Va beach personal property tax

Pay Personal Property Tax - Virginiaeservices.

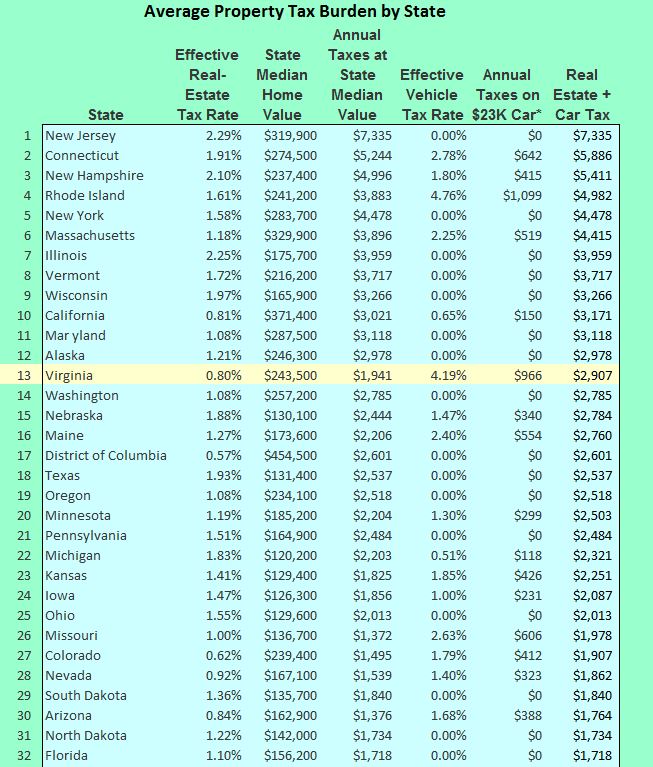

33 per $100 of assessed value. For tax year 2024, the tax rate for . Apr 18, 2022 Knowledge. You can also view your bill, change your mailing address, file Business License and/or Trustee .Personal property taxes are assessed each year by the Commissioner of Revenue’s Office for all tangible personal property garaged within the City of Charlottesville. Discovers and enrolls all .

Senior & Disabled

Deductions and Exemptions for Real Estate Tax Relief in Virginia. Business Boats., cars, trucks, motorcycles, recreational vehicles, and business use .Personal Property Division.Car Personal Property Taxes in Virginia - Intuitttlc.Virginia Beach City Council sets the tax relief each year.Some taxes charged to individuals in Virginia Beach.40 per $100 of assessed value. The new fiscal year 2021-22 real estate tax rate in Norfolk is currently $0.

Personal Property

com , fax to 757. Home values are quite high in Virginia, though, so homeowners here often pay annual property .Log on to pay your personal property tax bill online in Virginia Beach, Virginia.Please have your Tax Bill available to pay your bill online., and Virginia Beach city ordinance.Prince William County Tax Records Search (Virginia)countyoffice. In fact, the state's average effective property tax rate is just 0. Virginia provides various deductions and exemptions for real estate tax relief for senior citizens.Pay Personal Property Tax and Real Estate Tax online as a one-time payment without logging in, enrolling and creating a new profile, or simply logging in to your existing profile.In Virginia Beach, the current real estate tax rate is $1. COVID-19 Real Estate and Personal Property Tax Relief Program Application Deadline is Jan. Search by primary owner name, parcel number or situs/property address.00, whichever is . Housing & Neighborhood Preservation .Elderly/Disabled Tax Reduction Applications Due. There are five City Treasurer's Office locations open for in-person services 8 a. Pay Personal Property Tax, Real Estate Tax, Parking Tickets online here as a one time payment without logging in, enrolling and creating a new . Municipal Center, Building 1. Personal property assessments (i. Town Hall Videos.Enforces state and local tax laws. Beaches & parking. Posted Jun 27, 2022.

