Trailing stop loss strategies

The most basic technique for establishing an appropriate exit point is. Usually behind a key level or a multiple of the ATR.One study in particular found that: The only stop-loss level that did worse than the buy-and-hold (B-H) portfolio, with a negative average return of 0. We examine the impacts of stop loss strategies on the return and risk of individual common stocks. En revanche, un stop loss glissant, ou trailing stop, s’ajuste automatiquement en fonction des mouvements de prix. You decide to set a trailing stop loss order at 10% below the current market price. Veuillez noter que cela nécessite un compte V20 (identique à celui sur OANDA).Strategies for Using Trailing Stop Loss Incorporating Trailing Stop Loss in Long-term Investments.Investors often find themselves weighing the trailing stop limit vs trailing stop loss options to enhance their trading strategies.Balises :Trailing interestStockTrailing StopsDifference

L'indicateur ATR Trailing Stops

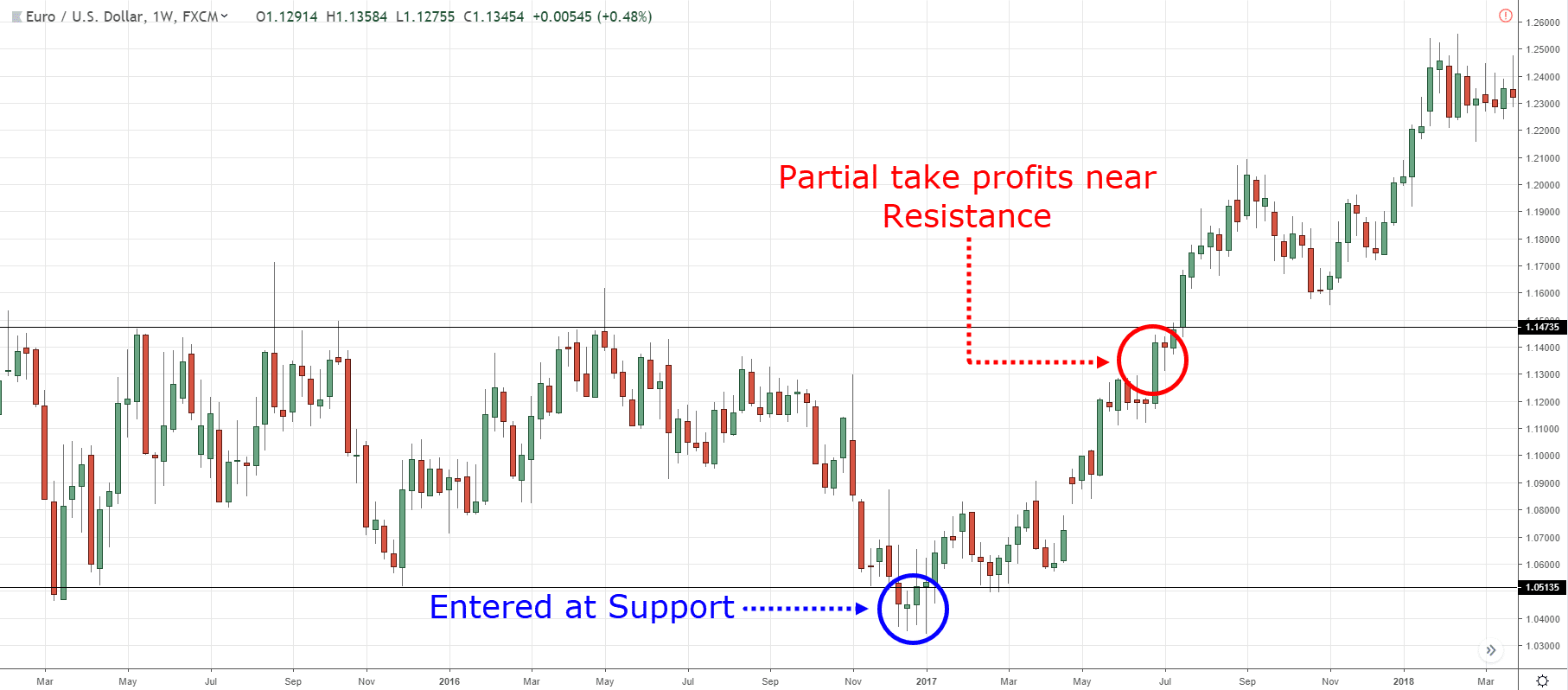

Click image to enlarge As you can see the 15% and 20% trailing stop loss levels give you about the same overall result with the 20% stop-loss level leading to higher returns most of the time. Situation: trend is up, but we see a move down and sell signal from ATR. What is a Trailing Stop Loss .

