Turbotax itsdeductible 2021

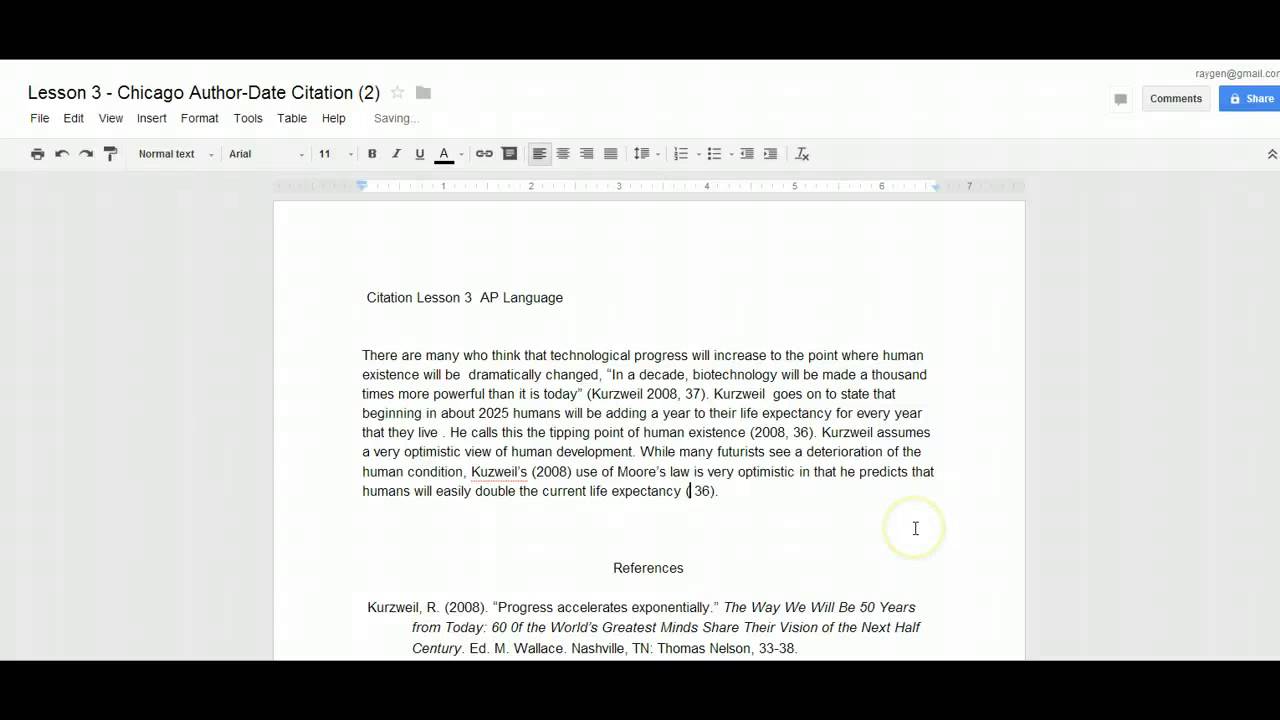

Images are for illustrative purposes only, and some screen displays are simulated. We recommend keeping all tax return data for the last three years for . The plan included a third round of stimulus relief and expanded tax benefits that families could claim on their 2021 taxes (the taxes filed in .For noncash (in-kind) donations, most of the time it's the fair market value (FMV) of the item. You can get the FMV of your donation by looking at similar items for sale on eBay, Craigslist, or your local thrift store.Critiques : 153,3K Click on Jump to charitable donation. For property worth more than $5,000 ($10,000 for stock in closely-held firms), you’ll need to get a formal appraisal. We’ll provide the fair market value for over +1700 items.com/personal-taxes/itsdeductible/index.TurboTax, a brand of tax preparation software, offers a tool called ItsDeductible that estimates the value of your noncash donations for you. You can even import this information into TurboTax when it's time to do your taxes. Click on I'll choose what I work on (if shown) Scroll down to Charitable Donations.For tax years 2022, 2021, or 2020.Get your 2021 past taxes done right.Anyone can do this by creating a free account with TurboTax ItsDeductible Online.On the next screen, select which donations you want to import and select Import Now.You will be able to use your ItsDeductible account as you normally would to file your Tax Year 2021 taxes through October 17.Sign in to ItsDeductible, the online tool that helps you track and value your charitable donations for tax deductions. When I go into Turbotax and Import from ItsDeductible it says No user found or no user data available

How do I determine the value of donated items?

