Time weighted returns excel calculation

As one can observe, the .

Time-Weighted Return (TWR)

How to Calculate Your Time-Weighted Rate of Return (TWRR) – Canadian Portfolio Manager Blog.

Time-Weighted Rate of Return (TWR or TWRR) Calculator

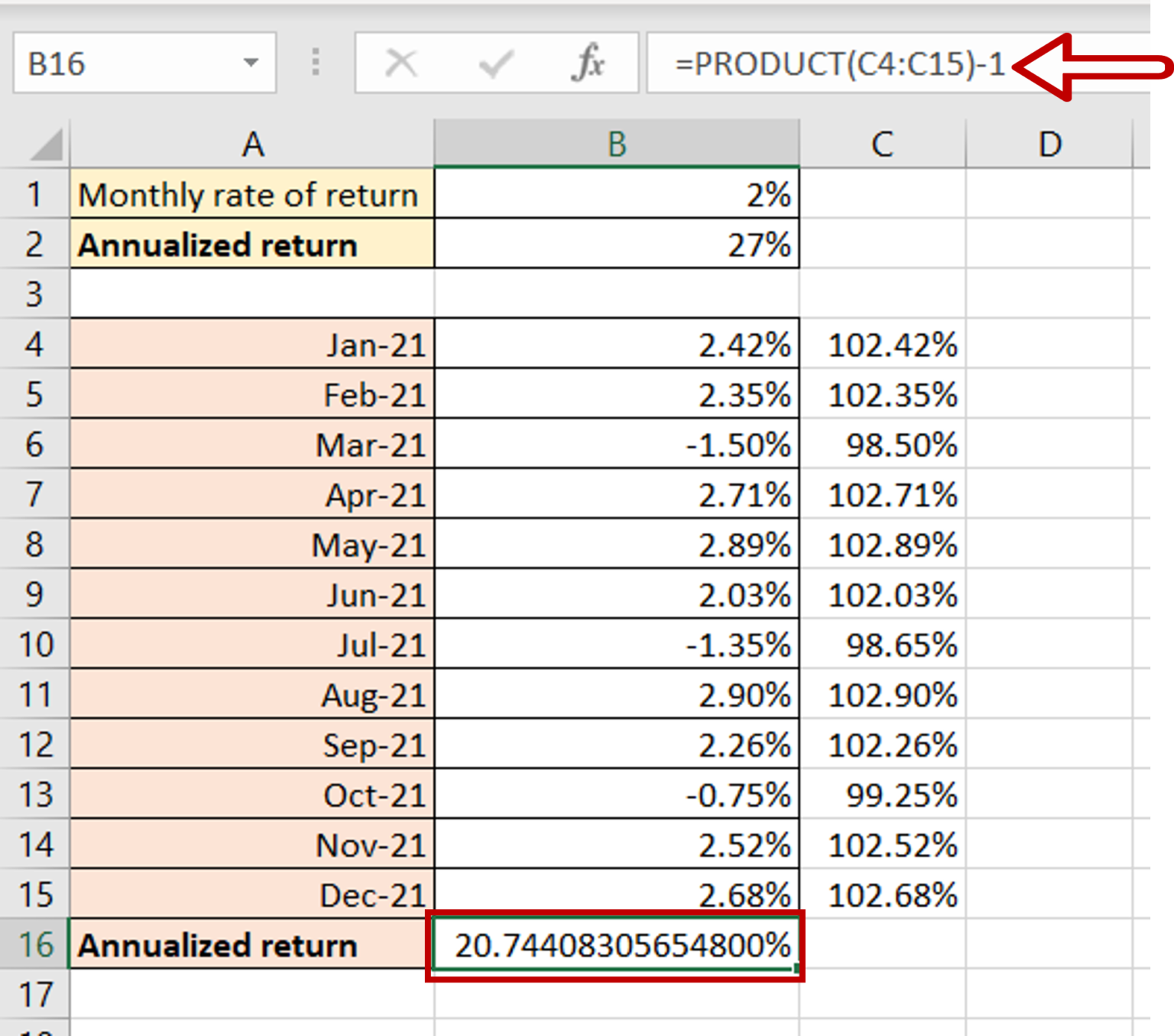

Multiply the rate of return for each sub-period by each other. So the formula in .To calculate the weighted money return you need to find the rate that will set the value of the present values of all cash flows and terminal values equal to the value of initial investment. The following formula is used to calculate TWRs: time-weighted. It is calculated by finding the rate of return that will set . Each investor’s cash flow decision resulted in a higher or lower MWRR, relative to the TWRR. Step-by-step guide to calculating time-weighted return in Excel.

