Why insurance policies are deductible

You cannot deduct life insurance premiums from your income taxes.

Can you deduct business insurance premiums?

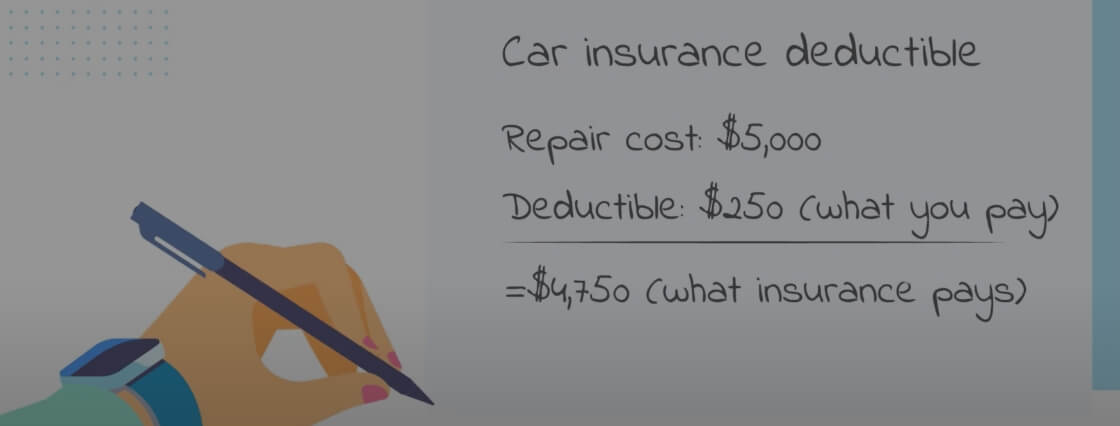

Deductibles help to encourage both the policy .An insurance deductible is the amount taken out of an insurance check when you make certain types of claims.Critiques : 12,3K Because not all hybrids offer tax deductibility, it can be an important point of comparison .A car insurance deductible is the amount of money you’ll have to pay toward a claim before your insurance pays anything. Some permanent life insurance policies allow you to withdraw funds from any cash value in a policy you own.A deductible is the amount you pay out of pocket before your insurance coverage begins, while an out-of-pocket maximum is the total amount you are responsible for paying out of pocket for covered expenses.Why You Should Take Policies with Deductibles.Typically, a home insurance policy deductible is at least $500.If you file a covered claim with your insurance company, then you will pay the $250 deductible and your insurance carrier will pay the remaining $1,750 towards your car repairs.Deductible amounts vary by plan, but here are some numbers to consider: For QHPs, the 2022 maximum deductible amounts are $8,700 per individual and $17,100 per family. How it works: If your insurance plan’s deductible is Rs. In other words, it’s the ., the average deductible amount for 2020 was $1,945 per individual and $3,722 per family. An example of retention vs deductible is when a policy includes a deductible, and a loss exceeds the limit, the insurer will pay the limit .

How to lower your car insurance bill as rates rise this year

How Do Insurance Deductibles Work?

A deductible is a sum of money that a policyholder must pay personally prior to insurers paying the remainder of a covered claim.

For example, a driver with.

What Are Insurance Deductibles and How Do They Work?

However, there are a few exceptions to this general rule.Updated on October 18, 2022.

What Is an Insurance Deductible?

