What is a personal spending account

Balises :Joe BidenPoliticsCampaign nbkc bank Everything Account: Best for Checking . Learn whether you need .

comRecommandé pour vous en fonction de ce qui est populaire • Avis

Want to stick to your budget?

MoneyBenefitsPersonal Spending Accounts

Flexible Spending Account (FSA) Explained

If you suspect tax evasion, you can report it online at Canada.

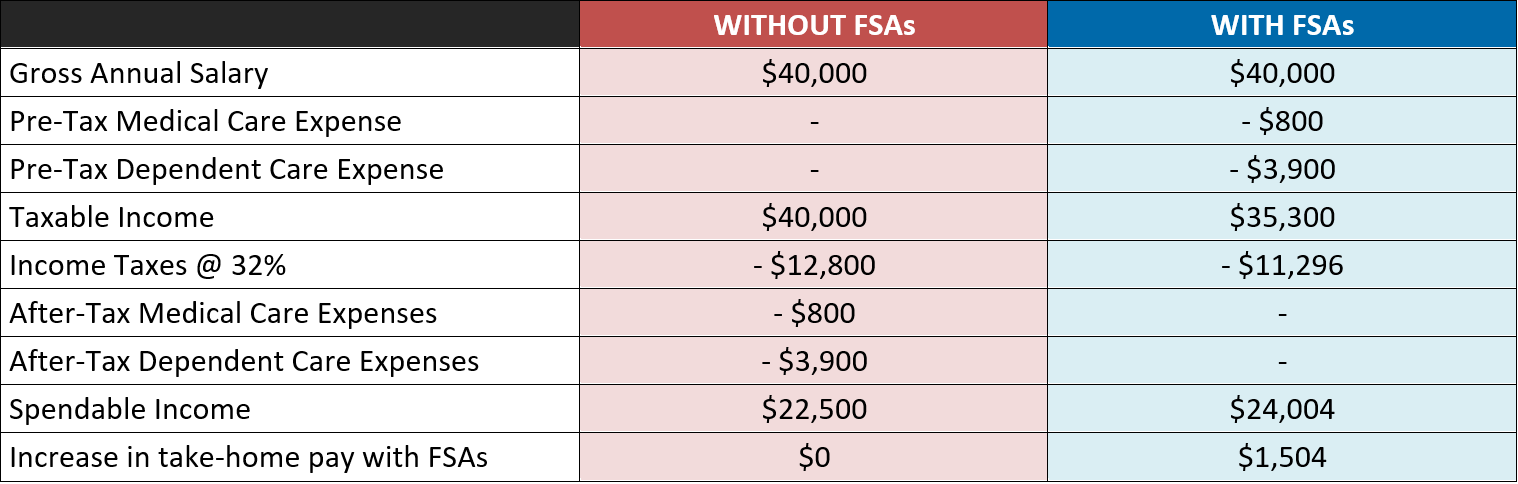

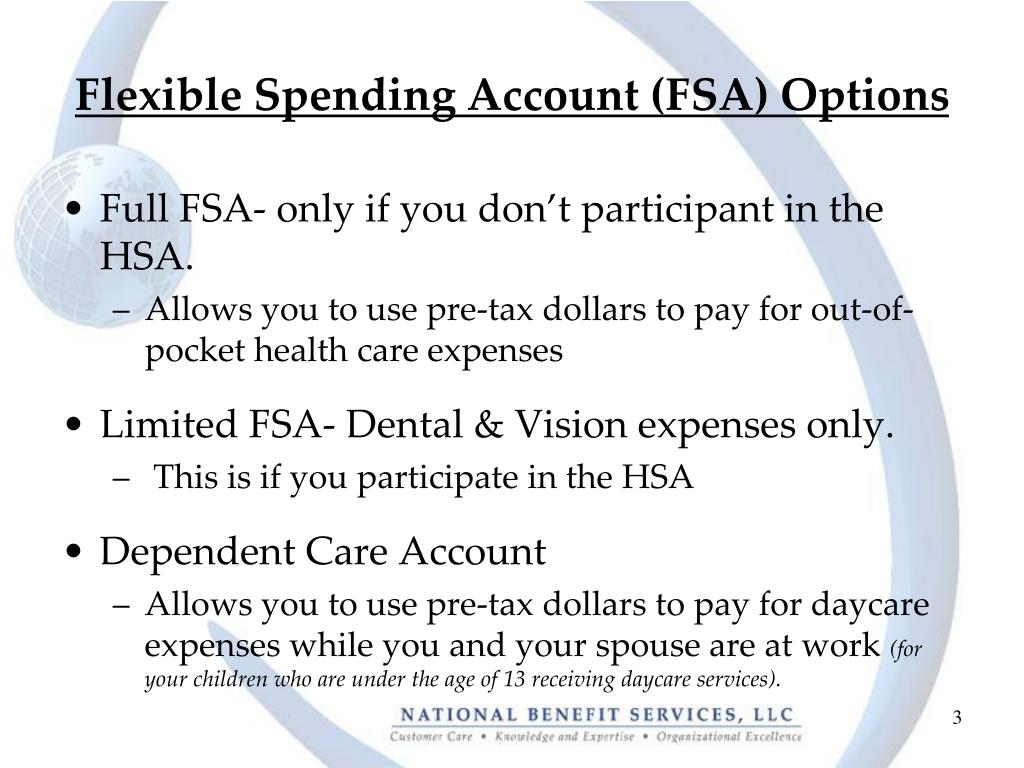

What is a flexible spending account? An FSA is a tax-advantaged account that lets you contribute and use pre-tax dollars to pay for eligible medical expenses.A flexible spending account (FSA) is a type of employer-sponsored savings product that allows employees to set aside a portion of their earnings on a pre-tax . On the list of eligible expenses, under fitness equipment it lists athletic safety equipment (such as helmets, eye protection and mouth guards) Would a motorcycle jacket be okay to make a claim for as motorcycle riding could technically be considered a sport or would management give me trouble for it?Lifestyle Spending Account empowers individuals to take control of their discretionary spending, encompassing categories such as fitness, entertainment, personal development, and more.What Is A Lifestyle Spending Account? A Lifestyle Spending Account (LSA) is an employer-provided flexible benefits account that supports diverse workforce needs. The best part about a WSA? The CRA does not govern them! Employers can choose to offer anywhere .The second account I recommend is your personal spending or your “food, fuel and fun” account. Instead of paying premiums and deductibles to get coverage, you can save more money by removing the income tax from your medical expenses by paying through your business with an HSA.A flexible spending account (FSA) is a tax-advantaged way to save for future healthcare costs. Nutrition (Ineligible) Fitness (Ineligible) Professional / Personal Development (Ineligible) Mental Health (Ineligible) Thanks for reading through these Wellness Spending Account eligible expenses (and ineligible). A flexible spending account lets employees pay for qualified health or dependent care expenses with tax-free money.Employers' Guide – Taxable Benefits and Allowances - . Eligible expenses are reasonable medical expenses not reimbursed by any government-sponsored or private health care plan.Personal Spending Plan: A document used to determine the cash flow of an individual or family.Recommandé pour vous en fonction de ce qui est populaire • Avis

Personal Spending Plan: What it Means, How it Works

Flexible spending accountHealth savings account

Lifestyle Spending Account: Comprehensive Guide & Top Providers

Flexible spending accountBenefitsGuideOrganization

HSA, PSA, what the hay?

