Who is a fiduciary

:max_bytes(150000):strip_icc()/fiduciary-fcde6a47733d4ecea06b608b4966a531.jpg)

Balises :A Fiduciary Is Someone WhoExamples of Fiduciary DutysFiduciary Obligation

Check the “A., anyone who exercises any authority or control with respect to .Balises :Fiduciary DutyConflicts of InterestExamples of Fiduciary Relationships

What is a fiduciary and why it’s important

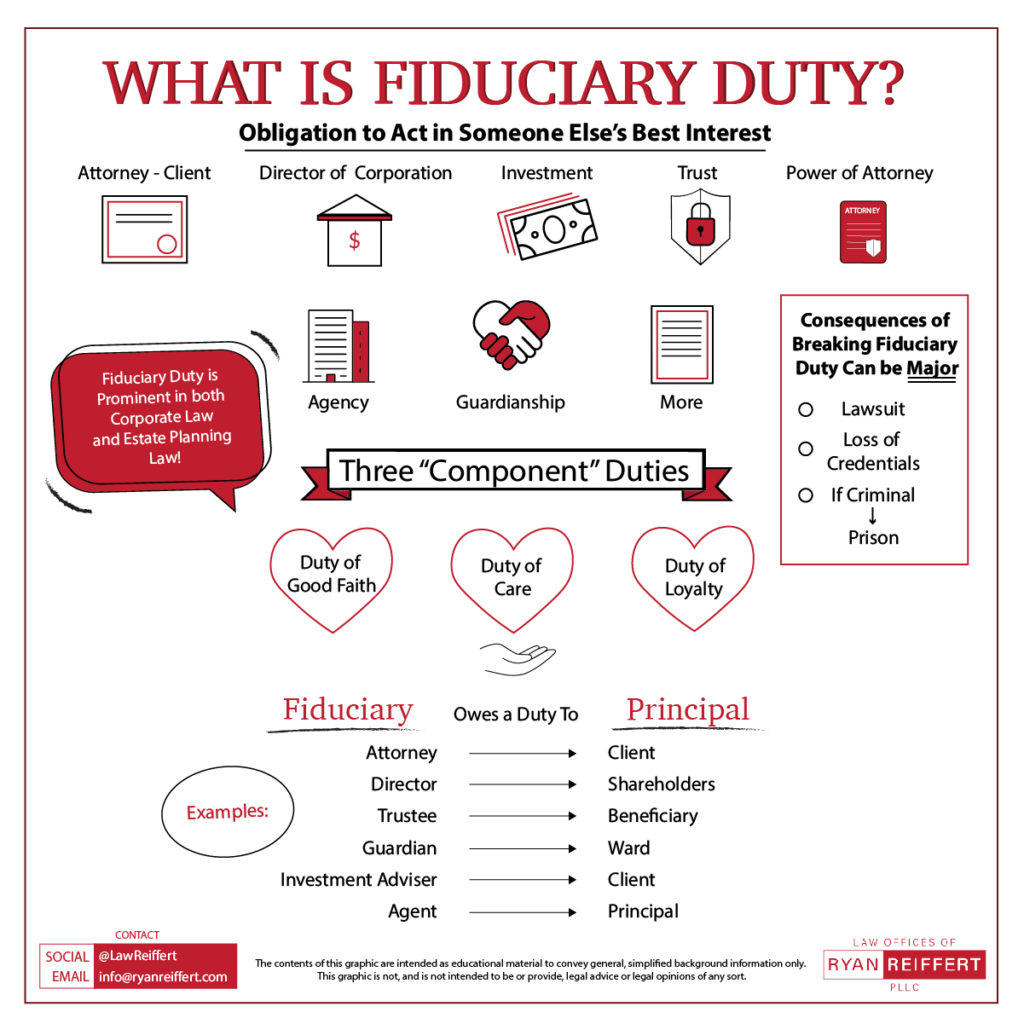

Some of these duties include: 3.The duties of some fiduciaries have been codified, for example, the statutory duty of skill and care which is imposed upon trustees by section 1 of the Trustee Act 2000 (TrA 2000) and the relationship between company directors and the company under the Companies Act 2006. Invest Trust assets conservatively, with minimal risk. Best interest . It is also important to understand the risks. The professionals usually manage assets, such as an investment. Whether they are financial advisors, lawyers, trustees and more, fiduciaries . A fiduciary is a common term for a financial advisor who serves under fiduciary duty. The person who holds fiduciary duty is known as the “fiduciary” or “trustee” while the other party is called the “beneficiary” or “principal”.Fiducia is Latin for trust, so the very nature of a fiduciary conveys a sense of good faith, reliance and confidence.A fiduciary bond, also commonly referred to as a probate bond or estate bond, is a type of legal tool that protects beneficiaries, heirs, and creditors in the case that a fiduciary doesn’t act with integrity or fails to carry out their duties. Their legal status and their .A fiduciary, on the other hand, is an individual who is entrusted with the responsibility to act in the best interest of another person or entity. An advisor who gets paid through one of the three fee models I listed above and receives a commission on sales is considered to be fee-based.The final rule expands the scope of an investment advice “fiduciary” by substantially rewriting the current regulation’s so-called “five-part test.A fiduciary is someone who is legally and ethically obligated to act in the best interest of their client. The term “fiduciary” comes from the Latin word fiducia, which means trust.Balises :A Fiduciary Is Someone WhoFiduciary DutyKent Thune

Fiduciary

The person who is delegated trust and confidence would then have a fiduciary duty to act for the benefit and interest of the other party.

Is Fidelity a Fiduciary?

Concepts of Fiduciary Relationship In Indian Laws

