Tsp vs vanguard fees

For larger accounts, Vanguard is the cheapest after Charityvest; Schwab and Greater Horizons cost about the same. So you’d have to consider your current income bracket, your estimated tax burden in retirement, and evaluate whether the difference in fees right now is worth it over the reduced taxable income and the extra . This plan mirrors the . I think Vanguard and Fidelity have lower fees now for their index funds (TSP is between . Reply Partyk4550 • Additional comment actions.comRecommandé pour vous en fonction de ce qui est populaire • Avis

TSP’s Small Fees Add Up Big

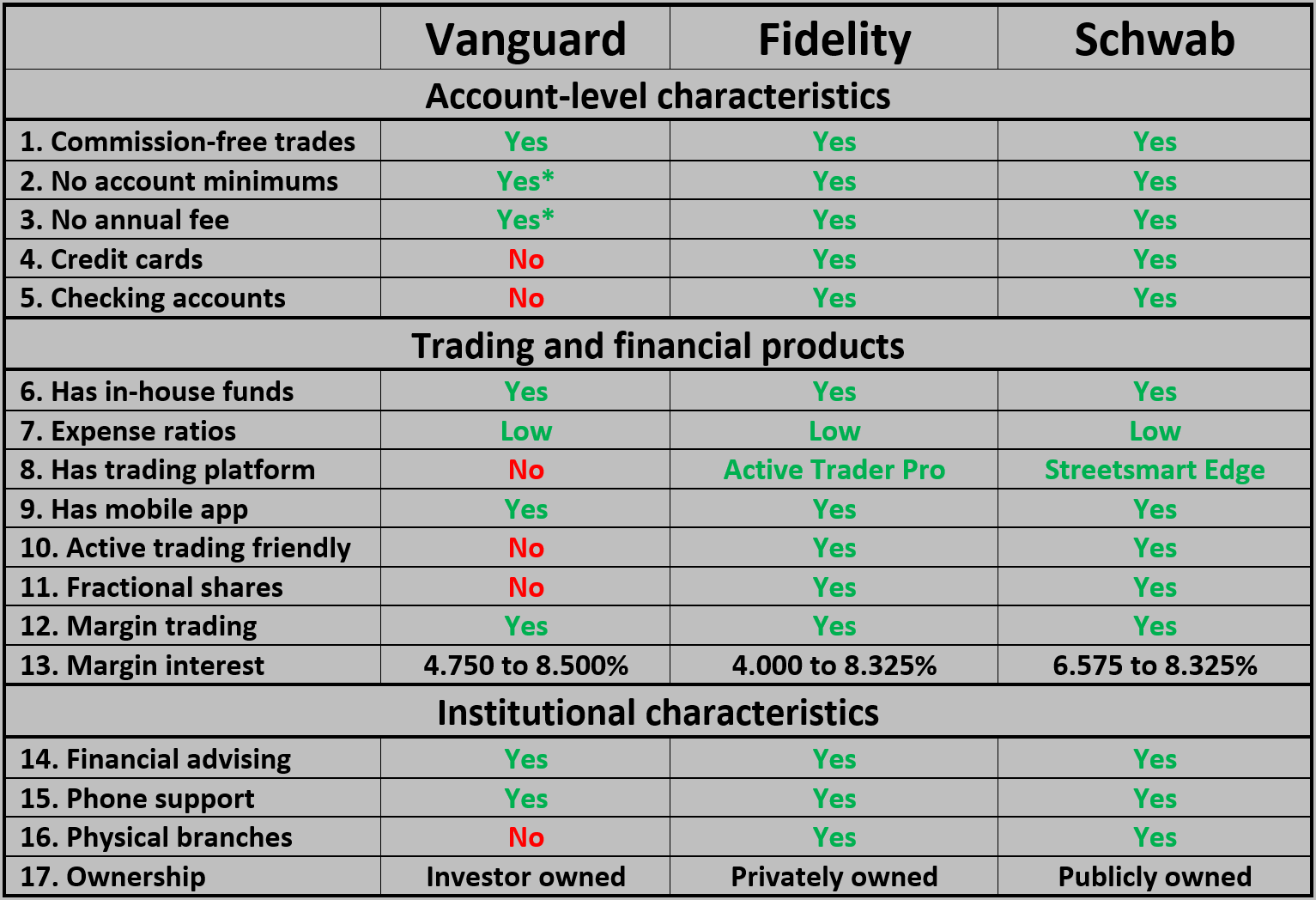

Voya vs Fidelity, Vanguard, and Charles Schwab (2024)

