Uk employer contributions 2022

National Insurance Rates & Thresholds for 2022-23

If you are an ESR employer, please also read the section on ESR. London Borough of Barnet Pension Fund Lincolnshire Pension Fund West Yorkshire . Please email rachel.

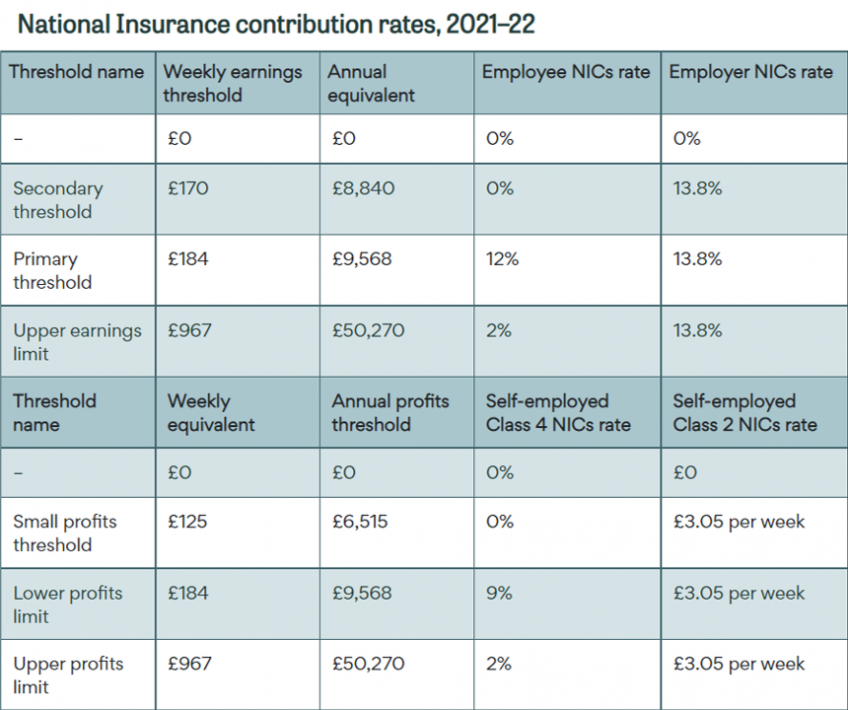

Rates and thresholds for employers 2021 to 2022

Sample The sample included 22 employer pension decision makers across a range of sizes (employee numbers) and industries, and 8 employer advisors and influencers.

National Insurance rates and categories: Contribution rates

Get emails about this page.1 National Insurance . We take a look at how .What you should know about 2022-23 and 2023-24 rates. Home; Contact us Contact us.2 TPECG provides funding for schools to support the increase in the employer contribution to the teachers’ pension scheme that came into effect on 1 September 2019. This report provides details on the size and shape of our . Employer contributions.This will depend on the type of scheme you choose.Employers’ Contributions to the LGPS in 2022-23 in England and Wales amounted to £8. Employees’ contributions to the scheme were £2.Taxable Income: £40,000.6%, plus the employer levy of 0. If you’re checking your payroll calculations or . You need to pay the correct contributions on time to your staff pension scheme. However, they do not have to contribute if you earn these amounts or less: £520 a month. employer duties. The figures are set by the Government and reviewed annually. Payrolling expenses and benefits for the 2023 to 2024 tax . at source approach. Contact us Complaints and IDRP Issue with our main helpline .The minimum contribution is a percentage of a worker’s gross annual earnings that fall within the qualifying earnings band. Your annual allowance is the most you can save in your pension pots in a tax year (6 April to 5 April) before you have to pay tax. The National Insurance threshold rose on 6 July 2022, from .

Check your payroll calculations manually

General information and customer supportHMRC is now using card readers to take paymentsHMRC is making it easier for customers to make payments during face to face visits.

For more information, read paragraph 3.uk with any comments about the contents of this bulletin. For example, if a worker earned £20,000 in 2021/22 their qualifying earnings would be £13,864 and their . These figures are reviewed each year by the government.2022 and February 2022, we conducted 30 in-depth interviews. Barnet Pension Fund Lincolnshire Contribution Rates West Yorkshire Pensions Fund Rates.