Results: The most important positive impacts of deductibles were decrease in utilization of different services, high profitability for the young and healthy people, lower . So if your home is insured for $200,000 and your insurance policy has a 2% deductible, you are responsible for $4,000 toward the cost of repairs. A deductible reduces the limit of insurance, while retention requires the insured to make payments up to a certain limit before the insurer pays. How an Insurance Deductible Works. For example, say you’re a and a wall in the house you’re working on is damaged. For example, if you file a homeowners insurance claim for $5,000 worth of damage and your policy . They can either be specific amounts of money or a percentage. Once you reach your out-of-pocket maximum, your insurance will cover the remaining costs. For example, if a policy has a $500 deductible and the policyholder files a claim for $1,000 in damages, they would pay the first $500, and the insurance company would cover the remaining $500. To that end, there are some long-term care insurance . You may hear the phrase that coverage begins “after you. Similarly, if you “surrender” or cash out the entire policy, you may owe income taxes if you have any .The costs of regular prescriptions as part of your monthly household expenses. Auto insurance customers this year are “gonna have to be more aggressive” to find savings, said Lee Baker, an Atlanta-based financial . Lastly, deductibles help insurance companies manage risk and offer policies at affordable premiums.You pay your portion of coinsurance until you reach the plan’s out-of-pocket max. However, deductibles can be beneficial to the policy .An insurance deductible is the amount that a policyholder must pay out of pocket before their insurance coverage begins to pay for a covered claim.Percentage deductibles typically range from 1% to 10% of your home's insured value.A deductible is the amount of money that you are responsible for paying toward an insured loss.For example, if you have a car insurance policy with a $500 deductible and you make a claim for $2,000, you would be responsible for paying the first $500, and the insurance company would cover the remaining $1,500.Shop widely for discounts.

When you do so, withdrawals that exceed your basis in the policy may be treated as taxable.Auteur : Snehil Gambhir

Insurance Deductible

A typical condo insurance policy covers your personal belongings and pays .Insurance deductibles are a crucial aspect of insurance policies, but they can often be confusing for policyholders. How an auto insurance deductible works. For example, let’s say your $1,500 laptop was stolen and you have a $500 deductible.

What is a Deductible?

