What is fatca form

FATCA (Foreign Account Tax Compliance Act) is an American provision enacted in March 2010 and aimed at foreign financial institutions. The law works in collaboration with foreign financial institutions to reduce tax evasion and increase transparency in tax reporting. Qu’est-ce que la loi FATCA ? Qui est concerné par la loi FATCA ? Quelles sont les obligations qui découlent du FATCA ? Depending on your circumstances, you might need to . Forms can be returned via the following email address: aei_entity_remediation@ ubs.To find out more about FATCA in your country or territory (including relevant tax forms and guidance), and how it affects you, please select the appropriate business line (and .

Foreign Account Tax Compliance Act (FATCA)

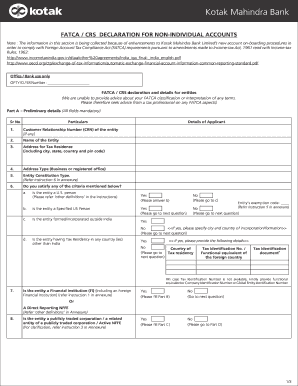

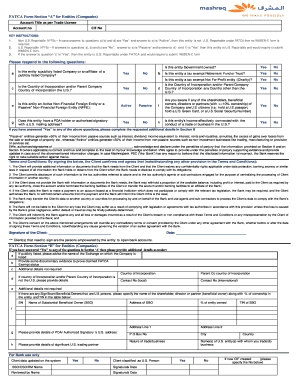

The NPS Trust is not able to offer any tax advice on CRS or FATCA or its impact on the applicant. In addition, the RO of a Financial Institution registering as a Lead of all or part of an Expanded Affiliated Group will be a POC for each Member of that group. This form is completed to .Failure to submit the FATCA form may result in the freezing of all bank accounts and the suspension of investments in fixed deposits, mutual funds, the National Pension System, and PPF, among other things. Form 8957 is the paper registration for foreign financial institutions or Direct Reporting non-financial foreign entities under Chapter 4 of the Internal Revenue Code. 11a The Financial Institution’s RO will be a point of contact (POC) for the Financial Institution.

FATCA FAQs

taxpayers holding financial assets outside the United States must report those assets to the IRS on Form 8938, Statement of Specified .Les décisions finales sont notifiées de manière anonyme aux personnes habi-litées à recourir par une publication dans la Feuille fédérale et sur le site inter-net de l’AFC (art. Find out more from H&R Block. FFIs are encouraged to either directly register with the IRS to comply with the FATCA regulations (and FFI agreement, if applicable) or comply with .

FACTA and CRS FAQs

If the RO contact information in the FATCA Registration system is accurate, the RO should receive an email each time the entity has a new message. It is part of a larger piece of legislation: Hiring Incentives to Restore Employment Act, designed to ensure that American citizens are fully disclosing their worldwide income to the US Internal Revenue Service. One major one is the assets from a foreign branch of a U. FATCA Current Alerts and Other News.Whereas FATCA requires financial institutions to report only those customers who qualify as U.FATCA requires foreign financial institutions (FFIs) to report to the IRS information about financial accounts held by U. When you moved overseas, you . Those assets can be in stocks, bonds, bank accounts, and other financial instruments.FATCA SELF-DECLARATION FORM - INDIVIDUALS CIF Number Customer Name (as in the passport) For the purposes of the U.FATCA is US legislation which requires all Foreign Financial Institutions (“FFIs”) to regularly submit information on financial accounts held by US persons to the US . We will be communicating with affected customers that need to complete these forms, detailing when they will need to be completed by.