Some other related topics you might be interested to explore are Time-weighted Rate of Return, Holding Period Return, and Internal Rate of Return.

Excel Tutorial: How To Calculate Time-Weighted Return In Excel

Calculating the expected return.Calculating TWR in Excel Step-by-Step. Calculation Examples. PP always employs a daily holding period.

Time Weighted Rate of Return using dates

It’s best to know the pros and cons of each when using them to evaluate . The calculation of the time-weighted rate of return starts with dividing the reporting period into distinct but continuous holding periods.

Time Weighted Rate of Return

Learn how to calculate it and why . In other words, the money-weighted rate of return, (MWRR) is equivalent to the internal rate of return (IRR).

How to Use The ROI Formula in Excel (Step-by-Step)

How to Calculate Your Portfolio's Investment Returns

Time-Weighted Rate of Return.

Time-Weighted Returns Explained: Formula and Definition

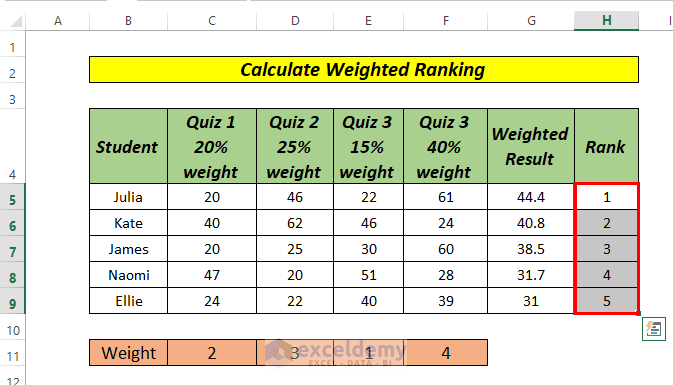

You can do this by subtracting the .Use the SUM function to calculate the weighted returns, by multiplying each return by its respective probability and then summing these values together.

The formula for calculating the time-weighted portfolio return when there are no external cash flows is: , B i B i E i V V r − = where . Excel can do it all.

Excel Tutorial: How To Calculate Time Weighted Return In Excel

Let’s assume that an investor had a portfolio with the following beginning and .To calculate the money-weighted return in this example, we need to consider the timing and amounts of cash flows and their respective investment periods. Time-Weighted Rate of Return (TWRR) 9. today’s date) and ending value (i.

The Holy Grail of portfolio performance benchmarking is the .D8: = (1 + D6)^4 - 1.

Manquant :