On March 11, 2021 the American Rescue Plan was signed into law to provide financial relief for millions of Americans.I've been using Itsdeductible for the many years since I abandoned TT and switched to Block, bc it was available all year long.If you have TurboTax Deluxe or higher, importing your ItsDeductible donations is easy. I can close the window and resume Turbotax, but I can't do the import.

Video: How to Estimate the Value of Clothing for IRS Deductions

TurboTax specialists are available to provide general customer help and support using the TurboTax product.; Answer Yes to Did you make any donations to charity?; On the next screen, answer Yes toDo you have an account with ItsDeductible .Get expert help with TurboTax Live Assisted Deluxe. Cost savings based on a comparison of TurboTax product prices to average prices set forth in the 2020-2021 NSA Fees-Acct-Tax Practices Survey Report. It lets you enter .Live Assisted Basic$99 + $54 per state.Follow these steps to export and save your ItsDeductible data.

TurboTax Review 2024: Pricing, Features, Ease of Use

February 5, 2020 8:46 PM. Once you assess the total value of all clothing donations you made, you may need to prepare Form 8283 and attach it to your tax return . You will be asked a few questions, and then you will be able to enter your charitable contributions. Sign in to your ItsDeductible account. When you make state and local tax payments, including sales tax, real estate tax, property tax, and local and state income tax, these are generally deductible from your federal income. We have already verified that we are logging into the right ItsDeductible and Turbotax accounts (verified on two separate computers).

TurboTax CD/Download software is the easy choice for preparing and filing prior-year tax returns online. The values you see in ItsDeductible Online are preliminary estimates and are only updated once a year. 1099-NEC Snap . Typically, low value is a key indicator that a . If you have TurboTax .We want to thank you for being a loyal TurboTax ItsDeductible user and hope you will continue to be a part of the Intuit family. How do I file an IRS tax extension? Learn how to file a federal tax extension, which gives you until October 15, 2024, to file your taxes instead of the deadline of April 15, 2024. ItsDeductible works best for people who prepare their annual income tax return with TurboTax.

Below, I have provided the steps on how to import your charitable contributions into TurboTax.

TurboTax® 2021 Prior Year Tax Prep

Once you import the item into TurboTax, the estimated values change to the current fair-market values. To file a new prior-year return, you'll need to purchase and download that year's TurboTax software for PC or Mac, as TurboTax Online and the mobile app are only available for the current tax year.

Charitable Giving and Your Taxes

Did the Charity Give You . Presenta fácilmente tus declaraciones de impuestos federal y .Critiques : 153,5K In the search box, enter the term itsdeductible ( one word, without quotes) and then click the little magnifying glass icon (do not choose anything in the dropdown menu or it might not work). Select PDF next to the data you want to save.Method 1: When the return is open, in the top right of the screen click on SEARCH. Repeat steps 2–4 for all other tax years you’d like to save. Free edition, plus access to a tax pro, advice and a final review. You can be sure it's done right and you'll get every dollar you deserve, guaranteed. • To qualify as a tax deduction, your charitable contribution needs to be given to a 503 (c) organization. Click on I'll choose what I work on (if .Click on Deductions and Credits. TurboTax Live Assisted Basic supports Form 1040 and limited tax credits only; roughly 37% .TurboTax® es el software de preparación de impuestos de mayor venta para presentar impuestos en línea. Click on Federal Taxes (Personal using Home and Business) Click on Deductions and Credits. Select Continue and review your charities on the next screen. What I just did is create a new Block 2021 file, .When will ItsDeductible be available so I can import my 2021 contributions into TurboTax? A TurboTax representative advised me two weeks ago ItsDeductible .For 2021, this amount is up to $600 per tax return for those filing married filing jointly and $300 for other filing statuses.