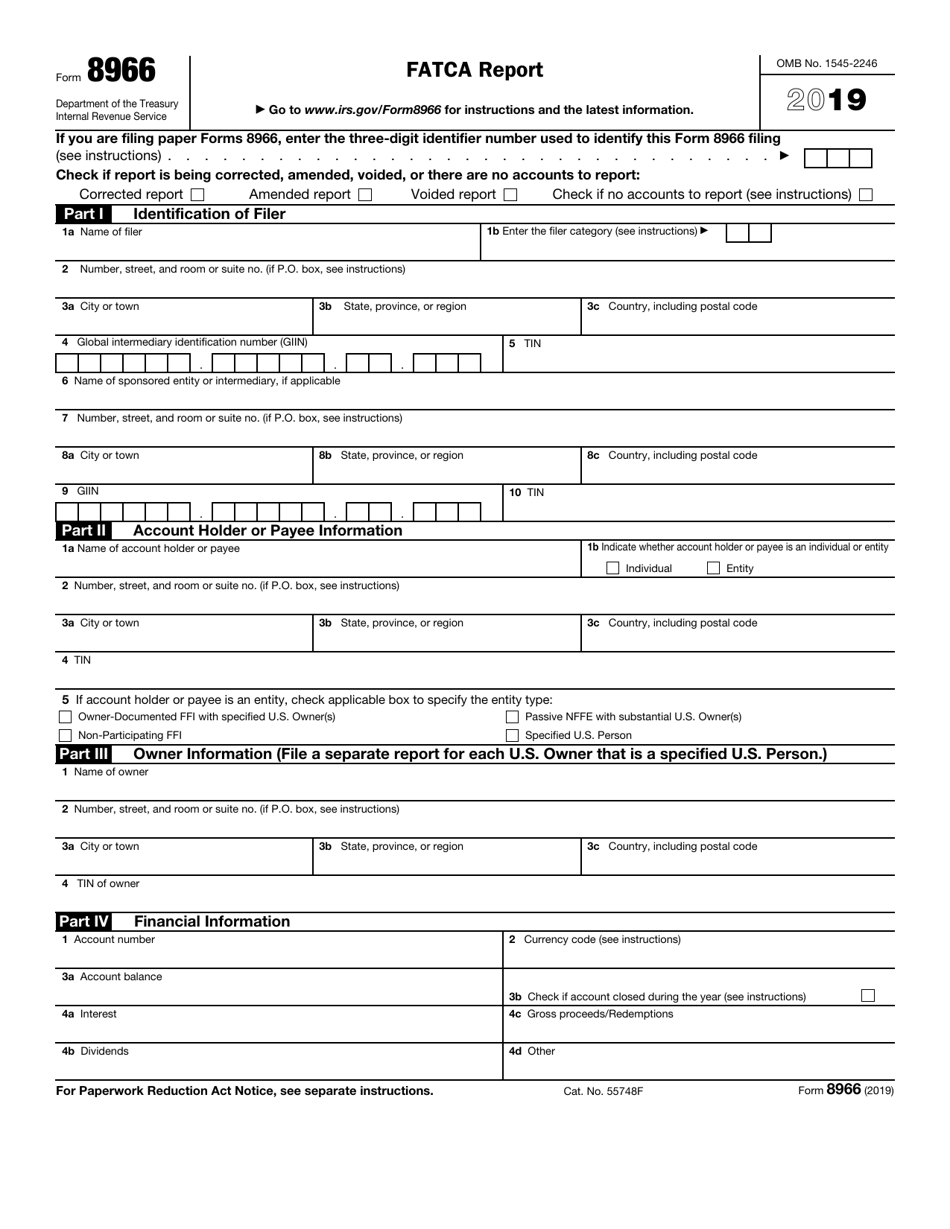

What is FATCA? This declaration is essential for conducting financial transactions and . We get it! Foreign financial reporting can feel confusing. Under FATCA, certain U.in This process is automatic. Information on submitting a return under . Form 8938 requires you to report any foreign assets and has different . Forms 1042 PDF, 1042-S, and Form 1042-T PDF are used to report amounts withheld under chapter . financial institutions (USFIs) and other types of U.FATCA Certifications must be completed and submitted online through the FATCA Registration system.

Frequently Asked Questions FAQs FATCA Compliance Legal

Business Email Address of RO Form 8957 (Rev. This documentation could be an HSBC declaration or a US tax form from the IRS. If you believe that you do not meet the relevant conditions, please do not use this declaration and instead use the relevant W-8 series form or W-9 form. Additional information may be required in order to determine whether the entity is active or passive (seeThe full form of FATCA is Foreign Account Tax Compliance Act which regulates any US citizen living either in the US or abroad to report their annual income on any foreign account that they are holding.Complete the FATCA-CRS form to determine whether your organization or Ultimate Beneficial Owners (UBO) are subject to tax abroad, even if you think you are not a foreign tax resident. citizens or by foreign entities in which U. Existing customers opening new in-scope accounts or providing information identifying a U. Under CRS, virtually all foreign investments handled by a financial institution become subject to a CRS report.

Understanding FATCA: Why File An FBAR And Form 8938 As An

The following FATCA forms and instructions are available: Individuals.How to determine Financial Institutions under FATCA.What is FATCA? These FAQs provide basic questions and answers related to Form 8938, including examples of specified foreign financial assets that need to be reported on Form 8938.Foreign Account Tax Compliance Act. What is the United States (“US”) Foreign Account Tax Compliance Act (“FATCA”)? In which countries does FATCA apply? Is Standard Chartered (the “Bank”) .FATCA stands for the Foreign Account Tax Compliance Act.Fatca Information for Individuals

Foreign Account Tax Compliance Act

Under FATCA, certain U. Due in part to CRS's wider scope, the nature of the relationships between .FATCA facilitates the transparent exchange of financial information between the United States and India.Foreign Account Tax Compliance Act Reporting for Expats. Le Foreign Account Tax Compliance Act (abrégé FATCA) est un règlement du code fiscal des États-Unis qui oblige les banques des pays ayant accepté un accord avec le gouvernement des États-Unis à signer avec le département du Trésor des États-Unis un accord dans lequel elles s'engagent à lui .

