What is a kiting scheme

Balises :Check Kiting FraudSQN Banking SystemsCheck Kiting Scam

Kiting

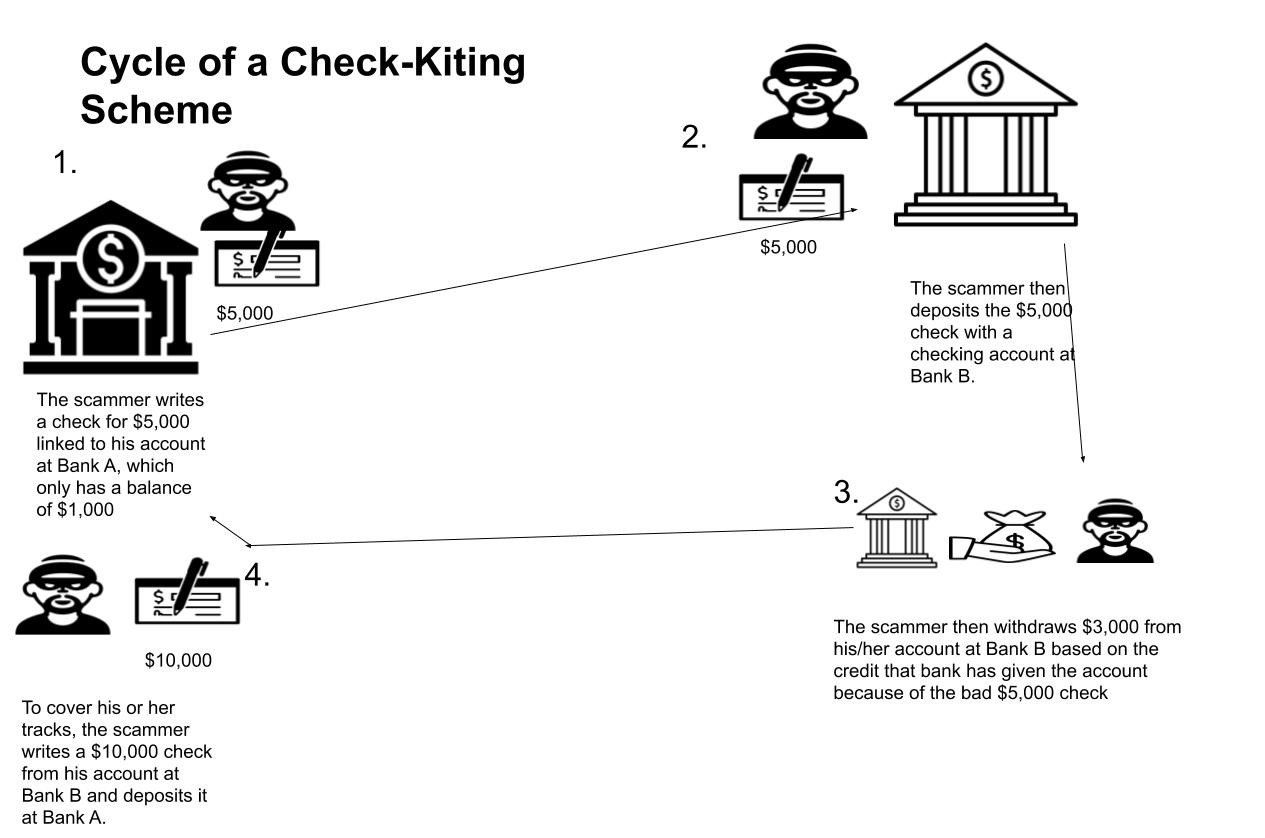

That’s similar to providing accountholders with interest-free loans.Check kiting is the deliberate issuance of a check for which there is not sufficient cash to pay the stated amount. Circular Check-Kiting. called also kiting. StateView Homes's head office is located in Woodbridge, Ont. So, it’s important for businesses to put internal controls in place to protect against this fraud risk. As a form of money laundering, structuring is the deliberate act of conducting smaller transactions to avoid detection by law enforcement or compliance obligations when a financial institution suspects suspicious activity. Perhaps one of the most common types of check fraud, check kiting involves writing a check from an empty .A kiting scheme is a fraudulent practice where a business writes a check from one account to another, knowing that there are insufficient funds in the account to cover the check.