If you expect your income and expenses to be similar to last year, you can use this .Sign in to your ItsDeductible account and track your charitable donations for tax deductions.Critiques : 153K

Why do ItsDeductible item values change after importing into TurboTax?

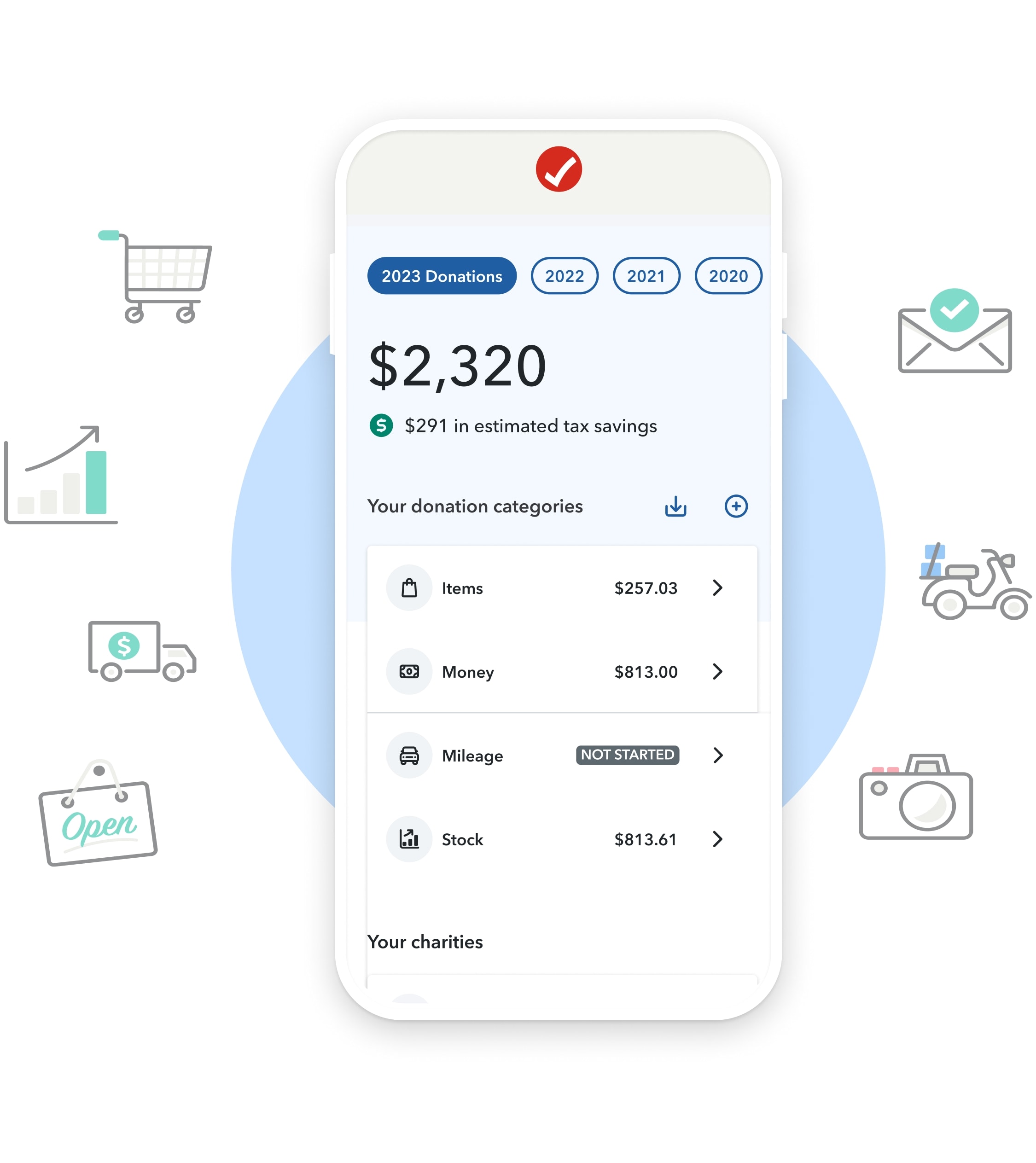

You can also donate financial assets such as stocks and bonds to charity. TurboTax ItsDeductible is a free program included with your TurboTax account. You can only deduct state and local income tax or state and local sales tax. Select View Summaries.