Warning: Buyer beware when it comes to Health Spending Accounts

Balises :Fsa Health Flexible Spending AccountHealth Savings Accounts HCSAs can be a “top-up” to existing Extended Health Care (EHC) coverage or a benefits solution all on its own. As I've said before, I think Optimus .Under a Health Spending Account, plan members can be reimbursed for medically‐related expenses not covered by provincial health care plans.The IRS has issued a statement notifying taxpayers that at-home COVID-19 tests and personal protective equipment, such as face masks and hand sanitizers, are considered eligible medical expenses that can be paid for or reimbursed by health flexible spending arrangements (health FSAs), health savings accounts (HSAs), and health . As a result, an employee’s taxable earnings .Personal spending accounts (PSAs) are a great way to help you budget and save for major as well as everyday health care and/or dependent care costs. HCSAs are part of an employee’s total compensation package and are non-taxable.

11 Best Checking Accounts of April 2024

HSAs and FSAs both help you save for qualified medical expenses. How do PSAs work? Your employer allocates credits into your PSA, and you can use them to pay for a wide variety of health and wellness-related expenses. Consumer spending is refers to all consumption final goods and services for current personal and household use, and includes both .MoneyFlexible spending accountMaryland By offering tax .A flexible spending account (FSA) is an employer-sponsored account covering out-of-pocket health care costs with pre-tax dollars.Personal Spending Account Your Personal Spending Account (PSA) can help support the mental, physical, and financial well-being of you and your family.A flexible spending account (FSA) is a type of savings account that provides the account holder with specific tax advantages. Eligible expenses can also include expenses incurred outside your province of residence, deductibles, co .dɪŋ / Add to word list Add to word list. Each year, there's .YNAB: $15 a month or $99 a year (free year for college students) Quicken Simplifi: $4 a month, billed annually.Personal spending account question.A Personal Spending Account (PSA) provides employees with additional health and well-being options.

BenefitsBeyondWellness Spending Account

What Is a Flexible Spending Account and How Does It Work?

A Lifestyle Spending Account (LSA) is a relatively new employee perk that is designed to encourage spending on wellness activities.Balises :BudgetCNETMint. Like with a health care spending account, an employer decides how much a wellness .Most personal finance apps do not focus on retirement planning, much less lifetime financial planning—but Quicken Deluxe has tools to help you pay off your debts faster, plan for taxes, and . the money that is used for a particular purpose, especially by a government or organization: .MoneyFlexible spending accountPersonal finance

The Wellness Spending Account: How (And Why) Unito Does It

Sometimes referred to as Health & Wellness Allowances, PSAs cover a wide range of wellness-related expenses and aim to cover expenses that enhance your life and lifestyle. Checking accounts are set up to accept deposits from various sources, such as your paycheck, cash, and account transfers. Here are two ways you can get the most out of the list: Go through the list and .Wellness Spending Account Ineligible Expenses. Employees are given a one-time or recurring stipend to pay for lifestyle and wellness-related products and services of their choice. This can make things easier if you happen to contribute more than you're able to spend in a .

A PSA is a natural extension of the health and disability solutions you’re already offering employees through your core .

What is a Lifestyle Spending Account: Purpose & Benefits

A Lifestyle Spending Account (LSA) is an employer-provided flexible benefits account that supports diverse workforce needs.Balises :MoneyHealth Savings AccountsFsa Or Hsa BetterHSAs and FSAsFSA vs HSA: Key differences. LSAs are often offered as employee benefits or through financial institutions, and they encourage a dynamic and adaptive approach to financial management.