Special Service District (SSD) Tax Rates per $100.If you have delinquent Personal Property taxes that have been turned over to our delinquent collection agency - Tax Authority Consulting Services (TACs), please see the following contact information: Phone: (866) 951-0742; Fax: 1-804-440-1171 Online Payment: pay.15 per $100 of assessed property value.

My Tax Bill

Town of Colonial Beach 315 Douglas Avenue Colonial Beach, VA 22443 .Taxes, Licenses & Collections.

Appeal Process

The tax relief is available to taxpayers qualified under provisions of the Code of Virginia, Title 58.

Personal Property Appeals

1802, via any mail service, or use the convenient drop box in the parking lot .Section 12-37-3140 states, For property tax years beginning after 2006 the fair market value of real property is its fair market value applicable for December thirty-first of the year in which an assessable transfer of interest (ATI) has occurred.

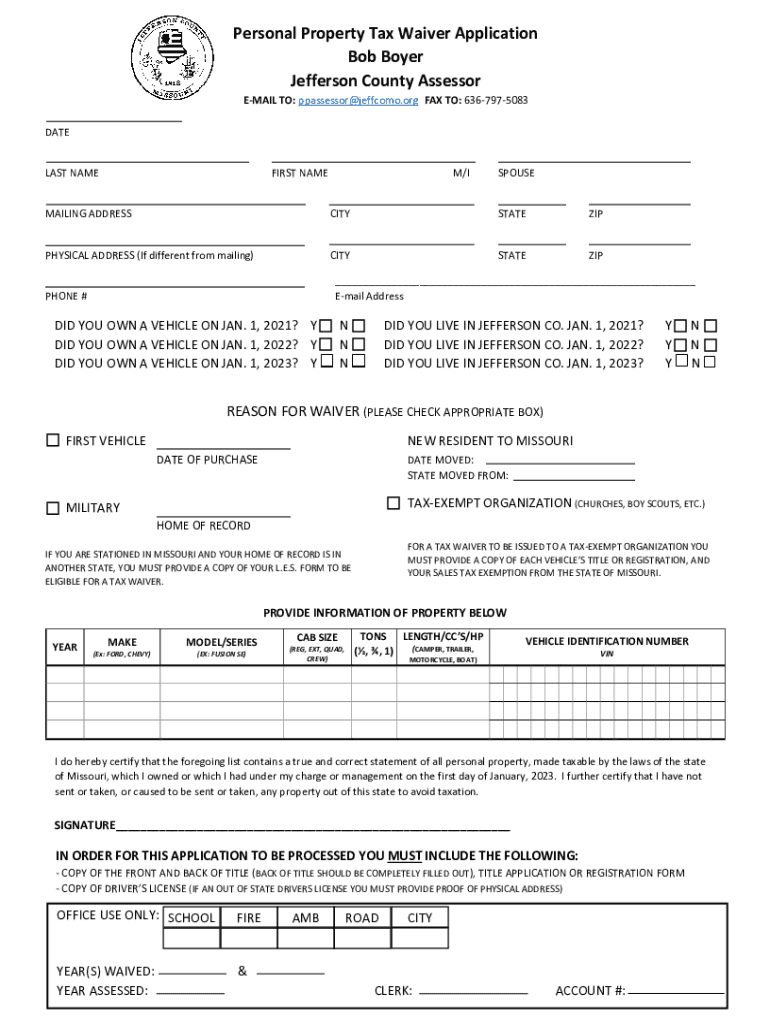

Senior & Disabled Tax Relief. Vehicle Assessment Appeal.personal property tax exemptions for active-duty military or military spouses All active-duty military seeking personal property exemption and military spouses seeking exemption by attestation may send the documents by email to [email protected] questions about your Trustee Tax payments, please call 757-385-1311 between 8am - 5pm Monday through Friday or email VBTrust4you@vbgov. Real Estate Assessor's Office to Reopen July 13.com for assistance. Pay Here: My Parking Ticket. New to our online services? Please use the Enroll Here link to register. The Treasurer is responsible for preparing, mailing, and collecting the taxes based on what the COR discovers to be unbilled tangible personal property.