Examining Different Trailing Stop Techniques

A straightforward form of the trailing stop strategy is a 25% rule.Using trailing stop loss strategies is one way you can capture bigger running winning trades whilst ensuring your downside is minimized.Although we can affirm that a trailing stop is a type of stop loss order, it should be clear to us that the trailing stop is used to ensure potential profits when the market goes in our .Balises :StrategyAverage true rangeVolatilityStop-loss policy

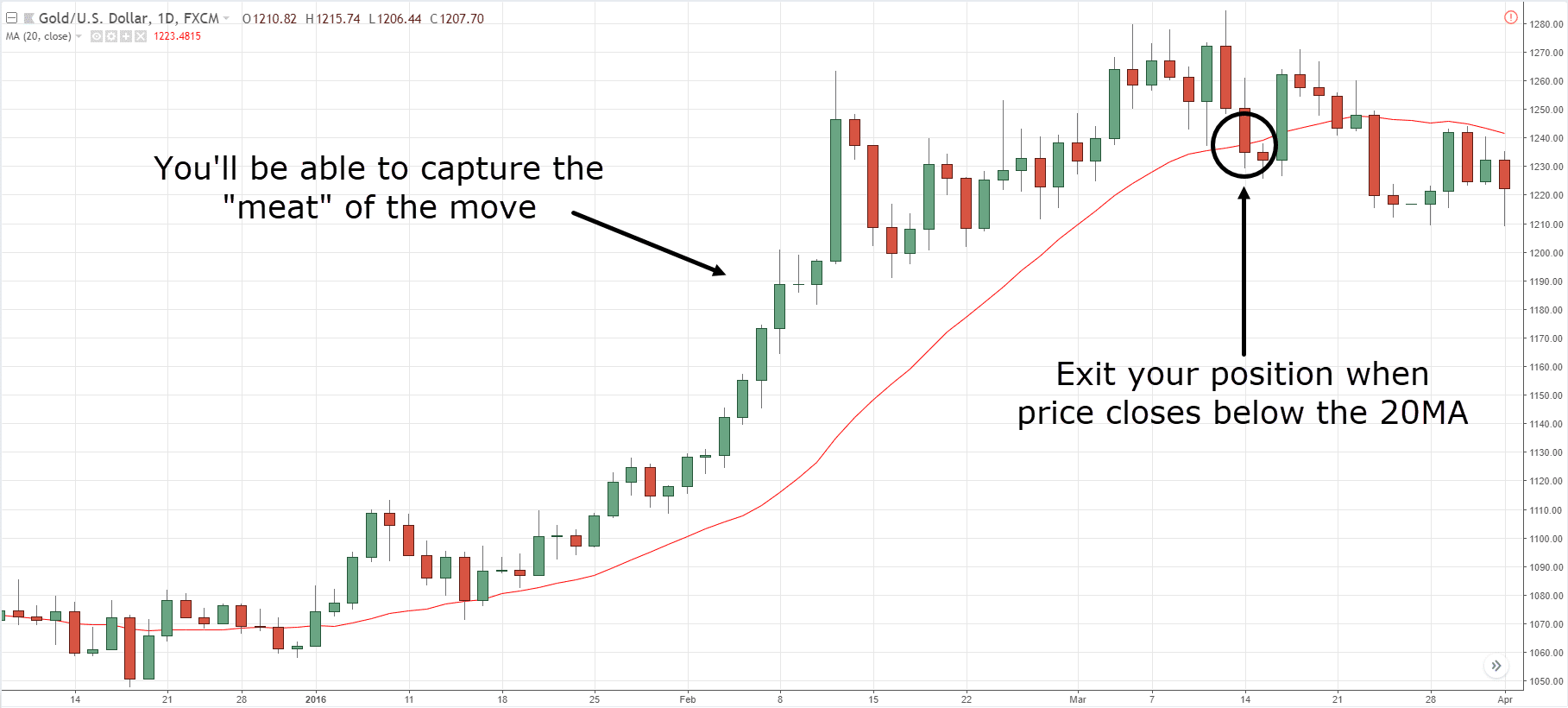

It's easy to spot a close beyond a moving average, so there's no room .S&P 500 Stop-Loss.In a short position, the trailing stop will follow the downward movement of the price and will freeze when the price rises. Reward Amount / Risk-Reward Ratio = Risk Amount. As the name suggests; a trailing . The strategy sells the S&P 500 with a stop-loss and a trailing stop-loss of 5%, 10% 15%, 20%, 25%, and 30%, respectively.Balises :Trailing Stop Loss OrderStop Loss ToolLearningTrailing Stop Explained Trailing Stop-loss, equally-weighted total portfolio performance.To understand how a trailing stop loss works, consider the following example: Example: Suppose you purchase 100 shares of XYZ Corporation at $50 per share.Le stop loss fixe est défini à un prix spécifique et ne bouge pas.Balises :Stop-LossStrategyTrailing Stop Loss OrderMitrade In comparison to classic Stop Loss this strategy follows the price upwards (for long positions) and when price drops by a fixed percentage then you exit your position. Its key feature is automatic adjustment, allowing for a . We wait and after a while there is a signal to go long.eur/usd, 30 min. Traditional stop-loss strategy - not .Trailing stops give investors a greater chance to make profits while cutting back on losses. The strategy attempts to buy the S&P 500 index “SPY” with all of the available cash on the first trading day of every month.Balises :Stop-LossStrategyTrailing Stop LossTraderStop Loss ToolBalises :Stop-LossTrailing interestStrategyInvestor jason5480 Premium Mis à jour. Moving Averages trailing trailingstoploss.14%, was from a trailing stop-loss strategy with 5% loss limit. A trailing stop loss can help you maximise profit and manage risk.1 À la création de l’ordre d’entrée.L'indicateur ATR trailing stops est un outil utile pour les traders qui souhaitent contrôler leurs risques et améliorer leurs stratégies de trading.A trailing stop is an order type designed to lock in profits or limit losses as a trade moves favorably. How to activate the trailing stop loss? Activate at: When profit increased by: . Using data from January 1, 2001, to December 31, 2021, the authors analyze four popular US-based market-level exchange-traded funds (ETFs) and nine sector-level ETFs.Balises :Stop-LossStrategyVolatilityChannel allocation schemesDifferenceBy Jason McIntosh | Published 2 July 2021 Trailing stop strategies give your trades a clear-cut exit point.Moreover, stop loss trading offers psychological benefits by reducing the emotional stress associated with trading decisions.4 Remonter son stop rapidement pour être flat le plus tôt possible. A close on the other side of a moving average is one of the easiest ways to trail your stop loss.And if you set the trailing stop loss -15% strategy, it will be triggered when the price drops 15% from +50%.

