Trade in journal entry

Traded in Car, received $21,000 for it, but. When you first purchase new equipment, you need to debit the specific equipment (i. You’ll want to state your setup, mark down your entry level and stop loss on it (I use green and red respectively). The journal entry is debiting fixed assets-car $ 50,000 and credit in-kind donation $ 50,000.

Journalize Entries for Trade-In of Similar Assets

I have an inventory item, XYZ, that when I sell I often receive back a trade in shortly after. This is posted to the Dividends T-account on the debit side.

Net book value of fixed asset = Cost of fixed asset – Accumulated depreciation.A trading journal is a record of all of your trades, including the entry and exit points, the position size, the reason for the trade, and the outcome. A and company ABC have made the hire purchase agreement of the car.A journal entry in accounting is how you record financial transactions. Payment term mean: 2/10, n/30 or 2/10, N30. It is a contra-asset account that reduces the loans receivable on the balance sheet. For loss on the exchange of fixed assets, the company records the new assets received at its . The Balance Sheet .Temps de Lecture Estimé: 4 min

Journal Entry for Vehicle Trade-In: a Comprehensive Guide

Giving these discounts builds good business relationships between buyers and sellers.The four most common bookkeeping errors are: Expensing inventory, capital assets, capital leases, loan payments and personal expenses (see table summary below).

13 (includes fees) Loan Amount is $48617. The existing building has the original cost of $600,000 and .In this case, the company ABC can make the owner withdrawal journal entry for the $10,000 on November 15 as below: Account. They have to record car based on the fair value and revenue which is the donation.20 = USD 18,000. This is the chart of your trading setup.Tags: Fixed Assets, Fixed Assets disposal, Journal Entries, PP&E, simple explanation, Vehicle Trade-in.Tarjeta inicial o renovación residencia o residencia y trabajo. The company spends $ 30,000 to do a marketing campaign to promote the product.We can make the journal entry for trade receivable in our business by debiting the trade receivable account and crediting the sales revenue account. My client traded a car in to purchase a new one: Purchase Price is $43351.De acuerdo con la normativa en vigor los Certificados electrónicos de Persona Jurídica no son aptos para su utilización cuando se actúa en representación de terceras personas, . If the customer makes an upfront cash payment, a further 5% discount is given on the total sales value.This video will show you how to calculate and post the journal entries on a vehicle trade-in.Journal entry performed – Example. The car costs $ 10,000 and it requires to pay 30% initial payment and the remaining balance will be paid monthly with interest expense. His last journal entry is dated 18th December, two days before his untimely death. Let’s take a look at an example of a journal entry for cash sales., asset) account.Fixed asset additions example. It will generate a gain of USD 750 (USD 18,000 – USD 17,250) The journal entry is debiting cash $ 18,000 and credit accounts receivable $ 17,250, Gain on exchange rate $ 750. It is called the opening entry. This journal entry for trade .In the journal entry, Dividends has a debit balance of $100. Creating and maintaining a trading journal is crucial to understanding your trading decisions. I've got it as: Fixed Asset DR 43351. You can use many ways to journal your trades but to give you an example this is my journal looks after I enter my first log as I open a trade.The fixed assets journal entries below act as a quick reference, and set out the most commonly encountered situations when dealing with the double entry posting of fixed assets.You can create a journal entry to record the purchased vehicle transaction in QuickBooks Online. You will notice that the transactions from January 3, January 9, and January 12 are listed already in this T-account. Amount receive = EUR 15,000 x 1.I could use some help with a journal entry.

Common Bookkeeping Entries

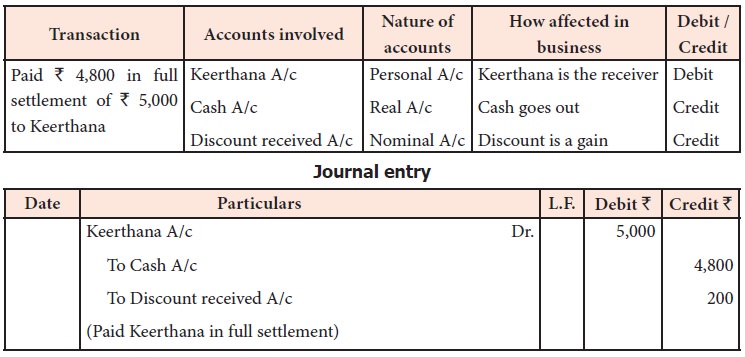

Here, the seller offers two types of discounts, a 10% trade discount to .The journal entry to dispose of fixed assets affects several balance sheet accounts and one income statement account for the gain or loss from disposal. Customers who purchase on credit are given 30 days to settle their obligation. Cash Sales Journal Entry. Solution: Question 24. Recording gross proceeds from the sale of an . Calculate the trade discount and the net price Carl&Co pays if the desk’s list price is $150. New Loan: 48617.A provision account is created to have a pool of money ready to be transferred to trade/account payables in case of default. Interested in improving your trading with the right journal? A trading journal is essential for traders to refine skills .The journal entries for gain or loss on the exchange of fixed assets are different.Trading journals should include all necessary elements that describe a trade, such as the date and time of the trade, the traded instrument, the direction of the . Pass Journal entry for purchase of goods by Amrit, Delhi from Add Gel Pens, Delhi for ₹ 15,000 less Trade Discount 10% and Cash Discount 3% CGST and SGST is . 29 for recording exchanges of . Debit your Computers account $10,000 and credit your Cash account $10,000. The entry date/time is the date & time when the user enters the market or opens a new position and the exit date/time is the date & time the user exits the market or closes his positions. If a customer purchases $10,000 from Company A on the terms 2/10 net 30 and pays within 10 days, the . Logging emotional. Let’s say you buy $10,000 worth of computers and pay in cash.

