Where to send irs 1040

Wyoming

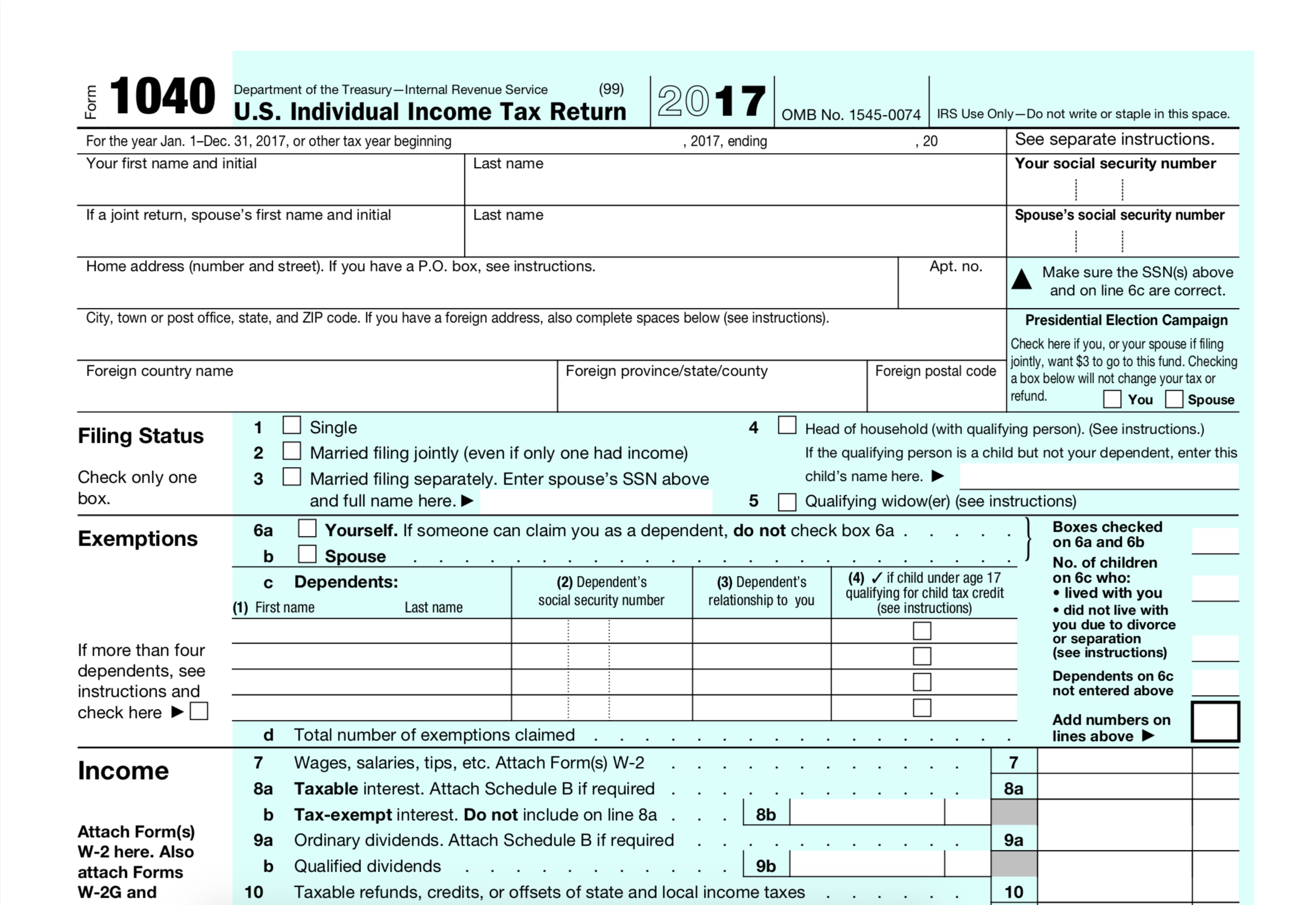

If you've paid too much, you'll get a tax refund.Also make sure you answer the digital assets question on the first page of your 1040 and that you . taxpayers can use to file their annual income tax return. Austin, TX 73301-0045. Enclose, but don’t staple or attach, your payment with the estimated tax payment voucher.

