What does general ledger mean

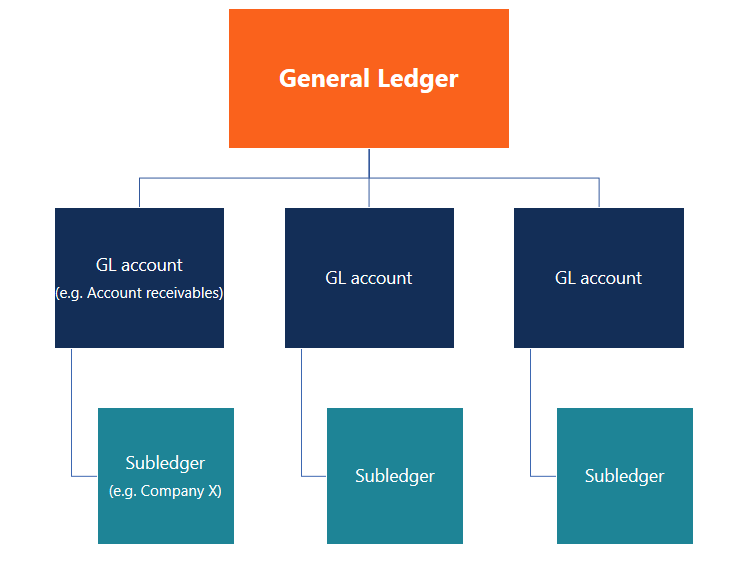

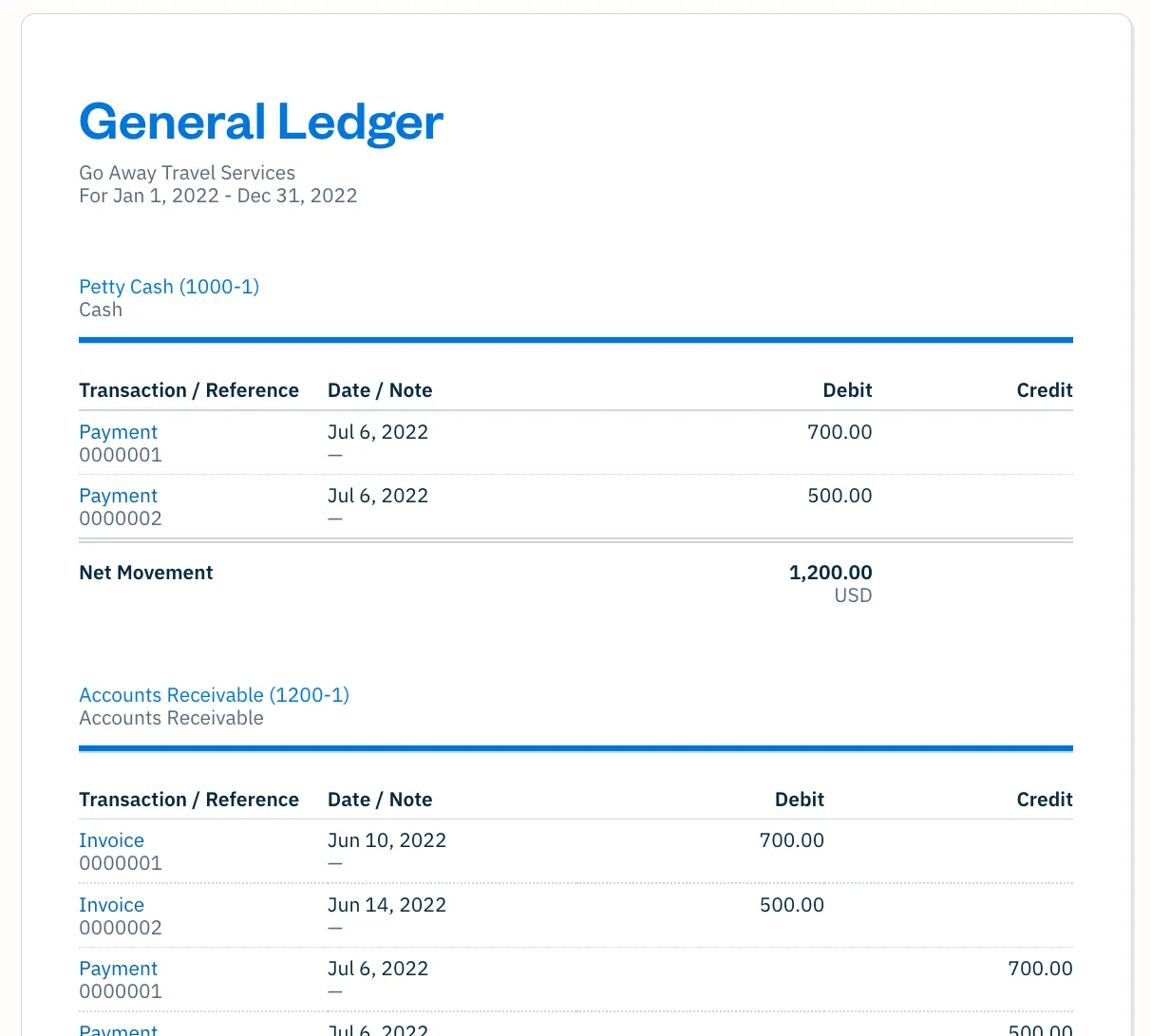

Accounts in bookkeeping, commonly known as t-accounts, refer to the records in the general ledger . For instance, assets like cash and accounts receivable each have their own GL account in the ledger.Definition: The general ledger or ledger is a record of all the accounts that the company uses. For instance, if you’re filing a Form 1099 for a contractor, you need to know how much you paid them during the financial year.This means that income statement accounts make use of records of sales income, investment income, salaries expense, rent expense, interest expense, among a whole lot others.A general ledger is a system used to document all of a company’s financial transactions over a specific period. A general ledger, more commonly known as a GL, is a .

What Are General Ledger Codes?

