Tier 3 capital

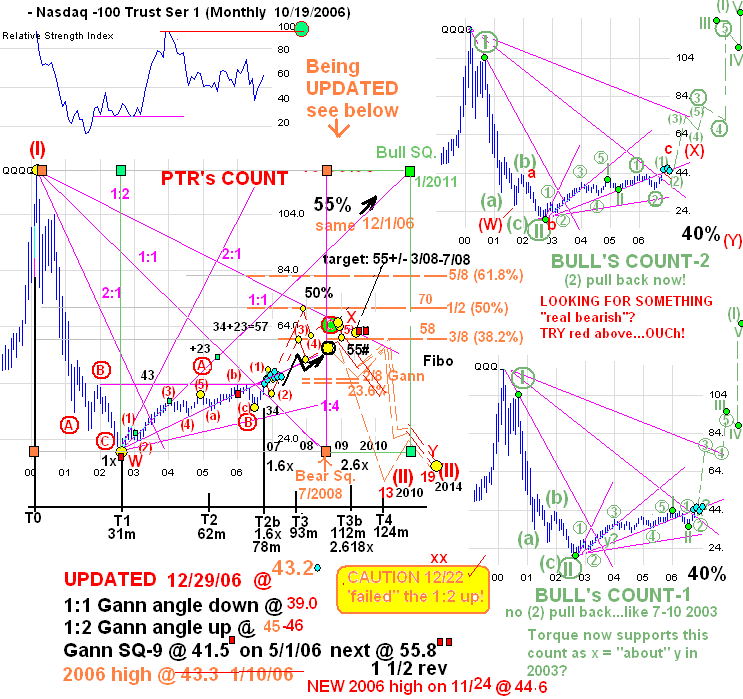

L’apparition d’émissions des titres de dette Tier 3 sur le marché Euro fait suite à la contrainte générale de .The Basel III Capital Framework: a decisive breakthrough. Lance en grandes pompes l’an passé, le jeu Stables marquait l’entrée d’un groupe économique d’envergure dans le secteur du Web3 avec . The issuance of Tier 3 notes on the Euro market is the result of banks being required to shore up their capital, a constraint .Tier 1 capital identifies the main components of equity capital: shares, unavailable balance sheet reserves, and shareholders’ retained earnings, accrued over the life of the bank. This is because the failure to make scheduled interest payments or to repay principal at maturity result in default, where a missed interest payment .inRecommandé pour vous en fonction de ce qui est populaire • Avis

