Vacation for salaried employees

To calculate PTO accrual rate, start with the maximum amount of PTO an employee can .Salaried Employees in Arizona and Overtime.Minimum Wage Law.

California passed a law in 2015 mandating that employers provide at least 3 days of paid sick leave a year.40, yielding an overtime rate of $11.

Texas Salaried Employees Laws

It defines wages as agreed-upon compensation for labor or services, encompassing fringe benefits.

com in Employees.Salaried employees are typically assumed to work 40 hours per week for hourly PTO accrual purposes.For part-time employees. As of January 1, 2022, the minimum wage in Illinois is $12. An employer may apply for a license to pay sub-minimum rates to learners and certain workers with physical and . Unless agreed or company use providing for a postponement of these days, the .20-24 paid vacation days (12%) 24+ paid vacation days (6%) Typically, the more years an employee has worked at a company, the more vacation days they are allowed.

4 PTO Policy Examples To Help You Create Your Policy

How Much Vacation Time and Pay Do Employees Get?

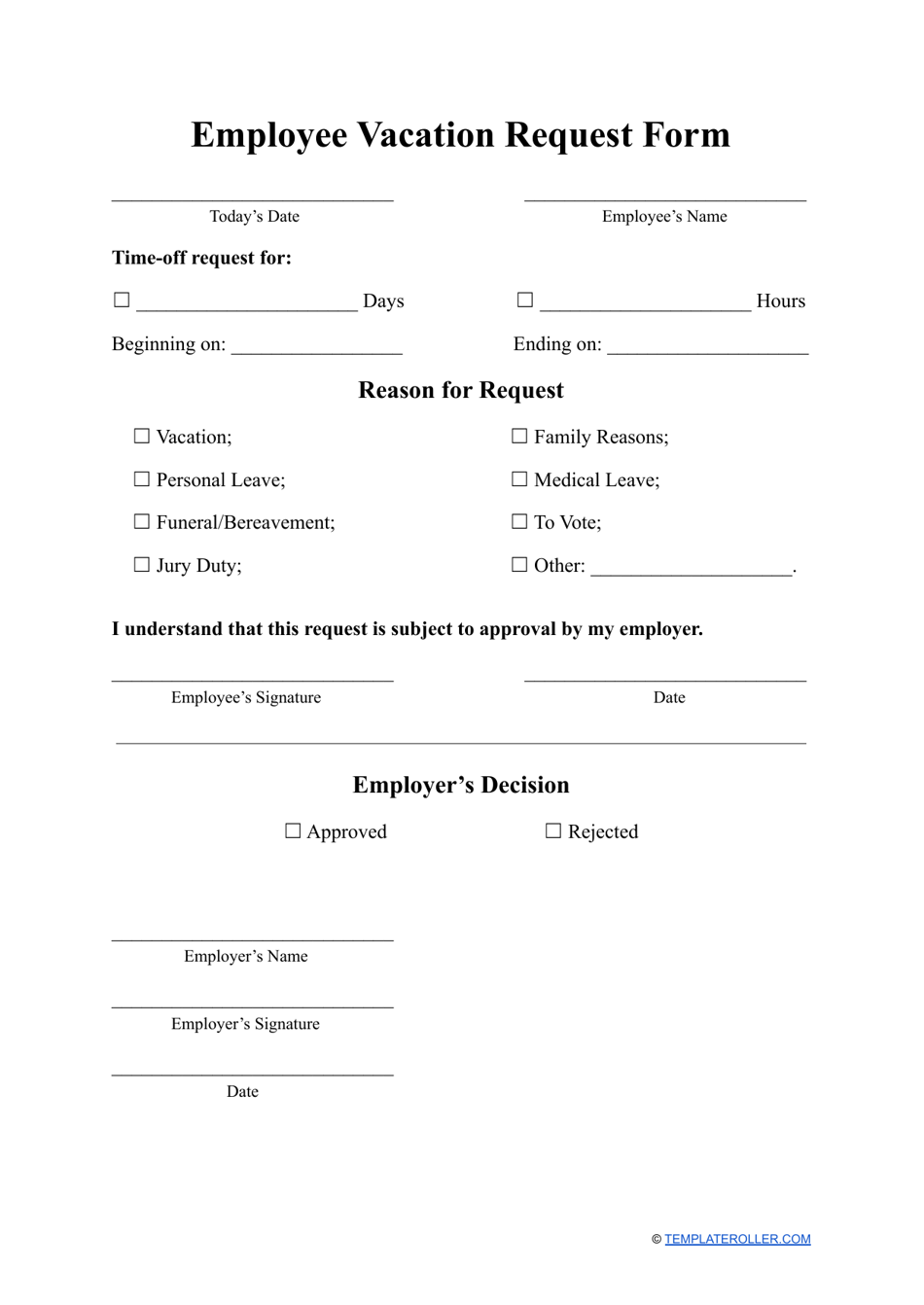

Bureau of Labor Statistics estimates that the average private industry worker gets 10 to 14 days of paid vacation after a year of service—in other words, .Hourly employees accrue 0. Sick leave is another matter.How to Calculate PTO for Salary Employees. Effective from January 1, 2020, California labor law requires employers with at least 26 employees to pay $1,040 every week or $54, 080 per annum. Paid vacation time works a little differently than something like sick days, which are usually unplanned. The Fair Labor Standards Act (FLSA) states that salaried employees earning over $684 per week are exempt from overtime pay. Generally, time tracking is essential for ensuring proper compensation, managing productivity, and complying with labor regulations. paid time off (PTO), and tips for negotiating time off. Planning and taking vacations as a salaried employee can be both exciting and overwhelming.Vacation and sick pay entitlements can be confusing. their vacation pay would be $2308 ($40,000 x 5. However, if your employer has a policy providing vacation leave (which is outlined in your employment contract or the company’s handbook), they are obligated to .

How To Calculate Prorated PTO

Assembly Bill 673, enacted into law by the Governor in 2019 in California, brought amendments to Labor Code section 210. When an employee uses a paid vacation day, they don't have to work that day, but they will still receive the same pay as if they had worked.For example, the state does not have separate wage and hour laws. Various methods, such as time clocks, .77%) of their eligible earnings for each vacation week, and.Vacation Pay is a required payment under section 35. This 4% is equivalent to 10 days of . The Fair Labor Standards Act (FLSA) does not require payment for time not worked, such as vacations, sick leave or federal or other holidays.

Vacations