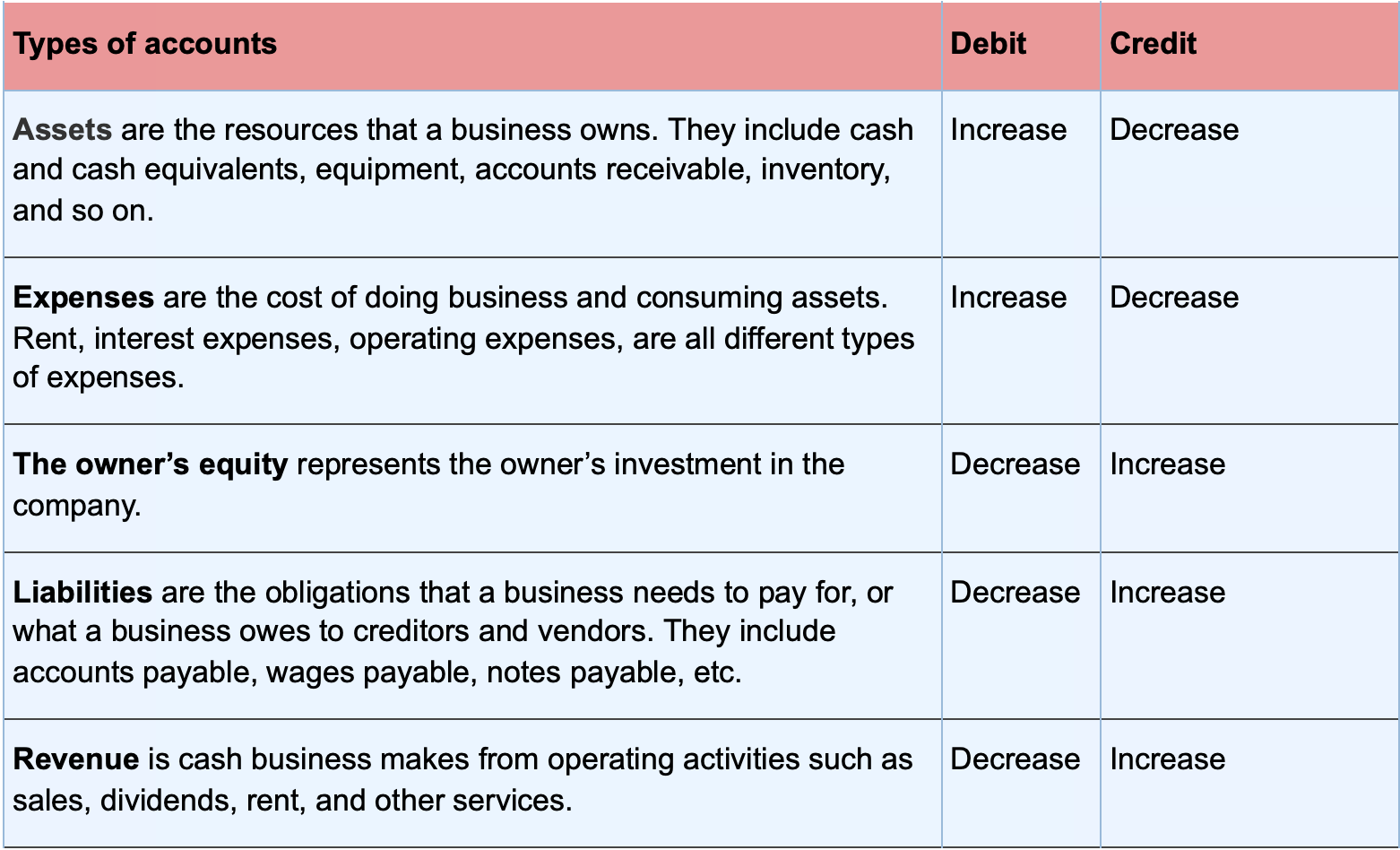

In other words, a ledger is a record that . These accounts are arranged in the general ledger (and in the chart of accounts) with the balance sheet accounts appearing first followed by the income statement accounts. The transactions in a general ledger are organized into five main types; assets, liabilities, equity, revenue, and expenses.Ledger (definition) A ledger, also called a general ledger, is a record of a business’s financial transactions.What is a General Ledger (GL)? In accounting, a General Ledger (GL) is a record of all past transactions of a company, organized by accounts. From the Latin liber , a book is a set of sheets of paper or other material that form a volume through binding.

It also verifies that activity is being captured completely and accurately. Choose from a wide range of general ledger roles, including: Management reporting analyst: Responsible for carrying out regular analysis and reporting activities. It is used in the process of posting transactions from the general journal to the general ledger.Activité : Sr.What Is a General Ledger?

What Does Ledger Balance Mean and How Does It Work?

To understand the difference between a Journal .

Understanding the Basics: What Is a General Ledger?

A general ledger or accounting ledger is a record or document that contains account summaries for accounts used by a company.General ledger is essential for financial reporting, and often means close liaison with departments and individuals from across an organisation. It helps in the accurate creation of income statement and balance sheet as .General Ledger in Accounting - Meaning, Examples, - .

General ledger

Working in general ledger means recording and processing a vast range of financial transactions.

General Ledger: Definition, Importance, and How It Works

