Total margin vs operating margin

Gross margin vs.Financial Management.Auteur : Brian Beers

Operating Margin

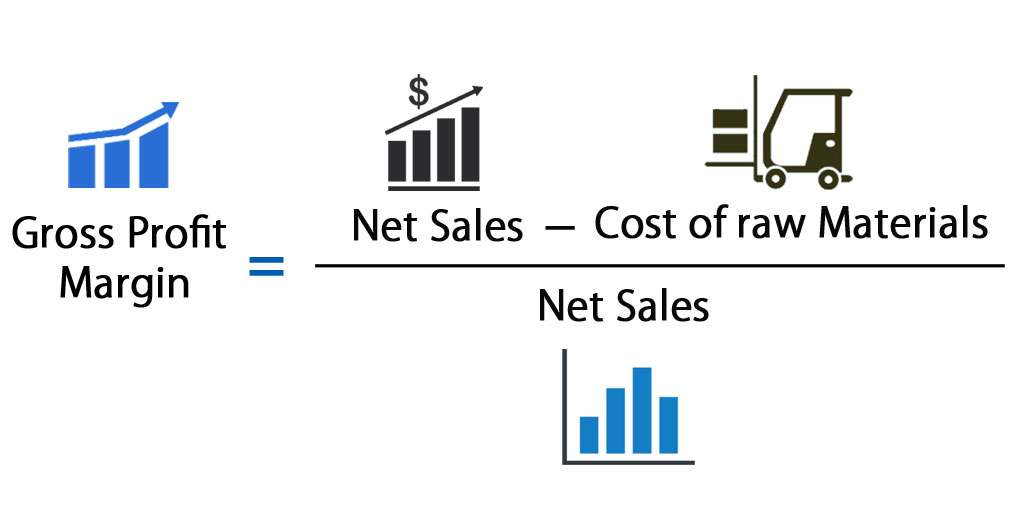

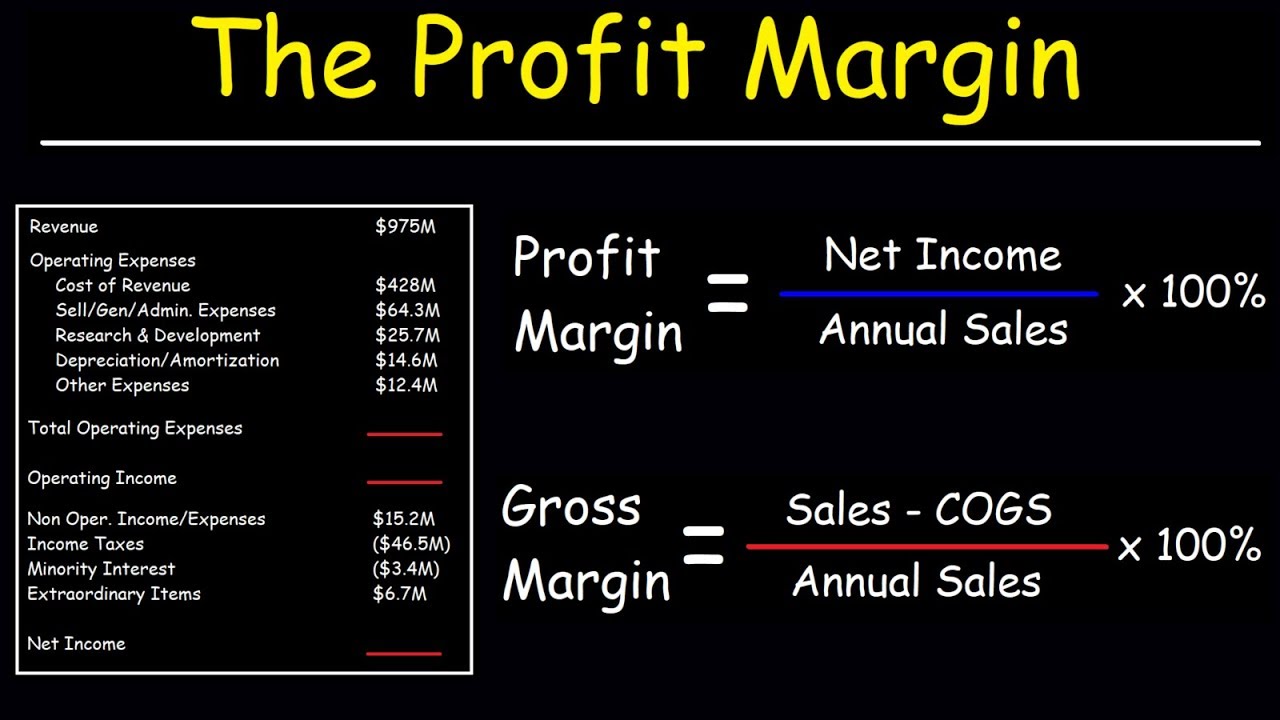

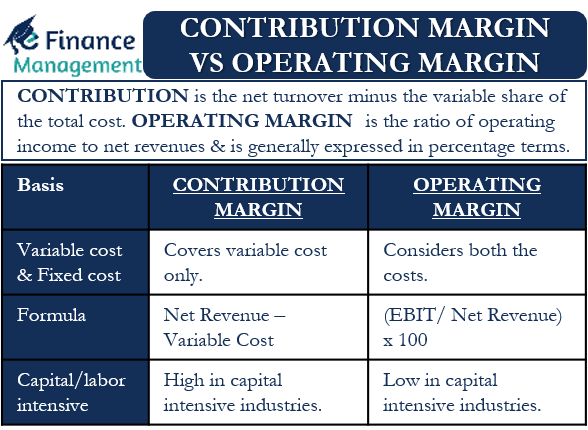

Margin of safety acts as a buffer beyond BEP, providing some financial security in case actual performance falls short of projections.Operating margin, also called the return on sales, is a measurement of how many dollars of profit a company earns per dollar of sales after paying operating . operating margin: Key similarities and differences.

Manquant :

operating margin March 28, 2021.Net profit is calculated by subtracting interest and taxes from operating profit—also known as earnings before interest and taxes (EBIT).8% year over year.Operating profit is the profit earned from a firm's normal core business operations.Manquant :

total marginThen, divide the net income by the total revenue, and multiply by 100 in order to express the result as a percentage.The operating margin ratio, also known as the operating profit margin, is a profitability ratio that measures what percentage of total revenues is made up by operating income.2 percentage points (+3. This margin is used to discern the profitability of an . Your net income can also be defined as your gross revenue minus pretty much all of your costs .operating income = revenue - cost of goods sold - operating expenses. Its operating margin is . By leader Size of lead . Q1 net income: $708M.The operating margin is calculated by subtracting all from sales, and then dividing the result by sales. Like operating margin, gross margin is a financial metric that measures the profitability of . The next and final step is to calculate the operating margin with the operating profit margin formula below: operating margin = .comRecommandé pour vous en fonction de ce qui est populaire • AvisMarge Opérationnelle : Définition et Calcul

