Trade payables turnover

:max_bytes(150000):strip_icc()/Accountspayableturnoverratio_final-d17fff78f8f24fc9bb4b1fd8697d41f7.png)

Accounts payables include trade creditors and bills .Some retail goods with high inventory turnover, like soap, may be paid off monthly. Short-term activity ratio.

Trade Payables: Definition, Benefits & Examples

Trade payables (also called trade accounts payable) are the money a business owes for goods and services when buying them on credit. = $33,220,000K ÷ $5,679,000K.51, notably lower than 2023.At this point, you may be wondering how you can calculate the account payable turnover ratio.应付账款周转天数(Days payable outstanding)应付账款周转天数又称平均付现期,是衡量公司需要多长时间付清供应商的欠款,属于公司经营能力分析范畴。公式为:或: 全球专业中文经管百科 ,由 121,994 位网友共同编写而成,共计 435,826 个条目 查看.

Ratio analysis

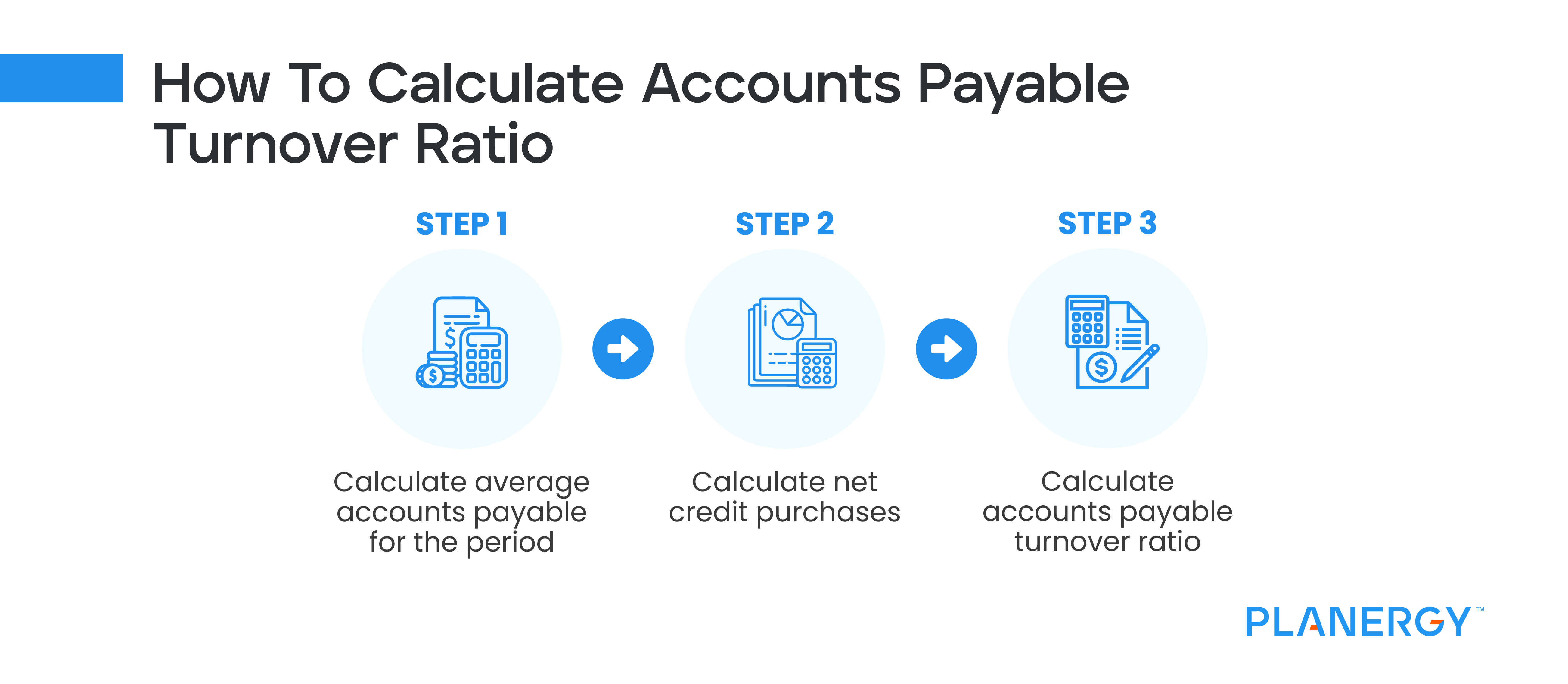

Revenue from contracts with customers . number of days of receivables outstanding deteriorated from 2021 to 2022 and from 2022 to 2023. Trade payables . Change is due to reduction in avg.Trade Payables Turnover Ratio is a measure of how many times a business pays off its creditors or suppliers in an accounting period. Average Trade Payables = (Opening Trade Payables + Closing Trade Payables)/2. Accounts Payable Turnover . Operating Profit 110.Case 4: Closing Trade Payables (including ₹25,000 due to a supplier of machinery) ₹55,000; Net Credit Purchases ₹3,60,000.Career Development.The accounts payable turnover ratio, also known as the payables turnover or the creditor’s turnover ratio, is a liquidity ratio that measures the average number of times a company pays its creditors over an . This ratio may be rounded to the nearest whole number, and hence be reported as 6. Solution Net Credit Purchases = $243,200 − $5,900 = $237,300 Average Accounts Payable = ( $23,000 + $34,900 ) / 2 = $28,950 Accounts Payable Turnover Ratio = $237,300 / $28,950 ≈ 8.Payables turnover = Cost of revenue ÷ Payables.Trade Payables = Creditors + Bills Payable. Year Trade Payables; Mar2023 ₹79,252 Cr: Mar2022 ₹69,750 Cr: Mar2021 ₹76,040 Cr: Mar2020 ₹66,398 Cr: Mar2019 ₹71,691 Cr: How is Trade Payables of TATA MOTORS Trending? Years Trade Payables % Change ; Mar2023 ₹79,252 Cr : .The net credit purchase value is important in calculating the value of a company’s efficiency and liquidity.Trade payables turnover ratio.

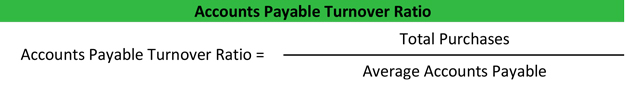

Here, “Total Purchases” refers to the overall value of goods sold within the specified time frame. In essence, the Trade Payables Turnover Ratio is a key tool for assessing a company's financial health and efficiency in managing its trade payables, which can have a significant impact on its .The latest Trade Payables ratio of TATA MOTORS is ₹79,252 Cr based on Mar2023 Consolidated results. अब, सवाल यह है कि औसत .Accounts payable turnover rates are typically calculated by measuring the average number of days that an amount due to a creditor remains unpaid. = $41,881,000K ÷ $11,635,000K.18 (g) Trade payables turnover ratio. Click for Solution. (B) Current ratio and Quick ratio.Accounts payable turnover ratio is a measure of your business’s liquidity, or ability to pay its debts. Increase is due to reduction in current assets and increase in trade .