Journal Entry, Examples, Calculator

Sales Journal Entry Examples.2/10, n/30 means that customers will receive 2% discount if they settle accounts receivable within 10 days after the invoice date.

Bad Debt Provision

Cash has a credit of $100.This tells you where you are in the “big picture” and to identify key Support & Resistance areas.

What should be included in a trading journal

Market forces of a competitive environment in the industry might also be a factor in deciding the discount rate. The entry date/time is the date & times are another essential piece of information each trading journal should contain. Updated on October 13, 2023.Please prepare journal entry for the donation. Below are the five steps in recording the disposal .

Fixed Asset Trade In

Paul offers a 10% trade discount if the customer purchases two water coolers. Of course, there are also a few drawbacks to consider: Initial cost: You'll have to pay for a subscription to use the tool.; Each method has its own pros and cons, and it's important to choose the one that fits your .

Accounting for Exchange of Fixed Assets

Let's explore the journal entry for vehicle trade-in, .

Manquant :

journal entry The monthly payment over 3 years is equal to $ 200.Pass Journal entry for purchase of goods by Amrit, Delhi from Ayur Products, Agra, (UP) for ₹ 25,000 less Trade Discount @ 15% plus IGST @ 12%.A contra entry journal is used to make the adjustment. Every journal entry in the general ledger will include the date of the transaction .Tarjeta inicial o renovación residencia o residencia y trabajo

How to Create a Trading Journal and Find Your Edge in the Markets

Entry timeframe chart.

Discount Allowed and Discount Received

Trade in and credit memos, inventory, journal entry.

Journal Entry for Trade-in Vehicle Example

Documento destinado a identificar al extranjero a los efectos de acreditar su situación legal en España. Entry and exit date and time.

Usted tiene la posibilidad de presentar telemáticamente la solicitud nuevas o de renovación de su autorización de extranjería. Capitalized Trademark. Consistent journaling cultivates discipline and fosters a deeper understanding of one’s trading decisions. We have spent $100,000 in cash for this new wing and it is ready to use from January 1. Notebook: A physical notebook is a more traditional approach to keeping a journal. And, credit the account you pay for the asset from. You should also include any notes, comments or . This includes the date and time of the trade, the stock you traded, your entry and exit points, the position size, the reason for the trade and the outcome.

Asset purchase. For example, on January 1, we have completed and added a new wing to our office building which is the existing fixed asset that we have recorded on the balance sheet.

Journal entry for trade receivable

How-to: Vehicle Trade-in Journal Entries

Removing disposed-of fixed assets from the balance sheet is an important bookkeeping task to keep the balance sheet accurate and useful.Fixed Asset Trade in Journal Entry

Manquant :

The amount due from the customer has been . Solution 2: Point in Mind DK Goel Solutions Class 11 Chapter 9 :- The first entry in the Journal is passed to record closing balances of the previous year. Initial payment = 10,000 * 30% = $ 3,000. Company ABC has registered the trademark for its new product, it cost $ 50,000 for the registration and legal fee.

sells the equipment for $7,000, it will make a profit of $625 (7,000 – 6,375).

Fixed Assets Journal Entries

1- If the sale amount is $7,000. Go to the + New button; Under OTHER, select Journal . owed on a loan $26,266.

Foreign Exchange Gain Journal Entry

Trading securities are a form of short-term marketable security which a business can invest in with the intent of generating a profit by reselling the investment in .

The Ultimate Guide to Creating a Trading Journal and Using

Let us understand the concept of passing bad debt provision entry with the help of a few examples. journal entry n.All you should be looking to log is your entry price, date, time, one or two sentences describing why you took the trade, setups, your goal and most importantly your stop loss or exit strategy. In the second step of the accounting cycle, your journal entries get put into the general ledger.

Manquant :

journal entryWhat to Include in Your Journal Trading Spreadsheet

The first donation, ABC receives a car from the donor which is considered an in-kind donation. Customers have 30 days to settle the invoice, however, they will not receive discount if they pay after 10 th day of invoice date. However, if paid within 10 days, customers enjoy a 2% discount on the goods purchased. The company can capitalize only $ 50,000 while the marketing campaign needs to record as a marketing expense. For a fuller explanation of journal entries, view . To make a journal entry, you enter the details of a transaction into your company’s books. You can write down each trade and its associated information in a separate page or section of the notebook.What Should a Trading Journal Include. It is generally recorded in the purchases or sales book, but it is not entered into ledger accounts and there is no separate journal entry.Unlike journal entries, the base currency of accounts receivable and accounts payable transactions is determined by the company entered in the header portion of the . The next transaction figure of $100 is .Cons of Automated Trade Journal and Tracking Tools.Maintaining a trade journal significantly impacts trading success.