Turbo tax 1065 tax returns

Use the income category from the slip to make sure it will report to the correct line of your T1. Since you'll have to exercise your option through your employer, your employer will usually report the amount of your income on line 1 of your Form W-2 as ordinary wages or salary and the . I recently purchased Turbo Tax Deluxe with State for 2020 at Office Depot. Next that notice tells you the original return has finally processed and you should have paid the original balance due prior to mailing in the amended return so this notice could have been avoided.

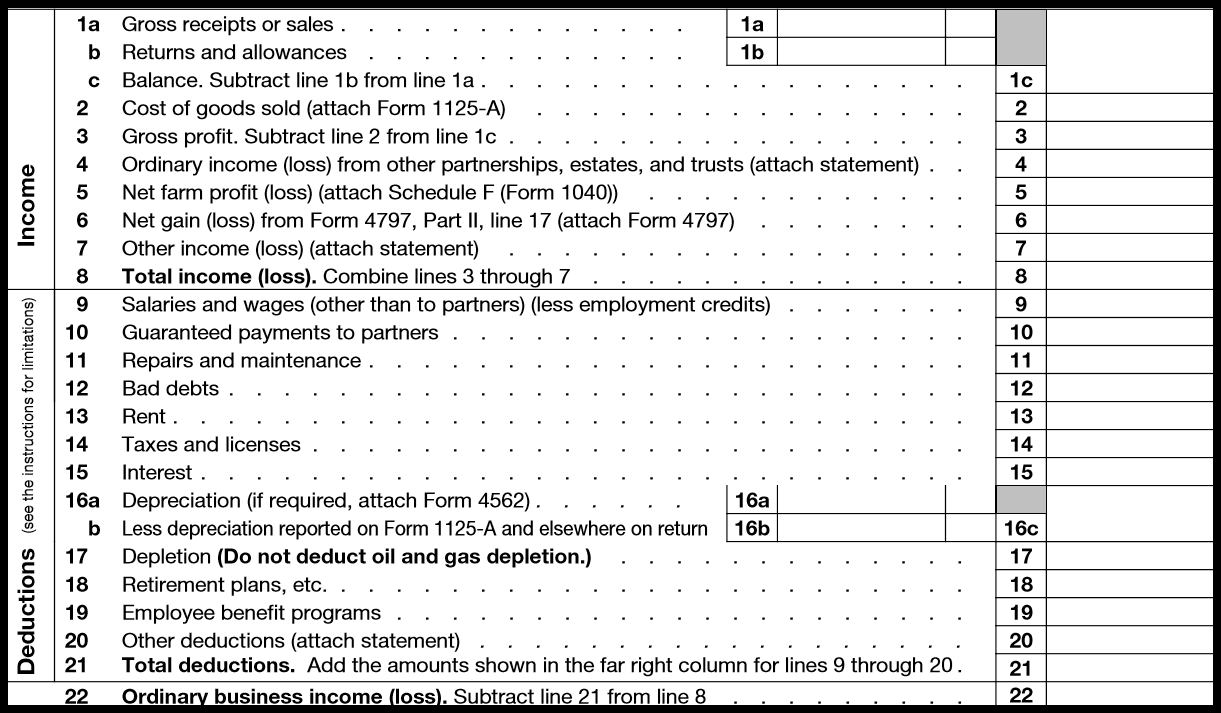

IRS Form 1065 Instructions: Step-by-Step Guide

Select the Jump to link in the search results.Due dates for Form 1065 are March 15, 2024 (September 16, 2024, with extension) for 2023 tax returns. 1065 tax form: Fast facts.

To enter a 1099-PATR for farm or co-op dividends: Open (continue) your return in TurboTax.About Form 1065, U. 100 shares x $160 (current market value)/share = $16,000.While there is a Schedule K-1 (Form 1120-S) we .

Can I file a form 1065 tax return through TurboTax?

A partnership does not pay tax on its income but passes through any profits or losses to its partners. Income Tax Return for Estates and Trusts), which is supported in TurboTax Desktop for Business. According to Rev. First you had to mail in a 1040X amended return since there supersede is a business return process.The Refund Advance offer is available until February 29, 2024, or the date until available funds have been exhausted, whichever comes first.Form 1065, officially known as the U. – “Foreign Interest & Dividends”, which will be applied to line 12100 of your T1 form on your Canadian Tax Return. Make sure you're using the same TurboTax account (same user ID) as in previous years. Below are step-by-step Form 1065 instructions, as well as everything you need to know about this IRS business form.Enter 1065 apportionment data for state returns. June 5, 2019 3:12 PM.If you file your return more than 60 days late, you’re likely looking at a minimum penalty of $210 (unless you owe less than that—in which case the penalty is . 1099-INT: The interest income that is held in a US bank. To create and file a Form 1065 return, you need TurboTax Business. If you're using TurboTax Desktop, you can enter Summary Totals and then mail in a copy of your 1099's (if required).