Accounts payable turnover ratio — AccountingTools

48: Mar2022 ₹6,252 Cr : .76 in 2019 to 3. Accounts Payable Turnover Ratio is a crucial financial metric that measures the efficiency with which a company is managing its accounts payable. turnover is a ratio that measures the speed with which a company pays its . The ratio stood at 5. Trade payables are the amounts a company owes to its suppliers from whom it has purchased goods or services on credit. Director of Global Product Marketing

What is Creditor’s Turnover Ratio?

The accounts payable turnover ratio measures how quickly a business makes payments to creditors and suppliers that extend lines of . This number represents the number of times accounts turned over during that period. Slower moving or more expensive products, like vehicles, might be on an annual schedule.Trade Payables Turnover Ratio = Net Credit Purchases: Average Trade Payables: हमें समय में अनुपात मिलेगा। अब सवाल यह है कि नेट क्रेडिट खरीद की गणना कैसे की जाए.The Accounts Payable Turnover is a working capital ratio used to measure how often a company repays creditors such as suppliers on average to fulfill its . Updated March 20, 2023. An activity ratio equal to the number of days in the period divided by receivables turnover. The Trade Payables Turnover Ratio is a significant financial metric that reveals how well a company manages its trade payables.

Accounts Payable Turnover Ratio measures how quickly a company pays suppliers, reflecting short-term liquidity.

Jabil Circuit Inc (JBL)

Two basic measures of liquidity are : (A) Inventory turnover and Current ratio.应付账款周转率(Account payable turnover rate)应付账款周转率是指年内应付账款的周转次数或周转天数。应付账款周转率是反映企业应付账款的流动程度,是一个反映流动负债支付能力和占用供应商资金状况的指标。

Days Payable Outstanding (DPO) Defined and How It's Calculated

Comparing this to the prior years, the payables turnover ratio in 2022 was 7.

Accounts Payable Turnover Ratio : Definition & Calculation

Cash Purchases ₹10,80,000.

Trade Payables Turnover Ratio

Manquant :

trade payablesGuide to Understanding How Trade Payables Work in Accounting

Accounts Payable Turnover Ratio Defined: Formula

Gross margin= (Gross profit ÷ Revenue) x100% Return on capital employed (ROCE)/Return on equity (ROE) Return on capital . It is a financial ratio that helps in the analysis and evaluation of creditor payment policies and procedures.comAccounts Payable Turnover Ratio: Definition, How to .Accounts Payable Turnover Ratio Calculator - .Account payable turnover ratio biasanya dihitung dengan mengukur jumlah rata-rata hari dimana jumlah yang harus dibayarkan kepada kreditur tetap tidak dibayar. Two-thirds of all sales are on a credit basis. It indicates the speed with which the payments are made to the trade creditors. PepsiCo Inc's payables turnover ratio has shown a fluctuating trend over the past five years.22 (h) Net capital turnover ratio. Total pembelian / Rata-rata hutang usaha = Account payable turnover ratio.The accounts payable turnover ratio is a short-term liquidity measure used to quantify the rate at which a company pays off its suppliers. AP2 = Accounts Payable balance at the end of the period. Calculate its accounts payable ratio.