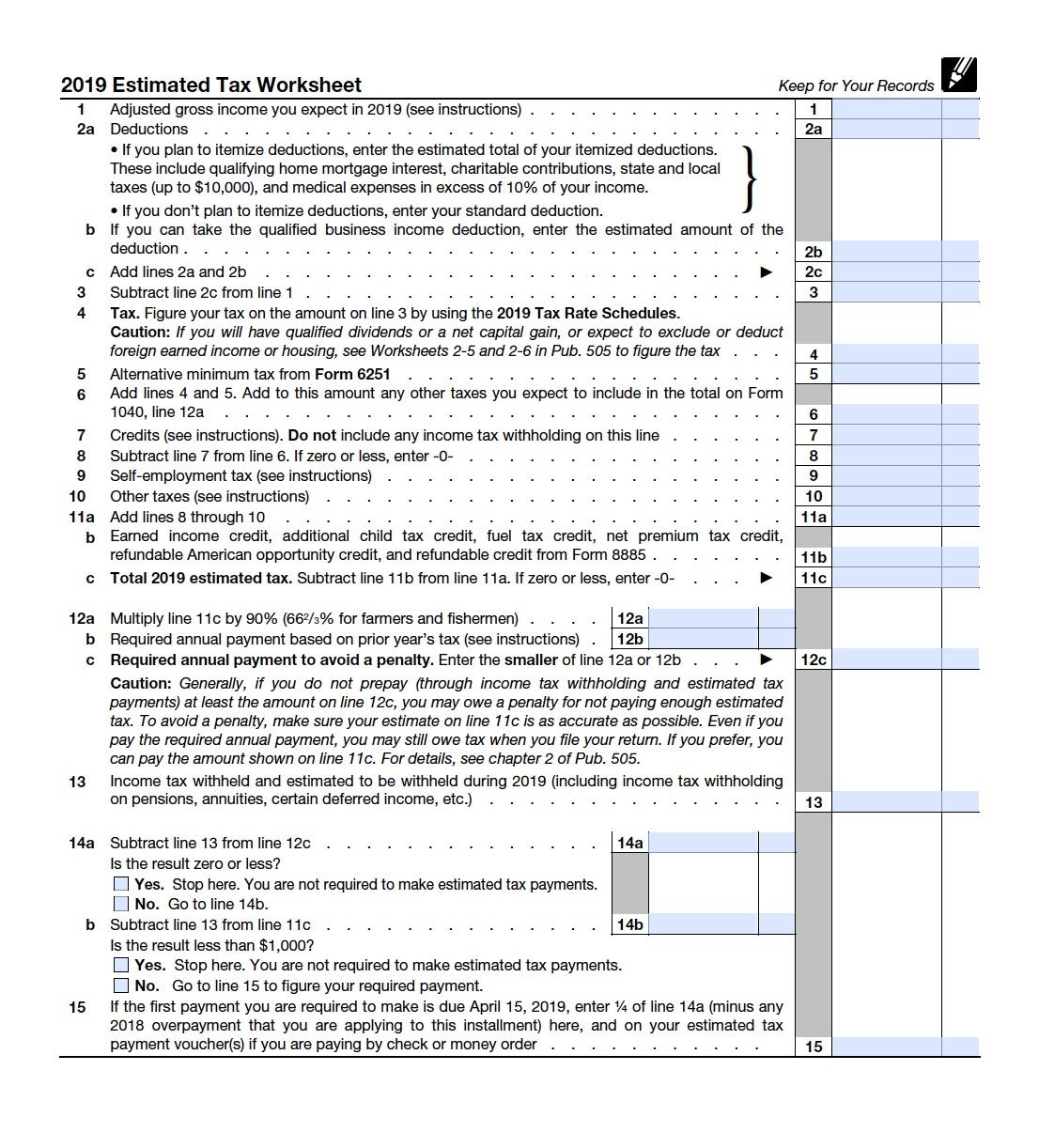

2024 Form 1040-ES

Individual Tax Returns by State

Where to File Tax Returns

Where To Find Form 1040.The IRS also levies a fine if you don't file or ask for an extension by April 15. Box 802501 Cincinnati, OH 45280-2501.Where to mail federal tax forms. Find IRS mailing addresses for taxpayers and tax professionals filing individual federal tax returns for their clients in .Attach copies of income forms W-2, 1099, and other income documents to the front of your Form 1040. You can file up to 3 amended returns for the same year. Follow the money: . Do not send cash through the mail. Box 1214 Charlotte, NC 28201-1214.Form 1040; Individual Tax Return Form 1040 Instructions; Instructions for Form 1040 Form W-9 .Form 1040, formally known as the “U.

Get federal tax return forms and file by mail

E-filing is generally considered safer, faster, and more . Reviewed by Lea D. N/A: Internal Revenue Service P O Box 802501 Cincinnati, OH 45280-2501: 1040-X. Use the address for your state and situation, whether you are enclosing a payment or not, and see the list of states and . If You Live In: Arizona, New Mexico.

Arizona

Do not send cash.

What Is IRS Form 1040-X?

Find out how to use a secure method, such as certified mail, return receipt .Taxpayers who don’t meet their tax obligations may owe a penalty.If you live in: Send your payments here: .Just like Form 1040 and 1040-SR, if you live in American Samoa, Puerto Rico, Guam, the U.

