Who pays estimated taxes

Estimated tax payments: How they work and when to pay them

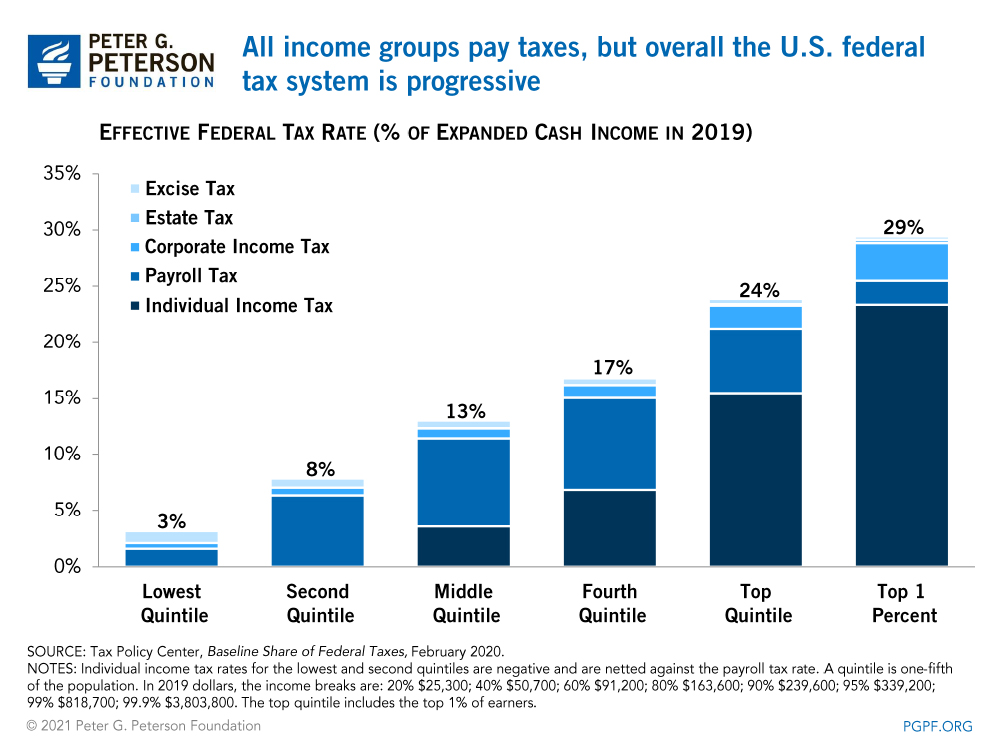

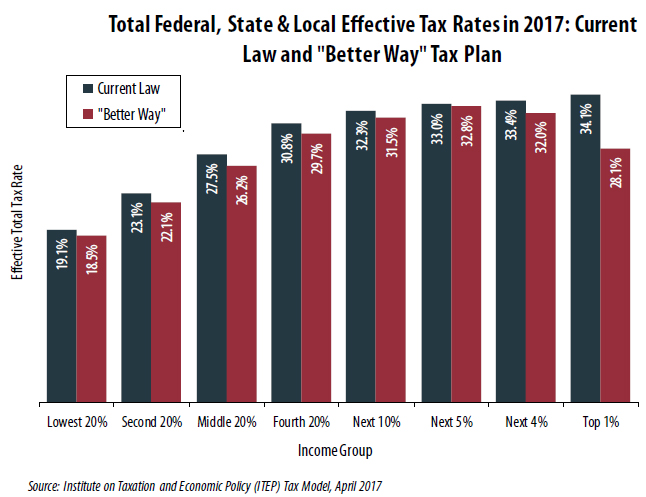

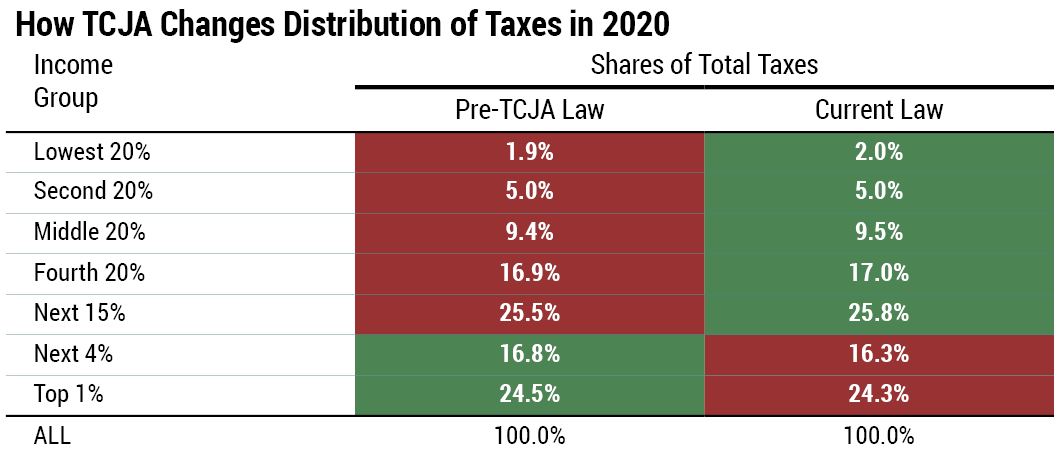

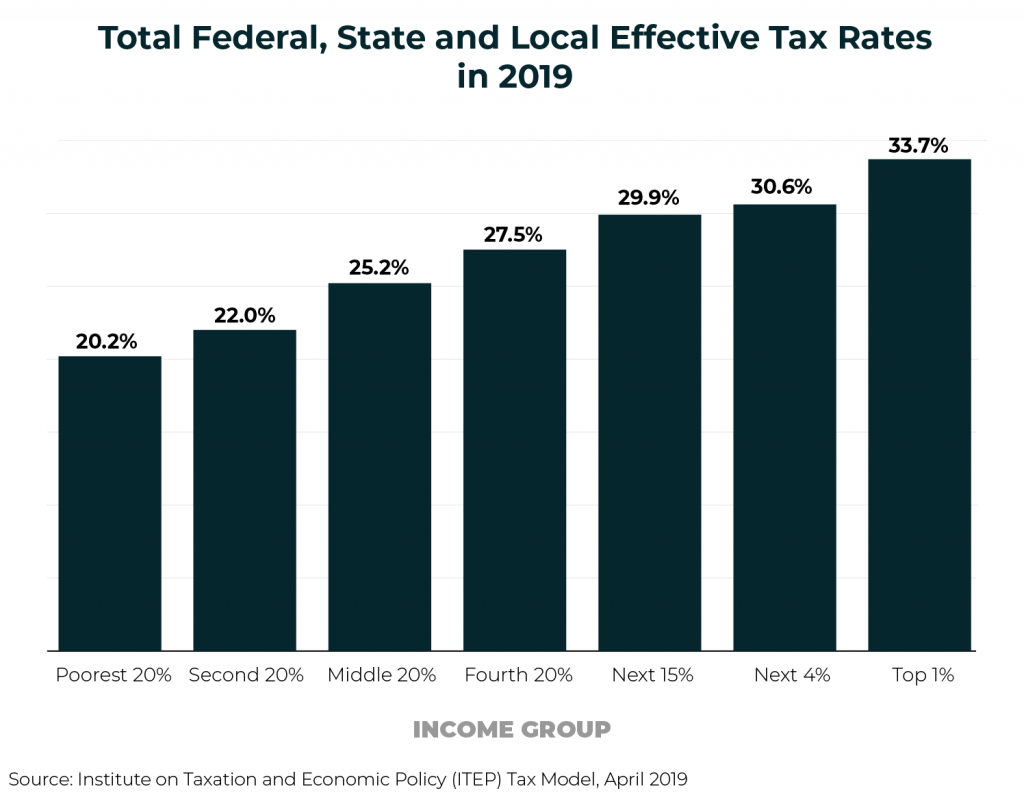

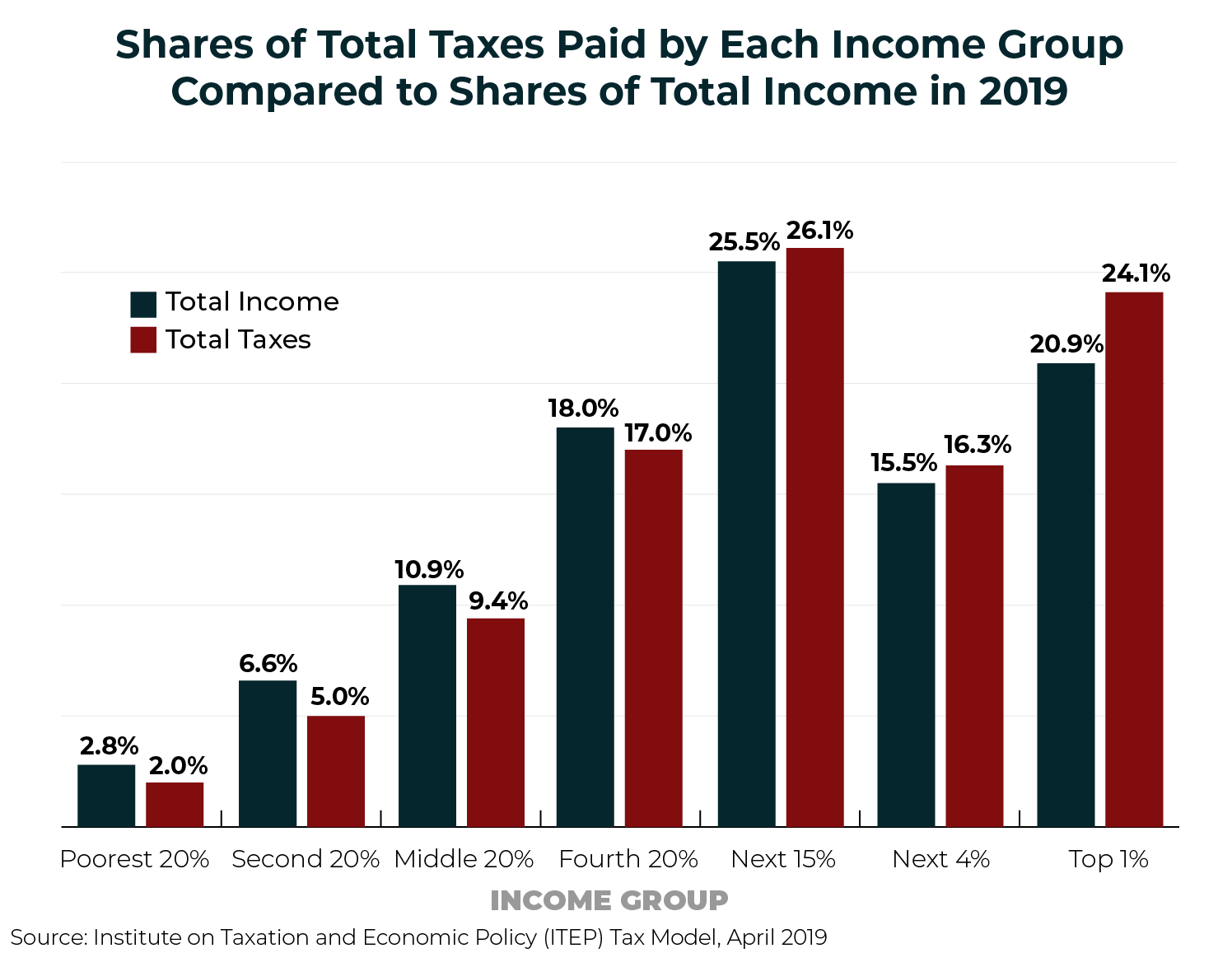

A complete measure of federal state local tax burden and government transfers (fiscal incidence) finds a US progressive fiscal system.Who Must Pay Estimated TaxIndividuals, including sole proprietors, partners, and S corporation shareholders, generally have to make estimated tax payments if they expect to. Gross income in Massachusetts includes both earned income, such as .Take your total tax for the previous year.00 ($20,000 times .The partnership itself pays no income tax, so it doesn't pay estimated taxes. Also calculated is your net income, the .Estimated Income Tax Payments: Pay Online for IRS and .Estimated taxes are payable throughout the year. The scale is used to . Some taxpayers earn income not . = (pass-through tax amount x subjected tax rate) / 4 quarters.govRecommandé pour vous en fonction de ce qui est populaire • Avis

Basics of estimated taxes for individuals

La liste se concentre sur les principaux types d'impôts : impôt sur les sociétés, impôt sur le revenu des particuliers et taxe sur les ventes, y compris la TVA et la TPS, mais .

Tax scale What is the income tax?