Accounts Payable Turnover Ratio

State the formula used. It establishes relationship between net credit annual purchases and average accounts payables. For example, let’s say a company agrees to buy $100 worth of chocolate bars from a supplier at $1 a piece.The accounts payable turnover ratio indicates how many times a company pays off its suppliers during an accounting period. In simple terms, the Accounts Payable Turnover Ratio indicates the number . 14 = 365 ÷ 26. REQUIRED (a) Calculate the following ratios. Earnings Per Share +56.November 04, 2023.Trade receivables 9 300 Cash and cash equivalents 4 240 28 100 Current liabilities Bank overdraft 8 000 Trade payables 10 400 18 400 All purchases are on credit. Example – Payables Turnover Ratio.Days Payable Outstanding - DPO: Days payable outstanding (DPO) is a company's average payable period that measures how long it takes a company to pay its invoices from trade creditors, such as .The latest Trade Payables ratio of WIPRO is ₹5,972 Cr based on Mar2023 Consolidated results. Dividing that average number .Asset turnover = Revenue ÷ Capital employed. (C) Gross Profit ratio and Operating ratio. All values updated annually at fiscal year end. It also measures how a company . They are treated as a liability for the company and can be found on the balance sheet. In order to determine the amounts that you need to divide: Indeed Editorial Team.What Does the Accounts Payable Turnover Ratio Measure? Considered a liquidity ratio, the accounts payable turnover ratio, also known as the payables turnover ratio, determines .December 31, 2023 calculation. The ratio decreased from 3.Accounts payable ratios — AccountingToolsaccountingtools.Creditors turnover ratio is also know as payables turnover ratio. Average receivable collection period.comRecommandé pour vous en fonction de ce qui est populaire • Avis Membagi angka rata-rata tersebut dengan 365 menghasilkan rasio perputaran utang usaha. Accounts payable turnover shows how many times a company pays off its accounts payable during a period. trade receivables .It suggests that Nike managed its trade payables more effectively during this period, potentially negotiating better payment terms with its suppliers.

What is the Accounts Payable Turnover Ratio, or AP Turnover Ratio? The accounts payable turnover ratio measures the rate at which a company pays back . Closing Trade Payables 540000; Net Purchases ₹43,20,000.To calculate the accounts payable turnover ratio, you can use the following formula: Accounts Payable Turnover Ratio = Total Purchases (or Total Cost of Goods Sold) / Average Accounts Payable. (A) Liquidity Ratios. 条目; 讨论; 编辑; 收藏; 简体中文; 繁体中文; 工具 . Year Trade Payables; Mar2023 ₹5,972 Cr: Mar2022 ₹6,252 Cr: Mar2021 ₹5,182 Cr: Mar2020 ₹5,840 Cr: Mar2019 ₹6,266 Cr: How is Trade Payables of WIPRO Trending?

PepsiCo Inc (PEP)

Example – Trade Payables. Credit Purchases – Credit Purchases Returns. Net AP / Average AP = Accounts Payable Turnover Ratio. If the turnover ratio declines . Businesses closely . The higher the accounts payable turnover ratio, the quicker . The payables turnover ratio for Jabil Inc has shown fluctuations over the past five years. Trade Payables = Creditors + Bills Payables. You can record trade . The formula for the account payable turnover ratio is as follows: TSP/ (AP1 +AP2)/2) Where: TSP = total supplier purchases, AP1 = Accounts Payable balance at the start of the period. (D) Current ratio and Average Collection period.

Accounts Payable Turnover Ratio

Average Accounts Payable is calculated as .

Account Payable Turnover Ratio: Pengertian Lengkap dan Cara

The company sells its inventory at $2 a piece over the next two weeks. It is on the pattern of debtors turnover ratio.Trade payables represent short-term liabilities/debts arising when businesses acquire products or services from external vendors or suppliers to fulfill . Calculate Trade Payables Turnover Ratio.Select the best alternate and check your answer with the answers given at the end of the book. Tangible Book Value 280.Trade Payable Turnover Ratio is a financial ratio that measures how efficiently a company pays its suppliers for the goods and services it has purchased on .Activité : Sr.Trade payables lets a company set up a system where it can pay its suppliers with the gross profits it earned from the inventory the supplier provided.Using the abovementioned formulas, here is an example of how to calculate your accounts payable turnover ratio. The accounts payable turnover ratio treats net credit purchases as equal to the cost .

Accounts Payable Turnover Ratio

61 in 2023, indicating an improvement from the previous year.