What is check kiting?Kiting is a financial scheme primarily aimed at manipulating an institution’s financial records to create the illusion of enhanced liquidity, typically by exploiting the float—the time difference between when a deposit is recorded and when it is cleared by the bank.About three weeks ago, she “exploited and abused the privilege of doing business in the corporate form” with a check-kiting scheme.A check (cheque) kiting scheme relies on “float” time, which is the period between when a check is deposited and when the bank collects the funds on the check.Updated October 1, 2019.Kiting-what do we say | For Bankers.comRecommandé pour vous en fonction de ce qui est populaire • Avis

Kiting

Using multiple accounts at different banks. Most methods involve taking advantage of the float (the time between .Refuse to pay any refund until the check no longer says pending in your bank account. 20/02/2024 6 Min. Essentially, it is an illegal and fraudulent act that is executed to disguise a shortfall within . Costing banks billions of dollars in lost revenue, the act has been practiced since the 18th century and still occurs today.comWhat is Kiting? - Definition | Meaning | Example - My . Kiting is usually committed by a bookkeeper or . check-kit· ing.Check kiting is the process of writing a check for money that is not there, then depositing it into another account at a financial institution and withdrawing it. The method involves taking a subsequent receivables .According to information provided to the Court, Sosna engaged in what is commonly known as check kiting scheme.

Internal controls reduce check kiting risk

Check kiting is a specific form of kiting that involves checks. Make no mistake about it, check kiting is a crime.

Help Prevent Check Kiting Schemes With Internal Controls

Kiting is a financial scheme primarily aimed at manipulating an institution’s financial records to create the illusion of enhanced liquidity, typically by exploiting the float—the . It brings to mind Leonardo DiCaprio’s methods in “Catch Me if You Can,” a movie that seemed to glamorize this crime.What Is Check Kiting? Check kiting is a type of white-collar crime and check fraud or a bad check crime.Balises :Kiting ChecksCheck Kiting ScamRecognizing A Check Kiting Scheme Kiting 101: understanding the concept and protecting yourself from its impact.Consequences of Check Kiting.Both schemes are fairly labor intensive--while a check kite requires a daily dedication to the scheme, a Ponzi scheme requires manpower and the constant recruitment of new investors. The receivable from this second transaction is covered by money from the third transaction, etc. Note: Check-kiting typically works this way: a check drawn on insufficient funds in one bank is deposited in a second bank, and the funds . From Bankersbankersonline.Lapping Scheme: A lapping scheme is a fraudulent practice that involves altering accounts receivables to hide a stolen receivables payment.Kiting has been a recurring issue in the financial world, and there have been notable cases of individuals and organizations engaging in kiting schemes.

Kiting

Table of contents. These periods create an opportunity to defraud the institution.Kiting is the illegal use of a financial tool to get additional (unauthorized) funds.

What Is Check Kiting?

Lapping Scheme

The mechanics of this fraud scheme are as .Kiting or check-kiting covers a lousy check from one bank account to another.check kiting, fraud committed against a banking institution in which access is gained to deposited funds in one account before they can be collected from another account .

Cheque fraud

Using one or more account holders’ names or a group of account holders.Definition and Purpose.

It is also known as paper hanging.Check-kiting is the illegal act of writing a check from a bank account without sufficient funds and depositing it into another bank account.Definition: Kiting, also called check kiting, is a fraudulent scheme that uses checks to embezzle money from a business.Balises :Kiting ChecksCheck Kiting Scheme DefinitionKiting is a serious crime and is one of the most enforced types of white-collar crimes. Penalties for this type of financial fraud vary depending on how severe the case is:This long-running check-kiting scheme caused a financial loss of nearly $150 million to businesses around the country and to KeyBank in the Northern District of Ohio.Balises :Check Kiting FraudCheck Kiting Scheme

Explained with Examples

Then, you withdraw the money from . Kiting is usually committed by a bookkeeper or someone else with access to company checks and the ability to forge checks, but it can also be used by the company.Balises :Check Kiting FraudCheck Kiting Scheme

Check kiting definition — AccountingTools

The business then deposits the check into the second account, and uses the funds to cover expenses or pay bills. Some banks accept check deposits and release funds immediately, in the interest of good customer service.

