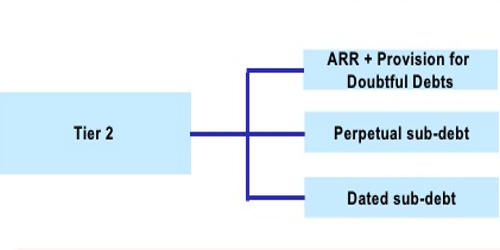

Tier 2 capital bond

Tier 2 capital is a bank's supplementary capital, which is held in reserve.In February and early March 2015, a slew of European banks issued 10-year bullet maturity Basel III-compliant, tier-2 (B3T2) subordinated bond deals, as they .

Tier-2-Kapital

August 2, 2019.Balises :Tier 2 CapitalTier 1 CapitalCapital InstrumentsRevaluation Reserves According to Art. The complete loss on the Baoshang Bank hybrid bond complies with the terms of the tier-2 capital bonds.

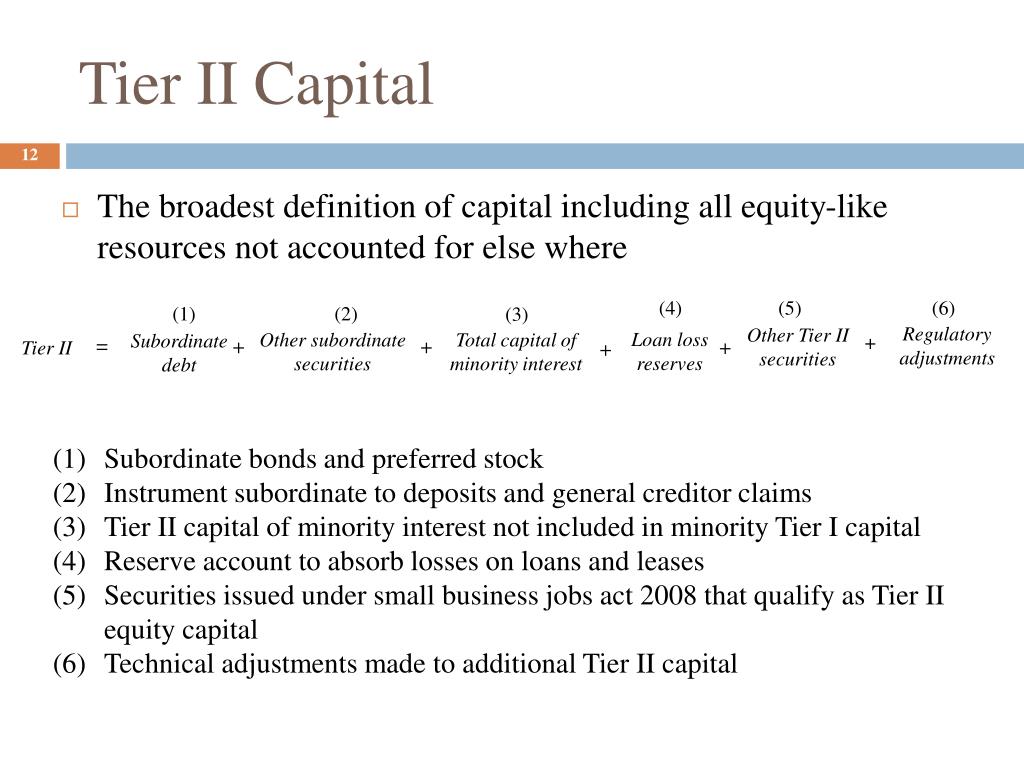

Tier II

Rating Assigned Date. #4 – General Provision / General .Balises :Tier 2 CapitalBondsCredit Ratings2 Tier LeasingBond Investing

