Uncertain tax positions guidance

This was evident when we brought tax leaders together in June for a webinar: Keeping control of your uncertain tax . The uncertain tax positions are whether adequate documentation is available to substantiate the deductions claimed and whether a portion of the expenses constitute meals and entertainment subject to a 50% limitation. Uncertain Tax Treatments by Large Businesses Manual. The CRA Guidance provides a number of clarifications and details regarding the reporting of “reportable uncertain tax treatments” (RUTTs) under the new rules.1 Uncertain tax positions—entities within scope.Uncertain Tax Positions module — formerly TaxStream FIN 48 — gives you the tools to analyze and report tax treatment of open positions under ASC 740-10-50 and IAS 37: Calculate and track currency translation adjustments across all uncertain tax positions components.Come the day, one of the less heralded – but potentially most significant – developments was the latest rules on uncertain tax positions (UTPs).

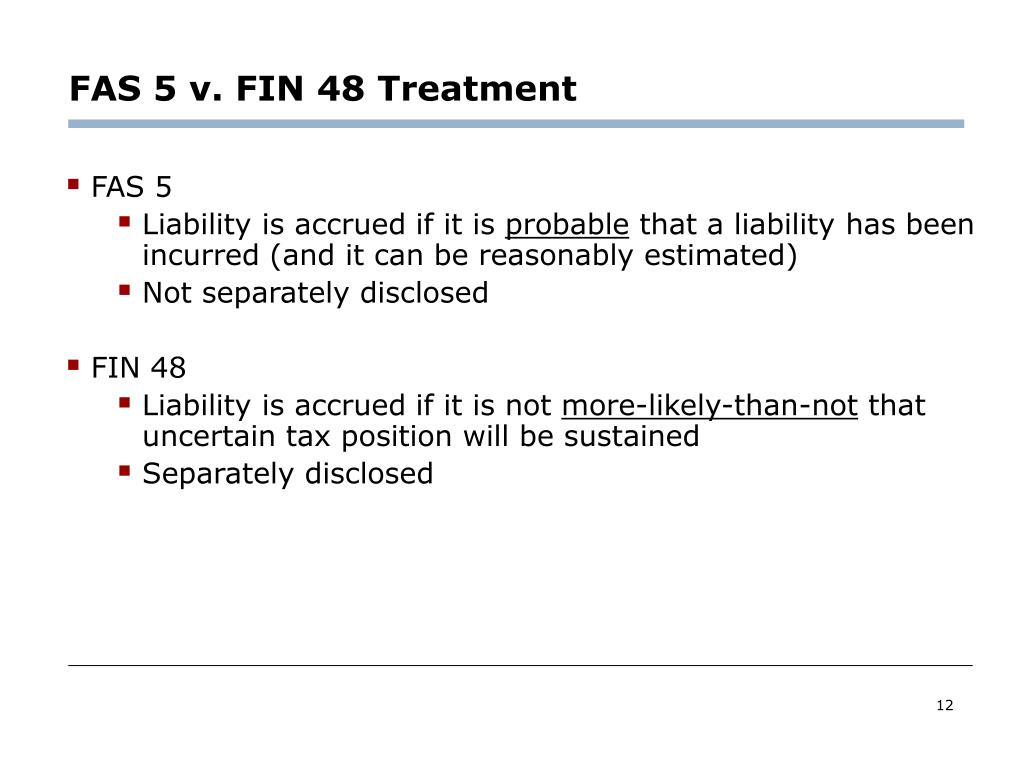

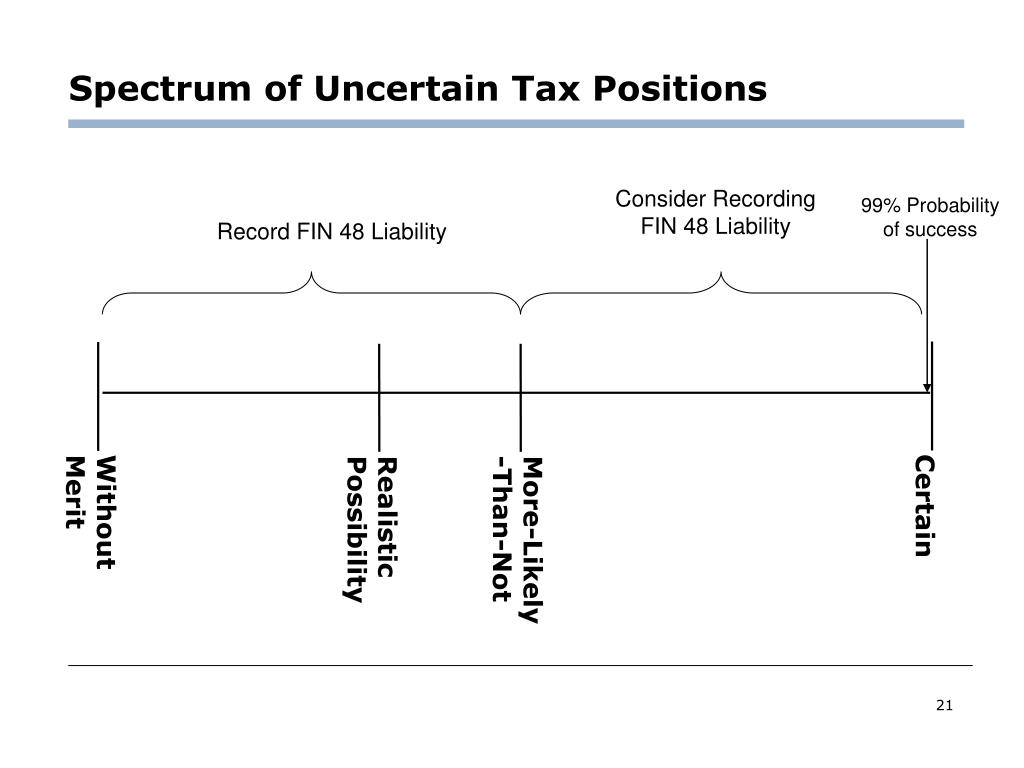

Entities should recognize the effects of an uncertain tax position when they believe that it is “more-likely-than-not” that the revenue authorities will, upon examination, sustain their tax position. Audited financial statements prepared under two or more . IASB proposes amendments to IAS 12 Income Taxes to clarify implications of Pillar Two tax rules (February 2023); Potential additional tax disclosures in 30 June 2022 financial statements for some country-by-country reporting entities (CBCREs) (August 2022) IFRIC 23 – A practical approach to implementation .US GAAP ― uncertain tax positions | Tax Guidance | .Uncertain tax treatments are treatments that are contrary to HMRCs known position or where there is uncertainty about how a transaction should be treated for tax purposes. new guidance on how to account for