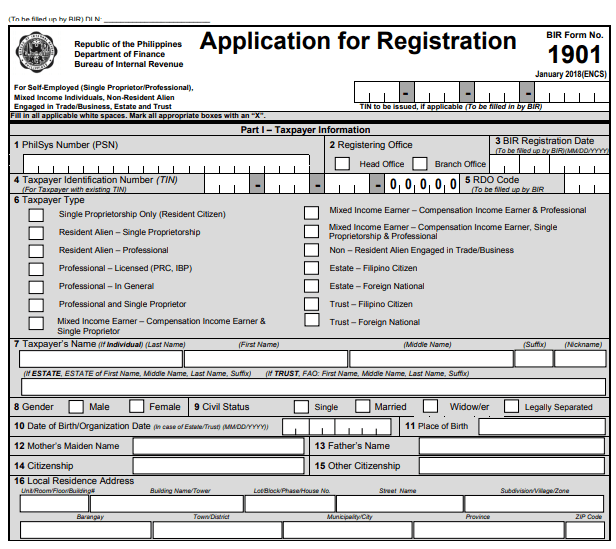

Tin application form

The Internal Revenue Service issues employer federal identification numbers and administers federal payroll and income taxes, including social .Revenue District Office - External Service. INDIVIDUAL ONLINE TIN APPLICATION. You will need to .

FORM 001A Individual Taxpayer Registration Form

MIDDLE NAME LINE 1 LINE 2 LINE 3 LIADDRESS@å POST OFFICE BOX 15. (b) If there are any errors, rectify them and re-submit the form. Academic year: 2023/2024. SECTION A (For Sri Lanka Citizen) National Identity Card Number (NIC) * : Name with Initials *(English): (Sinhala) : (Tamil) : SECTION B (For Foreigner) Passport .Individual taxpayers making an application for TIN should note the following: Application for Individual TIN: Completed Application Form.

How To Get TIN Number 2023: Requirements, Steps, and Fees

Obtaining a Taxpayer Identification Number (TIN)

(c) A confirmation screen with all the data filled by the applicant will be displayed.Male SECTION A: GENERAL TIN REGISTRATION 1.

Application for IRS Individual Taxpayer Identification Number.If you are an individual who wants to register for tax purposes in Papua New Guinea, you can use the myIRC online portal to complete the application form.1902 TIN Application Form. This document has been uploaded by a student, just like you, who decided to remain .This site uses cookies.Then proceed to Number 9 and fill out all the fields.

TIN on-the-Web

It should be noted that in cases where the TIN Certificate was lost or damaged, the applicant .When you file your tax return or need to talk to the IRS, you’ll likely have to provide a tax identification number, which is also called a TIN or tax ID number.

La création d’un numéro d’identification fiscale (TIN) européen pourrait constituer la meilleure solution pour remédier aux difficultés que rencontrent . PNG Passport Application Form; BSP SME Business . An application is done online by completing and uploading an excel .comNuméro d' identification fiscale européen ou NIF ou TINjuridique-et-droit.Individual TIN Application. Visit our cookies policy page or click the link in any footer for more information and to change your preferences.Learn how to apply for a Taxpayer Identification Number (TIN) in the Philippines, a unique number assigned by the Bureau of Internal Revenue (BIR) to . For use by individuals who are not U. Go to the IRD Sri Lanka website and select your preferred language.Filled TIN Application Form; Valid Identification Card; IPA Documents; You should submit TIN 2 if your entity is solely-owned (owned by one person). CUSTOMS NUMBER 5. reason for completing . August 2019) Department of the Treasury Internal Revenue Service .Here is a look at how to get the TIN for individuals in Nigeria. a 1902 Blank Form. On the main menu under e-Services, click on ‘access to e-Services’ and select ‘Click on Taxpayer Registration: To register as a Taxpayer and obtain your TIN’. You may have accessed the Online EIN Assistant outside the hours of operation.

Please fill up the form using BLOCK LETTERS .

Application Forms

(a) An applicant will fill Form 49B online and submit the form.We apologize for the inconvenience.

Tax Information :: California Secretary of State

IRC TIN2 – Individual – TIN Application; IRC TIN1 – Non-Individual – TIN Application; TIN Application Guide; Migrations.Company Registration. A taxpayer identification number is a unique identifying number assigned to every taxpayer by the Uganda Revenue Authority (URA) for tax administration purposes.TIN Number en France ? Under Registration Type, select ‘Registered Company’. This service allows you to search, discover, consult company TINs and even validate any TIN .IEIM902330 - Tax Identification Number (TIN) A TIN is a unique number (or combination of letters and numbers) in a specified format issued by a jurisdiction for the purposes of. Students shared 156 documents in this course. Any person who is likely to transact in any tax related business with URA, shall be required to apply for a TIN. BIR Form 1904 - Application for Registration for One-Time Taxpayer and Persons Registering under E.

L'utilisation d'un numéro d'identification fiscale européen (TIN)

The fillable application form can be found via the Forms Tab on the homepage. 98 (Securing a TIN to be able to transact with any . 98 (Securing a TIN to be able to transact with any Government Office) Documentary Requirements › . University Batangas State University.Instant TIN Application; TIN Registration – Individual; TIN Registration – Non Individual; Group TIN Registration; Print TIN Submitted Forms; Track Application Status ; Document Authentication; Download online forms; Download Manual Registration Forms; EFRIS. You can also access other tax tools and resources from the Internal Revenue Commission. Online Application for Taxpayer Identification Number (TIN) of Local Employee.

