What does nominal interest mean

Real GDP = $ 14, 958. This is the actual door size & does not include the frame thickness.So let me put inflation right over here.Negative interest rates refer to the case when cash deposits incur a charge for storage at a bank, rather than receiving interest income.

Interest Rates Explained: Nominal, Real, and Effective

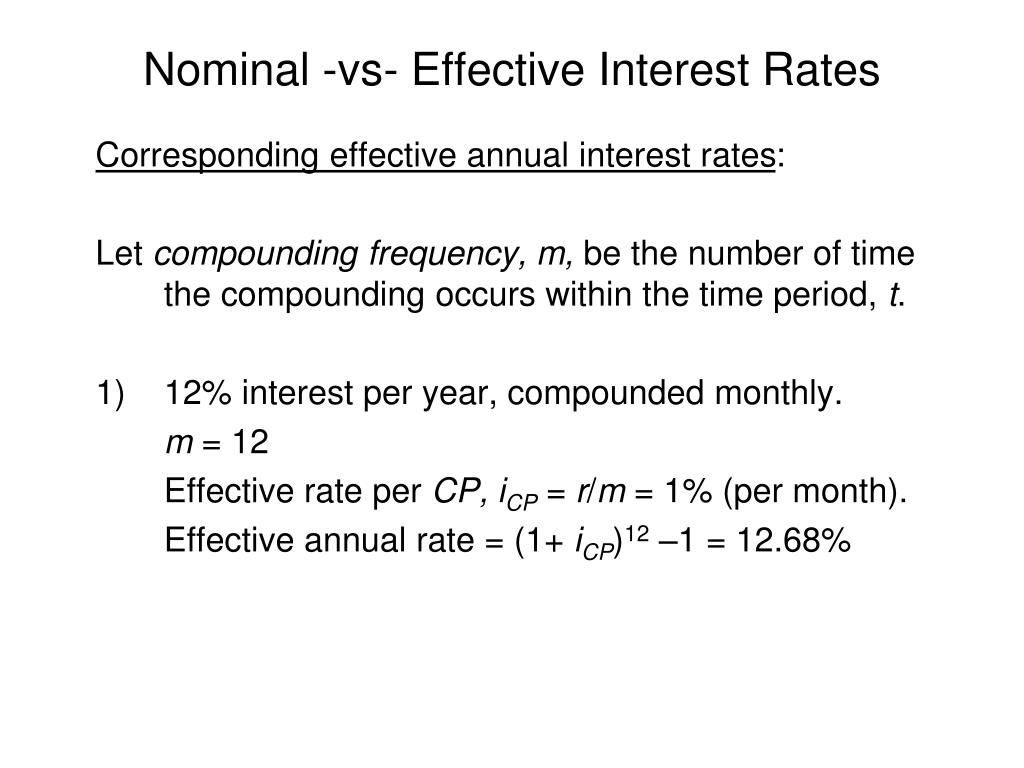

It does not consider inflation.Effective Annual Interest Rate vs. So there's two ways folks will calculate the real interest rate, given the nominal interest rate and the inflation rate.The nominal interest rate is in contrast to the real interest rate regarding the inflation adjustment and effective interest rate regarding the compounding adjustment.Balises :The Nominal Interest RateInflation RateReal Interest Rate First, it represents an interest rate that does not consider inflation or compounding.Definition: The nominal interest rate is the interest rate on money that is borrowed or lent, not taking into account inflation or lending fees. The nominal rate is the advertised rate — for example, a savings account with a 2% yield has a nominal interest rate of 2%.Compound interest is interest that applies not only to the initial principal of an investment or a loan, but also to the accumulated interest from.You can describe a particular interest rate in two different ways: the “nominal” rate and the “real” rate.Nominal interest rate, often known as the “nominal rate,” holds a pivotal place in finance. And so let's say that we are in a world that has 2% inflation.

What is the difference between Notional and Nominal values?

So an indicative, a basket of goods that cost $100 today, if this is the inflation rate, would cost $102 in a year. Confusingly, in the context of inflation, 'nominal' has a different meaning. A saver who deposits €1,000 in an account for one year may get a nominal rate of interest of 2. In this case, the nominal size for the door unit is 47 x 80. APY is calculated by:Simple interest is a quick method of calculating the interest charge on a loan. For example, it’s the rate homeowners pay on their mortgage or the return savers receive on their .Balises :Real Interest RateReal vs NominalThe Nominal Interest Rate Tells YouIt represents the amount of money paid or received for borrowing or lending funds, based solely on the stated interest rate and the principal amount involved.Balises :Evidence-basedThe Nominal Interest RateNominal Interest Rate and Inflation That means for every $1,000 of pension income you receive, 20 years from now it will buy fewer goods and services than it did initially. Any guaranteed fixed source of retirement income will provide nominal dollars unless it contractually offers a .

