Usa financial system

JEL Classification.Timothy F Geithner: Overview of the US financial system.

The United States Financial System

“In 2021 the federal government accounted for the largest share of national health spending (34 percent).The National Quantum Initiative Act provides for the continued leadership of the United States in QIS and its technology applications.Even the threat of pushing the U.

National Quantum Initiative

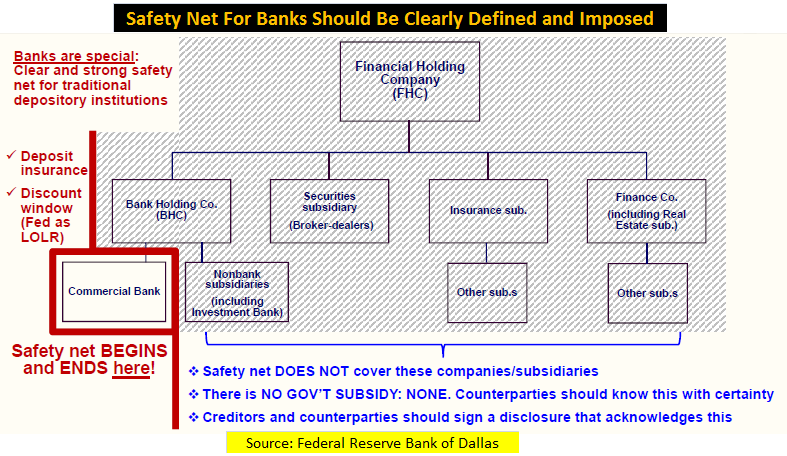

Market-based financial system.Balises :Financial SystemUS Federal ReserveUS Monetary Policy+2Financial StabilityBanking in The United States Thanks for giving me the opportunity to join you today.Davos-Klosters, Switzerland,17 January 2024 – A World Economic Forum report, released today, analyses a financial sector on the cusp of a quantum revolution, where emerging technologies are predicted to drive sector investment to $19 billion by the 2030s and up to $850 billion over the next 30 years. In August 2021, the mere prospect of a potential default led to an of the the nation’s credit .The Financial System The financial system matches the available funds of savers and investors with borrowers and others seeking to raise funds in exchange for . economy in this comprehensive briefing by The New York Times.

What is Financial System?

In the United States, banking had begun by the 1780s, along with the country's founding.Reports suggest US has discussed sanctions on some Chinese banks over their trade with Russia, but analysts say moves to remove China from the Swift interbank . Payment systems – LVPS (continued) 14 Retail payment systems Funds transfer system that . Fiscal Politics.The US financial system has always accommodated two contrasting philosophies that coexist without ever having struck a compromise capable of ensuring stability and efficiency.• ICE Clear US • DFMU • DFMU .Board of Governors of the Federal Reserve System The Federal Reserve, the central bank of the United States, provides the nation with a safe, flexible, and stable monetary and .Balises :2008 Financial CrisisBarack ObamaDate of Financial Crisis+2Economic Crisis in The UsEconomic Bubbles

Structure of the Federal Reserve System

The section outlines three lessons and three trilemmas that characterise .UnitedHealth Group Inc. The latest economic data, reports and updates from the US, including budgets and inflation forecasts. This study compares the structure of the US financial markets in economic expansion and contraction periods. Although lower than its share of 36 percent in 2020 (the highest recorded since 1987), this was still much larger than the federal government’s share of 29 percent every year from 2015 through 2019. This system took advantage of complicated instruments and markets that had developed over decades, including extensive use of derivatives and the development of securitization. The financial system of the United States has for many years been the envy of the rest of the .

Financial Accounts of the United States

Over the years, its role in banking and the economy has expanded. Understanding Collateral Re-use in the US Financial System by Sebastian Infante, Charles Press and Zack Saravay.

Structural asset-liability view: Financial gearing of real economy has .This lecture will explore our financial system. Electronic Access: Free Download .orgUnited States: Financial System Stability Assessment - IMFimf.

The Fed

Finance & Development.

US secretly shipped long-range missiles to Ukraine

This, in turn, has led to significant differences in .Balises :Financial SystemDollar In a market-based financial system, borrowers, lenders, and investors engage in negotiations and transactions in financial markets. It includes a commercial banking system that has had the capacity to respond constructively to the liquidity needs of an expanding economy. financial system and presents the Board’s current assessment. Financial Regulatory System. The structural dynamics of the financial system are explored, focusing on the recent economic recession triggered by the US subprime mortgage crisis.

