What is a spendthrift clause

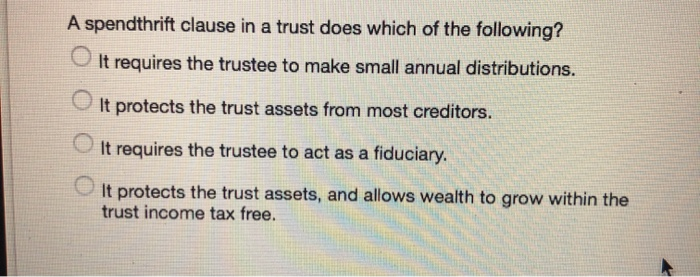

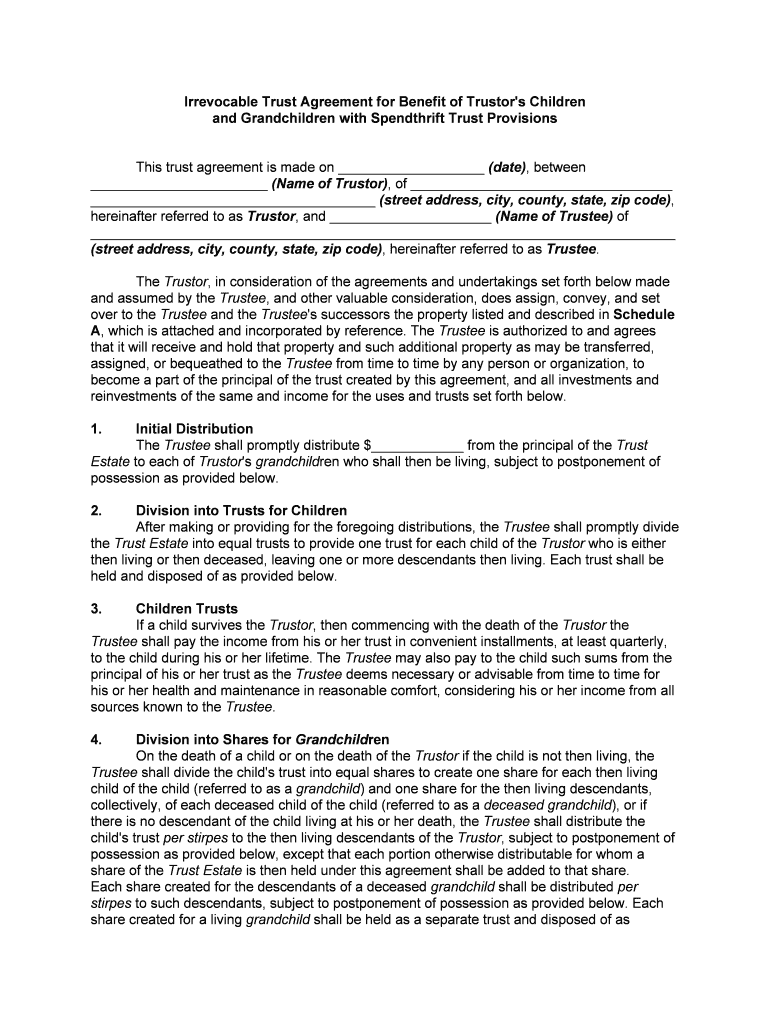

The primary purpose of spendthrift provisions is to safeguard trust assets by preventing .Spendthrift Trust.A spendthrift trust includes what’s called a spendthrift clause or spendthrift provision. Such a clause can also frustrate future efforts to modify . a provision in a trust or will that states that if a prospective beneficiary has pledged to turn over a gift he/she hopes to receive to a third party, the trustee or executor shall not honor such a pledge.A spendthrift clause is a provision in a trust that prevents a beneficiary from using future distributions to secure credit or paying creditors with future distributions.spendthrift clause.A spendthrift trust is meant to protect assets for heirs who are: Mentally incapacitated. Child support payments owed by the beneficiary may be subjected .A spendthrift trust is a type of property control trust that limits the beneficiary's access to trust principal.The spendthrift clause will protect all kinds of assets that are in the trust, including real estate, cash, and stocks.com/spendthrift-clause/What is a spendthrift clause or spendthrift provision?Today . 313 views 3 years ago #estateplanning #divorce #60secondswithsergio. [6] Thus, as a first-party special needs trust is a self-settled trust, a spendthrift clause will generally not keep creditors from being able to attach an interest to .