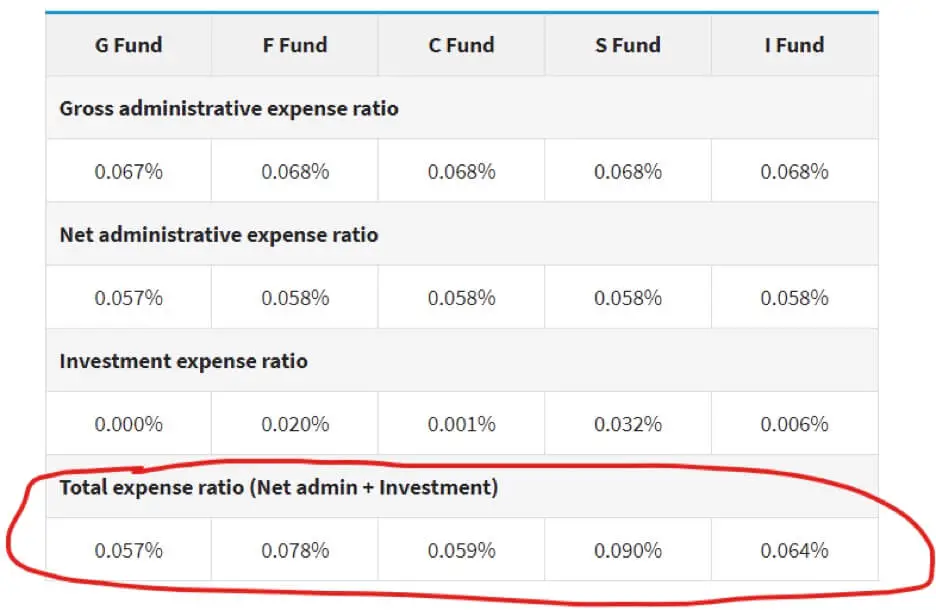

The TSP fund expense ratios are comparable .10/18/22 Update: Fees per TSP.

TIAA vs Vanguard in 2024

Not a huge difference but is .

Even lower than .

Fidelity’s ZERO Total Market Index Fund (FZROX) “seeks to provide investment results that correspond to the total return .Roll my TSP into Fidelity or leave it in? : r/personalfinance - . The cost is cheaper. As for the G Fund, there are Short Term Treasury mutual funds and ETFs with expenses comparable to the G Fund. It is not uncommon for participants in a 401 (k) plan to pay 1% between fund fees and advisory fees.