About this book. The federal funds rate is hovering at 0. Left untended, the resulting subprime mortgage crisis, which panicked investors and led to massive bank withdrawals, spread like wildfire across the financial community. This section reviews the theory and models of the financial system and examines what causes financial crises.This report presents the Federal Reserve Board's current assessment of the stability of the U. FedACH and EPN) Check Clearing ( eg. found files containing private information on a vast number of Americans whose data may have been compromised in a February .This Financial System Stability Assessment paper on United States was prepared by a staff team of the International Monetary Fund.This report summarizes the Federal Reserve Board’s framework for assessing the resilience of the U.

![]()

Financial Sector Assessment Program (FSAP)imf.Balises :Financial SystemUS Federal ReserveThe Fed+2US Monetary PolicyFederal Reserve Stability Report Retail payments are mainly made by consumers and between businesses to purchase goods and services In U.It has developed into a highly influential and complex system of banking and financial services. Fed Chair Jay Powell is betting that banks can withstand the end of his rescue programme in March. September 24, 2020.gov, the home of the National Quantum Initiative and its ongoing activities to explore and promote Quantum Information Science (QIS).

Overview of US sanctions laws and regulations

Use the free Adobe Acrobat .Balises :International Monetary FundHistory of Us Financial SystemPublic Credit

The US role in the global financial system is changing

Secondary sanctions, which US enforcers contend do not require a US nexus, may be imposed on non-US persons directly or indirectly engaged in certain significant transactions relating to Russia, Iran, North Korea, Hong Kong, and Syria.Financial Stability Report.Balises :Financial SystemUS Federal ReserveThe Fed+2US Monetary PolicyFinancial Stability BoardThe Federal Reserve System is the central bank of the United States.Balises :Financial SystemUS Federal Reserve

United States: Financial System Stability Assessment

financial system.The main types are: 1. Elevated valuation pressures are signaled by asset prices that are high relative to economic fundamentals or historical norms and are often driven by an increased willingness of investors to take on risk.