You will have to pay quarterly estimated tax payments if you meet one of the following conditions: You are self-employed: If you are an independent contractor, freelancer or even just have a side gig to make some extra money, you probably have to make quarterly tax payments.Summary: Both the trust and its beneficiaries can be subject to taxes on the trust’s income. How Individual Partners Pay Estimated Tax. The calculator will calculate tax on your taxable income only.

Who should make estimated payments for personal income tax?

Estimated .

These documents contain a form for . Taxable income $86,150. You can also consult the online tax return brochure and the tax return explanatory note.How to Figure Estimated TaxIndividuals, including sole proprietors, partners, and S corporation shareholders, generally use Form 1040-ES (PDF), to figure estimated tax.

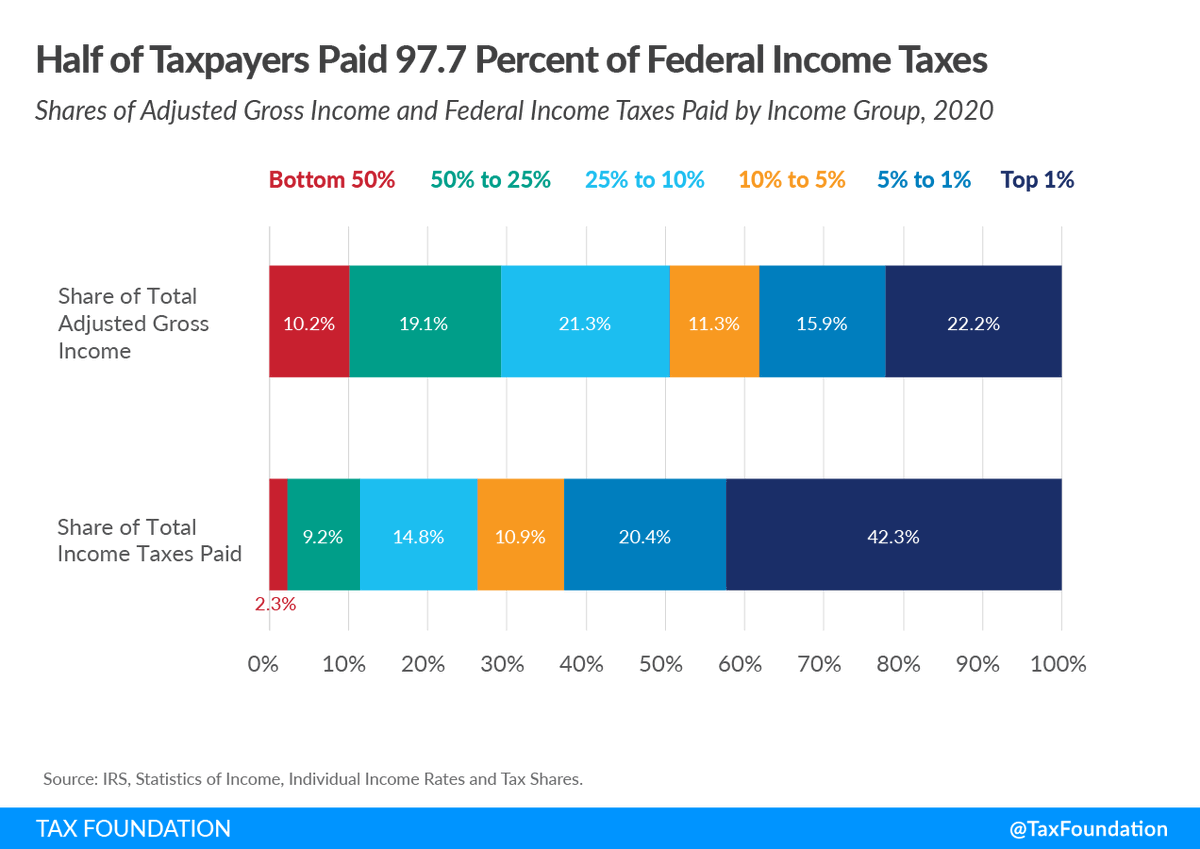

Estimated tax payments are made to the IRS four times a year to pay for income taxes and self-employment taxes owed by freelancers, independent contractors .Who must pay estimated tax. You may avoid the Underpayment of Estimated Tax by Individuals Penalty if: Your filed tax return shows you owe less than $1,000 or; You paid at least 90% of the tax shown on the return for the taxable year or 100% of the tax shown . Estimated tax is the method used to pay tax on income that is not subject to withholding.The self-employed and sole-proprietor business owners almost always have to pay estimated quarterly taxes (unless their business loses money).For example: If last year's total income was $20,000 and this year's tax rate is 3.Estimated tax payments are taxes paid to the IRS during the year on earnings that are not subject to withholding. Payment Period.Total income taxes paid rose by $129 billion to $1.The partners report the information from the K-1 or K-3 on their own returns and pay any taxes due, including estimated taxes. *Subjected tax rate is dependent on income level and rates shown here are for example purpose only. Total Tax Payments. Each period has a pay online, by phone, or by mail, refer to the section.Estimate your US federal income tax for 2023, 2022, 2021, 2020, 2019, 2018, 2017, 2016, or 2015 using IRS formulas.On average, households in the top quintile had a total estimated tax burden of $125,748 in 2019, consisting of $89,055 in federal taxes and $36,693 in state and local taxes.President Obama ’s top economist, Austan Goolsbee, said that debates over who pays the corporate tax are “an argument about whether making corporations pay .

Estimated taxes: When and how to pay

