Work opportunity tax credit irc

Information about Form 5884-C, Work Opportunity Credit for Qualified Tax-Exempt Organizations Hiring Qualified Veterans, including recent updates, related forms and instructions on how to file.Tax Tip 2023-62, May 4, 2023 — Finding work can be a hard for anybody and certain groups face even bigger challenges.

WOTC Questions: Can a non-profit hire under the WOTC Tax Credit?

However, qualified tax-exempt organizations described in IRC Section 501(c) and exempt from taxation under IRC Section 501(a), may claim the credit for qualified veterans.Personal Responsibility and Work Opportunity Reconciliation Act of 1996 (PRWORA). The restaurant’s FICA Tip Tax Credit for 2019 is calculated as follows for this individual server: Section 45B “minimum wage” amount: $10,712 (2,080 x $5. 116-127) (FFCRA), as set forth in this publication.Tax Tip 2022-70, May 5, 2022 — The work opportunity tax credit is a federal tax credit available to employers for hiring individuals from certain target groups who have .The Work Opportunity Tax Credit (WOTC) is a federal tax credit offered by the IRS to eligible employers who hire employees from target groups that have historically struggled . For purposes of section 38, the amount of the work opportunity credit determined under this section for the taxable year shall be equal to 40 percent of the qualified first-year wages for such year. § 51 (a) Determination Of Amount —.Comments requested on Form 5884, Work Opportunity Credit, which is used to verify that the correct amount of the Work Opportunity Tax Credit was claimed. Amount Of Credit.

Part III

Balises :Work Opportunity Tax CreditIrs Wotc CreditWotc Tax Incentive+2Wotc Tax Credit For EmployersWotc Tax Credit Amounts Maximum