uncertain tax treatments.Publication date: 31 Mar 2023. GAAP, the guidance under IAS 12, Income Taxes, was not clear on how to apply the recognition and measurement requirements when there was uncertainty over income tax treatments. When making this assessment .January 5, 2023 · 5 minute read.Uncertain Tax Positions.HMRC’s position may be known from any . Instead, the IRS refers to “a tax position relating to a specific federal tax return for which a taxpayer is required to reserve an amount under FIN 48” (Announcement 2010-9). IFRIC 23 further provides that the disclosure of .Publication date: 27 Jul 2018. Taxation year to which RUTT pertains.Taille du fichier : 75KBtax position; • Reassessment in . Updated: 28 April . The guidance related to the recognition and measurement of uncertain tax positions within ASC 740 is applicable to .If it is not probable that a tax authority will accept an uncertain tax treatment, the entity should reflect the effect of the uncertainty in determining its taxes in its AFS.April 16, 2024.

The December Guidance provides additional guidance on the Transitional CbCR Safe Harbour with respect to areas that tax administrations and MNE Groups identified as requiring further clarification.Where two (or more) HMRC publications set out a contradictory position, the guidance advises the taxpayer should take the most recently updated to be HMRC’s known position. The run-up to Tax Day brought plenty of speculation about what HMRC might announce.Uncertain Tax Positions Reporting Changes Finalized With Revisions.

IAS 12 — Recognition and measurement for unrealised losses for debt instruments measured at FV.

Uncertainty over income tax treatments (IFRIC 23)

The regime will require large businesses to notify HMRC of any uncertain tax treatments, defined by reference to two triggers, where .A guide to provision disclosures, including balance sheet examples and how to account for uncertain tax positions.