The minimum salary requirements for salaried exempt employees are set by the FLSA. PTO payout (PTO cash out) is when you pay out the value of an employee’s unused vacation days, sick time, or other paid time off (PTO) Payout of . Employees can use these days to request time off work outside of the regular weekend. Calculating prorated vacation days for part-time employees is best done by calculating hours rather than days.Employers are required to pay employees, at their regular rate, for all paid-time-off that the employee has accrued.Salaried employees in North Carolina who are non-exempt have the right to receive the state’s minimum wage.Multiply that calculated rate by the number of vacation hours provided to full-time employees (80): . In Texas, unless an employee earns a minimum weekly salary of $684 ($35,568/year) and falls into a legally recognized exemption category, they must receive overtime pay.

PTO Accruals: How They Work and How to Calculate Them

It’s not required by law, but some employers offer it as a way to attract and retain employees—Paid Time .This exceeds both the federal minimum wage --$7.Formula for Salaried Employees.

Vacation Pay for Employees: PTO Calculator, Tips, and More

This means that Caroline will be entitled to 20 hours of vacation per year.00 per hour for workers 18 and older.The regular rate for non-exempt salaried employees is determined by dividing all remuneration paid to the employee by 40 hours. In some exceptions, the federal minimum wage is applied. Annual vacation entitlement. §§ 48-1228 to 48-1234) applies to a wide range of employers and employees, including the state and individuals/entities employing workers in Nebraska. Alabama also does not have a state minimum wage law. Currently, an exempt employee in Georgia must receive a weekly compensation of $684.15 per hour, whilst the federal minimum wage is $7,25. Whether employees have the right to get paid for their unused PTO depends on the . One exception to this rule is that Alabama has distinct child labor laws. Mandatory Vacation Time: California employers are not required to give vacation time.0533 vacation hours per hour of work (regular accrual) and can only use vacation time that they’ve earned.Employers may offer paid vacation as part of an employee’s benefits package or as part of their salary.If employers continue paying salaried employees during their vacation period when no work is being performed by the employee, this is considered to be vacation pay.Exceptions to Overtime Exemptions for Alabama Salaried Employees. In British Columbia, for example, annual vacation leave . In this case, your employer must pay you the vacation pay proportional to the time taken. Calculating vacation accrual is slightly different for full-time salaried employees, given that these employees are counting their . To make the most out of your vacation days, it’s important to make a plan.com Guide to Human Resources & Staffing.Specifically, any salaried worker who earning less than $55,000 a year could soon be swapped to hourly pay under a recently proposed U.