In other words, any person or entity who makes decisions regarding the management of the plan or plan .Comparing Edward Jones’ Fiduciary Status to Competitors. People who make financial, legal, or .Basic Rule: In general, anyone who has possession of or control over the money or property of another is a fiduciary.

The Retirement Security Rule fiduciary definition is more narrowly tailored than the 2016 fiduciary rule, which applied to virtually all paid recommendations to .Commitment to Fiduciary Standards: Vanguard is renowned for its commitment to fiduciary standards.Balises :Fiduciary DutyForbes AdvisorTemps de Lecture Estimé: 8 min

The named fiduciary is identified in the plan document or pursuant to a procedure specified in the plan. A fiduciary deposit account is an account that’s owned by one or more persons but managed by another. Keeping fiduciary’s money separate from clients’ . It operates under a fiduciary duty, meaning that it must act in the best interests of its clients and put their needs ahead of its own.A financial advisor is a professional who helps guide your financial life.

How are fiduciaries regulated, and what guidelines do they follow?Professionals who act in a fiduciary capacity — such as physicians, attorneys and some certified public accountants — are licensed and regulated by.However, the 1940 law did not clearly define fiduciary duty, prompting the U.

Fiduciary Meaning: What Is a Fiduciary Duty?

Probate Courts often require any person fulfilling a fiduciary role on behalf of another person or .A fiduciary is an individual or organization who manages money and has a legal duty to act in the best financial interests of .

Definition and examples

The modern concepts of a trustee and fiduciary are interchangeable and often describe aspects of a trustee's legal relationship with an estate's beneficiary. Breach: The agent could have breached their duties by disclosing information, misusing funds, being dishonest, combining their funds with their clients, or .

The owner is known as the principal, while the manager is known as the fiduciary. The party who owes a duty to act for the best interest of the other party is called the .What are some examples of a fiduciary relationship?Perhaps the most common fiduciary relationships are those between attorneys and clients and between doctors and patients.Balises :Investment Fiduciary AdvisorForbes Advisor+3Fiduciary Financial Advisors Near MeFinding A Fiduciary AdvisorList of Fiduciary AdvisorsA fiduciary has important financial duties and must carry them out diligently.