excelCalculating Time Weighted Return Portfolio Performance

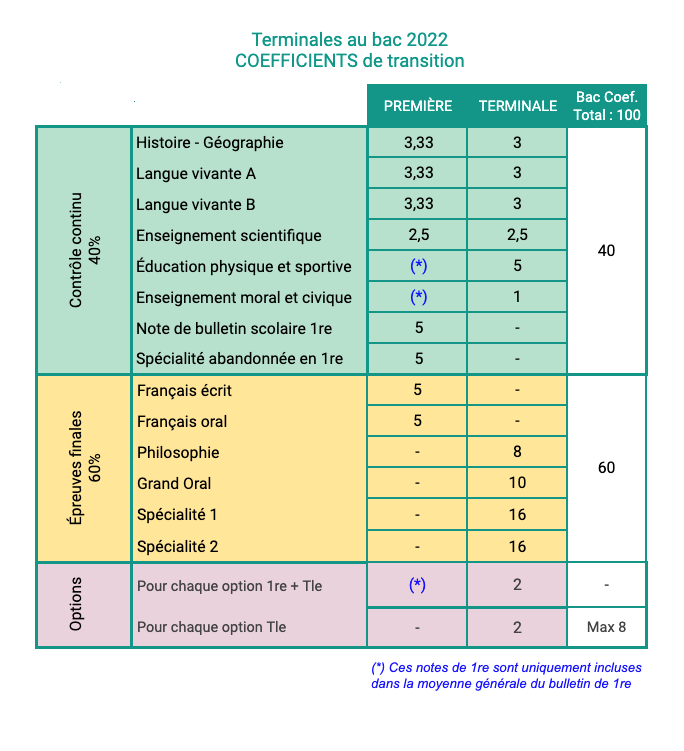

The deposit is a positive cash flow into the investment, so we subtract it from the valuation in this calculation.explain the condition of consistency in calculating the time- weighted rates of return of portfolio segments and the overall portfolio. as a starting place, until the firm reaches (fill in the blank with your target AUM before investing in your favorite accounting system).True time-weighting is very simple to calculate, but requires a high number of data points -- immediately prior to and immediately after each cashflow and at any . The following are the key data points . Now, let's walk through the process of calculating time-weighted return in Excel: Step 1: Gather the necessary data. They enter the portfolio data manually, starting with the beginning and ending values for each period.Calculating time weighted return in Excel requires specific data to accurately measure the performance of an investment portfolio. Step 2: Calculate the total investment at t = 1: It is used to compare the returns .

Die zeitgewichtete Rendite (time-weighted return, TWR) ist eine Methode zur Berechnung der Rendite einer Investition. Sie misst den Erfolg einer Anlagestrategie, unabhängig davon, wann und wie viel Geld in einem bestimmten Zeitraum investiert war. where P0 is the initial investment value, and . I assume the deposit is added to the account at the end of the period, after the gain or loss is added to the balance each month. In other words, MWRR is the discount rate at . In other words, it considers the timing and size of your contributions and withdrawals.

Time-weighted Returns

What Does TWR Tell You? x (1+HPn)] – 1, .Time-weighted returns (TWRs) measure the geometric average of a series of holding period returns (HPRs), in order to calculate the annualized compounding rate of return of a portfolio over time. They either download an existing template, or use formulas in the sheet.The Time Weighted Rate of Return measures the compound rate of growth over a period of time by assuming an investment at the beginning of a period and measuring the .

Excel Tutorial: How To Calculate Time-Weighted Return In Excel

Unlike other methods, such as simple return or money-weighted return, TWR removes the influence of cash flows and assesses the performance at each time period without any . Dividing SUMPRODUCT by SUM calculates the weighted average returns—3. “=SUMPRODUCT (B2:B7,C2:C7)”. Formula: To calculate the Money Weighted Return, you . Step 1: Calculate the total investment at the beginning ( t =0): Initial investment = −$85 Initial investment = − $ 85.And, where n is the number of investment periods.

How To Calculate Time-Weighted Return

Step 1) Begin by calculating the appreciation in share value over the years. `R_1 = (1300 - 100 - 1000)/1000` `R_1 = 0. In today’s part 1 video, I’ll cover the t. Collect the beginning and ending values of the investment portfolio for each sub-period, as well as any cash flows that occurred during those periods. The investor return is also called money-weighted return or internal rate of return. The steps to perform the given tasks are listed as follows: Step 1: Enter the following formula in cell B9.To calculate time-weighted returns, you need to follow these steps: Determine the initial portfolio value at the beginning of the investment period and cash deposited.The SUMPRODUCT function gives a value of Rs 4,770, which is the net amount earned from the portfolio, given the amount invested and returns. to track the MSCI Canada IMI Index).These sub-period returns are then geometrically linked together to obtain the time-weighted rate of return over the measurement period (“geometric linking” is just a fancy way of saying “add 1 to each .Some fund managers like to use Excel to calculate the time-weighted return.The money-weighted rate of return is a method for calculating the compound growth rate in a portfolio.Time-Weighted Rate of Return .