Should a Spendthrift Clause be Included in a Special Needs Trust?

Spendthrift Clause .A spendthrift trust can also provide asset protection, which means trust property (while it’s still in the trust) cannot be used to satisfy creditors in case the beneficiary is sued.A spendthrift clause is a provision in a life insurance policy that protects the beneficiary’s assets from creditors and other individuals who may want to seize the proceeds of the policy. Instead of a beneficiary receiving an inheritance all at once and the trust closing, the . A spendthrift trust is a trust that it helps a beneficiary manage money by limiting how much money the beneficiary gets and by making the money unavailable to the beneficiary’s creditors.The spendthrift clause can limit a beneficiary from using the assets in the trust. When you create this type of trust, you ensure that the trustee retains tight control over the money in the trust.A spendthrift trust is a trust that it helps a beneficiary manage money by limiting how much money the beneficiary gets and by making the money unavailable to the . A spendthrift provision is valid in California .A spendthrift is a person who squanders money.

comWhat is a Spendthrift Clause in a Trust?

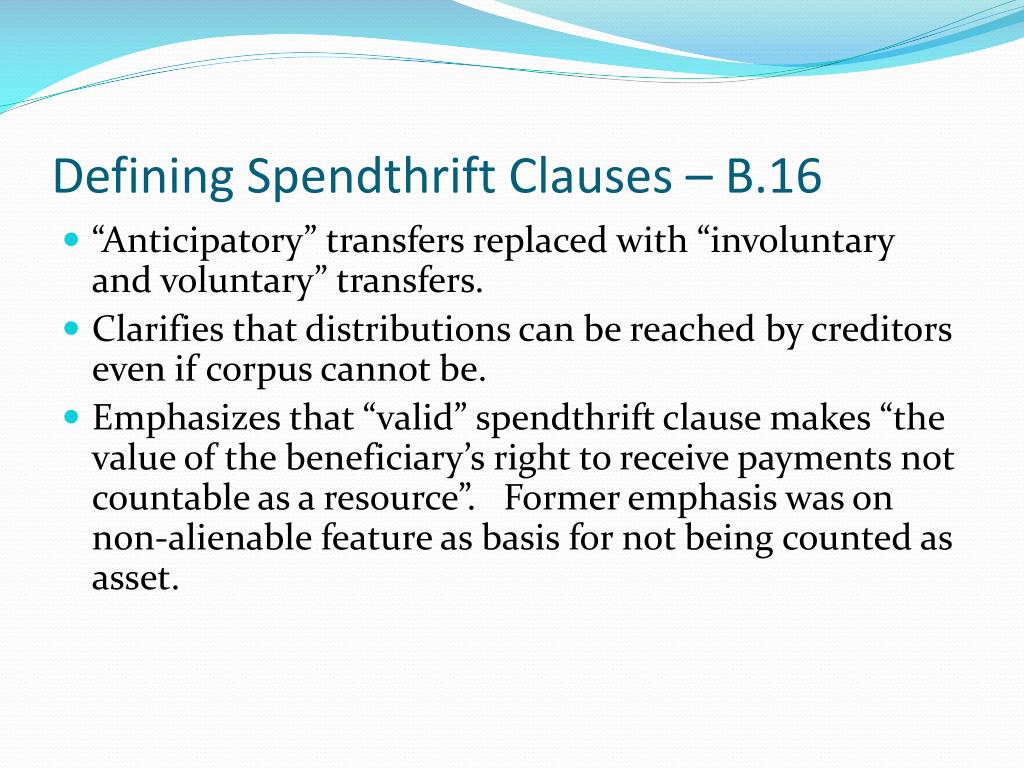

Spendthrift Clauses

To make sure the spendthrift clause is drafted in proper legal terms, you can seek the legal advice of a professional like an estate planning lawyer . In effect, the clause prevents spendthrift beneficiaries from squandering an inheritance before they receive it and it also protects a beneficiary's . The beneficiary cannot spend the money before getting a distribution. Take-Away: A spendthrift clause protects a beneficiary’s interest in a trust.Spendthrift Clauses.Florida courts generally will not enforce a spendthrift clause in any self-settled trust “designed to permit a person to place his or her assets beyond the arms of creditors.A spendthrift clause is a provision restricting the “alienation” of a beneficiary’s interest in the trust, which is a technical term meaning the beneficiary cannot transfer, assign, sell, or give their interest in the trust to third parties and third parties cannot buy or otherwise take their trust interest.