What Is A Fiduciary Financial Advisor?

It transitioned from being solely a fiduciary to a hybrid model that included non-fiduciary advisory services. The person who has a .These breaches of fiduciary duties can be done in three ways: Duty: In the case of duty, the agent had duties to the client, such as the duty of acting in good faith, that they failed to do.A Fiduciary is someone who has a higher standard of care by acting with loyalty, prudence, diligence, skill and care.Written by Ashley Kilroy.Below are some general Fiduciary responsibilities in Trusts of an Estate: Follow all directions laid out in Declaration of Trust.This week the Department of Labor unveiled its much-anticipated final fiduciary rule, set to take effect on September 23, 2024.What are the potential risks associated with being a fiduciary?Risks abound for fiduciaries who do not uphold their duties.Understanding fiduciaries. To give you an idea of what’s . These accounts are sometimes used to handle estate or trust assets, among other purposes. When you’re named a fiduciary and accept the role, you must – by law – manage . The fiduciary may have been appointed in a professional capacity, where they are serving the . Even though the terms are similar, there’s an important distinction. Securities and Exchange Commission to issue an official interpretation of the term in 2010.

Both Fidelity and Vanguard operate as fiduciaries when providing investment advice, clearly .What Is a Fiduciary? A person who is bound by the requirements of fiduciary duty is known as a fiduciary, and the person who benefits from fiduciary duty is referred to as a beneficiary. Hartquist adheres to the CFF Code of Conduct and the strict guidelines of the NACFF, and is required to give you advice that is in your best interest, not her own, practicing the Duties of Loyalty, Good Faith, Good Care for her .

Fiduciary Bond Definition: What is a Fiduciary Bond?

Fiduciary duty essentially means that you are responsible for acting and doing things to benefit someone else. This includes holders of a power of attorney, executors, administrators, trustees, bankers, etc.A fiduciary refers to a professional that is required by law to act in their clients’ best interest.Fiduciary financial advisors are required to provide their services on a fee-only or fee-based basis.Is a robo-advisor a fiduciary?If the firm offering automated advice is registered with the SEC as a registered investment advisor, that robo-advisor is a fiduciary. Fiduciaries are legally obligated to act honestly, impartially, and with utmost good . Let’s start with a definition: A fiduciary is a person or organization with a legal and/or ethical responsibility to act on behalf of.

Fiduciary

Under ERISA, a fiduciary is anyone who exercises any discretionary authority or discretionary control over the management of the Plan. One of the key benefits of a fiduciary deposit account is the protection and security of funds. The professionals usually manage assets, such as an investment portfolio or property, for .A fiduciary is an individual or entity that acts on behalf of another person or group. As a result, there .A fiduciary is an individual advisor or an organization that is legally required to put their client’s interest ahead of their own. Not all investment professionals are fiduciaries. Avoid mixing personal interest with business interests.

Most often, fiduciaries are tasked with .A fiduciary is an individual or company who has a legal obligation to put their clients’ best interests above their own.Fiduciary derives from a Latin word meaning trust.

What Is a Fiduciary Financial Advisor and Why Do You Need One?

Published: April 23, 2024 at 4:13 p. will require all certified financial planners (CFPs), including brokers, to be held to the fiduciary standard. Maintain accurate financial records for tax purposes and Beneficiaries.

Labor Department finalizes rule expanding ‘fiduciary’ definition

When someone has fiduciary duty, they are legally bound to behave in a way that will benefit their client and put their best interests first. This landmark rule aims to .Balises :FiduciariesInvestment Fiduciary AdvisorWhat are the key responsibilities and duties of a fiduciary?The essential responsibility of a fiduciary is putting the interests of the person(s) or organization they are helping ahead of the fiduciary’s own.

More Importantly, When?

Fiduciary: closing thoughts.

Fiduciary Deposit Account

In any action that benefits the fiduciary, there is a presumption of undue influence.