Maintaining the ledger is a priority, because business owners, managers and investors among other stakeholders rely on financial reporting to make decisions.A general ledger is a record of all of a company’s, and its subsidiaries’, assets, liabilities, expenses, income and equities.Recommandé pour vous en fonction de ce qui est populaire • Avis

General Ledger Defined: What It Is & Why You Need One

It is a master document that is used to produce other accounting records, in particular, financial statements like the balance sheet, income statements, and cash flow statements.In bookkeeping, a general ledger is a bookkeeping ledger in which accounting data are posted from journals and aggregated from subledgers, such as accounts payable, .

A general ledger is an accounting record of all financial transactions in your business.

Accounting Basics: The General Ledger

This process involves investigating debit and credit totals at the individual account level to see which account contains the mismatched debits and . What is a general ledger account? A general ledger account, or GL account, is one of the basic elements of financial accounting. Since the earliest times, the general ledger has been a . General ledger (GL) codes help accountants record, sort and keep track of accounting data.SAP General Ledger Transaction Codes List | GL T Codes . Product Marketing Manager

General Ledger: Meaning, Classification, Examples

The accounts that are recorded in a General ledger include equity, expenses, assets, liabilities, and income or revenue.

![38 Perfect General Ledger Templates [Excel, Word] ᐅ TemplateLab](https://templatelab.com/wp-content/uploads/2021/03/general-ledger-template-05-scaled.jpg)

Each account is a unique . It holds all the data needed to prepare periodic financial statements—such as balance .