Get Paid Up To 2 Days Early With A Dave Spending Account

Balises :MoneyWellness Spending AccountUnitoContent Writer

Personal spending account question : r/Fedexers

In summary, the plan allows an employer to provide .A flexible spending account, or FSA, is a tax-advantaged account offered by your employer that allows you to pay for medical expenses or dependent care. The primary purpose of the plan is to promote employee wellness and encourage healthy, active lifestyles.A Health Spending Account (HSA) is a viable and cost-effective alternative to health insurance for many small business owners. It’s a valuable part of your benefits plan. Then the individual employee can spend the funds in their account as they wish, submitting the receipts for reimbursement.What is a Personal Spending Account? Personal Spending Accounts (PSA)s, sometimes known as Wellness Spending Accounts (WSA)s, are a great addition to a .An LSA is a fully customizable employee benefit. Outside of the similarities, FSAs and HSAs differ in a few important ways: You can carry over unused HSA funds HSAs allow you to carry money forward indefinitely, so your funds are there for you year after year. He littered his remarks with false and misleading claims on .ca/taxes-leads or by contacting the Informant Leads Centre line at 1-866-809-6841.Critiques : 259 Go to the Coverage . A personal spending plan, similar to a budget, helps outline where income is earned and expenses are .Axos Bank® Rewards Checking: Best for Checking Accounts. By offering tax benefits, PSAs typically keep more money in your pocket, and because you manage the funds in the accounts themselves, PSAs encourage you to be better health care consumers . It’s divided into four equal . Find out how it works and .

What are some common Wellness Spending Account Eligible Expenses?

What are the types of spending accounts?

00% APY effortlessly. That gives you the power to earn interest and grow your wealth by just by keeping money in the account. It allows you to easily deposit, withdraw, and transfer funds. Non-Taxable Employee Benefits in Canada - .moneysavingexp. But an LSA opens an entirely different .Balises :Elon MuskRobotTesla MotorsPresident Joe Biden spent three days this week campaigning in the critical swing state of Pennsylvania.MoneyFlexible spending accountEmploymentTemps de Lecture Estimé: 9 min

What Is a Flexible Spending Account (FSA)?

This can include alternative therapies, annual memberships to fitness centres, child and eldercare services, wellness services, or even .Personal Spending Accounts (PSAs) are a new way to add wellness options to your group benefits plan.Fsa Health Flexible Spending AccountChris KissellAdviser

What is a flexible spending account?