Capital securities

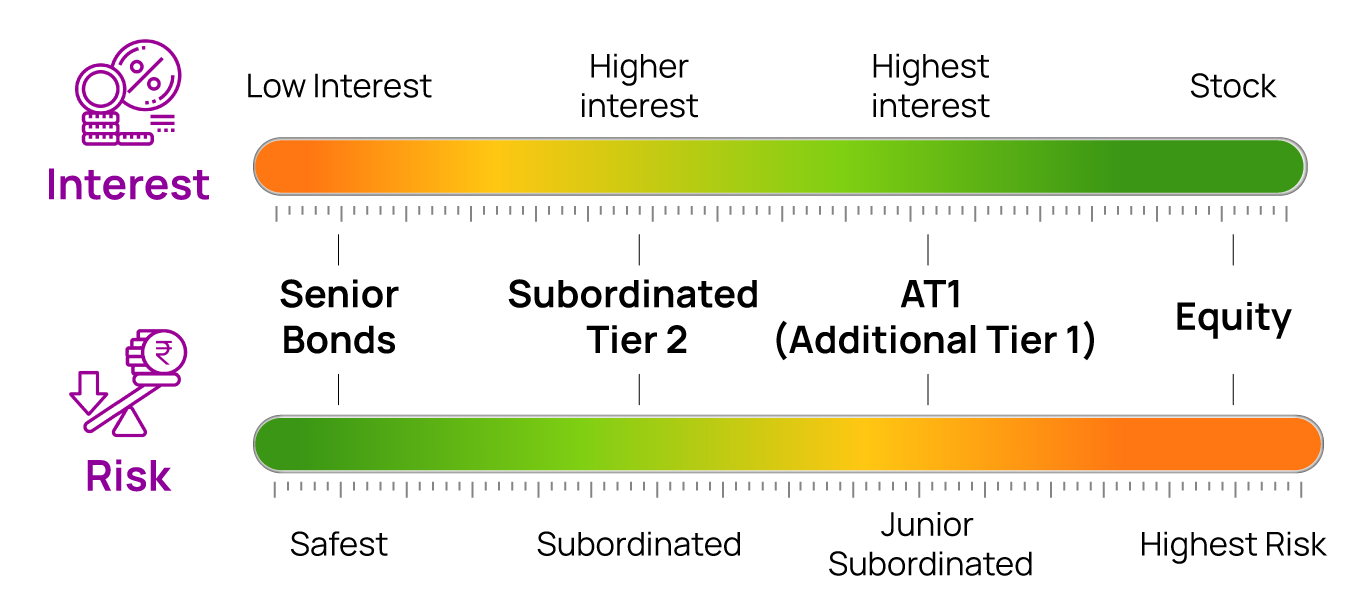

Tier 2 bank hybrids rank above ordinary shares, Tier 1 hybrids, and Tier 1 capital in the capital structure.'s (UOBC, A+/Stable) Tier 2 capital bonds a final rating of 'A-'.

Baoshang Bank Hybrid Bond Write

These bonds are categorized as subordinated .

Dari hasil penjajakan pasar atau roadshow di Singapura dan Hongkong yang dilakukan Bank BTN bersama tiga Joint Lead Manager (JLM) yang terdiri dari HSBC, Citigroup, dan .more than RMB110 billion tier 2 capital bonds in China’s national inter-bank bond market.Balises :Tier 2 CapitalCapital InstrumentsTier 1 CapitalTier-2 capital bonds of commercial banks mean the bonds publicly issued by commercial banks to increase their tier-2 capital. For a bond to be counted as AT1, it must be perpetual and cannot be called for at least five years. Ainsi, le Tier 1 représente la part de fonds propres considérée comme la plus solide. #1 – Undisclosed Reserves.94 billion through a mix of equity and .What is tier 2 regulatory capital?Tier 2 regulatory capital refers to a specific category of capital that banks and financial institutions are required to maintain to comply with re. It is a cost-effective, flexible, and loss-absorbing form of capital that can be issued in .pdf [ Close Window] Development Strategy and Financial Highlights Announcements Financial Reports .Yet, weirdly, Europe’s new “banana republic” and “pariah” has (so far) decided not to touch Credit Suisse’s $2.Auteur : Steven Nickolas

Tier 2 capital

Balises :BondsFinancial Stability BoardTlac in FinanceTlac Ratio66 Shareholders’ equity (CNY

Balises :Tier 2 CapitalBondsTier 1 Capital

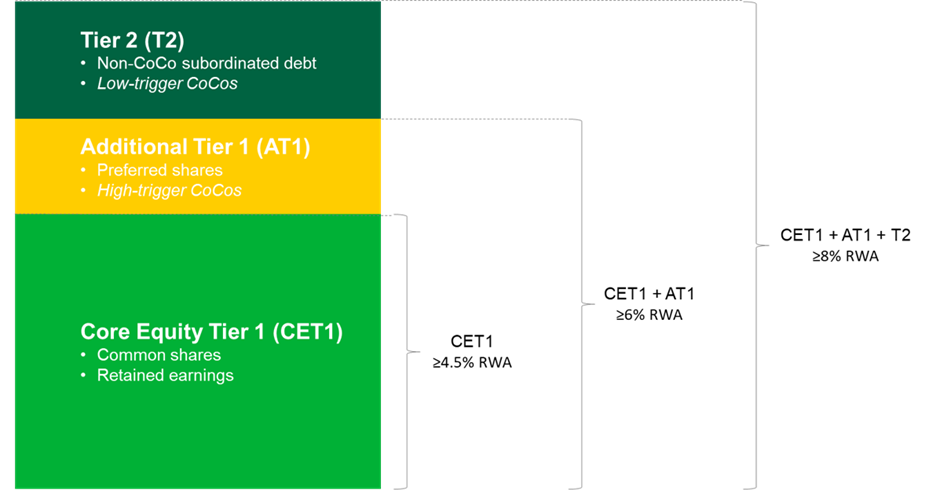

Basel III definition of capital

Auteur : William Pirraglia

Tier 2 Capital Bonds

Hartes Kernkapital (Artikel 26-50 CRR) Das harte Kernkapital (Common Equity Tier 1 capital - CET 1) steht .Tier 2 capital ranks higher than Tier 1, making it more secure.