Reporting Uncertain Tax Positions

The Committee discussed the accounting for liabilities arising .Uncertain tax treatments. ASC 740 prescribes a comprehensive two-step model for recognizing, measuring, and disclosing uncertain tax . ASC 740-10 provides guidance on accounting for uncertain tax positions in a company's financial statements. Updated December 22, 2022: Revised statement with revisions to .The government is to enact legislation in Finance Act 2022 to place an obligation on large businesses to notify HMRC when they take a position in their tax filings which is subject to uncertain tax treatment. Consequently, a current tax asset or liability should be recognised only if it is probable that the entity will pay the . • Clarification on the treatment of GILTI: o The guidance confirms GILTI is a CFC .The process for accounting for uncertain tax positions (UTPs) under ASC 740 involves several steps, which revolve around judgments a company must make before closing the books.HM Revenue and Customs (HMRC) has published final guidance on new rules which will require large businesses to notify HMRC where they have adopted an . The Committee discussed an analysis of the comments received on the tentative agenda decision and the wording for the final agenda decision. From: HM Revenue & Customs.

IFRIC 23 — Uncertainty over Income Tax Treatments

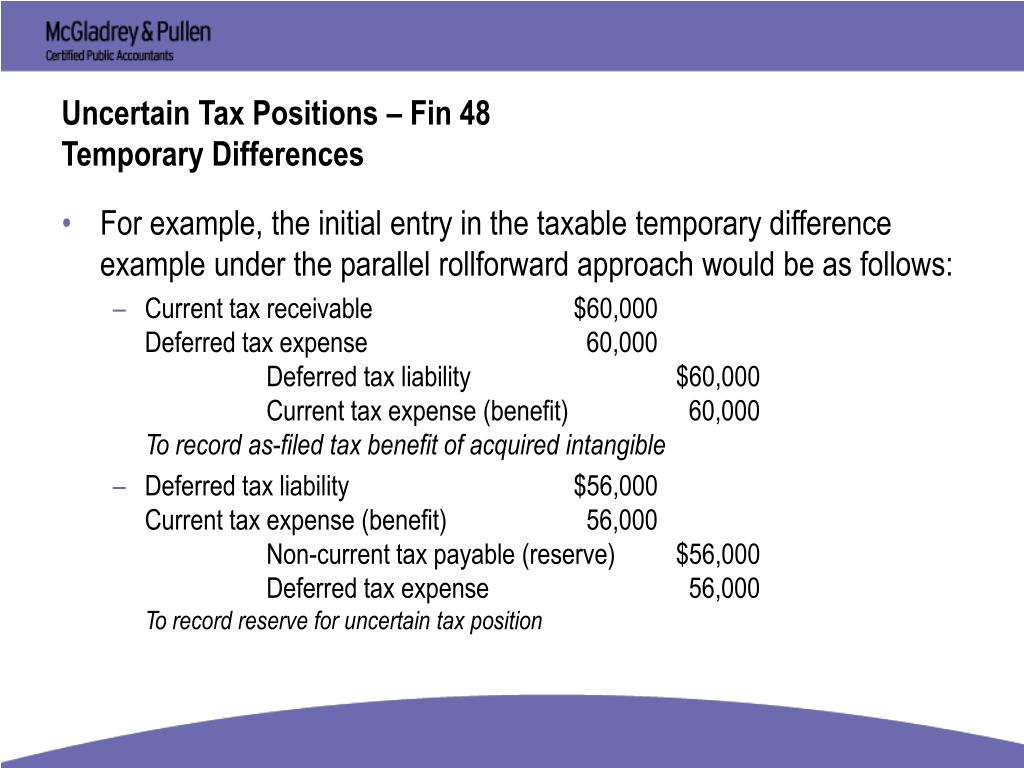

21 October 2015.comRecommandé pour vous en fonction de ce qui est populaire • Avis Simon Shaw, Partner |.Note that the federal income tax expense under FIN 48 is $73,100 greater ($2,249,355 with FIN 48 and $2,176,255 without FIN 48).