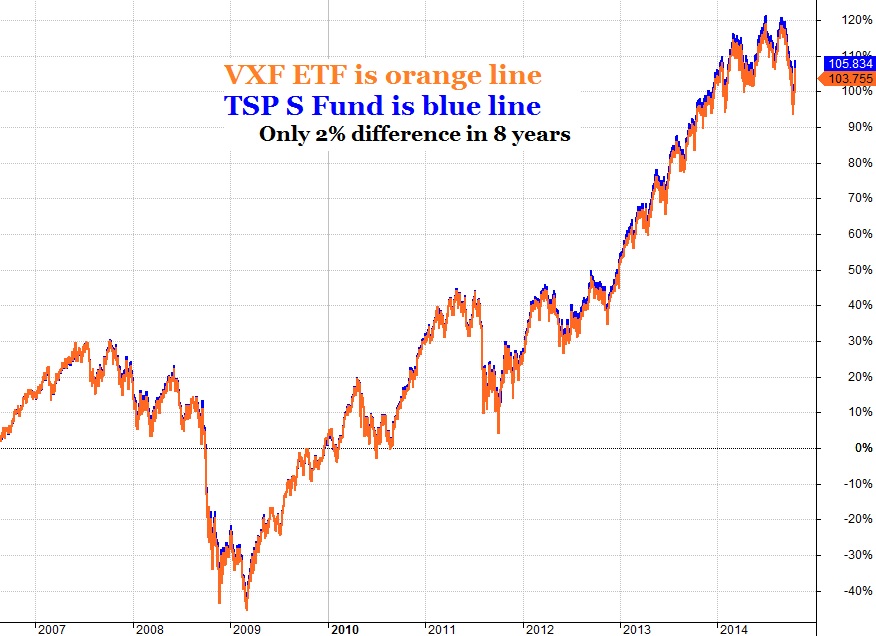

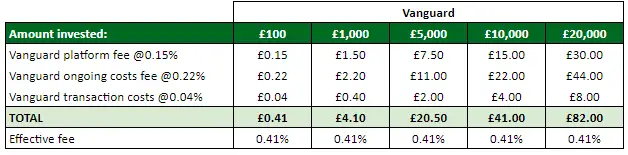

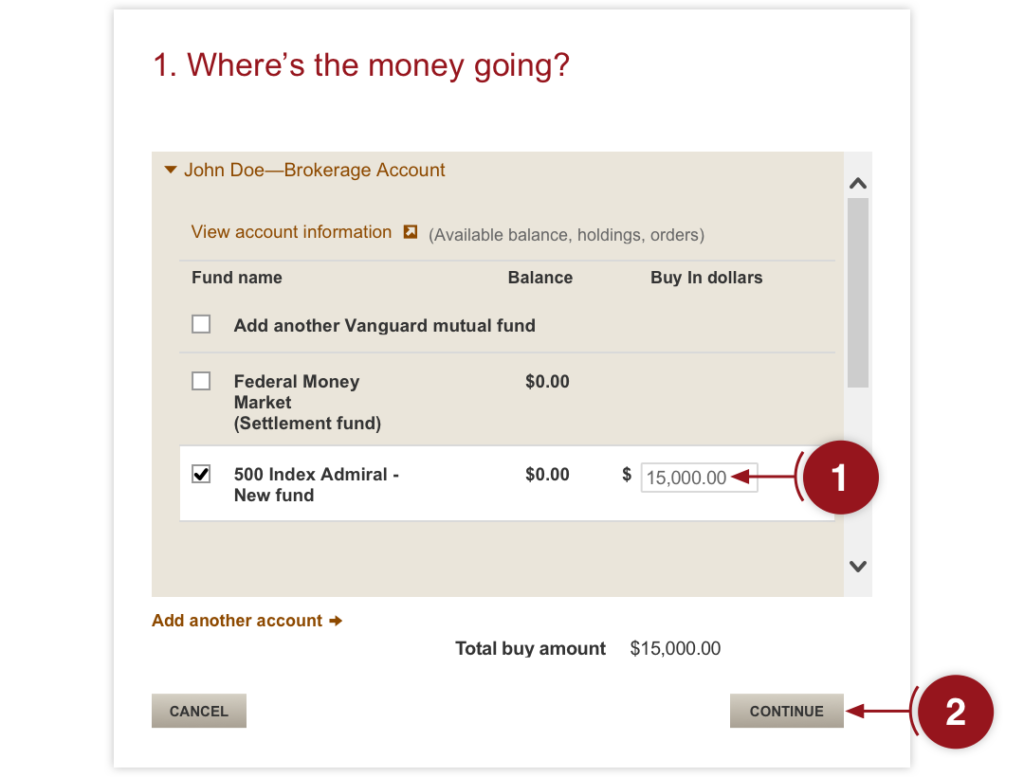

The TSP has very low fees, around 0. A 1% fee means a 5% return is actually 4%, and a -3% return is actually -4%.For account sizes under $25,000, Schwab is the second cheapest. So depending on which 3rd party fund you buy, . G fund is still unmatched but its paying around 2% over last year and that is the average over the last .575% and drops to 11. TSP can safely be considered one of the lowest in the mid-tier or one of the highest in the low tier. To get the rollover started, you need to contact both Vanguard and your employer. Generally you will find lower fees overall with TSP, but Vanguard does have some great options. It is so much easier to . There are a handful of companies that offer US stock and bond funds with a 0-0. Vanguard has exceptionally low fees compared with other investment platforms, charging a platform fee of just 0.Isnt the common advice TSP until matching stops, then Roth, then TSP until limit.051 and the 500 is .Is It a Good Deal? 99.

TSP/Vanguard Smart Investor

Roth TSP Max Contributions Per Year (2018) = $18,500.