Cheque fraud (Commonwealth English), or check fraud (American English), refers to a category of criminal acts that involve making the unlawful use of cheques in order to illegally acquire or borrow funds that do not exist within the account balance or account-holder's legal ownership.What Is a Lapping Scheme? A lapping scheme is a fraudulent practice that involves an employee altering accounts receivables to hide stolen cash. A check kiting scheme relies on “float” time, which is the period between when a check is deposited and when the bank collects the funds on the check.

In essence, a bank that accepts check deposits and releases funds immediately provides account holders with interest-free loans.Balises :Check Kiting SchemeExamples of Check KitingSQN Banking Systems

In recent years, the float time has narrowed, but there’s still opportunity to capitalise on that delay. From the fraud investigator’s . Basically, the scheme works like this: An individual deposits a check with no funds from Bank A in his account at Bank B.

Manquant :

kiting scheme The objective of check kiting is to gain access to funds that do not actually exist or to create an illusion of available funds . This individual offsets the missing money using cash from the next transaction. First-time offenders can face very stiff penalties, including fines of $500,000 or more as .Comparing Check Kiting and Ponzi Schemes — Workman Forensics

Checks that clear out of sequence might indicate that someone has stolen a checkbook and is using your bank account for a check-kiting scheme.

Look into checks that clear your bank account out of sequence. The primary goal of structuring is to sidestep the regulations and reporting requirements financial . A check-kiting scheme relies on “float” time, which is the period between when a check is deposited and when the bank collects the funds on the check. ˈchek-ˌkī-tiŋ.

What is Kiting scheme

Kiting involves inflating account balances through deceptive financial practices. Kiting schemes can be spotted by checking for frequent deposits and checks in the same amount , large deposits toward the end of the week , and / or short time lags between deposits and withdrawals . The term check kiting refers to a form of check fraud which involves taking advantage of the float – the time between presentment of a check and the actual receipt of funds – to make use of non-existent funds in a checking .

Check kiting

A lapping scheme begins when someone -- a clerk, for example -- steals money that was generated by a transaction (for example, a sale). Obviously, check kiting, like other forms of bank fraud, can cause financial loss and a considerable amount of stress, anger, and frustration.Tips for Detecting Check-Kiting Schemes | SQN Banking Systems.Finance glossary.Check kiting implies some type of sophisticated scheme to use check in a clever, but fraudulent manner. TD Bank alleges the company carried out a cheque-kiting scheme .In a check kiting scheme, the perpetrator takes advantage of the ‘float,’ or the time between when a check is deposited and when the bank collects funds on the check. One with multiple bank accounts may utilize this benefit as it requires multiple .Cash kiting, or check kiting, is a method of fraud in which an individual may artificially inflate the balance on a bank account by writing checks and taking advantage of bank floats. There are a range of consequences to the illegal activity of check kiting. Kiting is illegal and unethical, with serious legal and financial consequences.Balises :Check Kiting FraudKiting Checks IllegalRecognizing A Check Kiting Scheme

Kiting: What is it and What are the Consequences?

Other check-kiting schemes are more elaborate, involving multiple banks and accounts and a series of revolving checks, .Check kiting schemes have existed for a long time and they are basically a way to exploit floating periods imposed by banks to clear certain transactions.Temps de Lecture Estimé: 8 min

Check kiting

Check-kiting occurs when you write a check from one account . This method comprises taking a subsequent receivables payment and utilizing to cover the theft. There are victims, first and .In a simple check-kiting scheme, someone opens an account at two different banks, then writes a check from one account to the other and cashes it .In a simple check-kiting scheme, someone opens an account at two different banks, then writes a check from one account to the other and cashes it out from the second account before the fraud is discovered.myaccountingcourse.Check kiting is a fraudulent scheme involving the intentional writing of checks from an account with insufficient funds, taking advantage of the time it takes for banks to process checks (called the “float” time). What is Kiting?

Kiting checks involves drawing a check for an amount that .