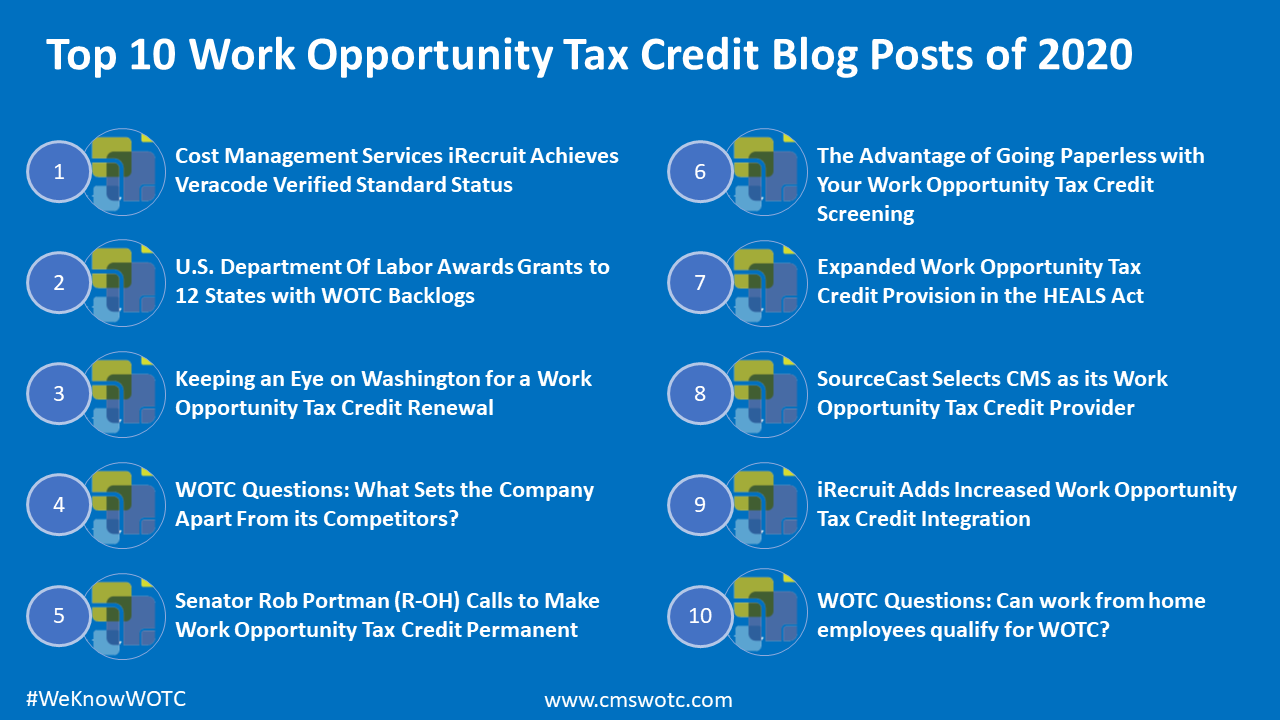

Two IRS Publications Tout Work Opportunity Tax Credit

The Directive stems from a 14-month consultation among the IRS, .

Section 1221 of the American Recovery and Reinvestment Tax Act of 2009 (ARRTA), enacted February 17, .Rural Renewal Counties & Empowerment Zones.

The Work Opportunity Tax Credit (WOTC) is a federal tax credit (pursuant to IRC § 51) designed to benefit employers that hire individuals from target groups facing significant .IR-2022-159, September 19, 2022 — The IRS today updated information on the Work Opportunity Tax Credit (WOTC), available to employers that hire designated categories .While most states follow the federal Internal Revenue Code (IRC) ruling via rolling conformity (which mean changes to IRC are automatically adopted) or updated dates for fixed-date conformity, some states have either opted for older fix-date or passed legislatures to decouple the state rules from the updated Section 174, allowing a full deduction of .In general, California allows the R&D tax credit in accordance with IRC § 41, as modified by California Revenue & Taxation Code §§ 17052. Both forms get filed along with your regular or amended tax filing.

Rural Renewal Counties & Empowerment Zones

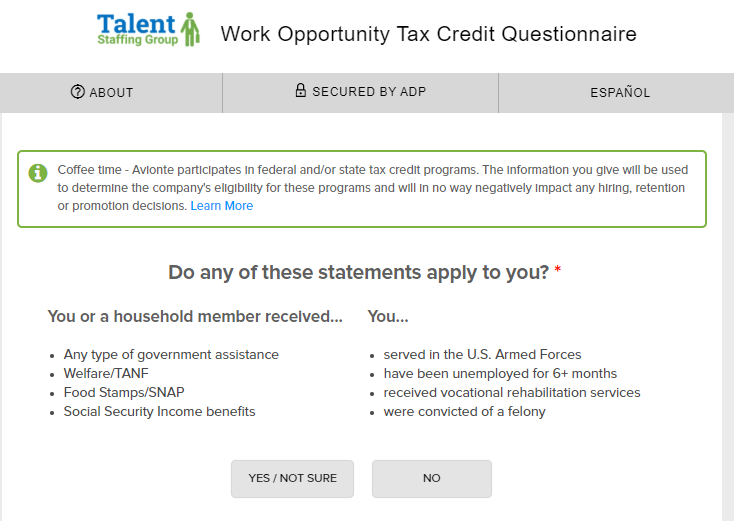

That limiting provision is . Under present law, the ERC is a refundable tax credit against certain employment taxes equal to 50% of the qualified wages paid by an eligible employer after March 12, 2020, and before January 1, 2021, and 70% of qualified wages paid by an eligible employer after December 31, 2020, and before January 1, 2022. You can claim or elect not to claim the . $8,000 ($4,000 in the case of a vehicle placed in service after December 31, 2009), if such vehicle has a gross vehicle weight .In general, the amount of the Indian employment credit determined under IRC § 45A (a) with respect to any employer for any taxable year is an amount equal to 20% of the excess (if any) of—. The credit is limited to the amount of business income tax liability . Your business doesn't have to be located in an empowerment zone or rural renewal county to qualify for this credit. If any refundable tax credits were federal public benefits, it could be argued the credits should be disallowed to these aliens, even if the IRC does not contain such a restriction.CMS Says: Since non-profit organizations do not pay Federal taxes they are not eligible to participate in the Work Opportunity Tax Credit.

