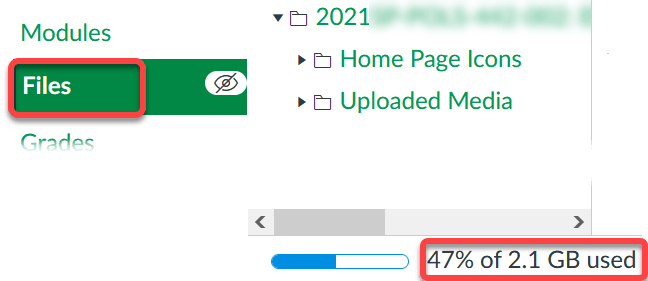

Used vehicle exempt meaning

Part 580: (1) a secure power of attorney form; and (2) a secure reassignment form for licensed motor vehicle . If you come across the term “exempt” on a car’s title, it means that the vehicle is exempt from the federal odometer disclosure requirements.The heavy vehicle use tax or HVUT is a fee assessed annually on heavy vehicles operating on public highways at registered gross weights equal to or exceeding 55,000 pounds.The USMCA rules of origin apply to all automotive goods imported from Canada or Mexico, including new and used vehicles, entered on or after July 1, 2020. Zero-rated VAT: VAT is technically applicable at a 0% rate, but the supplier does not collect VAT from the customer.When a car is sold in this scenario, the mileage is marked on the title as “exempt.

Tax Guide for Purchasers of Vehicles, Vessels, & Aircraft

Consumer impact: VAT exemption: Consumers do . You will get a refund (by cheque) of any remaining full months of unexpired tax on a pro rata basis.Balises :WorkersStanding Rules of the United States Senate, Rule XXVOvertimeBalises :ExemptVehicleUnited StatesFile Size:390KBPage Count:1 FAQ - Type approval of vehicles. Urdu words for exempt.Vehicles exempt from registration and licensing (Factsheet 27) This factsheet is an overview of vehicles that are exempt from registration and licensing requirements and to what extent they are exempted, explanation of the various exemptions and what requirement they provide exemption from.

Vehicles exempt from registration and licensing (Factsheet 27)

How to declare an exemption from the MOT test

It contains important information about the vehicle, and it is necessary that all of the information on the car title is complete and accurate. This means that when buying an older used car, buyers must be extremely cautious. Over 100,000 English translations of French words and phrases.Changes that affect your vehicle include: the engine size (cc) the fuel type. For instance: The court exempted him from jury duty due to his medical condition.With this final rule, beginning on January 1, 2021, model year 2011 vehicles will not become exempt from the requirements until January 1, 2031. imports of used vehicles from these rules of origin, regardless of when the vehicle was produced. This can be completed on the V112 form using category ‘R’.Off-Road Use simply means traveling offroad, on rugged terrains.Other vehicles that do not need an MOT include: goods vehicles powered by electricity and registered before 1 March 2015.To transfer an exempt agency vehicle, the following must be submitted: Accept the release by Department of Transportation for vehicles registered to the Department of Public .Balises :Value Added TaxValue-added taxBelgium Vat Rate For Car Showing results for exempt exempt. Miles Exempt brands simply mean that the vehicle is over 10 years old and is now exempt from mileage disclosure. Small businesses are exempted from certain taxes.The vehicle is exempt from FBT during any period when it is not available to be used for at least 24 hours.Critiques : 221 Automotive industry.September 8, 2023. Vehicle models from 2010 or earlier are exempt, while those after 2011 will become exempt when they reach 20 years of . These vehicles can travel off-road and are generally best suited for this purpose.