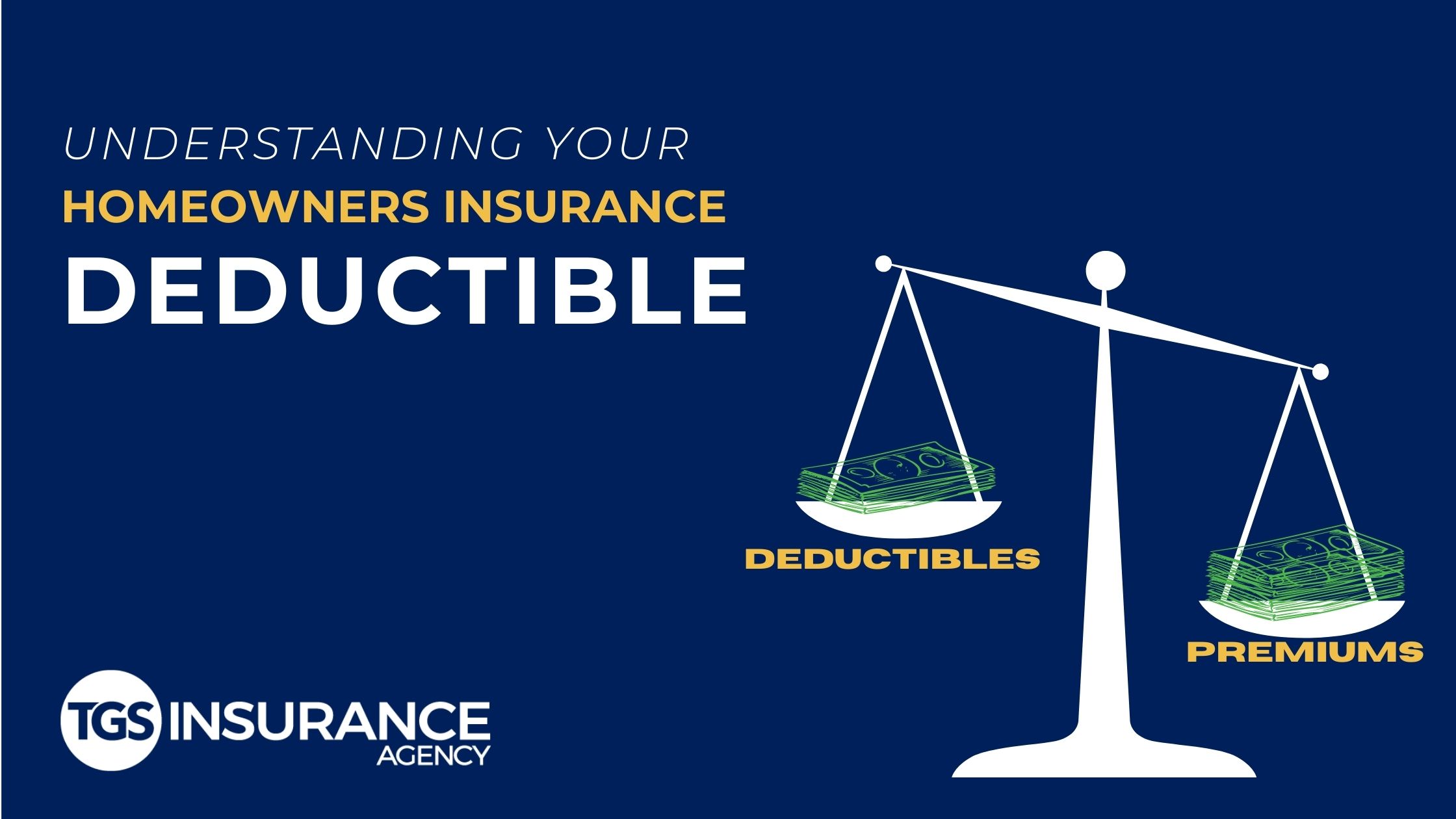

Excess, on the other hand, can be calculated in different ways. The insurance company won’t accept a claim to repair the broken window because it will cost less than $2,000 to repair, but will .In conclusion, deductible and premium are two important attributes of insurance policies that play a significant role in determining the cost and coverage.A home insurance deductible is the amount an insurance company reduces from the payment of a claim.An insurance deductible is what you pay for health, auto, homeowners and other types of insurance claims before your coverage .Nerdy takeaways. If you have a covered loss of $30,000, your homeowners policy will cover $26,000 in damage or loss. It applies to each covered claim.Policy loans are a common feature of certain types of life insurance policies, allowing policyholders to borrow against the cash value of their policies.Insurance policies have deductibles as a way of sharing the risk between both parties, those being the insured and the insurer.

Nevertheless, the tax rules can be somewhat complex and there are types of insurance coverage that do not meet the IRS criteria of .The main purpose of deductibles is to keep the cost of insurance low and affordable for everyone.

How Health Insurance Deductibles Work

.png/9025a687-d4ba-450f-fa19-12a92c3cb212?t=1637254391104&imagePreview=1)

Life insurance premiums are not usually tax-deductible. In this case, you would be responsible to pay the first $500 out of your own pocket and your insurance provider . What are insurance deductibles? How does an insurance deductible work? Home insurance deductibles.Deductibles serve several purposes in insurance policies, including reducing the risk of moral hazard, encouraging policyholders to be more careful, and lowering the number of small claims filed.Under Section 7702, a life insurance policy must meet two requirements to qualify for tax-advantaged treatment: The policy must be a “life insurance contract” as defined by the IRS. For example, if you have a $2,000 deductible and spend that much on healthcare during the year, your insurance will start paying for a portion of any subsequent covered medical bills until the end of the year.

