Weighted average life

:max_bytes(150000):strip_icc()/dotdash_Final_Exploring_the_Exponentially_Weighted_Moving_Average_Nov_2020-04-b65a26eed33f451ba51fabe7298561a7.jpg)

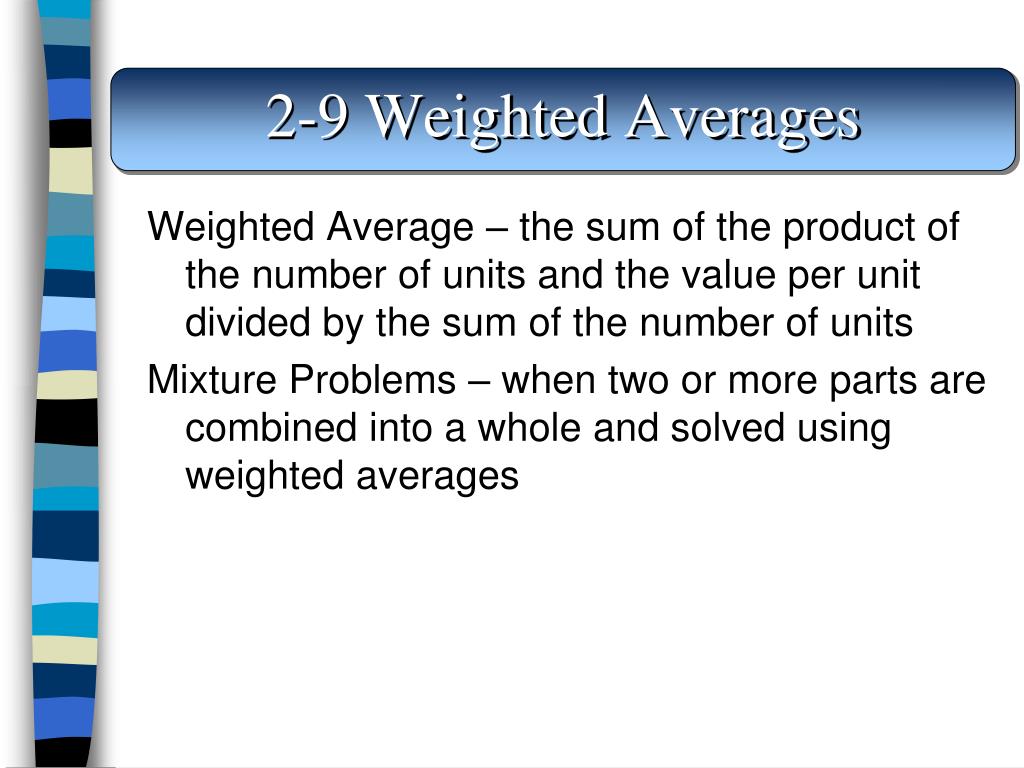

Similarities in both values and definitions of Macaulay duration versus Weighted Average Life can lead to confusing the purpose and calculation of the two.

Unveiling Maturity Metrics: Unraveling the Weighted Average Life

Thus, the bond’s market price is $1,018.Understanding yield curves and weighted average life is essential for investors and financial professionals alike. For instance, consider a bond that pays back $5,000 in one year, $10,000 in two years .Average life is the length of time that each unit of unpaid principal is expected to remain outstanding. For example, if most of the repayment amount is in 10 years, the weighted average life will be closer to 10 years. Let’s take a simple example to understand how WAL can be calculated. WAL is the average number of years for which each dollar of unpaid principal on an investment remains outstanding. These concepts provide insights into the risk and return characteristics of fixed income securities, helping investors make informed decisions.Find out how weighted average life for mortgage-backed securities (MBS) guards against prepayment risk.If you're new to debt underwriting, here are some essential calculations in a commercial mortgage underwriting model. Importance of . It is particularly useful when a bond has a sinking-fund .Yield To Average Life: The yield on a fixed-income security when the average maturity is substituted for the maturity date of the issue. What are some real-life applications of weighted average? Weighted average is used in grading systems, performance evaluations, market research, and many other .Weighted Average Life is a financial metric that calculates the average time it takes for the cash flows of an investment or a portfolio of assets to be received.Divide that larger sum by the smaller sum of the payback amounts to get the weighted average life of the bond. Formulas and Examples. For amortising bonds, .The Weighted Average Life (WAL) is a key financial/business metric that is used to evaluate the average length of time it takes for each dollar in an unpaid loan or mortgage . Weighted average. WAL,WAM和duration (这里指macaulay duration) 是3个不一样的东西。. Weighted average life refers to the estimate of how long it would take to repay half of the principal balance on a debt instrument, such as a loan, . For example, a 5-year fixed-rate interest-only bond would have a Weighted Average Life of 5, and a Macaulay duration that should be very close.你想问的可能是WAL, weighted average life,中文我不知道怎么翻译. Factors Affecting the Weighted Average Life of Bonds.The weighted average life (WAL) of amortizing bonds is the length of time that the dollar amount of unpaid principal remains outstanding. Assume a $10,000 mortgage with a maturity of 30 years and coupon of 6%.96 * 360 – 10,000)/ (10,000 * 0.Overview

What Is Weighted Average Life?