The gross, the operating, and the net profit margin are the three main margin analysis measures that are used to intricately analyze the income statement activities of a .Break-even analysis calculates the point where total revenue equals total expenses - the break-even point (BEP).

Marge brute vs marge opérationnelle un domaine CTA

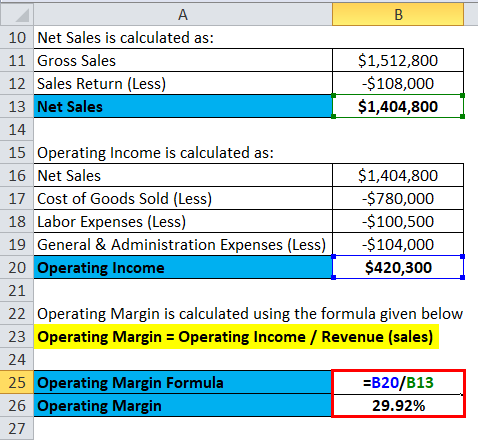

You can find the total net sales in the period of 3 months ending on June 25, 2022 at $82,959 and the operating income in that same period at $23,076. Operating Profit Margin = Operating Profit / Total Revenue x 100%.

How Do Gross Profit Margin and Operating Profit Margin Differ?

comOperating Margin Calculator | Operating Profitomnicalculator. Another way to interpret the $0.The gross margin ratio, also known as the gross profit margin, focuses on the relationship between total revenue and the costs directly associated with production and distribution.Operating Margin: Definition and Formula | Indeed. Gross margin and operating margin are two fundamental profit metrics used by investors, creditors and analysts to evaluate a company's current .(operating income / total sales revenue) x 100 = operating margin. The trend of the pretax .Operating Profit Margin is a profitability or performance ratio that reflects the percentage of profit a company produces from its operations before subtracting taxes .Operating Profit Margin = Operating Profit / Total Revenues x 100.4 percentage points cc). Calculate operating margin.

Here, the company earns $0. It shows the minimum sales volume required to start making a profit.40 in operating income for each $1. The expenses included in each .Learn about gross, operating, and net profit margins, how each is calculated, and how businesses and investors can use them to analyze a company’s profitability.Gross profit margin; Net profit margin; Operating Margin vs.Operating Profit = Gross Profit - SG&A = $5M - $2M = $3M.46% year over year.Operating income is equal to a company's gross income minus operating expenses, as follows: Net sales is a company's total sales revenue minus returns, allowances, and discounts.

What Is a Healthy Operating Profit Margin?