What is Time-Weighted Return (TWR)?

The sum function calculates the total amount of investments, which is Rs 1.Applying the Time-Weighted Return Formula in Excel.Time-weighted return (TWR) is a measure of investment performance that calculates the return for each time period separately and then combines these returns with equal .×(Pn−1Pn)−1. Two types of returns Investor return.Maneuvering the money-weighted rate of return excel calculator is straightforward.

Manquant :

excelSally wants to calculate the time-weighted return, so she divides the period into 4 sub-periods and calculates the arithmetic return for each one.6 percent in the first quarter of 2024 (table 1), according to the advance estimate .Money Weighted Return Calculator

The Time Weighted Return (TWR) is calculated using the following formula: TWR=(P0P1)×(P1P2)×. It represents the annual rate of .2` Period 2: 1st .Real gross domestic product (GDP) increased at an annual rate of 1. current market value) of your portfolio. Dividends paid = 3. Frequently Asked Questions (FAQs) Recommended Articles.Each period starts at the date of the last transaction (deposit or withdrawal or both) and ends at the date of the next transaction.Time-weighted return (TWR) is a method of measuring investment performance that accounts for the impact of cash flows and the timing of those flows.The time-weighted rate of return is a method for calculating the compound growth rate in a portfolio. It’s a preferred method among financial experts, bankers, and fund managers.

INTRODUCTION The rate of return on an investment over a specified time period is the percent gain or loss in wealth resulting from holding the investment over that period.

Zeitgewichtete Rendite (TWR) erklärt & Unterschiede zur GWR!

Subtract 1 from the result to achieve the TWR. Here, the weights sum to 125. Period 1: 1st Jan to 30th June 2010. A growth of $10,000 chart. The rate of return is an essential concept in . Step 3) Divide the total return on investment by the cost of investment. Ending value = 220. In this example, the prices are the values, and the numbers of stocks are the weights.The simple return (for the entirety of the three years, and for each year) and time-weighted rate of return are calculated as follows.To calculate the ROI for this investment, we need to calculate the total net return earned on this investment to date.

Time-Weighted Return Explained

Assess the performance of the student and state how the weighted average can be improved.

Time-weighted returns (TWR) and money-weighted returns (MWR) are two standard methods for calculating investment returns. Others create their own Excel sheet. Simple return: R = (Ve - Vb) / Vb. The time-weighted rate of return is a great method of measuring portfolio performance. The time-weighted rate of return reveals an investment’s return after removing the effects of deposits and withdrawals.

How to Calculate Your Time-Weighted Rate of Return (TWRR)

Then, they calculate the return for each of .He can calculate the weighted mean for the average share price.

Manquant :

excelCalculate time-weighted investment return

Utilize the AVERAGE function to calculate the expected return based on the weighted returns calculated in the previous step. First, we break down the 2-year period into two 1-year periods: Holding period 1: Beginning value = 200. Their investment strategy was exactly the same in each case (i.Portfolio returns (time-weighted returns, comparable returns) for 1 month, 3 months, 6 months, year-to-date (YTD), 1 year, 3 years, 5 years, and 10 years periods. Deshalb ist sie besonders nützlich, wenn es mehrere Cashflows gibt, beispielsweise wenn du öfter Geld . First, you’ll want to calculate the rate of return for each of your sub-periods.Money-Weighted Rate Of Return: A money-weighted rate of return is a measure of the rate of return for an asset or portfolio of assets. How to Calculate Time Weighted Return.

Using an HP12C calculator, we can calculate the TWR using the following keystrokes: hp12c. Money-Weighted Rate of Return (MWRR) 8. For each holding period (HP), a growth rate is calculated (Eq 1) and then compounded into an overall return (Eq 2). You then “geometrically link” each of these mini-returns to arrive at the time-weighted rate . Here’s what you’ll need to fill in: The starting date and starting value of your portfolio.Geometrically-linked, time-weighted returns, asset-weighted composite returns, dispersion and volatility statistics, PIC ratios.