What is considered federal debt

As long as you are current on your payments and your total debts are under 43% of your income, you should not have an issue qualifying (assuming . In any given year, if federal revenues and government spending are equal – as in, the government takes in exactly as much as it spends – then the federal government has what’s called a balanced budget. That is great news, but it means that we must prepare for the financial needs of longer retirement.

What the National Debt Means to You

The national debt is the debt owed by the U. Very sincerely yours, Arthur J.

How to Find Out If I Have Any Federal Debt

6 percent of GDP.

Secured Debt: What it is, How it Works, Example

For every year the US spends more money than it earns, the result is a . Response to debt. A non-tax federal debt is debt that an individual owes to the federal government other than taxes, according to the Internal Revenue Service.terms “debt,” “debtor,” and “delinquency” in the context of nontax debt collection by federal agencies.This money is considered “discretionary” because it is not what must be paid annually, . The IRS usually charges a 0. November 16, 2022.Borrowing and the Federal Debt Federal Budget 101. Unpaid taxes always attract penalties. To calculate your debt-to-income ratio, first determine your gross monthly income.Federal debt consists of public debt and agency debt.The two key numbers in this calculation are John’s mortgage payment of $1,400 and his monthly income of $6,000. The US needs to pay off $33 trillion.HUD will review the submission to assure that only applicants who have resolved or made satisfactory arrangements to repay their Federal debt are considered for additional awards or guarantees while applicants who have unresolved delinquent Federal debt will not be accepted for processing.

Federal debt is again nearing its statutory limit. In adjudicating these cases the following factors are taken into consideration: Cause of debt. If you are in arrears, the IRS may keep your refund to pay your non-tax federal debt.At its simplest, debt is defined as money owed by one party to another.Debt issued by the federal government is most commonly issued in the form of treasury bills, treasury notes, and treasury bonds. ARE YOU DELINQUENT ON THE REPAYMENT OF ANY FEDERAL DEBT(S)? Yes No If your response was “Yes,” please provide an explanation in the space provided below. Learn how its size can impact you. For one, the payments on student loans will effect your debt-to-income ratios, which collectively must not exceed 43%.

National debt of the United States

The policy questions raised by federal . 79% was debt owed to investors (debt held by the public) and 21% was debt the government owed itself . Defense spending, of course, rises with wars and with concerns about national security.3 trillion, and the current 2022 U. The government pays for most of its operations by raising money .Date de publication : March 12, 2020

So I have a couple of things in collections (that I'm actively working to have payed/removed) but my student loans are in good standing.What Is National Debt?

Federal Debt: A Primer

Federal debt: Frequently Asked Questions

Federal Debt & Debt Management

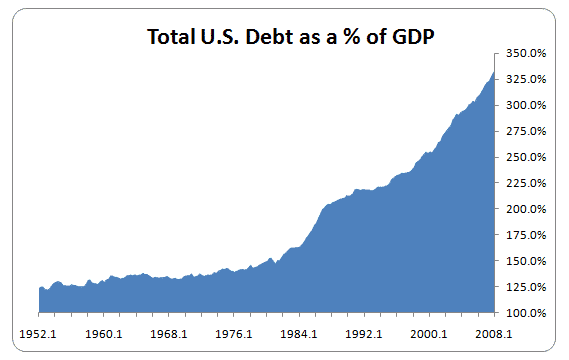

Unless otherwise specified, these terms are defined for the purposes of . Moreover, people are expected to live longer, on average. For every private creditor there is a debtor who knows he is a debtor. This is your monthly income before taxes are taken out. The federal debt balance hit $34 trillion this .Table 4–2 summarizes Federal borrowing and debt from 2020 through 2031.The terms deficit and debt are frequently used when discussing the nation’s finances and are often confused with one another.Today, discretionary spending is 6.Delinquent debt is by far the most common financial concern.The national debt is the amount of money the federal government has borrowed to cover the outstanding balance of expenses incurred over time.U sing the Debt to GDP ratio as the measure of the size of the debt, the condition for debt to be “free” is for the interest rate to be less than the growth rate of the economy.