Paid Vacation Rights for Employees

Department of Labor . These benefits are . Know the Difference Between Time-Off Requests for Exempt vs.

PTO Accruals Guide: How to Calculate PTO & Vacation Time

This being said, it’s worth .

Division of Labor Standards Enforcement (DLSE)

However, if he worked 50 hours, his hourly rate would be $6, which does not meet the requirements.PTO payout (PTO cash out) is when you pay out the value of an employee’s unused vacation days, sick time, or other paid time off (PTO) Payout of PTO usually occurs at year’s-end, at retirement, or at employment separation, unless you have PTO conversion. If you are paid by the hour in Ontario, you are entitled to receive four percent (4%) vacation pay, which may be banked or paid out each pay period.

Working Hours, PTO and Vacation

Updated December 5, 2022. This translates to bi-monthly payroll cycles, where employees must receive their earnings within 13 days after the conclusion of each pay period.

A Guide to Salaried Employees: Hours, Overtime and More

Likewise, nonexempt workers may receive a predetermined salary, but it should be equal to the federal . Having allocated Caroline’s vacation days, you will now prorate her PTO by dividing it by hours rather than days., an hourly worker with a year of experience averages 11 days of paid vacation a year. As per Mississippi regulations, employers are obligated to provide payment to their employees every two weeks. PTO may cover vacation time, sick . You should also schedule rest days into your .

CALIFORNIA LABOR LAWS FOR SALARIED EMPLOYEES

Having a job that offers paid vacation can leave you with questions. You may or may not have to pay sick days for a salaried employee, depending whether they're exempt or non-exempt or otherwise covered by a . For salaried employees, the 4% entitlement is your entitlement to paid vacation time.Indeed Editorial Team. This adjustment now permits employees to seek statutory penalties for delayed wage payment while they are still employed. Overtime While salaried .The Nebraska Wage Payment and Collection Act ( Neb.This is only possible if there is an agreement between the employer and the employee. Organizing PTO based on accruals allows employers to .When the Order, Decision, or Award (ODA) is in the employee's favor and there is no appeal, and the employer does not pay the ODA, the Division of Labor Standards Enforcement (DLSE) will have the court enter the ODA as a judgment against the employer. This judgment has the same force and effect as any other money judgment entered by .Best for hourly and salaried employees who are paid semimonthly; Monthly PTO accrual; Employees earn paid time off once per month; Best when your payroll is run monthly ; Accrual Rate. Yet, Arizona state law has a different stance – salaried employees are not exempt from overtime pay but have higher salary requirements. Salary employees accrue 3. As an employee working for a federally regulated employer, you are entitled to at least: 2 weeks of vacation annually . An employer whose employees receive gratuities or tips may pay 60 percent of the minimum wage to employees. Postponing or interrupting annual .Tips for Planning and Taking Vacations as a Salaried Employee. The salary received during the vacation must equal at least 4% or 6% of gross earnings, whichever is applicable, as set out above in subsection (1).What is PTO accrual? A PTO accrual is the policy that determines how and when employees earn PTO for the hours they work. Employers subject to the Fair Labor Standards Act (FLSA) must pay the current federal minimum wage, which, as of November 2021, was $7.Georgia’s minimum wage is $5. According to the U.You would calculate vacation pay at 3/52 (5.

PTO Payout: What, When, and How It Works

69 hours per workweek from the date of hire to . The majority of paid vacation days is 10-19 paid .This increment may not have much impact on California that already has a higher salary scale. 2) When an employee is absent for one or more full days, if your business has an established benefit plan that covers . Vacation pay after .You can reduce an exempt employee’s salary only in limited circumstances, as follows: 1) When an employee is absent from work for one or more full days (NOT partial days) for personal reasons other than sickness or accident. Decide where you want to go and what you want to do.; Non-exempt salaried .Waiving, postponing or splitting annual vacation. Accrual rate is how much paid time off employees earn per accrual period.January 3rd 2024.

Paid Time-Off Policies: Best Practices and Benefits

For example, for an employee who earns $1,000 per week.

Once an employee has accumulated 10 years of service, the average increases to about 15-19 days per year.

(Plus Other FAQs)

Employees can take a day off that they’d typically be working while still . To calculate PTO and vacation accruals for salaried employees, assume 2,080 working hours, 52 workweeks, and 365 workdays. In North Carolina, salaried employees are covered by federal laws including the Fair Labor Standards Act (FLSA), the Family and Medical Leave Act (FMLA), and the Occupational Safety and Health Act (OSHA).