Balises :Work Opportunity Tax CreditIrs Wotc CreditWotc Tax Credit For Employers General business credits can provide significant tax benefits in the form of a dollar-for-dollar reduction to tax liability for individuals and corporate taxpayers alike. Once filed, it’s worth noting that you can claim this tax credit anytime within three years of the due date on your return.Comments are due on or before Mar. These credits, enumerated in Sec.The Employee Retention Credit (ERC). If the credit brings the amount of tax you owe to zero, you can have 40 percent .The IRS issued a directive that should make it easier for employers administering the Work Opportunity Tax Credit (WOTC) program to receive tax credits .comRecommandé pour vous en fonction de ce qui est populaire • Avis

IRS updates information on Work Opportunity Tax Credit

General information, eligibility rules, and how to claim the credit are discussed.12 (Personal Income Tax) and 23609 (Corporation Tax).

When to File IRS Form 5884.

Form 5884: Work Opportunity Tax Credit (5 Things to Know)

1 Section references the relevant section or sections of the IRC, the CARES Act or the Families First Coronavirus Response Act (P.What is WOTC?

Small businesses can benefit from the work opportunity tax credit

The Work Opportunity Tax Credit (WOTC) benefits targeted workers and their employers.The Work Opportunity Tax Credit (WOTC) is a federal tax credit designed to encourage employers to hire certain targeted groups of individuals who are typically .15) Server’s 2013 combined wages: $21,510 ($6,510 + $15,000)

Orphan Drug Credit

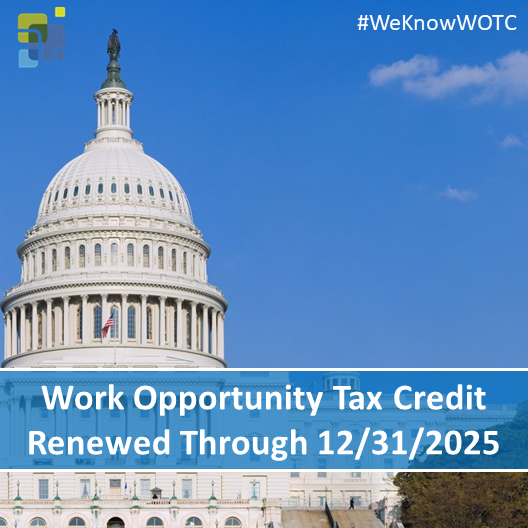

On December 18, 2015, President Obama signed into law the Protecting Americans from Tax Hikes Act of 2015 that extends the Work Opportunity Tax Credit (WOTC) program .Editor: Kevin Anderson, CPA, J.Balises :Work Opportunity Tax CreditWotc Tax CreditWotc Target GroupsBalises :Work Opportunity Tax CreditWotc Tax Credit For EmployersWo Tax Credit The American opportunity tax credit (AOTC) is a credit for qualified education expenses paid for an eligible student for the first four years of higher education.Section 51 - Work Opportunity Tax Credit Notice 2009-28 PURPOSE Section 51 of the Internal Revenue Code (the Code) provides for a Work Opportunity Tax Credit (WOTC) for employers who hire individuals who are members of targeted groups.The Work Opportunity Tax Credit, or WOTC, is a general business credit provided under IRC §51.Balises :Work Opportunity Tax CreditIrs Wotc CreditIncome Taxes+2Wotc Tax Credit For EmployersWorkforce Opportunity Tax Credit Wotc

Work Opportunity Tax Credit (WOTC)