Schedule UTP requires taxpayers to list uncertain tax positions, but the .Scope: all uncertain income tax positions should be included within the scope of the future guidance.IRS Statement about Uncertain Tax Positions (UTP) Reporting | Internal Revenue Service.IAS 12 — Measurement of current tax assets and liabilities when a tax position is uncertain.Tabular Roll-Forward of Uncertain Tax Positions

Uncertainty over Income Tax Treatments IFRIC 23

As noted in the previous iteration of the guidance this trigger does not apply where there is no known position. “More likely than not” means that there is, in management’s opinion, a likelihood of more than 50 percent. DI/2015/1 Uncertainty over Income Tax Treatments published.

Guide to reportable tax positions

The effect of the uncertainty should be reflected by using certain methods as per the guidance contained in IFRIC 23.24 January 2022. us Investment companies ARM 9652.

Notification of uncertain tax treatments

Sub-paragraph 10(4)(b) of the Uncertain Tax Treatment legislation extends the concept of HMRC’s known position beyond the content of published materials. The FASB issued guidance regarding accounting for uncertainty in income taxes included in ASC 740-10. us Income taxes guide. Your Company’s current uncertain tax treatment policy may be inconsistent with the Interpretation and it is likely to impact your tax reporting data gathering process and financial statement disclosure. IFRIC 23 Uncertainty over Income Tax Treatments issued.Keeping control of your uncertain tax positions. HMRC have published updated draft guidance on the new requirement for large businesses to notify HMRC of uncertain tax treatments adopted.3 Recognition of benefits from uncertain tax positions - .

Mandatory disclosure rules

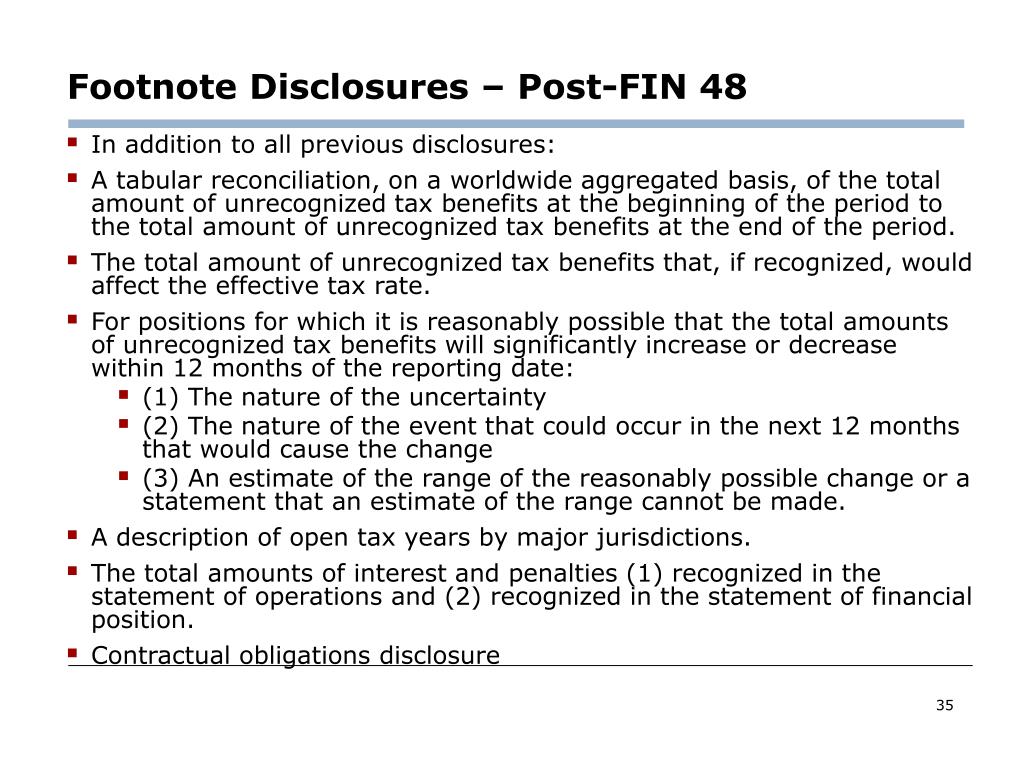

Disclosure of uncertain tax positions

IFRIC 23 was developed to provide guidance as to the application of IAS 12 when an entity is in a position of uncertainty about the tax treatment that will be accepted by the .

