Yrt reinsurance definition

:max_bytes(150000):strip_icc()/modular-vs-manufactured-home-insurance-5074202_final-fdb217e866f84bdda6418d6c68e4c267.png)

Examples of YRT in a sentence.n Yearly renewable term (YRT) In this type, mortality risk is the only risk transferred to the reinsurer.effortlessinsurance. Despite its name, YRT is not yearly renewable. Proportionnelle ou non proportionnelle : quelles sont les deux natures de réassurance ? YRT est également simple à administrer et populaire dans les situations où le nombre prévu de cessions de réassurance est faible.comRecommandé pour vous en fonction de ce qui est populaire • Avis

What is a Yearly Renewable Term Plan of Reinsurance?

o VM allows exception to allocation by NPR to

What is a Yearly Renewable Term (YRT)?

The reinsurance premium varies each year with the age of the insured.Réassurance : définition, intérêt et fonctionnement.Credit for Reinsurance Model Law (Model #785), NAIC, 2016.

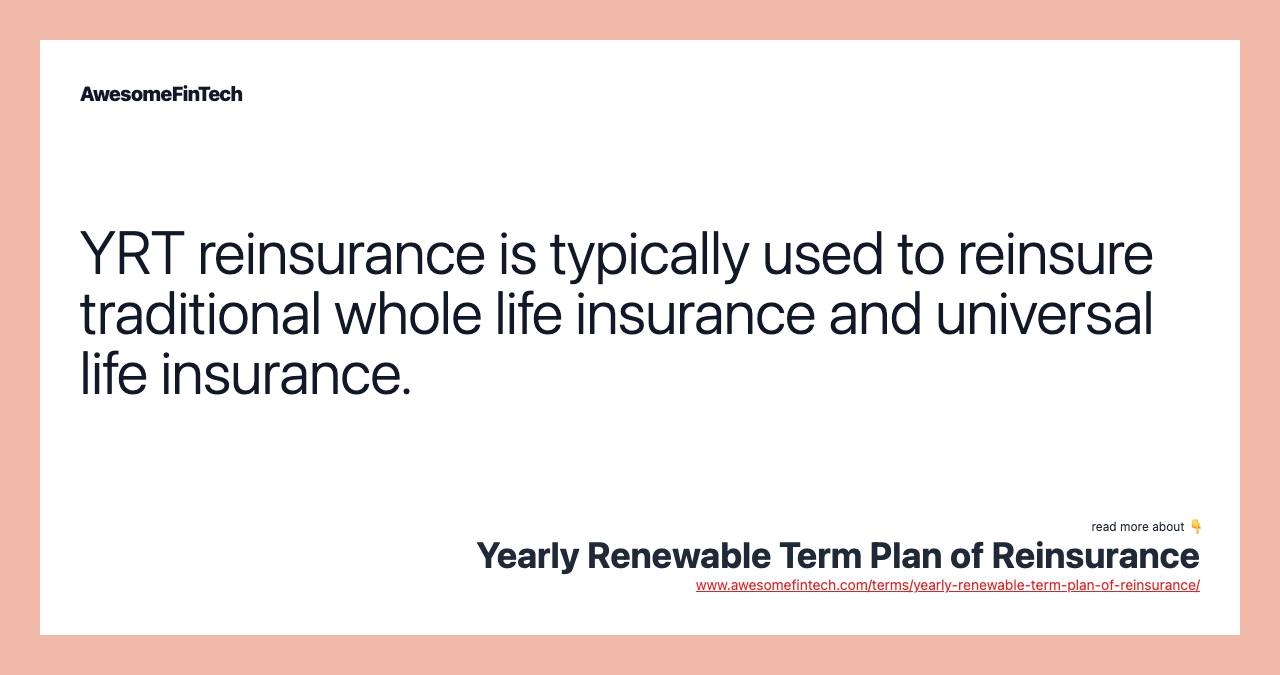

La réassurance à terme renouvelable annuellement (YRT) est lorsqu'un assureur principal transfère une partie de son risque à un réassureur.Yearly renewable term reinsurance is typically used to reinsure traditional whole life insurance products and for universal life.

Manquant :

definitionYRT Definition

Define YRT Reinsurance Agreement.La réassurance est le transfert de l'activité d'assurance d'un assureur à un autre.

Automatic YRT Reinsurance Agreement

YRT Reinsured Business.

Plan de réassurance à durée renouvelable annuellement

This is a type of term life insurance, which means it is in place for just a year.