TAN Application

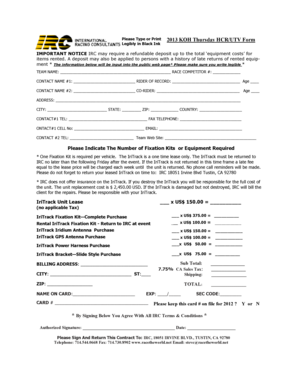

The Internal Revenue Commission (IRC) requires individuals and businesses to register for a Taxpayer Identification Number (TIN) if they meet certain requirements.

Tax ID Number (TIN): Definition, How to Get One

Complete the application form, ensuring you fill out every space with an asterisk symbol. An IRS individual taxpayer identification number (ITIN) is for U.Here’s how you can register as a corporate taxpayer. (a) An applicant will fill Form 49B online and . Msonkho Online is accessible by taxpayers through a portal on the MRA website . winding up) Request a re-print of TIN certificate INCOME TAX ACT 1959 AS AMENDED TAXPAYER IDENTIFICATION NUMBER (TIN) REGISTRATION - NON . Apply For TIN ». EFRIS Registration; Invoice/Receipt Issuance; Stock Management; Create Sub . You can register for TIN, file .

Understanding Tin: Properties, Uses, and Applications

PERSONS REGISTERING UNDER E. MRA issues a Taxpayer Identification Number (TIN) on registration that should be used on any correspondence with the Authority.Individual Taxpayer Registration Form FORM 001A This form is to be completed in CAPITAL LETTERS for the purpose of registration and issuance of Taxpayer Identification Number (TIN).Temps de Lecture Estimé: 7 min

TRA

Info More info. Step 4: Fill out the BIR Form 0605.com is a free limited validation service for TIN numbers all around the world. See separate instructions.

APPLYING FOR A TAXPAYER IDENTIFICATION NUMBER

Internal Revenue Service. Cost of Transaction: 1st time applicant (1st Certificate) – G$1,000; Re-print of TIN Certificate – $2,000. Taxpayers will be advised when processing is complete via email/contact number and prompted to .Taxpayer Identification Matching (TIN) Tools | Internal Revenue Service. TIN in full is the Taxpayer Identification Number.What to do with the completed form? If all the requirements are available, you should bring your application to any FRCS (Customer Service Centre) office to obtain your new joint FNPF/FRCS ID card.Learn how to apply for a TIN ID card, a free identification card issued by the Bureau of Internal Revenue (BIR) in the Philippines. citizens or permanent residents. TIN (Only for mended Applications) a. (PLEASE SPELL OUT ALL WORDS - NO ABBREVIATIONS) Internal Revenue Service FEDERAL CAPITAL TERRITORY.Do you need to register for a Taxpayer Identification Number (TIN) in Papua New Guinea? Amended Application 4. The applicant will have to visit the nearest FIRS office. Firrt Application b. However, it is susceptible to tin pest, a phase transition that can occur at temperatures below 13.Nous voudrions effectuer une description ici mais le site que vous consultez ne nous en laisse pas la possibilité. 98 (securing a TIN to be able to transact with any government office, e. TYPE OF APPLICATION (fick appropriate box) 2. This is a TIN registration process used by an individual to obtain a TIN from URA. However, if the entity is co-owned, you should fill both TIN 1 (Non-Individual) and TIN 2 (Individual).form tin2 irc office use only papua new guinea internal revenue commission tin application - individual taxpayer identification number (tin): pngirc - your partner in nation building last name: income tax act 1959 as amended taxpayer identification number (tin) registration - individual full name and address of applicant title: mr / mrs / ms. Find out the requirements, steps, .What documents should I submit along with the application form? You have to submit the following documents with the application form: 01) Proof of identity (POI), 02) Proof of address (POA), 03) Proof of date of birth (PODB) (applicable only for Individual & HUF status of applicant. Individuals who are registering with the Bureau of Internal Revenue for the first time by reason of employment are required to register within ten (10) days from the date of employment.APPLICATION FORM FOR TAXPAYER REGISTRATION (For Individual and Proprietorship) All fields marked with * are Mandatory .A TIN (taxpayer identification number) is a nine-digit number issued by the IRS (Internal Revenue Service) or the Social Security Administration (for a Social Security number) to .Consent and certificate director (Form 18 – Applicable only when Form 20 is obtained in order to recognize director’s signature) Articles of Association Registration certificate issued by the Board of Investment and relevant agreement Application Form for Taxpayer Registration - Company TPR_001_E (Not (Please click here for Guidelines in Hindi language) Application Procedure. Step 3: Proceed to the COR Update window and submit your accomplished BIR Form 1905 and other requirements for TIN card replacement. Application for taxpayer registration or change of registered particulars (entity).TIN APPLICATION - NON-INDIVIDUAL Taxpayer Identification Number (TIN): PNGIRC - Your Partner in Nation Building ENTERPRISE INFORMATION Close an enterprise taxpayer file (e.

The TIN application form can be downloaded here On registration, a USERNAME and PASSWORD is issued to the taxpayer for use when logging-in to the system (Please expect a waiting period of 24hrs after submission of the application form and the .

Taxpayer Identification Matching (TIN) Tools

Author : SalisuZago Created Date: . LTO, NBI, DFA, etc. This document . Abundance and Sources - Tin is relatively rare, making up about 2 ppm of the Earth's crust.

Taxpayer Identification Number & IRS TIN Matching Explained

how to generate a tin (tax identification number) in nigeria - 2024Registration for taxes is free and taxpayers can register through Msonkho Online or at any nearest Malawi Revenue Authority (MRA) office. Where to Avail: Online through the .Online Application for TAN (Form 49B) GUIDELINES.

-mais-beaucoup-moins-pour-celle-du-jardin-ethnobotanique-1420002454.jpg)