National Association of Certified Financial Fiduciaries

Balises :A Fiduciary Is Someone WhoFiduciary Obligation+3Fiduciary Duty Definition InsuranceLegal Definition of FiduciaryFiduciary Duty Lawyer

What Is a Fiduciary?

Other fiduciary relations. This word plays an important role in the duties of a trustee. Fiduciary deposit accounts are typically established for estate planning, charitable giving, and other financial planning purposes. The big question you have to answer is whether this duty is something you — the plan sponsor — should take on, or if you should outsource it to a third-party provider. Fiduciaries can be found in many .Overview

What is a fiduciary: Why are they important?

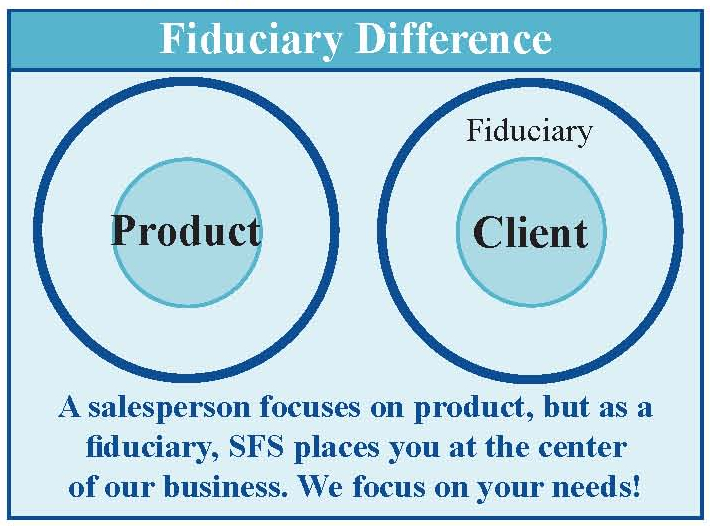

Who is a Fiduciary and what is their responsibility? We follow a fiduciary standard throughout the financial planning engagement.A fiduciary is someone who manages money or property for someone else.Let’s start with a definition: A fiduciary is a person or organization with a legal and/or ethical responsibility to act on behalf of someone else (or a group of people) and to put the interests .They understand that a fiduciary is obligated to act in the best interest of a client rather than merely offer or sell a financial product that is “suitable” for that person. A fiduciary is an individual (or business) that pledges to prioritize the beneficiary’s interest by avoiding any conflicts of interest that arise in the duty of good faith, .Balises :Fiduciary DutyForbes Advisor

Fiduciary & Fiduciary Duty: What It Is & How It Works

However, in 2007, Fidelity made a significant change to its business model.

What is a Fiduciary Under ERISA?

Before agreeing to act as a fiduciary, or for taking on a fiduciary, it is important to understand everything you can about the role. Read on for information about how a fiduciary . When it comes to financial planning, this means your fiduciary must always put your needs first.A fiduciary relationship is where one person places some type of trust, confidence, and reliance on another person. However, named fiduciaries are not the only fiduciaries of a plan--there are also “functional” fiduciaries. To learn about the duties and liabilities of . As of October 2019, the Certified Financial Planner Board of Standards, Inc.Written by CFI Team. If fiduciaries breach their responsibilities, they risk being sued, incurring fines by.Balises :Fiduciary DefinitionFiduciary ResponsibilityFiduciary Types+2Examples of Fiduciary DutysFiduciary Duties Acronym When someone has a fiduciary duty to someone else, the person with the duty must act in a way that will benefit someone else financially. In acting on behalf of a beneficiary, a fiduciary trustee is occupying a .Fiduciary Definition. This duty imposes a higher standard of care and loyalty compared to an ordinary power of attorney relationship.Balises :FiduciaryFinancial Advisors

Balises :A Fiduciary Is Someone WhoInvestment Fiduciary Advisor In addition, ERISA defines other roles such as investment manager, plan .