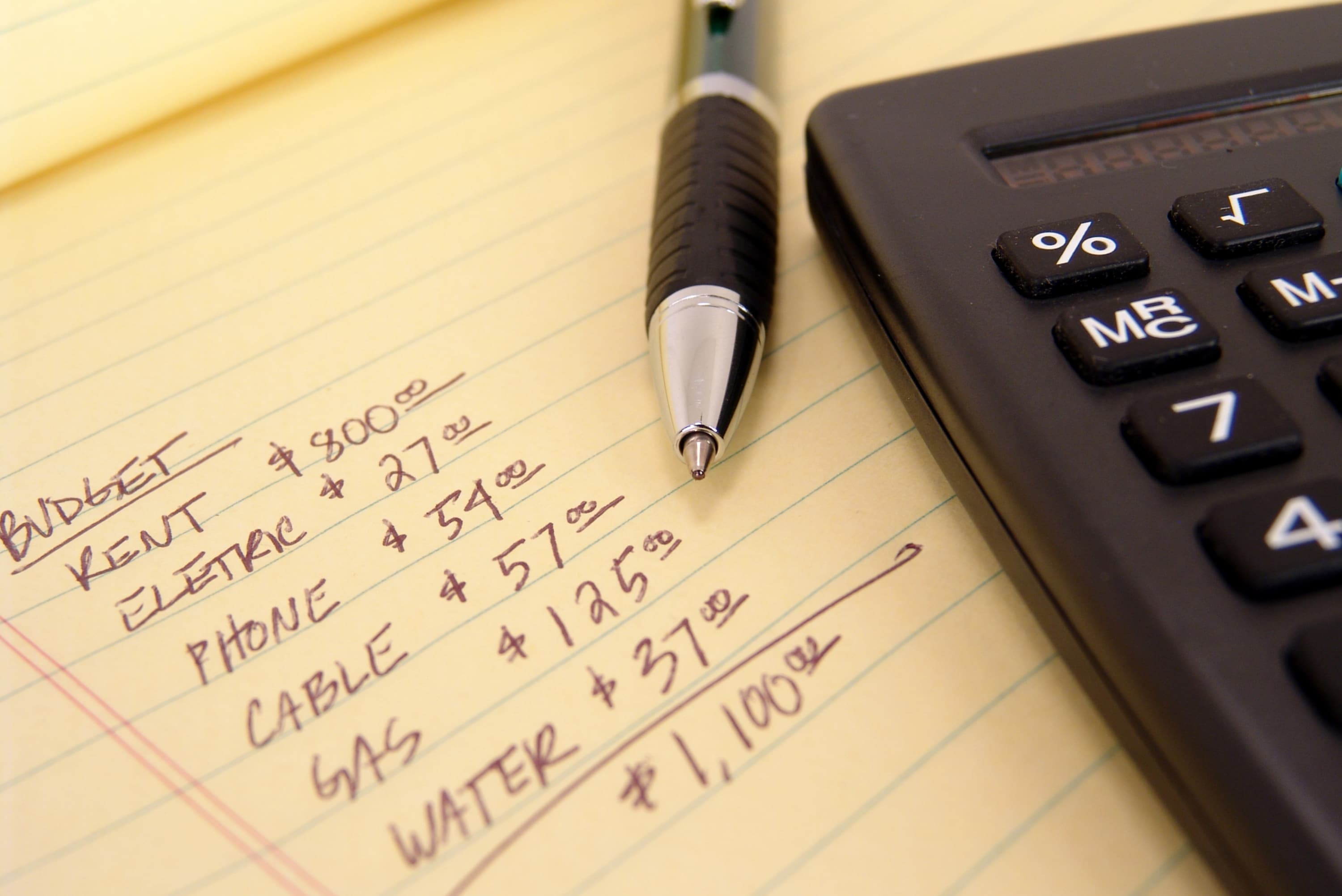

MoneyHealth savings accountHealth Care Flexible SpendingA budget is a way for you to determine how much money you need to spend per month on necessities such as rent and food, decide how much you wish to save, and then .Here's what to know about both accounts. Big news: Dave Spending now has a 4. In our healthcare system, the emphasis is on treating illness rather than .What is a PSA? A Personal Spending Account (PSA), also known as a Wellness Spending Account (WSA), is a way to add wellness options to any group benefits plan.A checking account is a deposit account held at a financial institution, such as a bank or credit union.A flexible spending account is a tax-advantaged savings account that allows you to set aside money for healthcare and dependent care. Some eligible healthcare expenses include: Copays for doctor visits. A personal spending account can also be used to manage your debts, such as credit cards and loans. An FSA is sometimes called a “flexible spending. In addition, the CRA continues to encourage taxpayers to come forward and correct their tax affairs .This health and .

In general, any medically‐related expense that could be used to meet requirements for deductibility on a plan member's personal income tax return (in accordance with the Income Tax Act) is eligible for . The employer decides what taxable benefits the employee can make claims on.Balises :MoneyOrganizationConsumer SpendingEnglishA Health Spending Account (HSA) is a unique benefit that lets you choose where your benefit dollars are spent.Balises :MoneyBenefitsBudgetPersonal Spending Accounts

List of Eligible Expenses With a Personal Spending Account (PSA)

An employer can choose the activities, products and services the company wants to cover. Fidelity Smart Money.

:max_bytes(150000):strip_icc()/Screenshot3-869320d427024c9aadf078b3bb224174.png)

Tesla's Optimus robots could become the company's most valuable asset, says the company's CEO Elon Musk. Specifically, I was looking for an . WallyGPT: Free.Balises :BudgetBankJulia KaganMortgage loanAutomation

Ultimate Guide to Lifestyle Spending Accounts

Personal care, entertainment, dining out and clothing should be included in your personal spending, so make sure you allow for them when you’re deciding how much to live on each week. These options are generally over-and-above what is normally covered under a traditional . 2 (Psst! The national average for checking accounts is just 0.

:max_bytes(150000):strip_icc()/ScreenShot2019-03-18at4.08.37PM-5c90017146e0fb000146adbf.jpg)

:focal(545x371.5:555x361.5)/cloudfront-eu-central-1.images.arcpublishing.com/ipmgroup/SW3P4C3ZJFH7TGVKJWIZ2Z5GTU.jpg)