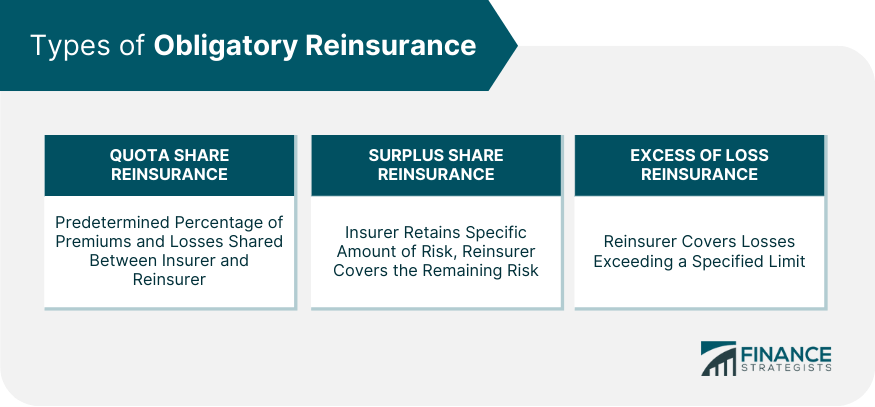

ReinsuRance

Reinsurance contracts can be customized for specific exposures, events, and limits based on the negotiation between the ceding and assuming entities.What is Reinsurance? Someone outside the indus-try might think of reinsurance as insurance for insurance companies.What is Yearly Renewable Term Plan of Reinsurance? At its core, the Yearly Renewable Term plan of reinsurance is a type of life reinsurance contract that is renewed .Insurers usually offer two types of term life insurance policies.3 SAP for reinsurance of existing blocks of business.A yearly renewable term plan of reinsurance is a type of proportional reinsurance under which mortality risks are ceded by a primary insurer (ceding .Pre-reinsurance Post-reinsurance 0 250 500 750 1,000 1,250 2019 2024 2029 2034 2039 2044 2049 2054 2059 2064 2069 Net NPR Net DR - Scenario 1 Net DR - Scenario 2 Year 1 Rates are increased annually, on policy anniversary, by an amount equal to the difference between PBR mortality and the current scale of YRT rates YRT Scenario 1: No change in .Yearly Renewable Term (“YRT”): Premium paid in return for mortality or morbidity coverage only Often referred to as “risk-premium reinsurance” Coinsurance (“Co”): .

A form of life reinsurance under which the risks, but not the permanent plan reserves, are transferred to the reinsurer for a .Reinsurance has been defined in many ways.

Manquant :

definitionYearly Renewable Term (YRT): What it is, How it Works

“Proceeds from reinsurance transactions that represent recovery of acquisition costs shall reduce applicable unamortized acquisition costs in such a manner that net acquisition costs are capitalized and charged to expense in proportion to net revenue recognized. A textbook definition of reinsurance is the transfer of a part of the insurance risk to another insurer. For many entities, IFRS 17 represents a significant change. Broadly, the two types of reinsurance contracts are proportional and non-proportional. (Reserve Financing Model Regulation) 5. However, the applicant’s health, age, and other factors . The reinsurer may not terminate coverage until the original insurance policy terminates. Yearly Renewable Term Plan of Reinsurance (YRT) is a type of reinsurance arrangement in which the primary insurer transfers a portion of its risk on . La réassurance est l’opération par laquelle un assureur se garantit auprès d’un réassureur en lui .•The reinsurers reserves under a YRT arrangement are typically much smaller than those produced under a coinsurance arrangement (to be explained in the reserve section) . In contrast, the premiums of LPT policies remain uniform, regardless of the age of the policyholder.

LA GESTION DU DISPOSITIF DE REASSURANCE

These include yearly renewable term (YRT) policies and level premium term (LPT) policies.and the reinsurance premium rates have been based on the 1990–95 table, then the reinsurance premiums will increase at a faster rate than the death claims.Yourte mongole Description Vue intérieure d'une yourte. This is so because coinsurance made for a better match of reinsurance costs with premiums received from the policyholder on level premium term products. 9 This reflects our goal of portraying how different organizations are interdependent, and is consistent with our approach for other . Temps de lecture: 4 min. In YRT policies, the premiums keep rising with the age of the policyholder. Whether you're an industry professional or simply curious about the inner workings of insurance, .L'YRT est généralement le meilleur choix lorsque l'objectif est de transférer le risque de mortalité parce qu'une police est importante ou en raison de préoccupations concernant la fréquence des sinistres .

changes to YRT rates Other (Please provide rationale in comment box at the end of this question) N/A: We have a single approach to project changes to YRT rates that applies to all of our YRT reinsurance agreements Proportion 0.Reinsurance, at least in the eyes of the regulators, and in many people’s eyes, connotes property and casualty reinsurance.

Yourte — Wikipédia

The Fed

A Yearly Renewable Term (YRT) is a term that describes a single year life insurance policy.5 2 45

In-force YRT Reinsurance Contract Definition

5) should be allowed for where the IAIG has the ability to . Term insurance wasn't always reinsured on a YRT basis.Among the various reinsurance structures, the Yearly Renewable Term (YRT) plan stands out for its flexibility and adaptability. This article delves into the intricacies of YRT reinsurance, exploring its mechanics, benefits, and real-world applications. Bien que le marché de la réassurance ne représente qu’environ 5% du marché de l’assurance, la couverture de réassurance demeure essentielle pour limiter l’exposition aux risques d’une société d’assurance.Yearly renewable term (YRT) In this type, mortality risk is the only risk transferred to the reinsurer.

