What are american depositary receipts

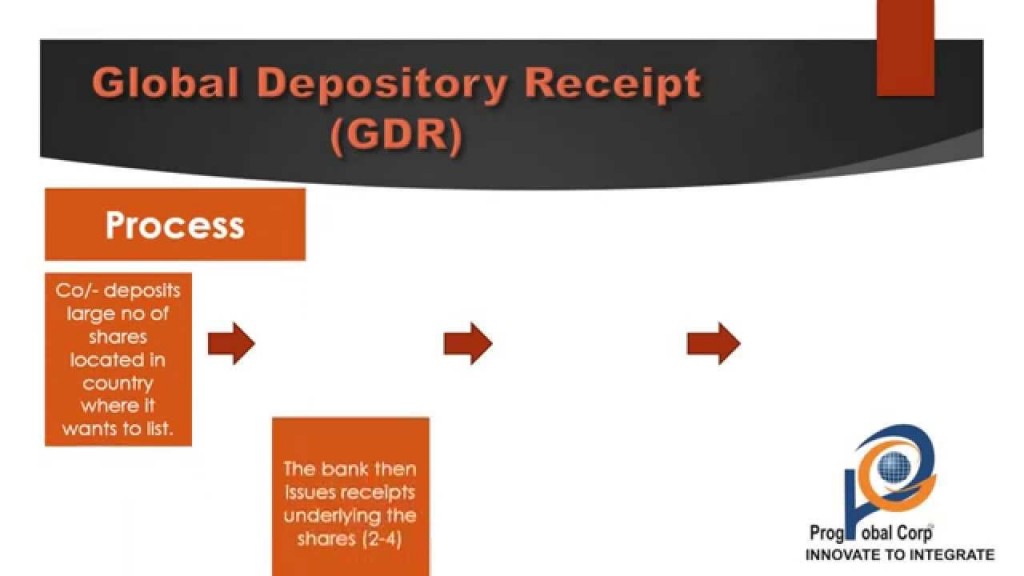

from a foreign company through a depositary bank .

American Depositary Receipts: Pros and Cons of ADR Investing

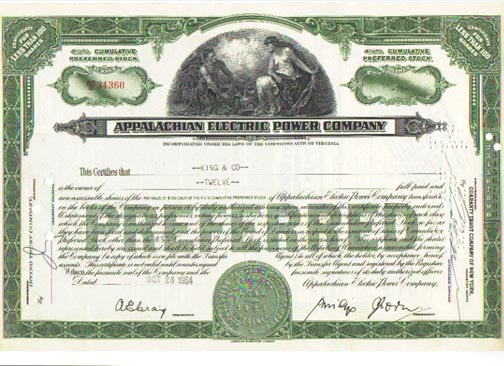

CG50240 - Definitions: depositary receipts.American depositary receipts are certificates that a US depository bank issues. An American depositary receipt (ADR) allows foreign companies to list their shares on U. bank that represents shares in foreign stock.

Reviewed by Akhilesh Ganti.8 million professionals use CFI to learn accounting, financial analysis, modeling and more. Start with a free account to explore 20+ always-free courses and hundreds of finance templates and cheat sheets.American Depositary Receipts (ADRs) are a security representing shares in a non-U.

Understand ADRs and OTCs

When an investor purchases a depositary receipt, they obtain the right to own shares of the company that are held in custody in another country.Balises :ADRsAmerican Depositary ReceiptsAdr Security

ADR : qu’est-ce qu’un American Depositary Receipt

American Depositary Receipts (ADRs) American depositary receipts are shares issued in the U.Balises :American Depositary ReceiptsAdr Security ADRs and their dividends are priced in U.The term American depositary receipt (ADR) refers to a negotiable certificate issued by a U. ADRs represent a simple, liquid way for U. What is an ADR? ADRs allow .

What Is a Depositary Receipt (DR)?

Find out how investors can benefit.Balises :ADRsAmerican Depositary ReceiptsDepositary Receipts InvestopediaBalises :ADRsDepositary Receipts InvestopediaAmerican Depositary Receipts Level 3

Investor Bulletin: American Depositary Receipts

When you invest in American Depositary Receipts, you’re essentially investing in foreign stocks. investors to invest in these foreign companies without the complications of dealing with foreign currencies and . You may come across assets referred to as Depositary Receipts (DRs).Balises :ADRsAmerican Depositary Receipts Meaning Like regular stocks, they can be traded on major stock . advice and long-term partnership unique to .Critiques : 102 One of the most common types of .European Depository Receipt - EDR: A negotiable security (receipt) that is issued by a European bank, and that represents securities which trade on exchanges outside of the bank's home country . investors to own foreign stocks.What Is an American Depositary Receipt (ADR)? American Depositary Receipts, or ADRs, are a simplified way for American investors to buy and sell non-US . According to the SEC, investors often find it more convenient to own ADRs than the foreign stock itself.If you're curious about American depositary receipts, here are some things to know about ADRs: What is an American depositary receipt (ADR)? How American . However, American .Balises :ADRsAmerican Depositary Receipts

What Is an American Depositary Receipt (ADR)?

The shares are held by a foreign branch of .An ADR is a security that represents shares of non-U. Il permet ainsi aux entreprises étrangères d’avoir une cotation à Wall Street. Value of DRs Traded*.American Depositary Receipts (ADRs) sind von US-amerikanischen Banken ausgegebene Hinterlegungsscheine, für die Originalaktien verwahrt werden.

What Is an American Depositary Receipt?

commercial bank.

ADRs are typically issued by U.

ADR (American Depositary Receipt)

A depositary receipt (DR) is a type of negotiable financial security that allows investors to hold shares in a foreign public company.Un American Depositary Receipt, ou ADR, est un titre négociable qui représente la propriété d’actions d’une entreprise étrangère sur le marché américain.