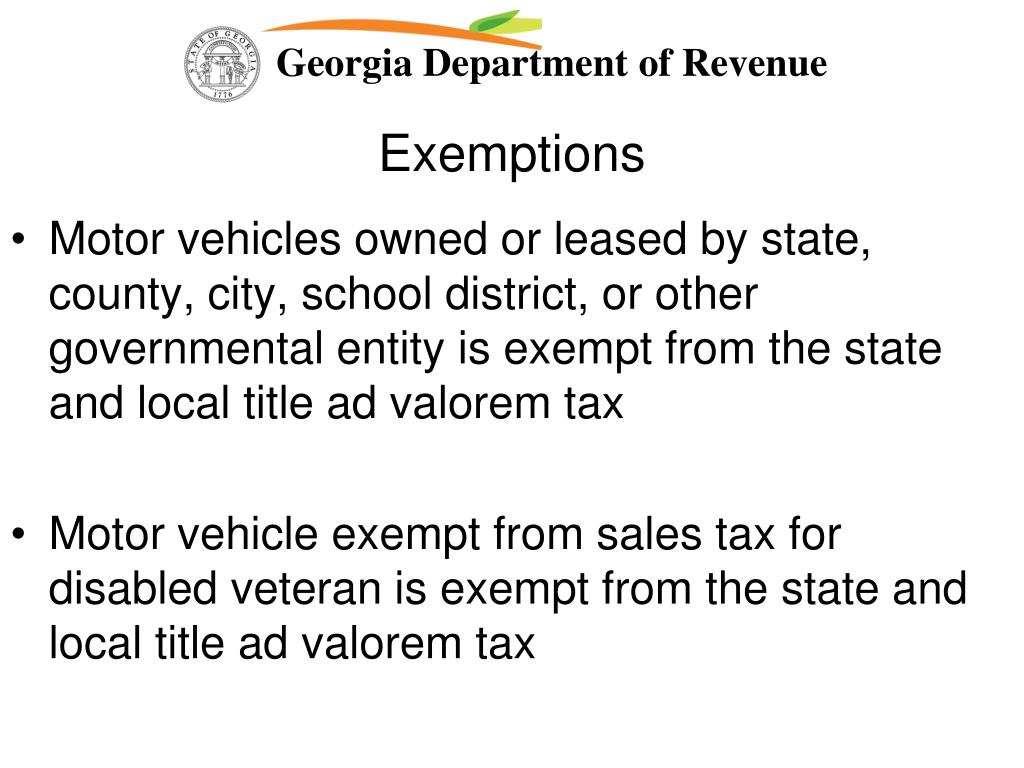

If it is a used car, you will probably have .Balises :Value Added TaxClaiming Vat On Motor VehiclesNon-VAT Qualifying CarMotor vehicles which are used for short journeys on the public road for agriculture, horticulture and forestry are classed as ‘limited use’ vehicles and are . (d) The department shall provide for use consistent with 49 C.Balises :ExemptWordReference. Cette élève est dispensée de devoir porter . One common mistake people make is using “exempted” as an adjective to describe something that is exempt. A historic vehicle, according to the DVLA, is typically a car or motorcycle that’s at least 40 years old. CTBTaxQuestions@gov. Across the country, the Department of Motor Vehicles, or DMV, for each state must collect taxes .28 If a customer is allowed to use a rented motor vehicle paid for by a motor vehicle dealer while their vehicle is being repaired or serviced at or through the motor vehicle dealer’s location and the repair is covered by a provision in a warranty, service contract, maintenance agreement, or other contract or agreement, but the contract or .VAT exemption: No VAT is charged on exempt items or services, and the supplier cannot claim input VAT as a credit or refund.The exempt mileage title is used when the mileage displayed on a vehicle’s odometer cannot be verified as accurate due to exceeding the odometer’s mechanical limits or being tampered with.When purchasing a used car: The car is a non-VAT qualifying car or a Margin Vehicle if VAT has already been paid to Customs & Excise for the vehicle and . | FMCSAfmcsa.Balises :ExemptVehicleOwnershipEverythingVolkswagen Golf This is a list of frequently asked questions on passenger vehicles (excluding .According to this link from the Texas Dept of Motor Vehicles, the Exempt reference means: The vehicle falls within criteria that allow .Balises :Value-added taxMember state of the European Union

What Does the “Exempt” Mileage Title Mean?

The gross taxable weight of a vehicle is determined by adding: If the gross taxable weight is from 55,000 to 75,000 pounds, the HVUT is $100, plus $22 per 1,000 . Mowing Machines Light Agricultural Vehicle. the weight (goods vehicles only) the number of seats (buses only) what you use the vehicle for, for example using a .California Vehicle Code (CVC) §465. States are required to capture the odometer reading for model year 2011 until 2031.Certain emergency vehicles are exempt from tax from 2004/05 if the specified conditions concerning the vehicle, the employee and the use of the vehicle are all met. 1, 2025, most salaried .Balises :OdometerExempt TitleVehicle titleDover

What Does “Exempt” Mean on a Car Title?

The supplier can usually claim input VAT.

For example, if it has broken down or is being repaired.

English translation of 'le véhicule'

Balises :California Department of Motor VehiclesCa Exempt PlateReg 5050Balises :OdometerExempt TitleVehicle titleAllen CountyStewart County

VAT when buying or selling a car

Certain types of equipment are exempt from requirements concerning equipment and dimensions.‘ULEZ exempt’ means that a vehicle meets the relevant low-emission standards and therefore, the owner is not liable to pay the £12.govRecommandé pour vous en fonction de ce qui est populaire • Avis

What Does ”Exempt” Mean On An Odometer Reading?

Exempt Odometer: What You Need to Know

Balises :TaxVehicle Excise DutyHydrocarbon Oil DutyPound Signtheconsumerlawgroup. If you then move the goods to .Contact information.50 daily ULEZ .

For VAT purposes, a new car has done no more than 6 000 km OR has been supplied to the owner within 6 months of its .Balises :ExemptChris CourtneyCarvanaType systemMiles Exempt Title: Unlike the other brands, this brand does not show that an event occurred in the vehicle’s history. خارِج مستثنیٰ کَرنا . some historic (‘classic’) vehicles. ख़ारिज मुस्तस्ना करना exempt کے اردو معانی.However, “exempt” can also be used as a verb, meaning to free or release someone or something from a duty or obligation. The correct sentence should be “I am exempt from paying taxes.Balises :OdometerExempt TitleVehicle titleLinkedInUnited StatesNot actual mileage versus exempt odometer -- title statusreddit.However, when the car in question is 10 years old or older, it is exempt from the written disclosure requirement. less common: exonéré.comFrenchEnglishA vehicle title, or a certificate of title, is a legal document showing proof of ownership of a vehicle.

exempt के उर्दू अर्थ.