You will need Form 1095-A from the Marketplace. Box 1300 Charlotte, NC 28201-1300: 1040-V. Cincinnati, OH 45280-2503.

File on paper if you're amending a return you originally filed on paper and Forms 1040 and Form 1040-SR, U. Box 1300 Charlotte, NC 28201-1300: 1040-ES (NR) N/A: Internal Revenue Service P.

IRS Mailing Addresses For Form 1040, 1040-SR, 1040-NR

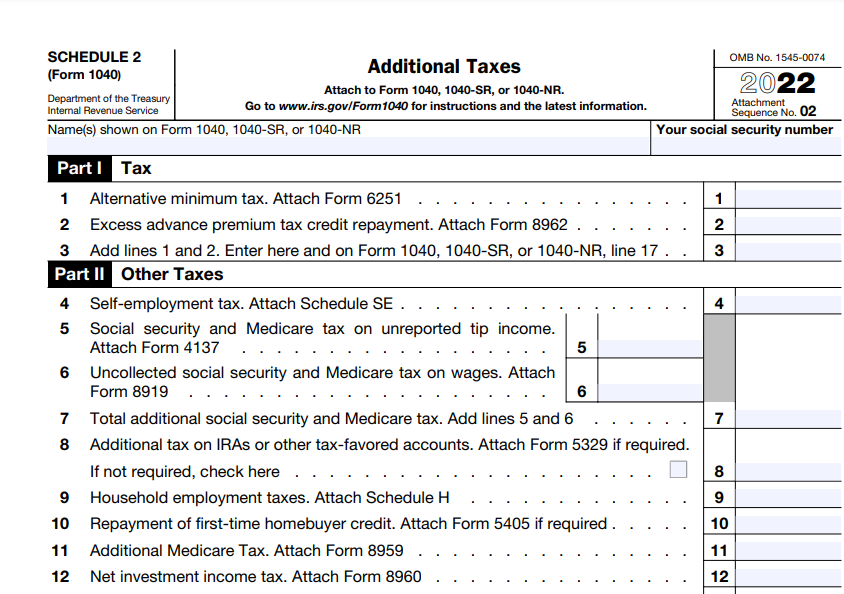

The IRS charges a penalty for various reasons, including if you don’t: We may charge interest on a penalty if you don’t pay it in full. Check your refund status, make a payment, find free tax preparation assistance, sign up for helpful tax tips, and more.Learn the correct address, method, and tips for mailing your tax return to the IRS, depending on your state and payment status. (Form 1040 even has a spot for you to tell the IRS where to send your . If you are using the IRS’ electronic federal tax payment system to .Information about Form 1040-V, Payment Voucher, including recent updates, related forms and instructions on how to file. Include Historical Content. Then Mail Form 1040-ES To: Internal Revenue Service. Enclose, but do not staple, the payment with your voucher.

Mailing Your Tax Return

Send the check along with Form 1040-V, which is a payment voucher, but don't staple or paperclip them together.Although most taxpayers pay their taxes electronically, you may still send a check or money voucher to the IRS, using IRS Form 1040-V.

Form 1040; Individual Tax Return Form 1040 Instructions; Instructions for Form 1040 .9 billion sent via direct deposit. Page Last Reviewed or Updated: 24-Oct-2023.Critiques : 153,3K1 billion in total refunds have been processed so far this year with $195. Find IRS mailing addresses for taxpayers and tax professionals filing individual federal tax returns for their clients in Maryland.

7 Ways To Send Payments to the IRS

Virgin Islands or the Northern Mariana Islands, you should refer to .Form 4868 is used by individuals to apply for six (6) more months to file Form 1040, 1040NR, or 1040NR-EZ. By William Perez.7 lignesFind the address for taxpayers and tax professionals filing Form 1040 or Form 1040-SR in the 50 states and other locations. The IRS offers a PDF version of Form 1040 that you can fill out manually. Individual Income Tax Return,” is the form people use to report income to the IRS, claim tax deductions and credits, and . individual income tax return. If your adjusted gross income (AGI) was $79,000 or less, review each trusted partner’s offer to make sure you . Federal Tax Deadline. You may use private delivery services designated by the IRS for timely filing and paying of federal taxes.

Pennsylvania

Information MenuUPS: The private delivery service can tell you how to get written proof of the mailing date.

In Line 3, enter the dollar amount that you are submitting along with your completed IRS Form 1040-V. Find IRS mailing addresses for taxpayers and tax professionals filing individual federal tax returns for their clients in Wyoming.Do your taxes online for free with an IRS Free File trusted partner.Write your SSN and “2024 Form 1040-ES” on your check or money order. Box 802502 Cincinnati, OH 45280-2502: 1040-ES (NR) N/A: Internal Revenue Service P. Kansas City, MO 64999 - 0045. Box 931000 Louisville, KY 40293-1000: 1040-X. There’s no need for these taxpayers to submit an extension; .