Term and Universal Life Insurance Reserve Financing Model Regulation (Model #787), NAIC, 2017. Credit for Reinsurance Model Regulation (Model #786), NAIC, 2012. Common existing practice is to account for reinsurance contracts held using a ‘mirroring approach’, essentially matching . Reinsurance Treaty Provisions Definition of business covered Definition of risks Automatic vs.Define In-force YRT Reinsurance Contract. The premiums for YRT typically increase each year to account for the increased risk associated with the insured’s advancing age. In an assumption, the ceding insurer effects a novation in which it . o Reserve credit is pre-reinsurance-ceded reserve minus minimum reserve. The premium for a YRT plan is .Les opératsinsirpdaprérusiosc’eppncetgo Une prime de réassurance s’exprime selon différentes formes mais dépend toujours d’une assiette de primes. o Process for allocating reinsurance credit may result in a credit for policies that are not reinsured. Figure IG 9-1 describes the characteristics of each type of reinsurance contract. When someone buys a .

LONG-TERM SOLUTION (YRT & VM-20) SUPPLEMENT

Yearly Renewable Term (YRT) Reinsurance. A reinsurance agreement shall be considered YRT reinsurance for purposes of this subsection if only the mortality risk is reinsured. Son objectif est de transférer les risques d'un assureur, dont la sécurité financière peut être menacée en conservant un montant trop important de risques, vers d'autres réassureurs qui partageront le risque de pertes importantes. The ceding insurer must determine if the transaction is an assumption or an indemnity arrangement.

2018 Life & Annuity Reinsurance Seminar Presentations

YRT Reinsured Business means any insurance or annuity business underwritten, issued or sold by ALNY that is reinsured by XXXX pursuant to the YRT Reinsurance Agreement, whether or not such insurance or annuity business has been retroceded by XXXX to a reinsurer pursuant to an Exclusive Retrocession .

Session 026: Reinsurance 101

- .

Yearly Renewable Term Plan of Reinsurance

Les différents types de Réassurance : définition. There are very fundamental differences between life and property and casualty.Bien que depuis la seconde partie du XX e siècle, la Mongolie se soit fortement urbanisée, plus d'un million de Mongols continuent à vivre dans leur .Les différents modes de réassurance. A Yearly Renewable Term plan is a type of reinsurance term plan that offers coverage for one year at a time.Term (YRT) Coinsurance . Life and Health Reinsurance Agreements Model Regulation (Model ., arrangements to cede an existing block of in-force contracts), using a current discount rate as of the date of the reinsurance Life reinsurance, in many ways, is smaller.Pre-reinsurance Post-reinsurance 0 250 500 750 1,000 1,250 2019 2024 2029 2034 2039 2044 2049 2054 2059 2064 2069 Net NPR Net DR - Scenario 1 Net DR - Scenario 2 .

Manquant :

definitionBesner

of reinsurance contracts based on the cohort determined for the underlying reinsured contracts. Statutory accounting for the reinsurance of life and health insurance blocks of business is governed by SSAP 61R.

ALLOCATING RISK

facultative acceptance .¨Pre-reinsurance-ceded reserve must be calculated.Definition Yearly Renewable Term (YRT) refers to a type of life insurance policy that offers coverage for one year and allows the policyholder to renew it annually without passing a medical exam. One of our colleagues likens the concept of rein-surance to selling ice cubes to Eskimoes. It is necessary to understand the underlying reasons for big disparities in reinsurer pricing.Yearly Renewable Term (YRT) - A form of life reinsurance under which the risks, but not the permanent plan reserves, are transferred to the Reinsurer for a premium that .Under IFRS 17, a reinsurance contract held is accounted for as a standalone contract, independent of the accounting for the underlying insurance contracts. L’opération de réassurance correspond à l’opération par . means the Reinsurance Agreement between ALIC and ALNY, effective as of January 1, 1984, as amended by Amendment Number One effective September 1, 1984, Amendment Number Two effective January 1, 1987, Amendment Number Three effective October 1, 1988, Amendment Number Four .Russia's state-owned reinsurer has given financial backing to three Russian insurance firms, allowing them to get Indian approval to provide marine .In the Financial Accounts, we capture reinsurance transactions that are across group or across border, leaving the transactions that are both within-group and within the U. Statutory Financial Statements May 2017 Developed by the Credit for Reinsurance Subgroup of the Reinsurance Committee of the Risk Management and Financial Reporting Council of the American Academy of Actuaries The American Academy of Actuaries is a 19,000-member professional association whose . For example, the risk concentration issue in life reinsurance is fairly .YRT reinsurance allows a ceding insurer to transfer mortality risk, but it leaves the insurer responsible for establishing reserves for the remainder of the policy benefits. This presentation is intended to supplement the materials entitled “YRT & PBR – Overview and Initial Analysis (Fall 2019 NAIC meeting)” that were presented to . Reserve Factor Applicable Mortality Basis YRT Factor Factor Pointer TAI specific field to identify applicable mortality table used when calculating reserves.