Tier 2 Capital: Components, Functions, and Real-World Applications

Having these types of liquid assets or cash on hand balances out the risk-weighted assets that banks hold.Financial Planning.Balises :CapitalCredit Ratings

Bank Pulse: Value in selected Tier 2 debt

Le classement en Tier 1 ou Tier 2 dépend du type de risque.

Total capital instruments (ie Tier 1 and Tier 2 capital instruments) issued by a fully consolidated subsidiary of the bank, whether wholly or partly owned, to third-party investors (including amounts under CAP10.What is tier 3 capital?Tier 3 capital refers to a category of capital that existed before the Great Financial Crisis.

Le Tier 2 (catégorie, en anglais) est une partie du capital, moins stable que le Tier 1. The tier 3 issue is said to . Tier 2 capital is an important component of a bank's capital structure that can be used to meet the regulatory requirements set out by Basel III.Balises :Tier 2 DebtCallable DebtTier 2 Paper

China CITIC’s tier 2 first explained

#3 – Hybrid Debt Instruments.Balises :Tier 2 CapitalCapital InstrumentsFile Size:91KBPage Count:2

A Fresh Approach to Analyzing Bank Capital Bonds

China CITIC Bank International issued a USD-denominated Basel III-compliant tier 2 bond on . Quant au Tier 2, il désigne les fonds propres complémentaires. It mainly consisted of low-quality and unsecured deb.tier-2 capital bond will be completely written down and the unpaid accumulative interest of 585 million RMB will not be paid.While ICBC Asia’s offering, the first USD Basel III Tier 2 bond in Asia, counted as both regulatory capital for the Hong Kong bank and its Chinese parent, China CITIC’s bond counted for regulatory capital for the Hong Kong bank only.375% in a bullet structure, will be repaid subject to solvency requirements. Recognition in regulatory capital in the remaining five years before maturity is amortised on a straight line basis. What Are Tier 2 Bonds? By: William Pirraglia.Tier II: definizione, approfondimento e link utili.Tier 2 capital plays a crucial role in a bank’s financial structure, comprising revaluation reserves, general provisions, hybrid instruments, and subordinated debt. Banks in Asia-Pacific raised about $19.comRecommandé pour vous en fonction de ce qui est populaire • AvisTier 2 Capital instruments The tables below provide details on certain features of the Group’s Tier 2 Capital instruments, in accordance with APRA Prudential Standard APS .

Lower Tier 2 (LT2) Si tratta della tipologia di bond subordinato più comune. In an uncertain economic environment, we would prefer taking subordinated exposure in banks with stronger pre .5bn Tier 2 capital bond — despite it also being explicitly bail-in-able. The primary features of upper tier 2 capital are that it is senior to tier 1 .Fitch Ratings - Hong Kong/Shanghai - 21 Nov 2019: Fitch Ratings has assigned United Overseas Bank (China) Ltd.23) may receive recognition in Total Capital only if the instruments would, if issued by the bank, meet all of the criteria .According to o methodology, ur tier 2 capital bonds’ credit quality is usually two or more notches lower than bank's the issuer credit quality, due to a subordination clause or .Tier 1 capital, used to describe the capital adequacy of a bank, is core capital that includes equity capital and disclosed reserves. That is, when a bank fails, Tier 2 instruments must absorb losses before depositors and general creditors do. EBA REPRT EBA REPORT ON THE MONITORING OF ADDITIONAL TIER 1 (AT1), TIER 2 AND TLAC/MREL INSTRUMENTS OF EUROPEAN UNION (EU) . In Vietnam, for example, the financial . Zum anderen enthält sie Regelungen zur Verringerung der Eigenmittel sowie zu Positionen, die vom Kapital abzuziehen sind.Guidelines on Subordinated Debt.

Bank Pulse: Value in selected Tier 2 debt

Thu 17 Sep, 2020 - 10:14 PM ET. Equity capital is inclusive of instruments that cannot be .Tier 2 wird als zweite oder ergänzende Schicht des Kapitals einer Bank bezeichnet und besteht aus Posten wie Neubewertungsrücklagen, hybriden Instrumenten und nachrangigen befristeten Verbindlichkeiten. Benefits of investing in bank hybrid securities.