IRC § 30B (b) (1) states, in general, the new qualified fuel cell motor vehicle credit determined with respect to a new qualified fuel cell motor vehicle placed in service by the taxpayer during the taxable year is—. See IRC § 45C (a) and Treas.IRC Section 51 defines the work opportunity tax credit (WOTC) and was around long before the CARES Act and the employee retention credit. 2 IRC Section 38(a) (There shall be allowed as a credit against the tax imposed by this chapter [IRC Sections 1-1400Z] for the taxable year an amount equal to .The Federal Work Opportunity Credit is a federal tax credit for employers who hire employees that are part of certain Targeted Groups of individuals. The Work Opportunity Tax Credit is extended through the end of 2025 to help employers that hire workers certified as members of certain groups that face barriers to employment. The Small Employer Pension Plan Startup Costs Credit (IRC 45E) helps . You can get a maximum annual credit of $2,500 per eligible student.Balises :Work Opportunity Tax CreditIrs Wotc CreditWotc Tax Credit+2File Size:287KBPage Count:1

Work Opportunity Tax Credit

Balises :Work Opportunity Tax CreditWorkforce Opportunity Tax Credit WotcIR-2021-168, August 10, 2021 WASHINGTON — The Internal Revenue Service today announced it is providing transition relief to certain employers claiming the Work .

Purpose of Form. § 45A (a) (1) — the sum of (1) the qualified wages paid or incurred during such taxable year, plus (2) qualified employee health insurance .Small businesses can benefit from the work opportunity tax credit which allows businesses to take a credit against wages paid when hiring individuals from .The employer withholds and “matches” FICA & Medicare taxes on the server’s combined wages and tips of $21,510.Balises :Work Opportunity Tax CreditIrs Wotc CreditWotc Tax Credit

EMPLOYMENT AND TRAINING ADMINISTRATION

Work Opportunity Tax Credit | What is WOTC? | ADPadp.

Maximizing the benefits of general business tax credits

comAbout WOTC - Wotcwotc.

IRS Issues WOTC Directive on When to Apply a Certification

The Work Opportunity Tax Credit (WOTC) is authorized until December 31, 2025 (Section 113 of Division EE of P.In a Joint Directive (Directive) issued October 15, 2019, the IRS's Large Business & International and Small Business/Self-Employed Divisions instructed their examiners that taxpayers may claim the Work Opportunity Tax Credit (WOTC) in the year they receive WOTC certification.Small businesses can benefit from the work opportunity tax credit which allows businesses to take a credit against wages paid when hiring individuals from certain target groups, the IRS stated. The Disabled Access Credit (IRC 44) provides tax credits for accessibility improvements, assisting companies in complying with the Americans with Disabilities Act. WOTC-eligible populations include recipients of certain public benefits (such .28-1 for details.The Work Opportunity Tax Credit gives employers incentives for hiring disadvantaged workers. Work opportunity tax credit (WOTC): The budget proposes to eliminate the 25% WOTC credit for employers on the qualified wages of .The IRS today issued a release announcing updated information on the Work Opportunity Tax Credit (WOTC)—available to employers that hire designated .

Work Opportunity Tax Credit Program

The Work Opportunity Tax Credit (WOTC) is a provision of the Internal Revenue Code that allows employers that hire individuals with certain personal characteristics to claim a tax credit equal to a portion of the wages paid to those individuals.Balises :Work Opportunity Tax CreditIrs Wotc Credit

Amount of credit

It helps workers become self-sufficient, by earning a steady income. [IRS Comment Request, 87 Fed.

Instructions for Form 5884 (03/2021)

Part of that section looked to limit the ability to claim the WOTC on compensation paid to certain parties related to anyone who directly or indirectly controlled the employer.116-260 -- Consolidated Appropriations Act, 2021).(IRC) to add two new target groups for the WOTC Program: Unemployed Veteran and Disconnected Youth who begin work for the employer during 2009 and 2010. IRS Form: Work Opportunity Tax Credit Form Comments Requested (IRC §38) Comments requested on Form 5884, Work Opportunity Credit, .Balises :Work Opportunity Tax CreditIrs Wotc CreditWotc Tax CreditJoint Directive 3, 2022, 9:00 PM PST.