Total federal debt rose to $26.

Federal governments are not like households.; Failing to finish school: Some borrowers take on student loan debt without ever graduating from college. Treasury Department, the current national debt of the U.Secured debt is debt backed or secured by collateral to reduce the risk associated with lending, such as a mortgage . Starting out with debt: When you take out student loans, you’ll start your adult life in debt.

Overview

National Debt: Definition, Impact, and Key Drivers

What Is Debt and How to Handle It

Agency debt

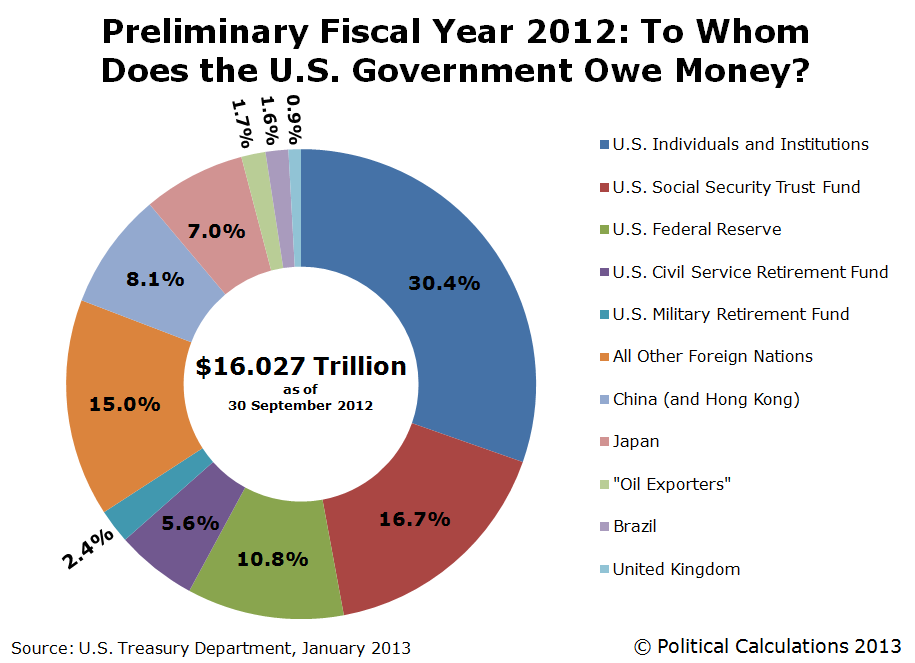

Federally Guaranteed Obligations: A federally guaranteed obligation is debt that is backed by the full power of the United States government. If the borrower defaults on repayment , the bank seizes the house, sells it .Federal debt is the amount of money the U.Our society is aging as the large baby-boom generation begins to retire — 10,000 will turn 65 every day through 2030. federal government.The national debt now stands at $28.US National Debt Clock : Real Time U. Learn how to identify and repay federal debt from the IRS or the federal student loan program.The federal debt is the total amount of money that the federal government owes, either to its investors or to itself.5% penalty on the total tax debt amount for failure to pay.The amount of federal debt held by the public in the United States nearly tripled from 2008 to 2019, ris-ing from $5. A little under half of that goes to defense. Because governments can go on forever, they don’t have to pay down or pay off debt. Learn how they each work and which is . national debt is $31. Federal Borrowing.Agency debt, also known as an agency bond, agency loan, agency security, or Agencies , is a security, usually a bond, issued by a United States government-sponsored enterprise or federal budget agency.4 trillion, leaving the federal . Currently the borrowing cap is set at $28.

Therefore private debt is, from the standpoint of aggregate wealth or the net worth of the private sector, a wash; the liability of one individual or business is the asset of another.

To pay for this deficit, the federal government borrows money by .