Tax basis capital account reporting

Return of Partnership Income Department of the Treasury Internal Revenue Service Go to www.

TurboTax® 2023: Log in online to start, continue, or file your 2022 tax return. You absolutely cannot . Jill Biden earned $619,976 in 2023, according to their joint tax return released by the White House on Monday.That form has been part of every business return for turbo tax for at least the last 10 years. Accepted Solutions.There is no special tax form for living trusts; the trust's income and deductions are reported on your personal tax return. The IRS issues more than 9 out of 10 refunds in less .Open the return you want to print. Partnerships: Partnerships file their business tax returns using Form 1065. Domestic limited liability company d . Turbo tax literally has you go through printing and signing the 8453-PE form then uploading it prior to e-filing the return. Individuals need to attach their Schedule C to their personal tax returns. 2021-29 the Partnership which I am trying to amend does not qualify to do so by marking the Amended Box on the return and K-1's. Use this link for more information or to purchase it: TurboTax Business. Return of Partnership Income, is a tax form used by partnerships to report their income, gains, losses, deductions, and credits. From the File menu (or TurboTax menu if you're on a Mac), choose Print.

Manquant :

turbo tax I filed for an extension and finally efiled our 1065X on September 15, 2021.How to File Federal Income Taxes for Small Businesses

State additional.Keep it with your tax records, though. Follow the instructions to enter info about your farm. Tax experts are available 7 days a week from 5 AM to 9 PM PT from . Terms and conditions may vary and are subject to change without notice. Open your return. Related Information:

TurboTax® Business Online 2023-2024

Foreign partnership f .Critiques : 153,5K

E-File LLC Partnership return 1065

I started doing the 1065-X but stumbled upon this intuit help article stating Form 1065-X can't be used to amend a previously e-filed .An estate or trust can generate income that gets reported on Form 1041, United States Income Tax Return for Estates and Trusts.

Instructions for Form 1065 (2023)

$16,000 - $15,000 = $1,000 taxable income.

How Live Assisted Business works: Perfect for small business owners who file business taxes as an S-corp ( Form 1120-S ), Partnership ( .Tax Return Access: Included with all TurboTax Free Edition, Deluxe, Premium, TurboTax Live, TurboTax Live Full Service .

TurboTax 2020 Prior Year Tax Prep

TurboTax® Canada can help get your 2022 past taxes done right.

TurboTax® Business Desktop 2023-2024

How to File Taxes with IRS Form 1099-NEC

That is your signature for your tax return. Did turbo tax include the Dr 0104 for the Colorado TABOR return for 2024 year? Yes. You can buy the Window version .I am trying to amend a 1065 return under the BBA.

How can I amend a 1065 return?

Critiques : 153,5K

Domestic limited partnership c . Partnerships file an information return to report their income, gains, losses, deductions, credits, etc. Select Search and enter SEP IRA contributions (use this exact phrase, including the s on contributions ).LLCs file a Form 1065 tax return for reporting purposes; the members report their business profits or losses on their individual (Form 1040) tax returns using the K-1 . Schedules K-1 (Form 1120S) . 2 Schedule B Other Information 1 . All other trusts need to file Form 1041 (U. You can also print directly from a saved PDF . Form 1040 + limited credits only.Login to your TurboTax account to start, continue, or amend a tax return, get a copy of a past tax return, or check the e-file and tax refund status. Explanation of Form 1065. I don't believe you are getting correct information on this.The 1099 should be entered as a Foreign slip in your tax return.Common questions about entering income and deductions in a Partnership return (Form 1065) in ProSeries SOLVED • by Intuit • 19 • Updated February 21, 2024 .Which product or service you use will depend on whether you need to file an income tax return for an estate (Form 1041), or an estate tax return (Form 706).Get your maximum tax refund, 100% free.Start for free.TurboTax Live Business tax experts are accessible via phone, chat, or one-way video if you need assistance. The IRS issues more than 9 out of 10 refunds in less than 21 days.Tax Return Access: Included with all TurboTax Free Edition, Deluxe, Premium, TurboTax Live, TurboTax Live Full Service customers and access to up to the prior seven years of tax returns we have on file for you is available through 12/31/2024. At the end of the tax . Pay $0 federal, $0 state with TurboTax Free Edition. An LLC that is taxed as a partnership pays no federal income tax itself. Inside TurboTax, search for 1099-PATR (be sure to include the dash) and then select the Jump to link in the search results. In the pop-up window, select the form set you want to print (tax return, specific forms, etc. Expert does your taxes. Note: If your TurboTax navigation looks different from what’s described here, learn more.All TurboTax software products for tax year 2023 are CRA NETFILE certified.Temps de Lecture Estimé: 8 min