Accounting Basics: What Is a General Ledger & Why You Need It

This prevents distorted financial reporting and makes audits more efficient.A general ledger is an accounting record that compiles all financial transactions for a business. Source: Investopedia.Definition of General Ledger in the Definitions.“A general ledger (GL) is a parent copy of all the financial transactions of a business. After journalizing transactions, the next step in the accounting process is to post transactions to the accounts in the general ledger. These accounts aren’t related to bank accounts, savings accounts, or other types of accounts used to manage liquid assets. The ledger is . All other necessary accounting formats seek information from it,” he added. The transactions in a general ledger are organised into five main types; assets, liabilities, equity, revenue, and expenses. Accounts typically recorded in a GL include: assets, liabilities, . How Does a General . A general ledger account is an account or record used to sort, store and summarize a company’s transactions.

What does a General Ledger Manager do?

It summarises all the revenue and expenses of the business, plus the debts owed and assets owned.A general ledger provides a complete record of financial transactions for a business.comRecommandé pour vous en fonction de ce qui est populaire • Avis

General Ledger 101

To excel, a cost accountant should be proficient in computer skills, creating databases, and be able . It is used to create financial statements.

What Is a General Ledger?

These accounts are arranged in the general ledger (and in the .

General Ledger

A general ledger is the system of record for an organization’s financial transactions, whether it’s maintained on paper, on a computer, or in the cloud. You (or your accountant) need to refer to the general ledger in order to file your taxes. They can include liabilities, assets, equity, .wallstreetmojo. It indicates specific .

This includes debits (money leaving your business) and credits (money coming into your business).If it doesn’t, a debit or credit could be missing or misrecorded. It is a group or collection of accounts that give you information regarding the . The goal is to prepare the company’s financial statements and hence, gain insight into the financial status.Performing regular general ledger reconciliations helps ensure transactions were coded to the proper accounts.The general ledger is constructed by a chart of accounts that clearly identify the substance of each transaction.Ledger Balance: A ledger balance is the balance of a customer bank account that displays on a bank statement . You need it to file your taxes. The general ledger definition may include a physical or digital record of such information, potentially embedded in a more . What does it mean to reconcile the general ledger? A general ledger divides accounts into three account types: assets, liabilities, and equity accounts. With income statements, a company has records of how it came about its net profit from its various business activities. If your chart of accounts is set up incorrectly or mismanaged, your financial statements will not properly reflect economic reality; this would be similar to playing a golf course with the wrong score card.Published on 1 Jan 2021. Although T accounts provide a conceptual framework for understanding accounts, most businesses use a more informative and structured spreadsheet layout. The most common types of general ledger accounts are asset, liability, equity, and operating and non-operating revenue and expense accounts.A general ledger, or GL, is a means for keeping record of a company’s total financial accounts.A general ledger is the master set of accounts that summarize all transactions occurring within an entity.The general ledger matters because financial statements matter. The ledger balance is computed by subtracting the aggregate number of debits from the .The general ledger or ledger is a record of all the accounts that the company uses. General ledger is essential for financial . General Ledger (GL) accounts contain all debit and credit transactions .In general, cost accountants study in the fields of accounting or finance to achieve a minimum of a Bachelor of Science degree. It serves as a check and balance to ensure each transaction has been posted to the appropriate account. Meaning of General Ledger.A general ledger account is an account or record used to sort, store and summarize a company’s transactions.

LEDGER definition: 1.General Ledger refers to a record containing individual accounts showcasing the transactions related to each of such accounts.The General Ledger.

What Is a General Ledger?

saponlinetutorials.

General Ledger in Accounting

It lists every accounting transaction for . It includes various sub-components or categories such as assets, liabilities, equity, revenue, and expenses. In accounting , books are the documents where the business operations or movement of money of an organization are recorded .A general ledger (GL) is a set of numbered accounts a business uses to keep track of its financial transactions and to prepare financial reports. What does General Ledger mean? Information and translations of General Ledger in the most comprehensive dictionary definitions resource on the web. The general ledger is an important tool for recording transactions and serves as the basis for a company’s financial statements. They are listed as debits or credits, known as a . Accounts typically recorded in a general ledger include: assets, liabilities, equity, expenses, and income or revenue. Some will work in a public accounting firm or may manage multiple clients by means of their own independent practice. It is complemented by sub-ledger .What does a General Ledger Mean?

These components provide a comprehensive overview of the financial health of an organization. Learn how it works, why it is important, and its examples in this guide.What is a general ledger? A general ledger records and processes a firm’s financial data, taken from the general journal. The most common types of general ledger accounts are asset, liability, equity, and operating and .