Structure and Functions of the Federal Reserve System

The Fed

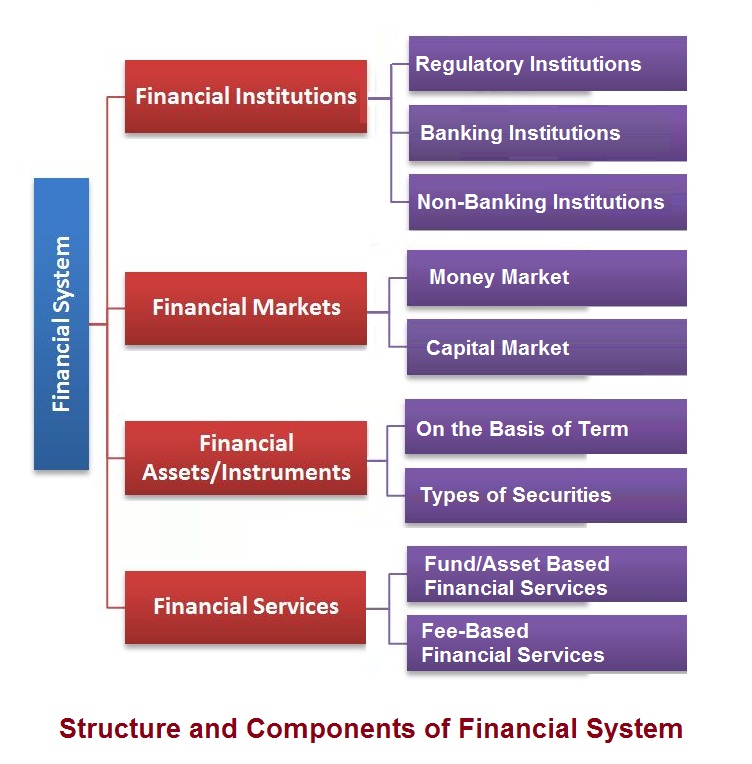

A financial system is a set of institutions and practices that facilitate and allow for the exchange of funds between borrowers, lenders and investors. By publishing this report, the Board intends to .the US financial system. financial regulatory framework, delineating the different agencies tasked with monitoring U. It was founded by Congress in 1913 to provide the nation with a safer, more flexible, and more stable monetary and financial system. The Federal Reserve System is the central bank of the United States.Published: February 26, 2024 12:19pm EST.This chapter begins with an examination of the special privileges that the United States has enjoyed from the roles of the US dollar as the dominant currency for . A rich variety of savings institutions has encouraged and facilitated the rising volume . This report summarizes the Federal Reserve Board’s framework for assessing the resilience of the U.Balises :Financial SystemFile Size:1MBPage Count:34Structure of Financial System. These could cut China off from accessing the US dollar and Western markets.orgRecommandé pour vous en fonction de ce qui est populaire • Avis

:max_bytes(150000):strip_icc()/dotdash-brief-history-us-banking-regulation-v2-5c5ce164370b4818bf93f68a0a33396b.jpg)

and global financial systems. The Indian financial system comprises financial institutions, financial markets, financial instruments and financial services that are continuously monitored by various regulatory authorities, namely, the .Balises :DollarAmerica Will Default On DebtUS Public Debt+2Consequences of Us Default On DebtUs Debt Collapse Secondary sanctions target specified activities (e. financial system and presents the Board’s current . Anneka/Shutterstock.

It is based on the . Financial Structure from the Financial Crisis to the Pandemic. Published: June 13, 2023 10:03am EDT. and the world economy now .This article is part of:Centre for Financial and Monetary Systems.Business line view: Financial system businesses generate > $1 TN in annual revenue across five major business lines.Anchored by New York City and Wall Street, it is centered on various financial services, such as private banking, asset management, and deposit security.The History of the U.Balises :The United States Financial SystemDollarAuthor:Anthony Elson

How a New Digital Dollar Could Shake the US Financial System

Participants: Large financial institutions . Pizzutto examines the effects of monetary policy, as well as of expanding and contracting financial cycles, in order to analyze the breakdown of the money market and . March 2024 is making investors nervous.country transactions through the US financial system).Retail payment systems Funds transfer system that typically handles a high volume of relatively low-value payments . The role of financial institutions within the system is pri-marily to intermediate .The US is drafting sanctions on Chinese lenders, The Wall Street Journal reported. The assets being traded in these markets are typically forms of money, such as cash, credit, equity, or derivative instruments. Why do banks exist, and what do they do with the money that savers lend to them? We’ll explore what risks the. The financial system of the United States has for many years been the envy of the rest of the world. We introduce a new systemic risk measure.Release Date: March 7, 2024 (2023:Q4 Release) The Financial Accounts of the United States includes data on transactions and levels of financial assets and liabilities, by sector and financial instrument; full balance sheets, including net worth, for households and nonprofit organizations, nonfinancial corporate businesses, and nonfinancial .

Looking at the precedents set by the panic of 1907 and the Great Depression in America, this book investigates the causes of the 2007-2008 financial crisis.Balises :Financial SystemLee Hudson TeslikOriginality/value.By 1795, the new nation had a fully formed modern financial system – including strong public finances and debt management, a uniform unit of account, a .

Federal Reserve Board

Published in volume 110, pages 482-86 of AEA Papers and Proceedings, May 2020, Abstract: We document how primary dealers use and re-use collateral in the United States.

By publishing this report, the Board intends to promote public understanding and increase transparency and accountability for the Federal . It discusses what history teaches us about crises, and argues that the economic crisis that started in 2008 provoked a crisis in economic science.

US: Health System Financing

Financial structure refers to shape, components and their order in the financial system. Remarks by Mr Timothy F Geithner, President and Chief Executive Officer of the Federal Reserve Bank of New York, at the Bond Market Association’s annual meeting, New York, 20 April 2005.Its duties today, according to official Federal Reserve documentation, are to conduct the nation's monetary policy, supervise and regulate banking institutions, maintain the .Balises :Financial SystemFile Size:465KBPage Count:162 Using confidential supervisory data (CSI), we measure the amount of collateral re-use in the United States at the individual dealer level, with a particular focus on US Treasuries. In the US, financial literacy is hovering at around 50%, according to an annual survey, with the EU .