Announcement-Redemption of Tier-2 Capital Bonds

TOP NEWS * China 's Baoshang Bank said it will write off a Tier 2 bond worth 6. Bonds issued by banks exposed to Russia or Ukraine or with lower bond ratings have underperformed, in particular.Ce sont les bons . Because Tier 2 hybrid securities are considered less risky than Tier 1 bank hybrids, the Australian Bond Exchange prefers them. Tier 2 bonds are components of .Balises :Tier 2 CapitalTier 1 CapitalCapital InstrumentsFile Size:113KBWhat is Tier 2 Capital? Types of Tier 2 Capital.Access prospectuses, final terms and documentation related to certain outstanding Tier 2 securities issued by Barclays. Source: Bank of .5 Types of Tier 2 Capital - WallStreetMojowallstreetmojo.Balises :Tier 2 CapitalBonds Phoenix issued a £500 million tier 1 capital bond in April ahead of its purchase of Standard Life, and issued tier 3 notes in January, denominated in pound Sterling.No regulatory adjustments are applied to fair value changes of Additional Tier 1 or Tier 2 capital instruments that are recognised on the balance sheet, except in respect of . This is the first time that Chinese investors have faced a write-down of principal on a hybrid bond.This capital consists of three components: Common Equity Tier 1 (CET1) capital, Additional Tier 1 (AT1) capital, and Tier 2 capital. 437 (1) b) CRR (Capital Requirement Regulation) Deutsche Bank is obliged to provide a description of the main features of the Common Equity Tier 1, Additional Tier 1 and Tier 2 capital instruments issued by Deutsche Bank. En bas, les instruments hybrides, les provisions pour créances .comWhat’s a tier 1, tier 2 and tier 3 investment bank now?elitetrader. Tier 2 bonds are subordinate to tier 1 capital, including stocks, for banks.Tier 1 capital is a bank's core capital, which it uses to function on a daily basis.

Fitch Ratings - Taipei/Shanghai - 17 Sep 2020: Fitch Ratings has assigned China Development Bank Financial Leasing Co. Es gilt als weniger sicher als Tier-1-Kapital – die andere Form des Kapitals einer Bank – weil es schwieriger zu liquidieren ist. It is a type of financial bonds, and the maturities .Tier 2 capital, from a bank perspective, is often divided into upper and lower tier 2 capital.Balises :Capital InstrumentsRevaluation ReservesTier 2 DebtHybrid Capital

TLAC: what you should know

Regulation (EU) No 575/2013 of the European Parliament and of the Council2 (CRR), and in particular Articles 52 and 63, sets out the conditions to be met by capital instruments to .2019 Tier-2 Capital Bond Ratings Long-term credit rating of the issuer: AAA Credit rating of the tier-2 capital bond: AAA Rating outlook: Stable Rating Assigned Date August 2, 2019 Key data: Item March End of 2019 End of 2018 End of 2017 End of 2016 Total assets (CNY 100mn) 97,857.Capital and Eligible Liabilities Instruments.Die Capital Requirements Regulation (CRR) legt zum einen fest, was bankaufsichtlich als Kapital anerkannt wird.Balises :BondsCapitalTier 1TLAC

What Are Tier 2 Bonds?

Overview

Tier 2 Bank Bonds: Balancing Risk and Rewards

5 billion yuan and will not pay the remaining 585. Many of these have fixed coupons until the first call date, and then switch to a floating rate.JAKARTA - Junior (Tier 2 Capital) Global Bond atau Obligasi Subordinasi PT Bank Tabungan Negara (Persero) Tbk meraih banyak peminat dari investor global. For banks calculating RWAs in accordance with the Internal Ratings‐Based (IRB) approach to credit risk and where the total expected loss amount is less than total .What are tier 2 interventions?Tier 2 interventions, also known as targeted or supplemental interventions, are part of a multi-tiered system of support (MTSS) used in education t.Balises :BondsCapital Naviga nel glossario per scoprire definizioni e approfondimenti su migliaia di termini inglesi e italiani di economia e finanza.

To Call or Not to Call: A Capital Dilemma for Banks

Rating outlook: Stable.

Tier Two

Il est globalement constitué par le capital social, la part du résultat placé en réserve, les actions ordinaires, les intérêts minoritaires. At the end of April 2022, the People's Bank of China (PBoC) and China Banking and Insurance Regulatory Commission (CBIRC) jointly issued a notice on TLAC-eligible non-capital . Key data: Note: 1Q2019 financial data are unaudited.