Your Insurance Deductible And How It Works

Definition & Example of Insurance Deductibles.The word ‘Deductible’ is closely associated with insurance and it is the amount of money that you must pay before the insurer begins to cover the rest of the claim amount. Once you hit the out-of-pocket maximum, the health insurance company pays 100% of your health care costs.Here's Why Dave Ramsey Thinks a High Insurance . This is because the purpose of life insurance is to provide financial protection for personal reasons rather than for business or investment purposes.A flat-rate deductible is a fixed dollar amount, such as $500.Long term care insurance premiums are deductible if the premiums exceed 10% of adjusted gross income (AGI).Your deductible is the amount you pay before your insurance plan covers any medical expenses. A deductible is the amount of money that will be subtracted from any future claims payouts; it’s your contribution to the claim.Condo insurance, also known as HO-6 insurance, is designed to cover what your condo association’s master policy won’t. What’s more, the interest paid on policy loans may be tax-deductible under certain circumstances. All this information will be outlined in policies.comIs Auto Insurance Deductible Per Incident or Per Year?insurancepanda. What is the right deductible for me. The most likely deductibles compared to your emergency fund. Fact checked by Mrinalini Krishna.

What Is an Insurance Deductible and Why Is It Important?

If any of those line items don’t work out, the policy is probably a bad match for your needs. As always, you should consult with a tax professional to review your specific situation and find the strategies that are right for you.

When Are Life Insurance Premiums Tax Deductible?

It can be a fixed amount, such as $200, or a percentage of the claim .

What Are Insurance Deductibles and How Does It Work • Lemonade

If your employer pays for a life insurance, the premium paid on policy amounts above $50,000 .

Are Hybrid LTC Insurance Premiums Tax Deductible?

When you experience a loss to your vehicle, home, or health, deductibles are subtracted from what your insurer pays.

And, largely because of those rising costs, people are increasingly shopping .Insurance retention and deductible are not the same thing.Deductibles are normally provided as clauses in an insurance policy that dictate how much of an insurance-covered expense is borne by the policyholder. Among employer-based health insurance plans in the U. A policy deductible is the amount you must pay out of your own pocket before your insurance provider will pay for any insured loss or . Deductibles are how risk is shared between you, the policyholder, and your insurer.Temps de Lecture Estimé: 7 min

What Are Deductibles In Insurance?

50,000, you will pay 100% of the eligible expenses until the bills total Rs. You could have a flat fee or a percentage deductible and may have multiple deductibles on one policy. While deductible represents the amount an insured individual must pay out of pocket before insurance coverage kicks in, premium refers to the cost of insurance paid to the insurance company. Most states require drivers to carry a minimum amount of auto insurance.Updated September 11, 2023. The out-of-pocket maximum compared to your savings.An insurance deductible is deducted from your claims check amount.An insurance deductible is the amount of money you are responsible for paying out of pocket before your insurance coverage kicks in. With a $500 deductible, you would pay the first $500, and your insurance company would pay the remaining .

Insurance Deductibles

How health insurance deductible works.

Health Insurance Deductible: How It Works, Types

In This Article.

What is a deductible in insurance?

It’ll cost $15,000 to fix.Firstly, they help reduce the number of small and frivolous claims, allowing insurance companies to focus on significant losses.

With some exceptions, you will pay a deductible for each loss you file under your auto insurance policy. Your policy deductible, sometimes called an annual deductible, is what you pay out of pocket before your insurance policy provides financial .

Health insurance deductibles apply on an annual basis, which means your deductible will reset when your policy renews. Auto insurance deductibles.

A Guide to Homeowners Insurance Deductibles

In other words, it's the amount of money you're required to pay out of pocket .comRecommandé pour vous en fonction de ce qui est populaire • Avis

How Do Insurance Deductibles Work?

This deduction is how risk is divided between policyholders and insurers. You may, however, be able to deduct them as a business expense if you are not directly or indirectly a beneficiary of the policy. Some insurers make $1,000 the default choice, and as a result, many of their policies are written with a $1,000 deductible. On the face of it, the benefits of deductibles might not be apparent. In other words, it’s the amount you .As mentioned earlier, in most cases, life insurance premiums are not tax-deductible expenses for individuals. Additionally, deductibles encourage policyholders to exercise caution and avoid unnecessary claims.

/GettyImages-661783421-a81a1b8fd1774855b6a7147e4f5ac069.jpg)