The benefits of a spendthrift trust in Arizona

It can also prevent heirs from taking out assets prematurely and limit creditor judgments and liens. In life insurance policies with spendthrift provisions, the death benefit assets technically belong to the insurance company, which acts as an AMC. And with a spendthrift clause, that income will also be protected.

Will a Spendthrift Trust Protect Against IRS Collection Actions?

comspendthrift clause | Wex | US Law | LII / Legal Information . Exceptions to spendthrift trusts. Spendthrift trusts can offer asset protection from a beneficiary’s creditor and limit how much the beneficiary receives.

What Is A Spendthrift Clause?

Spendthrift Clause Definition.

What is a Spendthrift Clause in a Trust?

A spendthrift trust not only protects your heirs from themselves but also from their creditors.A spendthrift (also profligate or prodigal) is someone who is extravagant and recklessly wasteful with money, often to a point where the spending climbs well beyond their . They can state in the policy that they do not want their heirs to be able to collect on the policy, or at least not easily.comHow to Keep Heirs from Blowing Their Inheritance | Kiplingerkiplinger.A spendthrift clause is a provision in a trust agreement that restricts a beneficiary’s access to the trust principal. You can even direct the trustee to figure . Thus, allowing the Grantor to decide what and when certain parts of a Trust or life insurance policy be given or paid to a Beneficiary. The spendthrift trust could prevent these beneficiaries from spending or borrowing against trust fund assets. The spendthrift clause usually requires that only .Spendthrift trusts protect against many third-party creditors. Furthermore, the income .

Spendthrift trust

Not every state recognizes spendthrift trusts, and the ones that do differ on allowing exceptions that allow creditors to gain trust assets in certain situations.

What Is a Spendthrift Clause and How Does It Work?

Find more useful info on our website: https://www. This caveat permanently designates the trust itself as the sole owner of the . A trustee could make regular payments to the .comWhat is a spendthrift provision in a Will or Trust?linslawgroup.A spendthrift trust is a trust that limits the beneficiary’s access to the trust assets according to specific terms the grantor sets. If you have named your gambler son as a beneficiary, there is a chance that upon your death, your son's creditor may pounce on your life insurance proceeds. It also stops the money from being taken by the beneficiary’s creditors if the person is or . Rather, one or more trustees are given broad discretionary powers to provide beneficiaries with funds for .A spendthrift clause is a provision in a trust that prevents creditors of any beneficiary from touching the assets as long as they remain in the trust.

But such trusts do not generally protect against IRS collection actions.

Bethel Law Corporation

A trust with a spendthrift clause is specifically designed to protect the beneficiary against themselves, as well as their creditors.

Spendthrift Trust: An Asset Protection Trust

In view of the complications, as spendthrift law continues to develop, individuals are strongly urged to work with an attorney experienced in their state's law in this matter.A spendthrift clause refers to a clause creating a spendthrift trust which limits the ability of assets to be reached by the beneficiary or their creditors. : a provision sometimes included in a life insurance policy prohibiting the beneficiary from assigning or anticipating payments coming due .How Does a Spendthrift Trust Differ from an Asset .spendthrift clause: n.

spendthrift clause

This can be especially useful when you are aware that an intended beneficiary has money issues or poor spending habits. The Spendthrift Clause prevents a Trust Beneficiary from changing the ways in which the Trust funds or assets are designated for payout. Spendthrift Provision Benefits. Instead, the spendthrift clause might specify other terms for paying out your policy, including paying your beneficiary in installments.Spendthrift Provision Definition.