Employer NIC Calculator

38% in employer contributions, including 0.From 31 October 2.Employer pension contributions and funding. Sample The sample included .HMRC has confirmed the 2022-23 National Insurance (NI) rates in an email to software developers.Member Contributions Changes Oct 2022 – Employer Information v1 Page 8 of 17 7 How the member contribution rate is set As set out in the payroll provider pack, how the member contribution rate is set depends on whether the member is an officer or practitioner post. Every three years an independent actuary calculates how much your employer should contribute to the Scheme, after taking into account investment returns.This research explores the current employer pension contribution landscape in the UK and considers how this could evolve in future to better support employee financial security in .

HMRC's annual report and accounts 2022 to 2023: staff and

This consultation ran from midday on 15 October .DHSC are seeking views on proposals for a new member contribution structure in the NHS Pension Scheme which will be implemented from 1 April 2022. Our sample was split as follows: . From 1 October 2022, this will go up by £16. £50,271 to £125,140. Today, a member working full-time with an annual pensionable pay of £40,000 will pay a contribution of £3,720 each year for their pension – that’s £310. Pension contributions are deducted from an employee’s wages after tax and, if the worker is eligible, the pension provider . (1 April 2024 to 31 March 2027) Band 1 (£23,000 and under) 26.The amount of Class 1 contributions you pay are based on how much you earn. In March 2019 the consultation response announcing the rise, the Department of Health and Social Care (DHSC) confirmed the available funding to meet the associated costs and that a transitional arrangement would .Your employer pays the balance of the cost of providing your LGPS benefits. Next release: To be announced. If you pay the minimum of 8%, you will need to base your calculation on a specific range of earnings. This will give him a salary of £33,333. Once the further planned change happens, it will stay .An increase in the amount of money that employers and employees must contribute towards National Insurance is coming into play in April 2022 – this contribution is also .Your employer cannot refuse.Employer Contributions Employee Contributions Income Tax Relief Total Contributions Employer Tax Relief: £10,330: £6,446: £51,928: Baseline (2021/22 thresholds in 2022/23 earnings terms .

Tax on your private pension contributions

The government has set minimum levels of contributions that must be made into your .

NHS Pension Scheme member contribution rates

Employers pay Class 1A . Rates and allowances: National Insurance contributions.08% for the employer levy, under their normal monthly payment .8% = Employer's NICs: . The Class 1 National Insurance rates for most people for the 2024 to 2025 tax year are: Your pay. over £125,140.66 for the week. When you’re enrolled into their pension . 3 At Spring Statement 2022 the government has announced that it will meet this ambition by aligning the starting .Employer pension contributions.ukRecommandé pour vous en fonction de ce qui est populaire • Avis

National Insurance rates and categories

If your business manufactures.67 a month to £326.Employer pension contributions in the UK . Class 1A and Class 1B rates. They are made of 2 elements: primary contribution of 6% paid by employees; secondary contribution of 6.Zero rate of secondary rate contributions for employees working in a Freeport tax site.25% on earnings over £50,270.

Employer pension contributions and funding

£480 over 4 weeks. For example, if a worker earned £20,000 in 2021/22 their . Guidance about different employer PAYE references for separate groups of your employees, the zero rate of secondary contributions for employers of armed forces veterans, and the zero . Your total earnings include: . In September he takes 10 days of unpaid leave which means that he earns £2777. × Employer's NIC Rate: 13. This bulletin sets out the rates and bands that apply from April 2022 for various purposes.

December 2022 issue of the Employer Bulletin

If you don’t, you risk being fined by The Pensions . The market value of LGPS funds at end .

Cookies on GOV.