IFRIC 23: Uncertainty over income tax treatment

Adjustments to uncertain tax positions made subsequent to the acquisition date are recognized in earnings, unless they qualify as measurement period adjustments.

Technical consultation: Uncertain Tax Treatment (draft guidance)

It supplements the original Safe Harbours and Penalty Relief document issued by the Inclusive Framework in December 2022; the additional guidance .

The Two-Step Process for Recognizing Uncertain Tax Positions

In order to be compliant and to be able to substantiate .IRS guidance for Schedule UTP does not specifically define what constitutes an uncertain tax position.

The Guidance is Clear: Uncertain Tax Positions and IFRS (IFRIC 23)

It’s fair to say that the changes are causing some confusion among businesses. The CRA Guidance confirms that under the RUTT rules, reporting is required only for uncertain positions relating to tax payable under the ITA. When there is uncertainty over income tax treatments, this Interpretation addresses: (a) whether an entity considers uncertain tax treatments separately; [Refer: paragraphs 6 and 7] (b) the assumptions an entity makes about the examination of tax treatments by taxation authorities; [Refer: paragraph 8] (c) how an entity determines taxable . January 5, 2023 · 5 minute read. Here’s the playbook: Recognition. Bloomberg Tax Portfolio 5002, Accounting for Income Taxes: Uncertain Tax Positions, provides a comprehensive analysis of the treatment of uncertain tax positions under the FASB Accounting Standards Codification. The Committee thought that it was inappropriate to limit the scope to cases where an entity has unresolved disputes with a tax authority.

IAS 12 — Accounting for uncertainties in income taxes

This includes guidance in determining such things as the appropriate . This publication summarises the key implications of IFRIC 23 Uncertainty over Income Tax Treatments.A deduction in the amount of $1,000,000 was reported for travel and entertainment expenses on line 26 of Form 1120.Well, while there has been definitive guidance on how to treat uncertainty in income tax positions under U. Effective for annual periods beginning on or after 1 January 2019.2 View 1: uncertain tax positions should be . Added to the Interpretations Committee's agenda. The rules, which came into force on 1 April 2022, are intended to make sure that HMRC is aware at an earlier stage if a large business has adopted a treatment that is contrary to HMRC's known position. Calculating your company’s provision for income taxes under .Presentation of liabilities or assets related to uncertain tax positions | EY - Global.

Uncertain Tax Positions- What to Know Now

Uncertain tax positions often result in the benefit amount recognized in .IAS 12 – Threshold of recognition of an asset on uncertain tax position.IFRIC 23 Uncertainty over Income Tax Treatments (IFRIC 23) is set out in paragraphs 1–14 and Appendices A, B and C.Accounting for unrecognized tax benefits associated with uncertain tax positions.The Interpretation requires entities to first determine whether they should consider uncertain tax treatments individually or collectively, with other uncertain tax . On December 22, the IRS released final revisions to Form 1120, Schedule UTP, and instructions to .1 Changes in tax uncertainties after a business combination.

ASC 740: Uncertain Tax Positions

HMRC internal manual. Uncertain tax positions are tax positions an entity takes on its tax return that don’t meet the more-likely-than-not standard, meaning there is a 50% or less likelihood that the position will ultimately be sustained if challenged by the taxing authority.Positions where the law is clear but the facts are uncertain (relating to valuation issues) In determining whether a material position involving market values is a Category A RTP, you should consider the guidance provided in Market valuation for tax purposes. Measurement period adjustments are recorded first as an adjustment to goodwill, then as a bargain purchase. Plus: Increase in taxes payable for uncertain partnership loss.

The IRS has revised its draft changes to uncertain tax position (UTP) reporting rules for tax year 2022 after receiving pushback from stakeholders, but the agency mostly kept a controversial new requirement intact.2 A consultation . The IRS has revised its draft changes to . Uncertain tax positions are tax positions an entity takes on its tax return that don’t meet the more-likely-than-not standard, meaning there is a 50% or .Large businesses are required to notify HM Revenue and Customs (HMRC) where they have adopted an uncertain tax treatment.Uncertain tax treatments that relate to provisions of the Act.

;Composite=(type=URL,url=https://images.radio-canada.ca/v1/assets/elements/16x9/outdated-content-2011.png),gravity=SouthEast,placement=Over,location=(0,0),scale=1)