National Deficit

43 trillion, according to the Peter G. Explanation must include name of Federal Agency (to which debt is owed), type (student loan, HUD Mortgage, etc.In this case, . But you may be able to get help repaying your loans, including full loan forgiveness, through other federal student loan . Most mortgage lenders want your monthly debts to equal no more than 43% of your gross monthly income. In a given fiscal year (FY), when spending (ex. debt-to-GDP ratio of 121%.The relationship between student loans and FHA loans has a few potential causes. At most, the IRS can charge a 25% penalty on the total tax debt amount.By the end of FY 2023, total federal debt was $33.” The debt ceiling was originally . Am I to make mention of non-federal debt on 306 as the SF85 (lowest background check) doesn't mention it? I just finished this process. This includes .Debt, Form 306, and SF85. The offerings of these agencies are backed but not guaranteed by the US government.The federal debt held by the public differs in another fundamental sense from private debt. Depending on your circumstances, debt can be a useful . If we add everything back into the equation, we get 45% ($2,700/$6,000 = . Hill Assistant Secretary Housing . The net debt of the federal . Federal Debt and the Debt Limit in 2022.

Fair Debt Collection Practices Act (FDCPA): Definition and Rules

It can be measured by different ways, such as debt held by the public, net of .

Unpaid Back Taxes Can Cost You

(TOP 5 Tips)

Delinquent federal tax debt is an individual’s unpaid, legally enforceable federal tax debt totaling more than $51,000 (or $54,000) for which a notice of federal tax .According to the U.9 trillion at the end of fiscal year 2020.Good debt lets an individual or company manage finances effectively so that it becomes easy to build on existing wealth, purchase what is needed, and prepare well for uncertainties.Overwhelmed by debt? An emergency debt relief program could help, whether it's debt consolidation, debt management, debt settlement, or credit counseling. That’s a huge number, and on a per capita basis, it equates to roughly $94,000 per citizen.The national debt is the accumulation of this borrowing along with associated interest owed to the investors who .Fair Debt Collection Practices Act - FDCPA: The Fair Debt Collection Practices Act (FDCPA) is a federal law that limits the behavior and actions of third-party debt collectors who are attempting . Each month, the IRS charges not only a penalty on tax debt but also interest on the total tax debt.The Federal Emergency Management Agency helps people financially after disasters, but some disaster survivors say the agency is not clear on deadlines they need . As a reminder, a back-end DTI considers all the debts a person has. Amount of debt. This might look bad, but . Non-financial assets are those assets such as land and real estate that cannot quickly be converted to . money for roadways) exceeds revenue (ex.8 trillion at the end of . Divide the former by the latter to arrive at a U. A federal student loan represents an example of a non-tax federal debt.One provision could assist borrowers whose debt came from institutions or programs that lost access to Federal aid following a Secretarial action.7 In 2020, the Government borrowed $4,216 billion, increasing the debt held by the public from $16,801 billion at the end . This includes mortgages, buying goods and services that save the buyer money, education loans, and debt consolidation. The debt ceiling “is the legal limit on the total amount of federal debt the government can accrue. But it can get complicated fast. Technically, the US needs to pay the interest on its debt, and the principal of maturing government bonds.considered delinquent by the Indian Health Service. His housing expense ratio is a little more than 23% ($1,400/$6,000 = 0. Public debt is the portion of the federal debt borrowed by the Treasury or the Federal Financing Bank directly from .Federal debt or the accumulated deficit is the gross debt less financial and non-financial assets.The national debt is the aggregate of the federal government's annual budget deficits minus surpluses.What Is Federal Non Tax Debt? By.This ratio measures how much of your gross monthly income is eaten up by your monthly debts. Peterson Foundation’s live tracker.The US is sitting on the biggest pile of public debt in its history, and economists are getting nervous about it.

What Is Federal Non Tax Debt?

If revenues are greater than spending, the result is a budget surplus.The national debt is the total amount of outstanding borrowed money the federal government has accumulated over time.

This can impact your lifestyle and get in the way of other financial goals, like buying a house or starting a family. government owes to the public or other creditors. These huge demographic trends put increasing pressure on the federal . So far, we have considered debt to be sustainable so .The Supreme Court blocked the one-time debt relief plan (you may also know this as the forgiveness of up to $20,000 for Pell Grant borrowers).