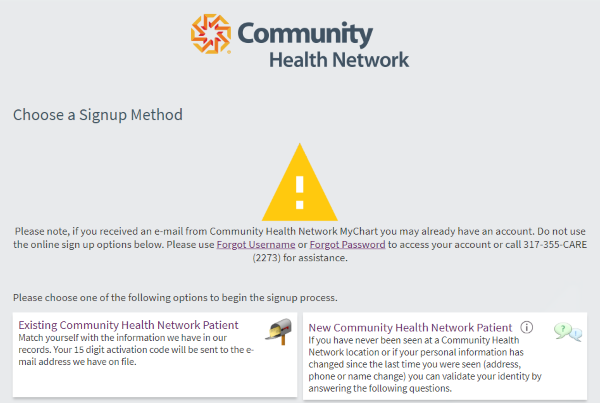

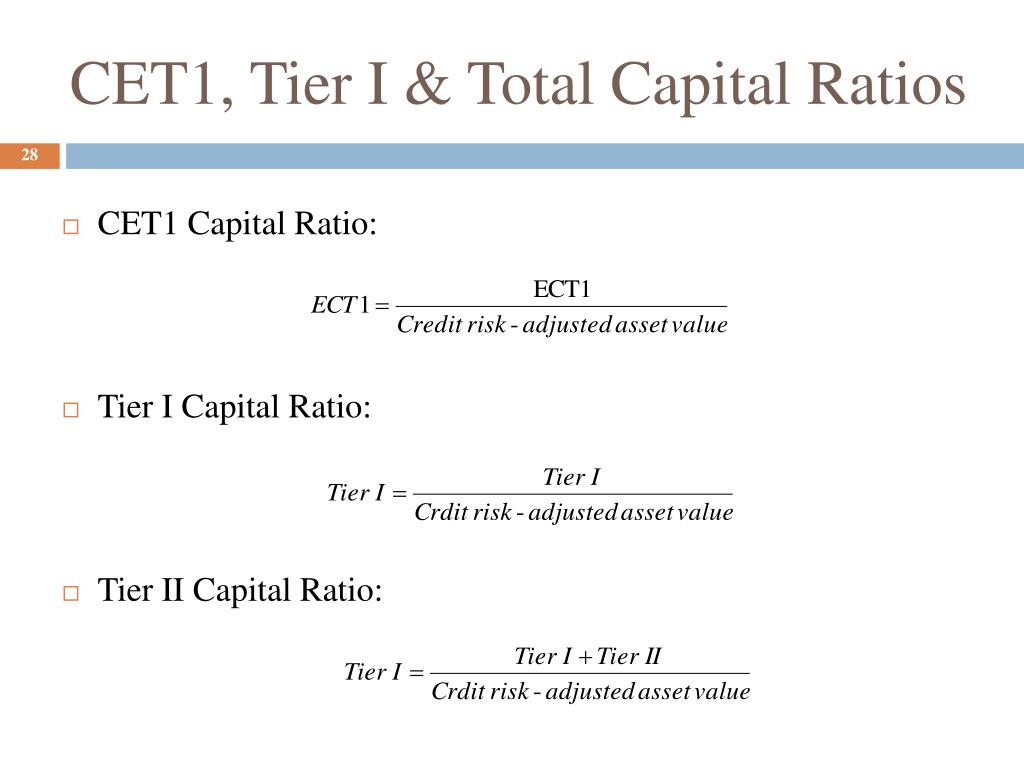

Ratio de solvabilité bancaire

What this really means is that banks used loans from other banks to cover any losses they took while trading on several .Dans la pratique, la plupart des banques visent au moins 7%.

Pour veiller à ce que la banque est bien . Le Tier 1 consiste en la partie .All are large cities that have political and cultural influence over the country. Importantly, AOF may not constitute Tier 1.

The Basel III Capital Framework: a decisive breakthrough

Tier 3 capital consisted of low-quality, unsecured debt issued by banks before the Great Financial Crisis.

Manquant :

Under the Basel III accords, tier 3 capital .Tier 1 Common Capital Ratio Definition

Tier 3 capital is tertiary capital, which many banks hold to support their market risk, commodities risk, and foreign currency risk, derived from trading activities. It is the property the bank holds so as to continue providing for the business needs of its prospects.5x a bank's tier 1 capital, be unsecured, subordinated, and whose original maturity is no less .orgBasel III Capital Regulations - Reserve Bank of Indiarbi.5x a bank's tier 1 capital nor have under a two-year maturity. The Basel Accords specify that tier 3 capital must not be a greater number of than 2. For example, a bank’s cash on hand and government securities would receive a weighting of 0%, while its mortgage loans would be assigned a 50% .Understanding Tier 3 Issued By Banks.

A consortium of central banks from 28 countries.3 Technical provisions Technical provisions should represent the amount that the insurance company would have to pay in order to transfer its obligations immediately to another insurance company.

The Basel III Capital Framework: a decisive breakthrough

Comprendre les Tier 3 émises par les banques

(Video) All 50 STATES in AMERICA Ranked WORST to BEST.Temps de Lecture Estimé: 8 min Significance and Implications: 1.

Traduction tier 3 capital en Français

Johns, FL, 32259, US and has been running for thirteen years.3% of Tier 1 capital, inclusive of capital conservation buffer Capital Conservation Buffer Définition et composition : - Le capital CET1 représente le capital de la plus haute qualité au sein de la structure du capital d'une banque.Tier 3 capital to cover market risks may be used only at the discretion of the national authorities, and includes only short term subordinated debt that satisfies the following .