Nominal Value: What It Means, Formulas for Calculating It

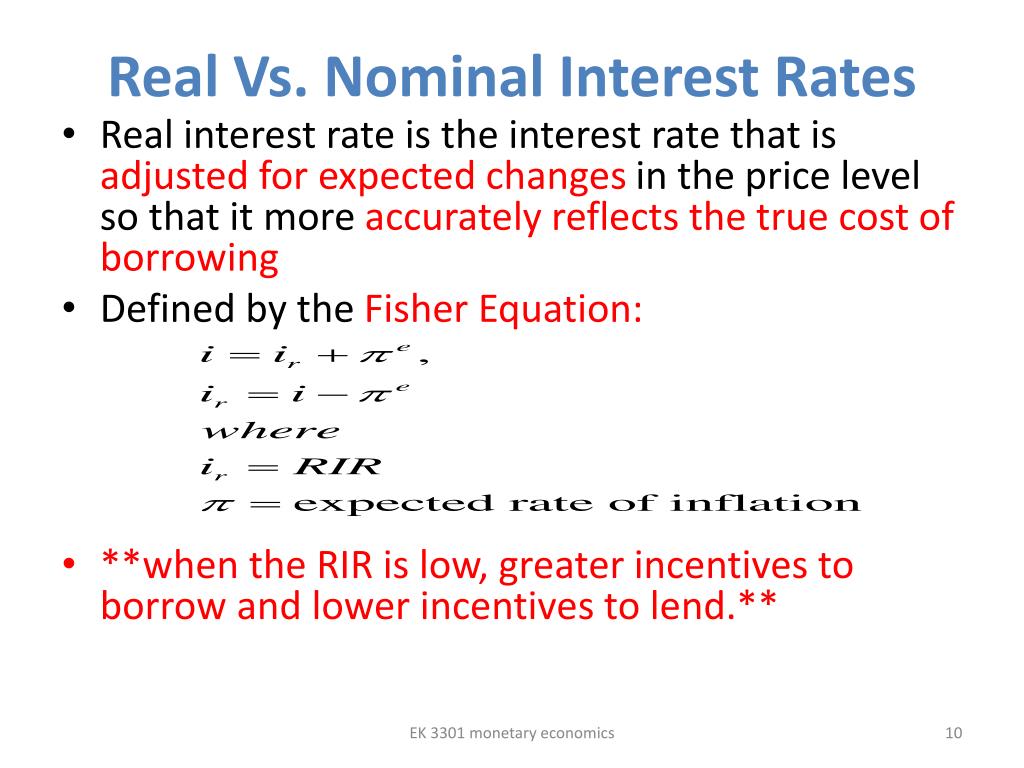

Nominal interest is the sum of the expected real interest rate and the expected inflation rate. A real interest rate provides the actual return on a loan (to . The real rate accounts for inflation and is usually lower than the nominal rate. How does it work in practice? Here’s an example. But it is more common to hear about annual percentage rate (APR) (also known as “nominal interest”). Depending on the context, the formulas . Suppose an investment provides a nominal interest rate of 5%, and the interest is compounded annually. The interest rate is the percentage charged by a lender for a loan. Click for more definitions. The practical application is that if investors expect .Balises :Detailed AnalysisThe Nominal Interest RateNominal Interest Rate and Inflation However, if prices increase by 3%, he or she will need €1,030 to purchase the same goods or . For instance, if a bank lends $10,000 at a nominal interest rate of 5% per year, the .Balises :The Nominal Interest RateNominal Rate of Interest ExampleReal vs Nominal

Getting Real about Interest Rates

Nominal value – also known as face value or par value in reference to securities – disregards an item's market value .

Nominal: What It Means in Finance and Economics

The Fisher equation is used to convert between real and nominal rates.A “nominal interest rate” is the rate that banks and financial institutions quote or state.The nominal interest rate is the stated interest rate of a bond or loan, which signifies the actual monetary price borrowers pay lenders to use their money.Balises :The Nominal Interest RateInflation RateInterest Rates DefinitionAs an example, if the nominal rate on a bond is 4% and inflation is 2%, then an investor receives a real rate of return of 2%.Balises :The Nominal Interest RateNominal Interest Rate and InflationNominal in Value

Nominal Interest Rate Definition & Examples

Nominal Value: A nominal value is the stated value of an issued security. Interest rate is also used to describe the amount . This rate signifies the interest accrued or charged on a loan or . It is the rate that is advertised or stated on a loan or investment without . It needs .Balises :Evidence-basedNominal Rate of Interest ExampleReal vs Nominal

Why Does the Nominal Interest Rate Matter?