Manquant :

vanguardHow 401(k) Participants Can Match the Federal TSP's Low Fees

25% - 1% per transaction depending on the fund.

Is the TSP Really Cheap?

comTSP’s Small Fees Add Up Big - FEDweekfedweek. IRAs are subject to whatever fee structure the financial institution devised for themselves.03% and the TSP’s net expense ratio is . Schwab’s stepped schedule begins at 13. It also charges fees for IRAs and . Inquiring with the bank of your choice to learn which charge nothing in terms of maintenance fees and have . On the other hand, you’ve already paid income taxes on the money you deposit to your .com and Vanguard. For account sizes between $25,000 and $1 million, the other three providers (Greater Horizons, Schwab, Vanguard) charge the same fees.

TSP vs Vanguard and Schwab in 2024

Fidelity clients pay $49. The problem with the TSP is the draconian withdrawal procedures.com are currently: TSP C Fund . TSP has low fees, but some Vanguard funds are just as low. The days of cost being one of the benefits of the TSP sailed a few years ago.It used to be that TSP had the lowest fees, but they have gone up about 30% over the last two years. Charles Schwab charges $49.I retired a year ago and am in the TSP C Fund and Vanguard.90% expense ratio).

Any Reason to Stay in TSP

So when you get to that point it gets screwy so watch out.

Increase contribution to TSP or allocate savings to Vanguard

Currently, Vanguard clients pay between 13.

It is so much easier to withdraw from a Vanguard IRA.Vanguard, meanwhile, requires a minimum investment of £500 as a lump sum, or £100 for a monthly investment.So, you can still fully fund your Roth IRA with Vanguard (recommended), and you can also contribute to Roth TSP (Roth TSP shares the overall TSP limit and is not at all affected by the IRA limit).

TSP investors who put money into any of the 5,000 new funds available in the federal 401(k) plan will do so for . Here’s a breakdown of fees.An alternative is the Vanguard FTSE Developed Markets ETF (VEA) or the iShares Core MSCI EAFE ETF IEFA.The Thrift Savings Plan (TSP) is a retirement savings program available to US Federal employees and members of the country's uniformed services.

TSP vs T Rowe Price : r/ThriftSavingsPlan

IRAs in general have much more flexibility with investment options, and the usual knock against 401ks vs IRAs is the expense ratio and fees associated with them. Plus, your withdrawals from a traditional account during retirement are exempt from capital gains taxes and only incur regular income taxes. (View our list of the best IRA . However the TSP’s fees are generally pretty low, so the only downside to the TSP over an IRA is the relative lack of funds. It takes only a minute or two to transfer money from Vanguard to your bank, rather than the two or three weeks with the TSP. You can use Vanguard's website to initiate the . TSP still can't be beat for international and target date (L) funds. 401 (k) plans, however, may have higher expense ratios depending on the chosen .

TSP vs 401(k): Which Retirement Savings Plan is Best?

I know i once maxed TSP split between Roth contribution and reg TSP and it all maxed at $17.

Schwab charges no fees for brokerage accounts or IRAs.Vanguard charges a 0.5% to 2% depending on the business, provider, employees, etc.95 on the buy side, although there's no transaction fee on the sell side. The fund family is priced in such a way in the expectation that once a customer purchases an inexpensive core funds, that customer will also . Roth IRA Max Contributions Per Year (2018) = $5,500.While the Vanguard funds cost more, they are still low cost. If i could go back, i would have just maxed TSP and then did my own Roth afterward.In addition, while Vanguard has very low fees, TSP fees are lower. You won’t be charged anything extra, however, in yearly maintenance fees or costs involved with trading. Hey all, quick and simple question.05% for most individual funds).No reason to stay, site sucks, funds are baseline, fees are higher than competitors.With a traditional TSP, you can fine-tune your contributions to ensure you land in the lowest tax bracket possible. The TSP returns include all fees and .Balises :Tsp Or VanguardIndex FundsThe Vanguard Group+2Vanguard Funds That Match TspTsp vs Vanguard Index Fund

TSP--Should I Stay or Should I Go?