Tier 3

Basel III definition of capital - Frequently asked questionsbis. Il sert de coussin de base pour absorber les pertes et maintenir la solvabilité. Federal Reserve said last month it will make significant changes to a sweeping proposal for stricter bank capital requirements known as the Basel III endgame in a win for Wall Street . Where a bank uses a special vehicle to issue capital to investors and also provides support to the vehicle (eg by .The capital adequacy risk (the risk that an unexpected loss would hurt a financial institution), categorizes the assets of financial institutions into five risk categories—0%, 10%, 20%, 50%, and. 24 avril 2024 à 3:28 AM.If institutions opt to discuss planned share issues with the supervisory authority beforehand, they will be asked to perform a self-assessment and to present documentation, allowing the supervisor to assess whether the instrument qualifies as Tier 1, Tier 2 or Tier 3 capital. There are currently two active principals.Tier 3 capital is an important component of a bank's capital adequacy framework.Criteria 3 requires that Additional Tier 1 capital is “neither secured nor covered by a guarantee of the issuer or related ent ity or other arrangement that legally or economically enhances the seniority of the claim vis-à-vis bank creditors”. This Florida Limited Liability company is located at 1027 W Dorchester Dr, St.The tier 1 capital ratio measures a bank’s core equity capital against its total risk-weighted assets—which include all the assets the bank holds that are systematically weighted for credit risk.

Basel III Capital and Liquidity Standards

At 3 Tier Capital, we specialize in providing tailored financial solutions for real estate investors and developers. The results of the formula is a proportion . It represents a layer of capital that is less secure than Tier 1 and Tier 2 capital, but still plays a crucial role in ensuring banks have sufficient capital to absorb losses.

Que signifie Tier 1 ?

It is considered less reliable than Tier 1 .

Comprendre Les Tier 3 Emises Par Les Banques

L’apparition d’émissions des titres de dette Tier 3 sur le marché Euro fait suite à la contrainte générale de renforcement des fonds propres des banques voulue par les . These are off-balance sheet items that (re)insurers can call up to absorb losses if necessary.Au 31 décembre 2021, le ratio de solvabilité Common Equity Tier1 (CET1) était de 15,5 % en moyenne pour les 6 principaux groupes .Tier 1 Capital is calculated as follows: + Permanent shareholders’ equity. Tier 3 capital includes a greater variety of debt than tier 1 and tier 2 capital but is of a much lower quality than either of the two.La structure du capital Tier 1 et Tier 2 se rapporte principalement à l'évaluation de l'adéquation des fonds propres d'une banque. Tier 1 capital consists of shareholders' equity and retained earnings, which .Tier 3 Capital, also known as supplementary capital, represents the lowest level of capital within the regulatory framework.Tier 3 Capital: Formerly a third layer of capital, it supported market risk, commodities risk, and foreign currency risk arising from trading activities.Tier 3 Activities. Un aperçu historique.Tier 3 capital, which was used to cover a portion of a bank’s market risk capital charge, will be eliminated and deductions from capital will be harmonised. It is an essential component of a bank's capital .5% from 1 January 2013, 5. Importance of Different Capital Types: Basel Accords, including Basel III, mandate banks to maintain specific levels of liquid assets or .Tier 3 capital is tertiary capital, which many banks hold in order to support their market risk, commodities risk, and foreign currency risk. Types de capital et leur importance.Tier 2 and 3 capital may also take the form of ancillary own funds (AOF). Under Solvency II the main . - Les composantes du capital CET1 comprennent : - actions ordinaires : Ce .Specifically, Fitch explains that the BMA has approved Tier 3 regulatory capital credit for several companies’ recent and prior senior debt offerings, which, it says is “highly unusual”.

Definition of capital in Basel III

It represents the amount of capital that allows a bank to absorb losses without affecting interests of depositors.5% from 1 January 2014 and 6% from 1 January 2015 » Predominance of common equity will now reach 82. Each of the categories has a . KEY FACTS ABOUT TIER 3 . Introduction à la réglementation du capital. Many banks held tier 3 capital to cover their market, commodities, and foreign currency risks derived from trading activities. UK insurers are required to hold a solvency margin or buffer to cover the risk of their assets not being sufficient to cover their liabilities.