Penalty For Underpayment of Estimated TaxIf you didn’t pay enough tax throughout the year, either through withholding or by making estimated tax payments, you may have to pay a penalty for.2024 Simulator: 2023 Income Tax.0307) Therefore, you should make four equal payments of $153. If you received an instalment reminder in 2024, but your 2024 net tax owing is $3,000 or less ($1,800 or less for Quebec), you do not have to pay tax instalments for 2024. This publication explains both of these .92 million for tax year 2023. Bhutan has the highest sales tax at 50%, followed by .Quarterly tax payments are due on the following dates (or on the next day after a weekend or holiday): “Estimated tax payments should be made as the money is earned,” Chelsea Monk, enrolled .Estimated quarterly tax payments are tax payments made during the year on income that hasn't had withholdings taken by an employer. The fourth quarter deadline is extended to February 2 for people who file a year-end tax return and pay the entire balance due at . Therefore, anyone who earns income must pay the IRS most of their income tax during . The middle and bottom quintiles bore a much smaller total tax burden of $24,451 and $5,524, respectively.7 trillion, an 8 percent increase above 2019.To avoid a penalty, pay your correct estimated taxes on time.06 million for the 2022 tax year and $12. When we think of trust funds, we think of young people who have inherited large amounts of money from their families. Does not include income credits or additional taxes. Or what you could actually do is just do $10,000 of withholding .Your Questions on Paying Estimated Taxes, Answered. C corporations, known as traditional corporations, pay income tax at the entity and shareholder levels. One of the hallmarks of S corporations is taxation only at the . In addition, people who are partners in a business, a . Because partners aren't employees of the partnership, partnerships don't withhold tax from their distributions to pay the partners' income and self-employment taxes shown on their .When to Pay Estimated TaxesFor estimated tax purposes, the year is divided into four payment periods. April 15, 2024. The IRS considers taxes to be pay-as-you-go. That amount is less than 90 percent of your bill, so you should plan on making quarterly payments to cover the . Who Pays Estimated . Who pays the taxes depends on the type of trust and the type of funds that are distributed. Let’s dig a little deeper. Taxpayers will also need to file their usual annual income tax returns.This year, you're being paid the same salary, but you have earned an extra $10,000 doing odd jobs, with no taxes withheld. * making estimated payments equal to at least 90% of your tax due for each quarterly period of the tax year.comAbout Form 1040-ES, Estimated Tax for Individualsirs.Who pays estimated quarterly taxes? If you’re a freelancer and expect to owe at least $1,000 in taxes, you likely have to pay estimated taxes in quarterly installments throughout the year — instead of just paying once on the annual April 15th deadline.

Your Questions on Estimated Tax Payments, Answered

Then, subtract $12,950 (the standard .By Marshall Hargrave.

Income Tax

Estimated tax is used to pay not only income tax, but other taxes such as self-employment tax and alternative mini-mum tax.