Form 1065 Instructions: A Step-by-Step Guide

Start for free. What type of entity is filing this return? Employee Tax Expert. Domestic limited liability partnership e .Fastest refund possible: Fastest tax refund with e-file and direct deposit; tax refund time frames will vary. • If you elect to be taxed as a partnership, you’ll prepare annual partnership tax returns using IRS Form 1065, but all .

Common questions about entering income and deductions in a

If you're using TurboTax Online, you can attach a PDF copy of your 1099's as shown in the screenshot above. Margaret James. Sign in to your TurboTax account.Which link? Do you need to file a separate Business return? Turbo Tax Business is not available to do online or on a Mac. The CRA typically estimates 8-14 days for electronic transmissions with direct deposit. @mandylorian5 . Pay only when we file. Images are for illustrative purposes only, and some screen displays are simulated. However, if trust and estate beneficiaries are entitled to receive the income, the beneficiaries pay the income tax rather than the trust or estate. Schedule M-2, line 3 will flow from Schedule M-1, line 9 “Income (loss) (Analysis of Net Income (Loss), line 1).Temps de Lecture Estimé: 4 minJuly 5, 2021 5:00 AM. Lock in next year’s software at November’s early season pricing.

How to file for a tax extension from the IRS

~37% of filers qualify.Beginning January 1, 2024, partnerships are required to file Form 1065 and related forms and schedules electronically if they file 10 or more returns of any type during the tax . A partnership must file Form 1065 to accurately report the financial activities of the business partnership to the Internal Revenue Service (IRS).Critiques : 153,4K

How do I view, download, or print a prior-year tax return?

You can file Form 1065 using TurboTax Business . United States (English) United States (Spanish) Canada (English) Canada (French) TURBOTAX; Expert does your taxes. Return of Partnership Income.

What version do I need for form 1065

Schedules K-1 (Form 1065) Partner's Share of Income, Credits, Deductions.

Enter 1065 apportionment data for state returns

Fact checked by Rebecca McClay. When you enter apportionment data, the level of detail . TurboTax CD/Download software is the easy choice for preparing and filing prior-year tax returns online. An expert does your return, start . Partners must include partnership items on their tax or information returns. When you get to Your Farming Income . Simply select the year that you .

can I attach PDF statements to TurboTax return efiled?

Updated on January 24, 2022.If you haven’t filed your 2023 tax return with the IRS yet and you still owe income tax for last year, the good news is you still have time to rectify those situations . • If you’re the single member of a limited liability company (LLC), you’ll typically file your business tax information on Schedule C and report the profit or loss from your business on Form 1040.For tax year 2021 and later returns: Starting with tax year 2021 returns, the IRS updated the 1065 Instructions with guidance on Schedule M-2 / Schedule K-1 (Item L) reporting. Photo: Thomas Barwick / Getty Images.gov/Form1065 for instructions and the latest .President Joe Biden and first lady Dr. Select Documents from the side menu, use the dropdown .As such, the LLC should file Form 1065: Partnership Return of Income for tax purposes. file business taxes. On the Self-Employed Retirement Plans screen, answer Yes to Did you make a 2023 self-employed . At the end of the year, all income distributions made to .

Solved: Amended 1065 Tax Return

Here are the small business tax forms you may need to file your return: Sole proprietorship: If you’re a sole proprietor, you’ll need to use a Schedule C IRS file form. TurboTax Desktop for Business also generates the trust beneficiaries' Schedule K .June 5, 2019 3:12 PM. Here's more info on Mailing Form 8949 for Summary Totals.Critiques : 153,4KSolved: I need to amend our 1065 tax return.As tax time rolls around, it’s not uncommon to find yourself facing the task of completing your tax return.