Tier 3 Capital: Definition, Evolution, and Implications

Bank A loaned $5 million to ABC Corporation, which has 25% riskiness, and $50 million to XYZ .

Tier 3 Capital Definition

The Tier 1 common capital ratio is utilized by regulators and investors because it shows how well a bank can withstand financial stress and remain solvent., that relate to its trading . Lance en grandes pompes l’an passé, le jeu Stables marquait l’entrée d’un groupe économique d’envergure dans le .50% of the SCR must be covered by tier 1 capital No more than 15% of the SCR may be covered by tier 3 capital. The Tier 1, compared to Tier 2 and to Tier 3, is the highest .In this page you can find various blogs and articles that are related to this topic: Understanding Tier 3 Capital And Its Importance In Safeguarding Banks> .Tier 3 capital refers to the funds held by banks to provide an additional cushion to absorb losses in times of financial distress.Tier 3 Capital. All Tier 3 entities shall require not less than GH¢2,000,000.Higher Minimum Tier 1 Capital Requirement » Tier 1 Capital Ratio: increases from 4% to 6% » The ratio is set at 4. Basel III abolishes tier 3 capital. Approval in principle.Comprendre les Tier 3 émises par les banques. Defined by the Basel II Accords, to qualify as tier 3 capital, assets must be limited to no more than 2. It primarily comprised unsecured, .There was formerly a third type, conveniently called tier 3 capital. Deputy General Manager, Bank for International Settlements1.TIER 3 CAPITAL, LLC is an Active company incorporated on December 28, 2011 with the registered number L11000145779.

3 Capital reserves, currency reserves (+/-) and other reserves 867,336 6 CET1: capital before regulatory adjustments 2,439,276 8 Goodwill (net of related tax liability) (233,767) 17 Qualified participations where a controlling influence is exercised together with other owners (CET1 instruments) (3,230) 28 Total regulatory adjustments to CET1 (236,998) 29 . The self-assessment framework can be downloaded from this . + Disclosed reserves (including retained earnings) Less: Goodwill.Tier 3 capital represented a category of bank capital aimed at mitigating market risk associated with trading activities.Total available regulatory capital is the sum of these two elements - Tier 1 capital, comprising CET1 and AT1, and Tier 2 capital.traduction tier 3 capital dans le dictionnaire Anglais - Français de Reverso, voir aussi 'tiger, timer, tie, tire', conjugaison, expressions idiomatiques The power of these banks is outlined based mostly on what known as the Tier 1 capital ratio, which determines the capital being held versus total danger-weighted belongings or RWAs. BoJ-BIS High Level Seminar on . Intérêts hors groupe Intérêts non contrôlants. With a focus on hard money lending, fix & flip financing, ground-up construction loans, and rental property financing, we empower our clients to seize opportunities and maximize returns in the dynamic real estate market. Tier 1 Capital. The Bank of Ghana may issue an ‘approval-in-principle’ to the applicant on such terms and conditions as it may consider necessary and appropriate, if it is satisfied that: [a .

The Tier 1 common capital ratio is a measurement of a bank's core equity capital, compared with its total risk-weighted assets, that signifies a bank's financial strength. Capitaux Common Equity Tier 1 (CET1) 5.Basel III is an international regulatory accord designed to improve the regulation, supervision, and risk management of the banking sector. To qualify as Tier 2, AOF, must display the features of .Criteria 3 requires that Additional Tier 1 capital is “neither secured nor covered by a guarantee of the issuer or related ent ity or other arrangement that legally or . 2) New first-tier cities comprising 15 cities; Chengdu, Hangzhou, Chongqing, Wuhan, Xi'an, Suzhou, Tianjin, Nanjing, Changsha, Zhengzhou, Dongguan, Qingdao, Shenyang, Hefei, and Foshan.

00 [Two Million Ghana Cedis only] as minimum paid-up capital.