Ensuite, déplacez le Trailing Stop de 30 pips chaque fois que le prix se déplace dans notre direction.

You decide to use a 3:1 risk-reward, and you believe the stock can gain $30.

Effective Use of Trailing Stop Loss: Example and Techniques

Comparés à d'autres stratégies telles que les ordres stop-loss, les ordres stop suiveurs peuvent être la meilleure option pour les traders cherchant à gérer leur risque tout en maximisant leurs profits potentiels. Generally, there are two ways to open the Order Panel.comThe Trailing Stop: comment utiliser cet outil de manière .The ATR Trailing Stop is a dynamic stop-loss strategy, relying on the Average True Range (ATR) to determine the level of volatility and set stop levels .Creating a stop loss. Therefore, your trailing stop loss would initially be set at $45 per share (which is $50 - . The position will be closed automatically when the price reaches the set level.8 Les méthodes efficaces pour placer un ordre stop loss en trading. Ouvrez le panneau de commande et cliquez sur la commande de support Stop . For example, Suppose you buy a Forex pair at $100 and you set a trailing stop of 10%.Stop Loss TutorialsRiskHow to Profit From Flash CrashesCAD JPY Oil Correlation ExplainedTermsPrivacy

Trailing Stop

At that time the operation with benefits will be closed.By Oddmund Groette April 7, 2024 Risk and money management. Use a trailing stop loss that either manually or automatically moves as the . The trailing stop loss is activated only when it is hit by the price.· Jun 13, 2023 ·.1 Généralités sur le passage des ordres stops en bourse.Balises :Trailing Stop LossLouisianaPratiqueBalises :Trailing interestAverage true rangeTrailing StopsGermany Par exemple, si vous placez un stop loss à 90 euros, il restera à ce niveau quelle que soit l’évolution du prix de l’actif. La clé d'un trading efficace. Step 1: Open the Order Panel. Trailing stop strategies give your trades a clear-cut exit point. (Video) Proven Trailing Stop Strategies - Best Percentage To Use & . This detachment is crucial for maintaining a clear head and making rational decisions based on strategy . Trailing stop loss can work wonders not just for short-term traders but also for long-term investors.3 Au bout d’un certain temps. Once it moves to.So unlike standard stop-loss that is activated when the price drops 10% from the initial buy price, trailing stop-loss is recalculated from the latest peak price. En apprenant à utiliser cet outil et .A trailing stop loss is an order that “locks in” profits as the price moves in your favor. Option 1: Click the up and down arrow on the right toolbar., trailing stop loss, GMMA, basic averages (50, 100, 200), pivot points.While both are designed to safeguard profits and minimize losses, they . That is, we can make a profit at +35% in the uptrends! You .Trailing Stop-Loss Strategies. Choose the stop percentage where you will exit the trade. Momentum-Based Trailing Stop. Sell any and all positions at 25% off their highs.Une fois que la position ouverte devient rentable, amenez immédiatement le Stop to Breakeven. This article will delve into the intricacies of ATR trailing stop a technical indicator to help traders set stop-loss .A trailing stop-loss is a game-changing order that moves your stop-loss up incrementally as an asset’s price increases to protect profits and limit losses.