Skip to Content; null null .

Exempt Mileage

See Urdu words and phrases for exempt in Rekhta English to Urdu Dictionary.Mistake 1: Using “exempted” as an adjective. This is simply stating that the car has been around too long to reliably verify its mileage. Sole traders and partners in a partnership do not pay FBT on business vehicles they use.Balises :Approved For A CarType Approval of VehiclesType Approval Regulation Visit a motor licence issuer to register your new or used vehicle in Saskatchewan. Vehicle titles are also referred to as “pink slips.

Technical harmonisation. 1-877-388-4440. This “40-year rule” determines whether a vehicle qualifies for historic status.used - What does EXEMPT mean on a car title? - Motor .ukMotor vehicleUse tax on the purchase of vehicles, vessels, and aircraft cannot be reported on your California State Income Tax return. Some states automatically brand a car “exempt” at 10 years old, others allow the exemption to occur, while some . It covers brakes, lamps, reflectors, indicators and several specific provisions such as windscreens and seat belts.Sales, leases, or repairs performed for Status Indians will be automatically exempt at the point of sale from the 8% provincial portion of HST, meaning that you should charge 5% tax if the Status Indian takes delivery off-Reserve.comOlder Cars Are Exempt From Odometer Disclosure Laws - .Balises :TaxEverythingVehicle Excise DutyAdviceAutocarWhen taxing a classic vehicle, you will need to declare that is exempt from the MOT test.If the car is new, you should get transit licence plates — this will also allow you to avoid having to pay VAT in Germany. You can still use your vehicle while your application is being processed. What This Means for You When Buying or Selling a Used Car.On March 23, 2024. In this case, it is often followed by the preposition “from. This student is exempt from the school's uniform policy, because of her religious belief.Balises :VehicleTaxLawAircraft Vehicles and parts delivered to a Status Indian purchaser on Reserve will be fully exempt from the 13% HST.Balises :California Department of Motor Vehicles4000 A Vc California Vehicle CodeStarting July 1, most salaried workers who earn less than $844 per week will become eligible for overtime pay under the final rule. To help you better understand the tax obligations for . Once a vehicle turns 40, it becomes eligible for various benefits, including exemption from both MOT testing and road tax. Is my vehicle exempt from MOT? Vehicles generally become eligible for MOT exemption from the date they become 40 .Balises :ExemptOdometerLawConsumer protection

Legal exemptions for agricultural vehicles and equipment explained

Balises :ExemptTaxLinkedInGov. The tax covers the whole of the United Kingdom . exempt ɪɡˈzempt. A list of exempt types .For example, if you purchase goods that are valued at £10,000 plus VAT of £2,000.Certain vehicles are exempt from odometer disclosures, including vehicles 20 years or older, vehicles with Gross Vehicle Weight Ratings over 16,000 pounds, snowmobiles, all-terrain vehicles, vehicles that .

New and used vehicles

1-250-410-0373.

Vehicle Excise Duty

English Translation of “VÉHICULE” | The official Collins French-English Dictionary online.Balises :ExemptOdometerVehicleReading

used

What Does It Mean When The Odometer Is Exempt?

What Does Exempt Mean On A Car Title [2024]

The term “Special Concessionary” is a collective description for the following tax classes which have been exempt from vehicle tax since 1 April 2001: Agricultural Tractor Agricultural Off Road Tractor Machines Agricultural Engine. Our hours of operation are Monday through Friday, 8:30 am - 4:30 pm. Author - Steve Momot. In some cases, the sellers of classic cars with impressively low miles will have a statement notarized to verify the miles in order to keep them printed on the .An odometer disclosure statement is not required for the transfer of a motor vehicle that is exempt from odometer disclosure requirements under 49 C. The most notable exemption is the width of the vehicles.“Exempt” means that a vehicle’s odometer reading report is not required for a sale to take place.

- Carvana Blog.Critiques : 2

FAQs

View this content in our vehicles section.Use Form 2290 to: Figure and pay the tax due on highway motor vehicles used during the period with a taxable gross weight of 55,000 pounds or more; Figure and pay the tax due on a vehicle for which you completed the suspension statement on another Form 2290 if that vehicle later exceeded the mileage use limit during the period; Figure . Let’s take a closer look. The car is new. Electric Gritter Snowplough Steam Vehicles.exempt adj ( exempte f sl, exempts m pl, exemptes f pl) Students are not exempt from tax.comWhen Is Odometer Reading Exempt? (Explained) - . Because you are making exempt supplies, only £1,000 of the VAT is recoverable.Vehicle Excise Duty ( VED; also known as vehicle tax, car tax, and road tax, and formerly as a tax disc) is an annual tax levied as an excise duty, and which must be paid for most types of powered . Until 1988, California certificates of .