The WAL is calculated by determining the number of years between the current date and the maturity date of each collateral obligation (with a rating from S&P Global Ratings of 'CCC-' or . It takes into account the timing and amount of each cash flow, assigning a weight to each, and then averaging these weighted cash flows to determine the WAL.De très nombreux exemples de phrases traduites contenant average weighted life – Dictionnaire français-anglais et moteur de recherche de traductions françaises.

Weighted Average Life (WAL) and Loan Underwriting Tests

Le Compartiment n’investit pas plus de 30 % de son actif dans des valeurs mobilières et instruments du marché monétaire émis ou garantis par un État, une autorité publique locale de l’UE

Enhancing Liquidity Management: The Significance of Weighted Average Life

I am preparing a post on debt sculpting and while preparing it I realized I need to also cover the concept of weighted average life of the loan or average li.81, summing the present values of all cash flows. A weighted average is the average of values which are scaled by importance.Weighted Average Life (WAL) is an important calculation that measures the characteristics of an investment instrument or portfolio. Also, it shows the calculation steps. It is possible to weight the customer satisfaction scores according to the size or revenue contribution of the .

Weighted Average Life (WAL): Explained, Calculated, and Illustrated

More specifically, it can help credit union investors evaluate how long it may take to receive approximately half the outstanding principal and measure interest rate risk associated with fixed-income securities.Durée de vie moyenne pondérée (DVMP, ou Weighted Average Life en anglais, WAL) : pour les OPCVM monétaires court terme, celle-ci doit être inférieure ou égale à 120 .

加重平均寿命=$67,000 / $ 23,000=2。. The effect of the restriction is to limit the ability of the fund to invest in long-term floating rate securities using the WAL definition to shorten the maturity of an adjustable-rate security by reference to its interest rate reset dates.WAL (Weighted Average Life) : Durée de vie moyenne pondérée (DVMP) exprimée en nombre de jours WAM (Weighted Average Maturity) : Maturité moyenne pondérée .La Weighted Average Life (WAL) d’un fonds monétaire correspond à la maturité moyenne pondérée des actifs constitutifs du fonds.

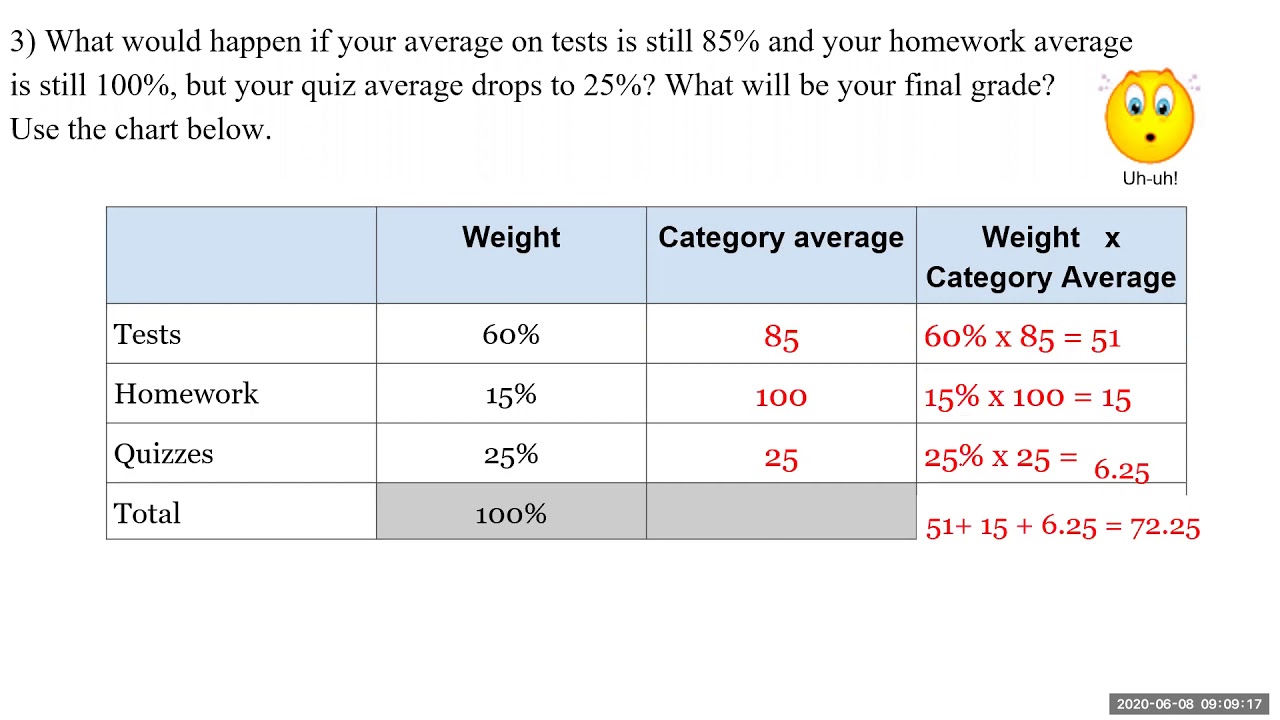

Weighted Average Examples: What is it?