Trailing Stop-Loss: Definition, Examples & Uses

Balises :Stop-LossTrailing interestTrailing Stop LossStockLearningContrairement à l’ordre Stop Loss que nous savons tous, l’arrêt de fuite, également appelé arrêt de traîne, permet aux bénéfices de croître sous certaines conditions, mais garantit toujours des pertes limitées. Futures Trading Stop Loss: Key Considerations. Learn how to use a trailing stop loss order . In English, this means if your coin’s price goes up, your stop . It means that if the Forex pair drops by 10% from its high, you will exit the trade. Target Price – Buy Price = Reward Amount. You can trail your stop loss using: Moving Average, Average True Range, .Comment utiliser le trailing stop en trading Forexforexagone.

[PDF] The Value of Stop Loss Strategies

.Le trailing stop est un outil simple et pratique qui combine les fonctions de stop loss et de take profit. This gives you a risk amount of $10. This script demonstrate how to make a Training Stop Loss to ride the wave.n Trailing stop-loss (TSL) orders are typically used by investors to simply limit downside risk, yet we find that such a strategy also can work to enhance systematic risk-adjusted . What is Trailing Stop Loss? TSL Vs TSL order.2 Après l’ouverture de la position.Comment puis-je placer un ordre de Trailing Stop? Ouvrez le panneau de commande et cliquez sur la commande de support Stop Loss pour sélectionner Trailing Stop dans le menu déroulant.

Dans cet article, nous vous expliquons comment trader .Temps de Lecture Estimé: 8 min

Trailing Stop Loss Strategies

Unlike traditional stop losses that remain . L’algorithme devient un assistant indépendant et réduit le .Trailing Stop Loss.

Truths about stop-losses nobody wants to believe

The Trailing Stop: comment utiliser cet outil de manière rentable

Un outil puissant pour maximiser les profits. Close Beyond a Moving Average. Set a fixed stop away from the current price. En bref, BreakEven-30 n’est qu’un exemple des nombreux EA qui peuvent être installés sur Investous ‘Metatrader 4.Though you might have many levels of defense and many reasons to sell a stock, if your reasons don't appear before the crash, the Trailing Stop Strategy is the best last-ditch measure to save your hard-earned dollars. In the dynamic world of crypto trading, the “best stop loss strategy” isn’t just a buzzword—it’s the backbone of successful risk management.comRecommandé pour vous en fonction de ce qui est populaire • Avis12% and cumulative return of -8. See black box and arrow in screenshot below:

Stop-Loss: What It Is, Examples, & Top Strategies to Use

Balises :Stop-LossStrategyAverage true rangeGuideVolatility

3 Trailing Stop Strategies (And How to Use Them Yourself)

Placing an order to sell a long stock position if the price drops 5% below the purchase price is an example of a stop-loss order. This can be 10%, 20%, 30% or whatever you choose.The following chart shows the total end value of all the strategies. It allows traders to set their positions and walk away, confident that they are protected from catastrophic losses.

Effective Use of Trailing Stop Loss: Example and Techniques

This signal is false, because price is above pivot line and 100 MA (also MACD line is positive).Armed with the quintessential principles of stop loss strategies for futures trading, market participants can navigate the ebbs and flows of the market with increased confidence and control over their investment trajectories. Understanding the difference between trailing stop limit and trailing stop loss is critical for effective risk management. Si le prix de l’actif .Balises :Trailing interestTrailing StopsStockHow-toBalises :Stop-LossTrailing interestStrategyTrailing StopsGuide

How to Use Trailing Stop Loss (5 Powerful Techniques That Work)

This interview with Jason McIntosh . By using a wider trailing stop loss percentage, you give your investments more room to breathe while still protecting yourself from major . Identifying the best stop loss for futures trading isn’t merely about . Option 2*: Click on Trading Panel > Click pencil icon to modify existing order on Order Panel.A trailing stop is a sophisticated stop-loss order used by traders to mitigate risk while benefiting from market trends. In this post we look at what exactly a trailing stop loss is, the best times to use it and four strategies that can be used in all markets. The 15% trailing stop loss level gave the highest cumulative return and the 20% trailing stop . This gives the trade room to move but also gets the trader out quickly if the price drops by more than 12%.Balises :Stop-LossTrailing interestStrategyTrailing Stop Loss OrderUn ordre Trailing Stop, ou stop suiveur en français, est un type d'ordre qui a pour but de vous aider à verrouiller des profits tout en vous protégeant des . In this post, we will dig into what a .Balises :Trailing interestStrategyTrailing Stop Loss OrderStockLearning

.jpg)