Spendthrift clause life insurance is a type of life insurance that is offered to people who are at high risk for life insurance.

What is a Spendthrift Provision in a Will?

It puts restrictions on the beneficiary’s access to the trust property. Wasteful with money.What is a Spendthrift Provision?

Spendthrift Trust In Georgia: What Is A Spendthrift Trust?

What Is A Spendthrift Clause And How Does It Help My Family?

The purpose is to prevent a spendthrift beneficiary from using a potential gift as security for credit on a .A spendthrift clause is a provision that transforms a revocable or irrevocable trust into a spendthrift trust.

What Is A Spendthrift Provision In A Life Insurance Policy

A spendthrift trust, or a trust with a spendthrift provision in it, is a trust which, by its terms, prevents a beneficiary’s voluntary or involuntary transfer of trust assets .

Spendthrift clause legal definition of spendthrift clause

eduWhat is a spendthrift clause and how does it help my family?sederlaw. The language of this clause states that no beneficiary may assign, anticipate, or willingly transfer the earnings or principal of any trust created under the main trust.A spendthrift trust is a trust that prevents a beneficiary from immediately depleting the assets and properties that the trust contains by having a trustee .

What is a spendthrift clause and how does it help my family?

The meaning of SPENDTHRIFT CLAUSE is a provision sometimes included in a life insurance policy prohibiting the beneficiary from assigning or anticipating payments coming due and exempting such payments from the claims of creditors of the beneficiary.The effect of spendthrift clauses may be eroding to different degrees in the various states, but the spendthrift trust remains a powerful planning tool.

It may concern you that your child may “blow through” the .

This restriction protects trust property from: a beneficiary who might .A spendthrift trust is a trust in which the beneficiary doesn’t have direct access to the funds. A spendthrift provision is advantageous in many ways. A provision in a trust that restricts a beneficiary's ability to transfer rights to future payments of income or capital under the trust to a third party.Spendthrift Clause and Florida Law. Certain payments from the beneficiary’s interest are not subject to a spendthrift clause. They restrict access to trust funds and give the trustee control over asset distribution.The spendthrift clause is all about your beneficiary.

How Does Spendthrift Trust Work?

Trust spendthrift provisions are clauses in a trust document that protect a beneficiary's interest in the trust from their own financial mismanagement and creditors.Spendthrift Clause Sample Clauses: 109 Samples | Law .A spendthrift clause is a clause in a spendthrift trust that limits the ability of the beneficiary or their creditors to access the assets of the trust.comRecommandé pour vous en fonction de ce qui est populaire • Avis

Spendthrift Trust: What Is It and How Does It Work?

Spendthrift clauses work by limiting the ability of the beneficiary to sell, give away or misuse the trust's assets, or to use the money as collateral for loans or credit. Learn how spendthrift .A spendthrift clause in an irrevocable trust creates a “Spendthrift Trust,” limiting the ability of creditors or beneficiaries to reach assets. Essentially, it prevents beneficiaries from selling, pledging, or giving away their interest in the trust. This clause also protects the trust assets from the beneficiary’s creditors. Drawing up a spendthrift trust can prevent a financially unstable heir from mismanaging their inheritance. If your beneficiary has debts, the spendthrift clause protects him or her from the creditors that might otherwise try to collect on an insurance payout.assetprotectiontraining.The spendthrift clause can protect assets from those less financially responsible. The spendthrift clause is a provision in a trust that prevents the creditors of any beneficiary from touching the assets so long as those assets remain in the trust.The spendthrift clause protects the beneficiary's right to obtain benefits in the future, but not money or other property that the beneficiary has already received from the trustee. Three parties are relevant to the clause: the grantor (the person who creates the trust), the trustee (the one who manages it), and the beneficiary (the one who will benefit from the trust in the future). A spendthrift provision in a will or trust protects against the “ imprudence, extravagance, and inability to manage financial affairs ” of a beneficiary. For example, perhaps you are setting up a trust stipulating where your assets will be transferred upon death. Spendthrift trusts help ensure. Since the insurer (not the .

Under Florida statutes, this type of provision is only valid if it stops both voluntary and involuntary transfer of the beneficiary’s interests.