Employer contribution rates. On average, employers pay roughly three quarters of the Scheme’s . Published 17 July 2023.25% on earnings between £9,880 and £50,270, and 3. You can also see the rates and bands without the Personal Allowance. From 6 April 2024 to 5 April 2025.2022-23 is a further increase by CPI to £9,880 from April. − Employer's NICs Threshold: £9,100. Having your employer contribute to a pension can be one of the most tax efficient ways to grow your retirement savings. Each interview lasted between 45 minutes to an hour and was conducted online. Annual estimates of the proportion of UK employees in employer contribution bands, by Standard Industrial . For the 2022/23 tax year this range is between £6,240 and £50,270 a year (£520 and £4,189 a month, or £120 and £967 a week).Unless otherwise stated, the following figures apply from 6 April 2021 to 5 April 2022.L G P C Bulletin 221 – Annual update March 2022. We use some essential cookies to make this website work.

Workplace pension contributions

In some situations, you will be exempt from paying National Insurance . An approach used to give employees tax relief on their pension contributions.NHS Pension Scheme member contribution rates Changes to contribution rates from 1 October 2022 Pensionable pay Rate until 30 September 2022 based on whole-time equivalent pay Phase 1 - contribution rate from 1 October 2022 based on actual pensionable pay Phase 2 - contribution rate based on actual pensionable pay Up to .Gary has an annual salary rate of £50,000, and usually receives £4166. In April 2022, Class 1 rates went up by 1.

CWG2: further guide to PAYE and National Insurance contributions

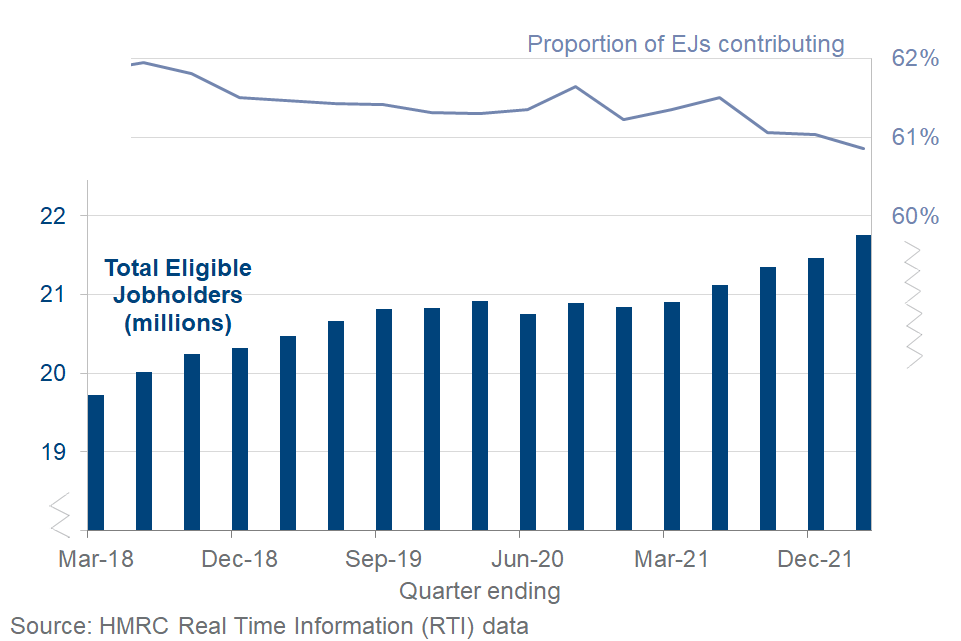

Example 2: Annual full-time salary of £40,000. About this Dataset.As of the fourth quarter of the financial year 2021 to 2022, 50% of eligible employments with a recorded employee contribution are contributing 4.

Reduction in the rate of National Insurance contributions from 6 November 2022 — updated guidance.National Insurance has to be paid by both employed and self-employed workers from 16 until they reach state pension age (currently 66).25 percentage points to 13.

Employer contribution rates

You do not get a Personal Allowance on .66) on the remaining earnings above £967.5% or more of their full taxable pay into their .

The Government has frozen the thresholds for 2022/23: The Automatic Enrolment .

National Insurance Contributions (Increase of Thresholds)

The amount will vary across different employers.HMRC's annual report and accounts 2022 to 2023: staff and remuneration report.