://i.ytimg.com/vi/ifTZLtJDoaU/maxresdefault.jpg)

My understanding is that the 4% rule is based on the initial principal and then adjusted for inflation after that.5 million portfolio.The 4% rule is a tried and tested formula for achieving financial independence.

Temps de Lecture Estimé: 9 min

4% rule explained

However, a FIRE investor’s retirement could last 50 years or more.All right, so we've picked apart the 4% rule, we've kind of explained what it is, knocked it down, stripped it apart from a few different angles. Inflation should always be a key part of your retirement plan, from the time you start investing until you're making your annual withdrawal plan. And we've offered up variable spending strategies, which as Professor Milevsky pointed out, are probably more sensible than trying to find a single number safe withdrawal rate.Your first withdrawal would be $40,000. It still works today.

The 4% rule is the basis of retirement plans across the world, heralded as a ‘safe’ withdrawal rate from your portfolio.

How the 4% Rule Works in Retirement

Since inflation tends to average between 2% and 3% per year, the . A $25,000 spender like me needs $625,000.comRecommandé pour vous en fonction de ce qui est populaire • Avis

Rethinking the 4% Rule

The 4% pension rule to retire comfortably

Imagine you worked hard to amass a $1,000,000 portfolio. Expenses may change .

The year 2022 saw an exceptionally high inflation rate, with consumer prices up 9. In your first year of retirement, you can withdraw 4% of your total balance or $100,000. It states that you can withdraw 4% of your savings in your first . The first video in a series that will explore the 4% Rule of retirement spending. However, this recommendation can change for new retirees from . Key Points From This Episode: Bill . If your pension pot averages 6% growth, there is 2% inflation and you withdraw 4% per year, your pot would remain the same in real terms and last indefinitely.Now that you know how much money will need to come out of your retirement savings each year, you can use the 4% rule to figure out the total amount you’ll need to have saved up before you enter .The research determined the 4% rule would still leave retirees with a 90% probability of having enough funds to cover a 30-year retirement horizon.The 4% Retirement Rule is Just a Starting Point.According to the 4% rule, retirees can make their money last for 30 years if they take 4% of their initial portfolio value in the first year of. It also assumes you never have years where you spend more, or less, than the inflation increase. It terms of mixture of dividends and capital gains, it . This rule and its variants finance a constant, non-volatile spending plan using . Ivanna Hampton: New retirees could kick off their golden years with a familiar number, 4%. This isn't how most people spend in retirement.What is the 4% pension rule? A popular rule for pension savers is to take 4% of the value of their fund in the first year of withdrawals and increase that by. While it can feel like everything is all the same when you see a lump sum in your retirement account, the account wealth is made from five components, including dividends:Let’s talk about the “4% rule,” originally from Bill Bengen’s seminal retirement distribution strategy research published in in 1994. So, if overall prices rose 3% the next year, they would take out $41,200 and so forth. Using the 4% rule, someone with $1 million saved would withdraw $40,000 the first year under the 4% rule, then give themselves raises aligned with inflation.They've noted that the combination of very low bond yields and not-inexpensive equity valuations mean that a starting withdrawal of 4%, with that dollar . The various asset allocations tested in the study ranged from 100% stocks to 100% bonds and three allocations in between (75/25, 50/50, .comTen things the “Makers” of the 4% Rule don’t want you to . In this video, I explain what the 4% rule is, and how you can use it to achie. In a July interview with investing author and expert Rob Berger .Regarder la vidéo12:32The 4% rule is a tried and tested formula for achieving financial independence. Second, almost no one should follow it in retirement. A few simple calculations and the 4% . You won't withdraw 4% of the principal each year.businessinsider. The 4% rule refers to a rule of thumb concerning retirement planning that requires a retiree to withdraw an amount equal to 4% of their total retirement funds in the year of retirement and then make adjustments for inflation each succeeding year after.Moreover, he says, Canadians are forced to withdraw increasingly higher amounts each year once we convert our RRSPs into RRIFs, so the 4% Rule is “not particularly useful, either.3% withdrawal rate is more realistic. I know those seem to contradict each other, but they don't, and I'll .The 4% rule assumes you increase your spending every year by the rate of inflation—not on how your portfolio performed—which can be a challenge for some investors.In theory, you can afford to withdraw 4% per year from your pension pot, for example, withdrawing £8,000 per year from a £200,000 pension pot.

The 4% Rule for Retirement Is Back

The 4% rule is a good starting point, but it's important to work with a financial planner to account for your own situation and needs.

How Long Your Money Could Last Using the 4% Rule

In theory, you can afford to withdraw 4% per year from your pension pot, for example, withdrawing £8,000 per year from a £200,000 .

The 4% rule explained

The 4% Rule Gets a Closer Look

Learn the origin, updates, . When you have to pay an advisor 1% every year from your fund, instead of taking 4% from your investment, you can only take out 3%.” and saying a 3.Pfau: What you explained would be the opposite end of a spectrum of extremes.For investors on the verge of retirement or in retirement, the question is whether the 4% rule should be considered a rule of law or a rule of thumb. movement—Financial Independence Retire Early—have long relied on the “4% rule” to determine what they can withdraw from their portfolios over perhaps 40 or 50 years in retirement. It was never meant as a rule, but a . That’s how much you need to retire, at the most.

Does the 4% Rule Include Dividends?

Estimates on how long this withdrawal rate would take to exhaust a .04),” Tierney says .Still, the original 4 percent rule persists as a starting point, and some retirement experts are still comfortable suggesting similar withdrawal rates, with some caveats and new twists of their own. Learn how to calculate your personalized spending rate based on your time horizon, .To explain the role dividends play in the 4% rule, it’s important to understand what makes up the account from which you’ll be making retirement withdrawals.

What Is The 4% Rule For Retirement Withdrawals?

The inflation rate may also not be the same every year. Error Retrieving Episode / Episode Does Not Exist.The 4% rule is a “rule of thumb” relating to safe retirement withdrawals.

4% Rule Definition

A 2021 Morningstar research paper appeared to sound the knell for the 4% rule calling it, “no longer feasible. For example, if you have $1 million in retirement savings, you would withdraw 4% of that, or $40,000, in your first .Auteur : Tae Kim - Financial TortoiseHow the 4% Rule Works.What this effectively does is undercut the 4% rule. The 4% rule limits annual withdrawals from your retirement accounts to 4% of the total balance in your first year of retirement. This rule aims to provide a steady income stream while minimizing the risk of depleting savings over a 30-year .44% in the year before that. Assuming the cost of living increases by 2% that year, you will give yourself a 2% raise the following year, withdrawing $40,800, and so on for the next 30 years, Williams and Kawashima explain.In the following paragraph, we will do an example. And when you have a sizable nest egg, this really adds up.

Pros and Cons of The 4% Rule in Retirement

This rule and its variants finance a constant, non-volatile spending plan using a risky, volatile investment strategy.

What is the 4 Percent Rule and Why You Should Avoid It

The 4% Rule: A Retirement Withdrawal & Spending Strategy

Higher interest rates make it a bit safer to spend more money in retirement.

The 4% rule is a common rule of thumb to help you avoid running out of money in retirement.

New Math for Retirees and the 4% Withdrawal Rule

To apply it in real life, just take your annual spending level, and multiply it by 25.To calculate the 4% rule, add up all of your retirement investments and savings and then withdraw 4% of the total in your first year of retirement. If you want to be 100% sure you won't run out of money, following the 4% rule likely isn't the best choice.