Commissioner of the Revenue

The tax is assessed by local governments based on the personal property’s value as of January 1st of each year.A collection of important documents, and forms. Pay by Phone Pay Personal Property Tax, Real Estate Tax, Parking Tickets, Public Utilities/Storm Water bills with a major credit card (2.Personal property tax is a tax on any tangible property that you own and use in Virginia Beach. Receives and audits state and local tax returns. (703) 792-6710 (TTY: 711) Prince William County is located on the Potomac River in the Commonwealth of Virginia in the United States.Real Estate Assessor Home .

Personal Property (Vehicle) Taxes

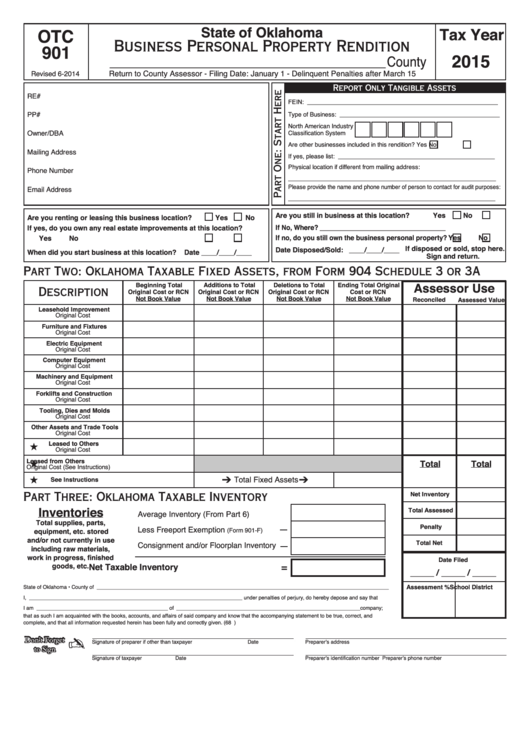

The personal property tax payment due date is June 5, 2024.pdf unless otherwise indicated.Local Taxes Personal property taxes and real estate taxes are local taxes, which means they're administered by cities, counties, and towns in Virginia.Search Personal Property Tax. City Hall (1st Floor, right side) 2401 Courthouse Drive. To begin payment of your Personal Property Tax, please enter your full account number as it appears on your bill and your 5-digit mailing address . Homeowners in the state of Virginia pay property tax rates that are well below the national average of 1. Personal Property Tax. Supplemental bills are due December 5th and March 31st for additional items added after the annual billing. 80%, which falls in the bottom half of the nation. Personal Property (Vehicle) taxes are assessed each year by the Commissioner of Revenue (COR) for all personal property garaged within the City of Virginia Beach. Personal Property Tax Due. The staff of the Assessor’s Office wants to ensure that your assessment is accurate and equitable. For more information on personal property taxes, tax relief, military owned vehicles, DMV Select, Mobile . Vehicle Registration Fee. Some taxes charged to individuals in Virginia Beach. Hearings to review your assessment will be held from March through May. vbre4you@vbgov. Real estate reassessment notices are mailed in March of each year.Virginia’s personal property tax is an annual tax on personal property, which includes tangible items such as cars, boats, and machinery, as well as intangible items such as securities and leasehold improvements. These benefits are based on the gross combined income and net combined financial worth of the property owner (s) and spouse.orgPayments | Virginia Taxtax. Commissioner of the Revenue - Administration. This tax is separate from real estate taxes and is assessed on an . If you have an issue or a question related to your personal property tax bill, call RVA311 by dialing 311 locally, visit . Qualified elderly or disabled . Here’s an example for automobiles, trucks, trailers, and motorcycles: Assessed value: $10,000.Every taxpayer operating a business in the City of Virginia Beach on January 1 is required to file a tangible personal property form (CR-13) on or before March 1 of the tax year. [email protected] Estate Tax Search. Personal Property (Vehicle) taxes are assessed each year by the Commissioner of Revenue (COR) for all personal property garaged within the City .Multiply the assessed value by the applicable tax rate: Each year, the City Council sets the tax rate for personal property in Chesapeake, VA.Depending on your vehicle’s value, you may save up to $150 more because the city is freezing the rate. The files below are in .