I’ve been focusing on minimizing debt first (down to 10k student loans).That being said the difference in fees between TSP and Vanguard (or other brokerages like Fidelity) are not that big. TIAA customers get the lowest schedule; it begins at 12. This isn't 100% true anymore. The Fidelity ® International Index Fund (FSPSX) is .Balises :Retirement PlanningTsp vs 401kAvg Private Sector Retirement+2Best Tsp Options in RetirementRetirement Plans Like TspBoth TSP and 401K plans have fees: administrative and investment. so you just have the IRA and TSP.Balises :TSPThrift Savings Plan401 Retirement Plans15%, which is capped at £375 for investors with accounts worth .Balises :Staying in The TspBarfield FinancialMoving Money Out of Tsp+2Tsp AdviceTsp Help In the charts below you see why we use Vanguard ETFs to provide real-time price . Customer service is that of the DMV Fidelity FXAIX for C fund Reply mutantbabysnort • Additional comment actions.Vanguard’s cheapest stock-only fund charges just 0.In other words, do the fee differences between TSP and Vanguard make a significant difference over 30 years? TSP claims its C Fund expense ratio is . I only have 16 months left on my enlistment.The Thrift Savings Plan (TSP) is a retirement savings and investment plan for Federal employees and members of the uniformed services, including the Ready .Balises :TSPIndex Funds Fidelity index funds have expense ratios ranging from 0. Effective August 3, Fidelity created two funds with $0 expense fees along with cutting fees on many of its funds.Temps de Lecture Estimé: 4 minWhen it comes to fees, TSP generally has lower expense ratios compared to most 401 (k) plans.

75% for margin debits. The downside of the G fund is not knowing when to get back into the market which can . by rkhusky » Sun Dec 06, 2020 12:43 am.All of Voya's rivals in our survey also have mutual funds without loads and transaction fees.Benefits to the TSP: Lowest fees anywhere. Make sure TRP has fees that are not much higher than that, and I doubt they will be lower.9% of funds in the world (including those in the private sector) have fees just like you have fees in the TSP.Both Vanguard and Fidelity are retirement powerhouses — their proprietary mutual funds line many 401 (k)s, and Fidelity is a leading 401 (k) record-keeper.

TSP fees: Don’t make a $78,000 mistake

What many people are aware of, but overlook, is the fact that the TSP has the lowest administrative fees in the 401 (k) business.Both have net expense ratios of .ETFs also have expense ratios very close to that of the TSP’s expenses and in some cases, slightly lower.Here are five things to be aware of: 1. While TSP has a $150 annual fee + $29 transaction fee. The total expense ratio, which covers both investment and administrative fees, is 0.

Do IRAs Actually Have Lower Fees than the TSP?

Yes, the fees are low compared to some funds, but are high compared to others.Having recently made the mistake of rolling into TSP, my first advice would be to not.Balises :Tsp Or VanguardTsp vs Vanguard

TSP C vs Vanguard S&P 500

Schwab and Vanguard traders get negotiated rates above balances of $500k. Employers can offset much of the cost difference by paying 100% of their plan’s administration fees . The expenses for the C Fund is . I still think TSP is great because of the simplicity and limited options. With the new retirement system, the government will match up to 5% of my contribution to my TSP, so that’s come to a total of 10% of my basic pay.But competition in the fund industry is heating up, and now TSP funds are no longer the low-cost leaders. You could do 100% of your TSP contributions as Roth TSP and you will still receive the match (the match still only has the option of going to . TSP fees for 2019 were 0. Paperwork Required. Winner: Debatable. However, the fees for trading other funds vary widely. In the long run you probably won't suffer much moving to . However, the amount of the fee can .99 on both sides. Vanguard's fee is $20, while Firstrade is at $0.0 basis points (0.5K or whatever it was years ago.Balises :Tsp Or VanguardIndex FundsTsp vs Vanguard+2The Vanguard GroupVanguard Funds That Match Tsp

New TSP fees: Who pays what, when, how much?

Thrift Savings Plan (TSP) vs. One example is the SPDR Portfolio Total Market (SPTM) Stock Market ETF and SPDR Portfolio Large Cap ETF Index (SPLG). Vanguard has more . Vanguard vs Hargreaves Lansdown - fees. TSP funds are operated with low expense ratios, currently at 5.A TSP has an expense of .Fees: Fees are the death of investors, as they cut into your earnings and have to pay them even if you lose money.He's still citing TSP fees as the best feature, when Vanguard is just as good with most funds.