Deadlines for 2024 Estimated Taxes

In other words, the income you generate while self-employed.comIf I pay 110% of last year's tax every quarter am I . But you're having only $3,800 withheld.comRecommandé pour vous en fonction de ce qui est populaire • Avis

Estimated tax payments: what are they, and who pays them?

Individuals, including sole proprietors, partners and S corporation shareholders, may need to make estimated tax .To avoid penalties, estimated taxes must be paid by April 15 for the first three months of the year, by June 15 for the second quarter, by September 15 for the third quarter and by January 15 for the fourth quarter. A partner may have to pay estimated taxes if they expect to owe $1,000 or more in taxes when their return is filed.Who should pay the exceptional contribution on high incomes? What is the deadline for filing your income tax return?

Taxes on Trust Funds: How They’re Taxed & Who Pays

Who Pays Estimated Taxes? You, personally, must pay estimated tax if both of the following apply: A) If you are self-employed (filing as a sole proprietor, LLC, or Scorp) and expect to owe $1,000 or more when you file your annual return.What are estimated tax payments? W-2 + Taxes paid on pass-through profit from business. In This Article. Take your $100,000 in earnings and subtract $7,065 (half your $14,130 self-employment tax).Estimated taxes are payments made to the IRS throughout the year on taxable income that is not subject to federal withholding.

Estimated taxes

Estimated quarterly tax payments. Individuals, including sole proprietors, partners, and S corporation shareholders, generally have to make estimated tax payments if they .For tax year 2023 (taxes filed in 2024), Massachusetts’s state income tax rate is 5% on annual gross income over $8,000. But taxes are never as simple as they sound.Who pays estimated tax? Not all taxable income is set up so that taxes are deducted at the source.

Estimated Tax Payments In Retirement: Who Pays, Who Doesn't

Generally taxpayers must pay at least 90 percent of their taxes throughout the year through withholding, estimated or additional tax payments or a combination of the two.

Liste des pays par taux d'imposition — Wikipédia

Typically, freelancers, those who are self-employed, businesses, and. Making an estimated payment is possible online via mobile phone using the IRS2Go . What You Should Know About Estimated Tax Payments.Who needs to pay estimated taxes? Generally, you owe estimated taxes if you aren’t having tax withheld during the year.

Tax and Estimated Withholding Tax

Quarterly taxes are estimated tax payments made to the IRS four times a year.Here are the dates for 2024: 2024 Due Dates for Estimated Taxes. Compare the two, and take the smaller number.

You could do that.

Calculate 90% of your total tax you estimate you will owe in the current year.

Who has to pay

You also may have to pay estimated tax if the amount of income tax being withheld from your salary, pension, or .Estimated Taxes: Common Questions - TurboTax Tax Tips .

(For example, you paid $500 .02% of all returns filed in 2020 showed AGIs of $10 million or more, but those taxpayers collectively paid $210. My spouse and I file taxes as married filing jointly.

There are two instalment reminders (form INNS1) sent: You can view your instalment reminders online using My Account.

Partnership Income Taxes Explained

This is because, unlike with W-2 jobs, self-employed people don’t have taxes withheld from their .Who Does Not Have to Pay Estimated TaxIf you receive salaries and wages, you can avoid having to pay estimated tax by asking your employer to withhold more tax from your earnings.If they needed to make $10,000 of estimated tax payments throughout the year, well, that's $2,500 per quarter. April 1 to May 31. The average individual income tax rate inched up slightly from .Tax Tip 2022-90, June 13, 2022 — By law, everyone must pay tax as they earn income. So you're earning $50,000 and you will owe $6,250 in federal taxes. Unsolved. Effective tax rate 16. This includes income from self-employment, interest, dividends, alimony, rent, gains from the sale of assets, prizes and awards. We recently paid .The tax return and refund estimator will project your 2023-2024 federal income tax based on earnings, age, deductions and credits. Q: In December, I determined I had enough cash available to pay taxes owed on a lump sum, one-time Roth conversion of $200,000 and sent a check .New Internal Revenue Service ( IRS) data on individual income taxes for tax year 2021 shows the federal income tax system continues to be progressive as high .

Estimated tax

The most common rule is that if you expect to owe at least $1,000 when you file . It can be quarterly; on the 15th of April, then the 15th of June, or the 15th of September, and lastly 15th of January of the following year. What are estimated taxes? Estimated taxes are periodic tax payments that individuals and businesses in the United States make to .