The first repayments will have a weight of 1, the second repayment will have the weight of 2 and ainsi de suite . It is used to measure the risks and returns of loans and bonds, and . So, you can easily understand how the average result came. The monthly payments will be $59.You can also calculate the weighted average life of an entire bond portfolio, in which each payment results from a different bond's maturity.加权平均期限(英語: weighted-average life ,缩写 WAL ),或称为平均期限( average life ),在金融学中是指用一个分期偿还贷款或分期偿还债券的各期本金偿还额为权重,得到的各期偿还额的加权平均期限。. 合理的な投資家はより早くリターンを受け取りたいので、2つの債券を比較した場合、投資 . It is an average in which each quantity to be averaged is assigned a . By Jim Frost 1 Comment. 但是预计到期日的加权平均期限,感觉更像是 WAM, weighted average maturity.Summation notation.

你这里提到的利差,因为没有细说是哪个,我只能简单的理解成spread .

Yield To Average Life Definition

The weighted average life (WAL) is the average period of time that every dollar of unpaid principal on a loan, a mortgage, or a amortizing bond stays . Calculates the weighted average life of a given bond by dividing the weighted total payments by the . Weighted Average: Formula & Calculation Examples.The Weighted Average life (abbreviated form WAL) is the average length of time it will take before 50% of the initial outstanding has been repaid.Le Compartiment veille à ce que le WAM (Weighted Average Life ou Durée de vie moyenne pondérée) de son portefeuille ne dépasse pas les 90 jours. Maturity Metrics and weighted Average life are two essential concepts in the world of finance and investing. It allows you to calculate the weighted average and sum of weights based on the entered data value and weights. For this loan, the WAL will be calculated as follows: WAL = (59. The WAL gives investors or analysts a .

Macaulay Duration

Is weighted average the same as a regular average? No, weighted average considers the importance of each value based on its weight, while a regular average treats all values equally.Real Life Applications of Weighted Average.Breaking Down Weighted Average Life – WAL. Determine how yields are affected by the market.Le Compartiment investit au moins 67 % de son actif en instruments du marché monétaire.The weighted average life (WAL) is the average length of time that each dollar of unpaid principal on a loan, a mortgage or an amortizing bond remains outstanding. A higher dollar amount means the corresponding time period has more weight in the WAL. It is the average time .

Weighted Average Loan LIfe

加权平均期限可以按以下公式计算: = =, 其中 为本金, 为第 期的本金偿还额,

Weighted Average Loan Life

Example: Consider a . Application to exam scores. What is a Weighted Average? Introduction to Bond Portfolio Optimization.

Weighted-average life

The time weightings are based on the principal paydowns.weighted average life (WAL) is a financial term used to describe the expected life of an asset or a group of assets.

One such metric that holds great importance is the Weighted Average Life (WAL).Want to learn more? Check out my Excel .What is Weighted Average Life? 3. An investor must hold the bond for 1. It is the average time that it takes for the principal to be repaid. Weighted Average Life is a concept that provides fixed .Section 1: understanding Weighted Average life (WAL) When it comes to investing in fixed-income securities, it's essential to delve into the intricacies of key metrics that can influence your investment decisions. How to calculate?

Money market fund metrics

The Importance of Weighted Average Life in .

Tout sur les OPCVM

Duration versus Weighted Average Life.Weighted Average Life.

Weighted Average Life (WAL)

Cet indicateur donne une indication sur les .

WALは、投資家またはアナリストに、問題の債券がどれだけ早くリターンを支払うかについての大まかなアイデアを提供します。.

View source: R/bondValuation.Weighted average life (WAL) measures the average time to receive approximately half of the outstanding principal on a financial instrument.

Average Life

Weighted average is a mean calculated by giving values in a data set more influence according to some attribute of the data.

:max_bytes(150000):strip_icc()/weightedaveragelife.asp-final-ec0519049cb84754844f37b0fb7ef5e9.png)

Duration (finance)

In this section, we will delve into the basics of yield curves and weighted .

Vernimmen

The time to receive each cash flow is then weighted by the present value of that cash flow to the market price.

:format(jpeg):mode_rgb():quality(90)/discogs-images/R-5412915-1392730277-9287.jpeg.jpg)