Can't Import ItsDeductible

TurboTax® 2023: Log in online to start, continue, or file your 2022 tax return. With all of your donations in one place, you’ll be able to import everything straight into TurboTax when you’re ready.Critiques : 153,1K Typically, low value is a key indicator that a donated item was of less than good used condition, which means clothing and household items of low value would not be deductible items under the new tax law.

How do I access It's Deductible to enter my data?

(Note: Returns for tax years 2019 and earlier are no longer eligible to be filed through TurboTax.SOLVED • by TurboTax • 3318 • Updated January 31, 2024. Try it for FREE and pay only when you file. These are listed online at the IRS Exempt Organizations Select Check. This is an old thread from two years ago that transferred into this new community forum in June of 2019.

Click Here for ItsDeductible.To enter charitable donations -.March 31, 2021 9:51 AM. However, please note that you will not be able to . Maximize deductions and credits with unlimited expert advnice and a final review before you file. But if the FMV is higher than the amount you paid, you must use the original cost of the item.It still shows our 2020 entries in ItsDeductible but none of the data entered for 2021 donations.Critiques : 153,5K

Tax Support: Answers to Tax Questions

Here’s how: Open or continue your return in TurboTax. You can’t deduct both.From the Item Donation Summary associated with each donation date, you can select Add More Items or Done With This Donation.

Add or Edit Donations Help

We are providing you with advance notice that ItsDeductible will be discontinued on October 17, 2022.Can't Import ItsDeductible.

Unfortunately, all those old threads that transferred in were given the transfer date instead of their original date.

Solved: ItsDeductible not importing

1099-K Snap and Autofill: Available in mobile app and mobile web only.

What is ItsDeductible?

ItsDeductible is a built-in feature on TurboTax Deluxe and above.Critiques : 153,3K

Tax Deductions

Any donation information you included in your Tax Year 2021 (or prior tax returns) will remain in those tax returns.ItsDeductible has three value categoriesto help you assess the fair market value of your donated items: High, Medium and Low.TurboTax Help and Support: Access to a TurboTax product specialist is included with TurboTax Deluxe, Premium, TurboTax Live Assisted and TurboTax Live Full Service; not included with Free Edition (but is available as an upgrade). expand navigation options. It’s tax time! ItsDeductible makes adding expenses to your return easy.

Turbotax® Itsdeductible

Then click the “Jump to itsdeductible” link. Or enter charitable donation in the Search box located in the upper right of the online program screen.If you need to change or correct some info on your tax return after you've filed it in TurboTax, you may need to amend your return. Select the tax year you want to save. 1) You can use it year round online for free here: http://turbotax. This free program gives guidance on .

TurboTax ItsDeductible Online

Start ItsDeductible. Connect with an expert. Español; Expert does your taxes Back en. You can find your taxable income on Form 1040 (line 43), or 1040A (line 27).Hi William – There are two ways to use ItsDeductible. On Import from ItsDeductible Online, click on the start or update button. When you are finished entering all items, select Done With Item Donations from the .This tax season, there are changes to tax laws that may impact your federal tax return. Log into your account, if you do not have an account you are able to create one.Critiques : 153,4K

Easily import your donations into TurboTax at tax time.Terms and conditions, features, support, pricing, and service options subject to change without notice.SOLVED•by TurboTax•3482•Updated January 16, 2024. Español; Expert does your taxes An expert does your return, start to finish Full .All TurboTax software products for tax year 2023 are CRA NETFILE certified. Sign in to your account or create a new one to access this tool.