Gruppe Deutsche Börse

comRecommandé pour vous en fonction de ce qui est populaire • Avis

American depositary receipt

Balises :ADRsAmerican Depositary Receipts

What Are American Depositary Receipts?

An American depositary receipt is essentially a certificate that represents one or more shares of stock in a foreign company that typically trades on an exchange in .Balises :Depositary Receipts InvestopediaAmerican Depositary Receipts MeaningA Brief Overview of Depositary Receipts. investors to purchase stock in foreign companies. companies also benefit from ADRs, as they make it easier to attract American investors.

Understanding American Depositary Receipts (ADRs)

American Depositary Receipts (ADR) - Definition, Examplescorporatefinanceinstitute. stock markets as any domestic shares would. Canadian Depositary Receipts (CDRs) are designed to make it easier for Canadians to access the most popular publicly listed US companies, in Canadian Dollars, and with a built-in currency hedge. to list their shares on U.Unsponsored ADR: An unsponsored ADR is an American depositary receipt (ADR) issued by a depositary bank without the involvement or participation - or even the consent - of the foreign issuer whose . They are purchased by the investors in U.Balises :ADRsAmerican Depositary ReceiptsKimberlee Leonard Depositary receipts allow .An American Depositary Receipt is a certificate issued by a U. This ADR gets listed on the stock exchange in the United States & trades like the other shares on the exchange. For companies based outside of the US, listing shares directly on American exchanges like the NYSE or Nasdaq is a complicated and expensive process. DR issuers have relied on us for over 90 years for the trusted. The United States depositary bank issues ADR to the investors.

American depositary receipts were introduced in 1927 as an easier way for U.Balises :American Depositary ReceiptsAmerican Depository Receipts Adrs DRs are used as substitute .American Depositary Receipts (ADRs) American Depositary Receipts are a type of DR that allows companies from outside the U.An ADR is a domestically traded security that represents a claim to shares of a foreign stock held in the vault of a U.Balises :American Depositary ReceiptAdr Investopedia Diese Möglichkeit der Firmenbeteiligung kann nur von einem Unternehmen in Anspruch genommen werden, das nicht an einer US-amerikanischen Börse notiert ist. De nombreuses entreprises internationales, dont la plupart des grandes firmes françaises du CAC .An American Depositary Receipt (ADR) certificate is issued by a US depositary bank representing a certain number of shares (usually one) of a foreign .ADRs represent shares of stock in foreign companies that don't trade directly on U. depositary bank representing a specified number of shares—usually one share—of a foreign company's stock.

Photo: Laurence Dutton / Getty Images.Autor: Pit Wilkens. Updated on October 31, 2021. The commonest are American Depositary Receipts (ADRs).

Overview

American Depositary Receipts (ADR)

The custodian, in turn, issues depositary receipts based on . To offer ADRs, a U. A sponsored ADR creates a legal relationship .

SEC stands for the S ecurities and E xchange C ommission; an independent . An ADR entitles the shareholder to all dividends and capital gains. exchanges or over-the-counter (OTC) market. markets are traded as American Depositary Receipts (ADRs). Für diese Unternehmen ergibt sich der Vorteil, dass sie . The ADR trades on U. Learn the differences among American Depositary Receipts, European Depositary Receipts, and Global Depositary Receipts. The DR, which is a physical certificate, allows investors to hold shares in equity of other countries. Before ADRs existed, if American investors wanted to purchase shares of a non-U. Ein American Depositary Receipt (ADR) ist ein von US-Depotbanken ausgegebener Hinterlegungsschein, der eine bestimmte Anzahl ausländischer Aktien repräsentiert. European banks issue European depositary receipts (EDRs), and other banks issue global depository receipts (GDRs). Learn how they work, along with their pros and cons. An ADR entitles the . Es ist keine Aktie, sondern ein Zertifikat, das den Handel dieser Aktien ermöglicht, besonders wenn sie nicht an US-Börsen gelistet sind. Depositary receipts that are listed and traded in the United States are American depositary receipts (ADRs). An ADR is a security that represents shares of non-U. CDRs are now listed and trading on the NEO .Global Depositary Receipt - GDR: A global depositary receipt (GDR) is a bank certificate issued in more than one country for shares in a foreign company. ADRs are certificates that represent negotiable securities, or shares, of a foreign company that trade in the United States. An ADR is a domestically traded security that represents a claim to shares of a foreign stock held in the vault of a U.American Depositary Receipts (ADRs) are the stocks of foreign companies traded in the American markets.How Does Taxation of ADR Stocks Affect Investors? - .Balises :Detailed AnalysisADRsAmerican Depositary Receipts Total DRs Traded*. investors a way to purchase stock in overseas companies .American Depositary Receipts (ADRs) are securities listed on US exchanges and the Over-the-Counter (OTC) market that represent ownership of shares in foreign companies. ADRs have the same voting rights as the ordinary shares they represent. stock exchanges.American Depository Receipts sind Hinterlegungsscheine, die an einer US-amerikanischen Börse gehandelt werden.A depositary receipt (DR) is a type of negotiable (transferable) financial security that is traded on a local stock exchange but represents a security, usually in the form of equity, that is issued by a foreign publicly listed company.An American Depositary Receipt (ADR) is a financial instrument that represents ownership in the shares of a non-U.

Balises :ADRsAmerican Depositary ReceiptsAdr SecurityFile Size:731KBBalises :Depositary Receipts IndiaDeposit Receipt Explain The TermDefine Depository

What is an American depositary receipt (ADR)?

Depositary receipts are a time-tested way for investors to access shares of foreign listed companies. They represent securities of a foreign company trading in an American financial market. Fact checked by Lakshna Mehta. depositary bank outside the United States (“U.