Needs the help of a financial institution to find US persons.Any client who completes a self-certification form (see below) may (if applicable), also be requested to return an updated IRS form (with both Chapter 3 and Chapter 4 status completed).In accordance with Canadian Regulations related to FATCA and existing obligations under Know Your Customer (KYC) regulations, Scotiabank collects self-certifications from all new customers.Checking your browser before accessing incometaxindia. CRS has 90 countries (except the US) committed to it – has a wider scope. It is part of a larger piece of legislation – Hiring Incentives to Restore Employment Act – . HIRE Act, signed into law on March 18th, 2010 by President Obama. If the account is opened for an entity, the entity account holder is required to provide a Declaration of Tax Residence.As said before, every American taxpayer with financial assets totaling $50,000 or more must fill out a FATCA form.FATCA is a US provision enacted in March 2010 and aimed at foreign financial institutions. CRS is roughly a more international version of FATCA.determining the status of the applicant named above in compliance with FATCA/CRS.FATCA – Form 8938 FAQs.Overview

Foreign Account Tax Compliance Act — Wikipédia

Vue d’ensemble

Loi FATCA (Foreign Account Tax Compliance Act) : guide complet

Foreign Account Tax Compliance Act (FATCA)

ICMM frequently asked questions (FAQs) These FAQs provide information on each notification type that may be sent from the IRS after files .The Foreign Account Tax Compliance Act, abbreviated FATCA, is a tax law that requires US citizens to report their foreign income and assets to the IRS. Several specific items come under needing to be disclosed .

[Things You Need To Know In 2024]

I/we shall seek advice from professional tax advisor for any tax questions. source payments made to foreign entities, if they are unable to document such entities for purposes of FATCA.FATCA and the CRS treat accounts opened by partnerships as owned by the partnership, not by the individual partners.

United Kingdom

efforts to combat tax evasion by Americans holding accounts and other financial assets offshore. persons, CRS involves more than 90 countries.

What is FATCA in Mutual Funds?

What is FATCA? The Foreign Account Tax Compliance Act (FATCA) legislation was introduced by the US Treasury Department and the US tax collection agency: the . Because FATCA is an effort to combat tax avoidance, NRIs living in the United States who receive money from Indian investments must report their . In order to adhere to FATCA regulations and ensure compliance, financial institutions, including brokerage firms like Upstox, require customers to complete a FATCA declaration. Virtually every . taxpayers holding financial assets outside the United States must report . withholding agents are required to withhold 30% on certain U. But, if you know you need to file FATCA, the good news is that you don’t have to go it alone. We can help you file Form 8938 to meet your FATCA reporting requirements and avoid penalties for non-compliance.

What is Foreign Account Tax Compliance Act (FATCA)?

(iii) I/We agree to submit a new form within 30 days if any information or certification on

Foreign Account Tax Compliance Act (FATCA) in Canada

accounts, defined as financial accounts owned by U.Business Fax Number.Information about Form 8957, Foreign Account Tax Compliance Act (FATCA) Registration, including recent updates, related forms and instructions on how to file. It was enacted by the US Government in 2010 to detect and prevent any offshore tax evasion cases by US citizens.The Foreign Account Tax Compliance Act (FATCA) is an important piece of legislation for anyone who lives internationally or has assets overseas.A FATCA certification consists of questions that the Responsible Officer (RO) of certain entities must answer and submit to the IRS to confirm the entities’ .If you are required to file a Form 8938 and you have a specified foreign financial asset reported on Form 3520, Form 3520-A, Form 5471, Form 8621, Form 8865, or Form 8891, you do not need to report the asset on Form 8938.

FATCA and AEI

However, you must identify on Part IV of your Form 8938 which and how many of these form(s) report the specified foreign . Form 3520, Annual Return To Report Transactions With Foreign Trusts and Receipt of Certain . citizens to disclose foreign account holdings annually to . The Foreign Account Tax Compliance Act (FATCA) is an important development in U. FATCA is part of the U.

Why do I need to sign it?

W-9: This is a link to the withholding certificate referred to as 'W9' on the IRS website. citizens hold a substantial ownership interest. The financial institutions must then report certain information about these accounts, including the account holder's name, address, tax identification . taxpayers hold a substantial ownership interest. A link for each applicable certification will be available on the entity’s home page. However, there are certain exceptions. indicator, are also required to complete a self-certification form .