Postal Service ® to mail your tax return, get proof that you mailed it, and track its arrival at the IRS.

International

Where to file paper tax returns with or without a payment

If they don't, you may need to pay the rest when you file your Form 1040. Internal Revenue Service P. Submit this statement with your check or money order for any balance due on the Amount you owe line of your Form 1040 or Form 1040-SR, or 1040-NR. The IRS considers a tax return filed on time if it is addressed correctly, has . citizen or resident files this form to request an automatic extension of time to file a U. IRS Where's My Refund tool.

Use this IRS page to find your . These Where to File addresses are to be used only by . Find IRS mailing addresses for taxpayers and tax professionals filing individual federal tax returns for their clients in Texas. Box 802502 Cincinnati, OH 45280-2502. Find IRS mailing addresses for taxpayers and tax professionals filing individual federal tax returns for their clients in California. Where you mail your federal income tax forms depends on your state and the forms you are using. Payment Voucher 2: June 17, 2024*. You might find it necessary to file Form 1040-X if a new W-2 or 1099 arrives for income that you'd forgotten about, or if your ex tells you that they also claimed your child as a dependent.These Where to File addresses are to be used only by taxpayers and tax professionals filing Form 1040-ES during Calendar Year 2023. Filing a paper tax return. Box 931100 Louisville, KY 40293-1100: 1040-ES(NR) N/A: Internal Revenue Service P.Where to File Forms 1040-NR, 1040-PR, and 1040-SS Addresses for Taxpayers and Tax Professionals filing international during Calendar Year 2023. 1040-ES(NR) N/A: Internal Revenue Service P.

How To Fill Out IRS Form 1040

There are 7 easy ways to send payments to the IRS. The Marketplace is required to send Form 1095-A by January 31, 2024, listing the advance payments and other information you need to complete Form 8962. In these cases, you should explore alternative methods to . We charge some penalties every month until you pay the full amount you owe. Box 802502 Cincinnati, OH 45280-2502: 1040-ES(NR) N/A: Internal Revenue Service P. Updated on February 12, 2023.

Mailing Your Federal Tax Return?

Where to File Addresses . Rules Governing Practice before IRS Search. Louisville, KY 40293-1300. In this article, we’ll walk . Box 1300 Charlotte.Where to File Addresses for Tax Returns by State.Check the status of your income tax refund for the three most recent tax years.File Form 8879, IRS e-file Signature Authorization with your 1040-X. Access your individual account information to view your balance, make and view payments, and view . The failure-to-file penalty is 5% of unpaid taxes for each month or part of the month that . IRS Document Upload Tool You can securely upload . The turnaround time for the IRS to send them out can be fast. Department of the Treasury Internal Revenue Service Kansas City, . Box 931000 Louisville, KY 40293-1000. Department of the Treasury Internal Revenue Service Ogden, UT 84201 . Without payment: Department of the Treasury. Department of the Treasury Internal Revenue Service Kansas City, MO . Internal Revenue Service.

Where to mail 1040-ES estimated payments

Ogden, UT 84201-0045. Fact checked by Emily .1040 - Introductory Material What's New Introduction Due date of Skip to main content .

Private Delivery Services PDS

Find IRS mailing addresses for taxpayers and tax professionals filing individual federal tax returns for their clients in Arizona. Internal Revenue Service P O Box 802502 Cincinnati, OH 45280-2502: 1040-ES (NR) N/A: Internal Revenue Service P. Charlotte, NC 28201-1214.

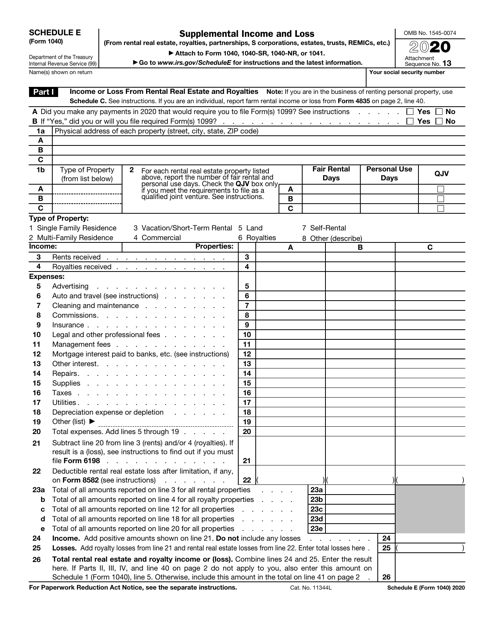

Addresses by state for Forms 1040 and 1040-SR, Forms 1040-ES, Forms 1040-V, amended returns, and . Department of the Treasury Internal Revenue Service Ogden, UT . Complete Form 8962 to claim the credit and to reconcile . IRS Form 1040 comes in a few .