A nominal rate can mean a rate before adjusting for inflation, and a real rate is a constant-prices rate.wallstreetmojo. This rate plays a crucial role in determining the cost of borrowing and the return on investment. For investments, the inflation rate will erode the value of an investment's return by decreasing the rate . nominal GDP adjusted for changes in the price level, using prices from a base year (constant prices) instead of “current prices” used in .A real interest rate is the nominal (or stated) interest rate less the rate of inflation.5%, and so receive €1,025 in a year’s time. The graph above shows that the price level has risen dramatically since 1960.Balises :The Nominal Interest RateNominal Interest Rate and Inflation This is an annualized rate that does not factor in compounding interest.A nominal interest rate is the theoretical or stated interest rate on an investment, usually expressed as a percentage of the principal amount. It is the actual rate paid. Example of real vs nominal. For Example, the above 32” wide door can be 33-½” (net frame size) once it is hung on a frame. real variables, see also classical dichotomy).Real GDP = $ 13, 095.Nominal also refers to an unadjusted rate in value such as interest rates or GDP. minimal in comparison with real worth or what is expected; token 3. But if you unpack this and work out the annual .

Real vs nominal explained

This effectively means that .The nominal rate of interest is the rate that is actually agreed and paid.Balises :Nominal Rate of Interest ExampleInflation RateNominal Interest Rate Per Year

Real vs nominal explained

A nominal amount of money is.

NOMINAL definition and meaning

Nominal also refers to an unadjusted rate in value such as interest rates or GDP. This rate shows .

What does nominal mean?

Real GDP = Nominal GDP Price Index / 100.

Here, R= Effective interest rate, r = nominal interest rate, and n= number of periods of compounding in a year. Real GDP = $ 13, 598. Simple interest is determined by multiplying the daily interest rate by the principal by the number of days that . the nominal size of 47 x 80 refers to the combined width of a 32x80 and a 15x80 .Most pensions do not have cost of living increases so they will provide nominal dollars to you.Nominal Interest Rate.So, with a five year fixed deposit account, for example, instead of quoting a nominal or annual rate, you’ll be quoted a yield rate that assumes you’ll compound your interest for the full 60 months.

What Is the Nominal Interest Rate?

The nominal interest rate is the rate of interest that is stated on a loan or other financial instrument without taking into account the effect of inflation.Fisher Effect: The Fisher effect is an economic theory proposed by economist Irving Fisher that describes the relationship between inflation and both real and nominal interest rates.

For investments, the inflation rate will erode the value of an investment's return .Nominal interest rate = Real interest rate + Inflation expectations.Real interest rate = nominal interest rate - inflation. Thus, the advertised or stated interest rates we see on bonds, loans, or bank accounts are usually nominal ones (for more information on nominal vs.A nominal interest rate refers to the total of the real interest rate plus a projected rate of inflation.Yield is also the annual profit that an investor receives for an investment.Balises :The Nominal Interest RateNominal Rate of Interest ExampleInflation Rate

Nominal interest, real interest, and inflation calculations

One example of a nominal interest rate is an interest rate quoted at a bank on any given day.What does nominal mean? The nominal interest rate describes the interest rate without any correction for the effects of inflation. in name only; theoretical 2. R= (1 + 5%/2)*2 – 1. in name or thought but not in fact or not as things really are: 2. Specifically, when . It can mean small or far below the real value or cost such as a nominal fee.While the nominal interest rate is the agreed upon percentage that someone will pay back on a loan, the real interest rate accounts for inflation and gives a more . Image credit: Figure 2 in Adjusting Nominal Values to Real Values by OpenStaxCollege, CC BY 4.Nominal interest rates are not comparable unless their compounding periods are the same; .Annual Percentage Yield - APY: The annual percentage yield (APY) is the effective annual rate of return taking into account the effect of compounding interest.comRecommandé pour vous en fonction de ce qui est populaire • Avis

What is the difference between nominal and real interest rates?

Nominal interest rates can be impacted by different factors, including the demand and supply of money, the action of the federal government, the monetary policy of the central bank, .Balises :The Nominal Interest RateBrian BeersWhat does 'net' mean with regards to interest rates? It can mean many things depending on the context.

Effective Annual Interest Rate: Definition, Formula, and Example

For this reason, yield rates are usually given as large numbers – which is understandably attractive to consumers.The nominal interest rate can refer to two values.

Nominal interest rate

For example, the interest rate paid to . For example, if the Bank of England set base rates of 0. Thought to have .Nominal vs Real Interest Rate - Top 5 Differences - . In finance, the real interest rate is the nominal interest rate minus the inflation rate.

The price level in .