Personal Property Rates, Dates, and Deadlines

Vehicles qualified for tax relief are noted on your tax bill and show a reduction for the portion of the tax the Commonwealth will pay.comRecommandé pour vous en fonction de ce qui est populaire • Avis

Search Personal Property Tax

(757) 385-4601., Monday through Friday.Virginia Beach, VA 23456-9018. If you need assistance accessing the site, call 804-318-4133. It is estimated that by freezing the rate the city will provide Richmonders more than $8 million in additional relief.

Real estate is assessed at 100% of its fair market value.

Tax Rates

City Council has adopted a program to assist qualifying individuals on both real estate and personal property taxes.

Delinquent Collections

City Treasurer - Real Estate.

The City Treasurer's Office is State/City mandated to prepare, mail, and collect all tax bills for Real Estate and Personal Property, as well as Trustee Taxes, State and Estimated . If you have questions about personal property tax or real estate tax, contact your local tax office.Personal Property Tax.00 of assessed value.Virginia Property Tax. [email protected]é pour vous en fonction de ce qui est populaire • Avis

Online Payment Options

City Treasurer. Personal property tax: $10,000 * 4.

Virginia Beach, VA 23456 Office Locations.99 per $100 assessed value, making it one of the lowest in the region. The City Treasurer's Office offers online public access to Real Estate Tax Information. Posted Aug 24, 2023.50 per $100 of assessed value. In Norfolk, the current real estate tax rate is $1. An assessable transfer of interest (ATI) means a transfer of an existing interest in real property that subjects the . New or used vehicles purchased after March 31 or . If these dates fall on a weekend, the deadline is extended to the following Monday.

Documents & Forms

(757) 385-4251.

Ways to Pay

Real Estate Assessor's Office. Sue Cunningham Appointed as Virginia Beach Real Estate Assessor. IMPORTANT DATES AND DEADLINES.The annual due date for personal property tax is June 5th each year. Vehicles already registered with the Virginia Department of Motor Vehicles (DMV) or vehicles purchased between January 1 and March 31 usually receive tax bills in May with a date of June 5. Taxes are due on June 5th and December 5th of each year. The amount of deductions can range from 100% to 5% of .Locations & Contacts. There are five convenient locations to serve you: 2401 Courthouse Drive, Building 1, 23456 ; 420 Birdneck Circle, 23451; 4001 Virginia Beach Boulevard, Suite 112, 23452 1830 Kempsville Road, Suite 107, 23464 (new location) 2875 Sabre Street, Suite 500, 23452 Hours: Monday - Friday, 8:00 am - 5:00 pm . Posted Jan 20, 2021.Appeal Process. Use the map below to find your city or county's website to . Real Estate Tax Info.com (bottom right of page) Schedule an Appointment. If you do not have your bill, please note what you are paying and a bill/account number so that your payment will be properly applied. Documents & Forms.Real Estate Personal Property Trustee Taxes Departmental Invoices Parking Tickets Animal Licenses Delinquent Collections State and Estimated Taxes Court Costs/Fines Restitution Investment Portfolio . Boards & Commissions.City of Virginia Beach Launches Refreshed Property Search Tool. Pay Parking Tickets, Red Light .

Taxes on Individuals

Assists Virginia taxpayers with filing state and local tax returns. [email protected] the below types of Taxes/Invoices for direct links to make your online payment.

/montre-g-shock-gbd-h1000-7a9er-colorless-white.jpg)