EBITDA Margin vs Operating Margin

Markup shows profit as it relates to . Core net income was USD 3. Operating Margin: How Do They Differ? Gross margin and operating margin are both ways companies can assess their profits, . EBITDA is used to determine the total potential earnings of the company, whereas the operating margin aims to identify how much profit can the company . We have found that Company ABC has an operating profit margin of 30%, which is generally considered to be a good value. Net Margin would calculate profitability after all costs. What Is Operating Margin? How to Calculate Your Business Operating Margin.4% of net sales, increasing 2. This value does not include any profit earned from the firm's investments, such as earnings from firms in which .Operating margin is the percentage of profit your company makes on every dollar of sales after you account for the costs of your core business.9% of revenue, compared with 3.Operating margin.

The operating margin formula is: (operating income / total sales revenue) x 100 = operating margin. Operating Profit Margin = $3M / $5M x 100% = 30%.

EBITDA Margin vs Operating Margin: While both are highly popular metrics to determine the profitability of a company, EBITDA and operating margin differ in significant ways which include: 1. Bao gồm: Biên lợi nhuận gộp – Gross margin; Biên lợi nhuận hoạt động – Operating margin; Biên lợi nhuận ròng – Net profit margin ; Trong đó, khác với chỉ số biên lợi nhuận gộp và . Adjusted operating EBITDA: $1.Net profit margin is the ratio of net profits to revenues for a company or business segment .40 is that for each . That’s total revenue minus all operating expenses, including COGS, as well as depreciation and amortization. Net profit spotlights a company’s ability to manage its interest payments and tax payments.

WM credits cost savings, strong EBITDA margins for positive Q1

This means for every ₹100 of Revenue earned, and the bank generated ₹38.

Gross, Operating, and Net Profit Margin: What's the Difference?

For HDFC Bank, the calculation will be given below.To calculate operating margin, you first need to know your business’s operating income. Gross margin focuses on the company’s efficiency in production, while operating margin considers the overall profitability from operations. The formula is: Operating Margin = (Operating Income / Total Revenue) * 100. Investors compare the operating profit margin of a company with the operating profit margin of industry competitors or a benchmark index . Scott Beaver | Sr. Operating margin measures the profitability of a .Updated Feb 15, 2019.Profit margin is a profitability ratios calculated as net income divided by revenue, or net profits divided by sales.Total votes Percent of votes in % In; Allegheny : 61 % 39 % 95,567 >95% : Westmoreland : 54 % 46 % 9,572 >95% : leader .Profit margin and markup show two aspects of the same transaction.The operating margin measures how much profit a company makes on a dollar of sales after paying for variable costs of production, such as wages and raw materials, but before paying.

A positive percentage .The formula for operating profit margin is: \begin {aligned}&\text {OPM}=\frac {\text {Operating Income}} {\text {Revenue}}\times100\\&\textbf .

Gross Margin vs Operating Margin: What's the Difference?

For example, say a company has an operating income of $500,000 and net sales of $1 million. Therefore, HDFC Bank’s operating profit margin was 38.Operating margin hay biên lợi nhuận hoạt động là một trong bộ 3 chỉ số biên lợi nhuận, đánh giá khả năng sinh lời của doanh nghiệp.Here's what the formula for gross margin looks like: (TR-CGS)/TR x 100 = GPM For example, if a company's total revenue is $300,000,000 and their cost of goods sold is $90,000,000, then you can put the numbers into the formula to get: (300,000,000 - 90,000,000) / 300,000,000 x 100 = 70% Gross profit margins are typically much higher .La marge brute mesure la rentabilité au niveau du produit, tandis que la marge d'exploitation évalue la rentabilité au niveau opérationnel. This will give you the company's total margin ratio. It is calculated by dividing operating income by revenue.

EBIT also includes the non-operating income that the company generates along with the income from the company’s operation. The net profit margin is then calculated by dividing net profit over total revenue. The higher the pretax profit margin, the more profitable the company.The net profit margin tells you the profit that can be gained from total sales, the operating profit margin shows the earnings from operating activities, and the gross profit margin is the profit remaining after accounting for the costs of services or goods sold.

Operating Margin Calculator

In our example, operating income equals $10,000,000 - $5,000,000 - $2,500,000 = $2,500,000.

The difference between gross margin and operating margin

Pretax profit margin is a company's earnings before tax as a percentage of total sales or revenues .3% in prior year.As discussed above, the contribution margin is the remaining portion of net revenue after deducting all variable expenses of an organization.Operating Income ÷ Total Revenue = Operating Margin Using the numbers from the income statement, we’ll calculate operating margin: $40,000 ÷ $500,000 x 100 .

Break-Even Analysis vs Margin of Safety

By the numbers.

How to Calculate Profit Margin

Product Marketing Manager. Net income or net profit may be determined by subtracting all of a company’s . Comprendre la différence . How they’re similar: Both gross margin and operating margin are measures of financial health, because they show how efficiently a company can turn sales into profit. Operating Margin Example. But operating income only includes the income flowing through company operations in its statement.

Operating Margin

Both usually are expressed as . Profit margin shows profit as it relates to a product's sales price or revenue generated. The profit margin formula simply takes the formula for .