2 cfr 200 capital expenditure

- LII / Legal Information Institutelaw.Temps de Lecture Estimé: 6 min

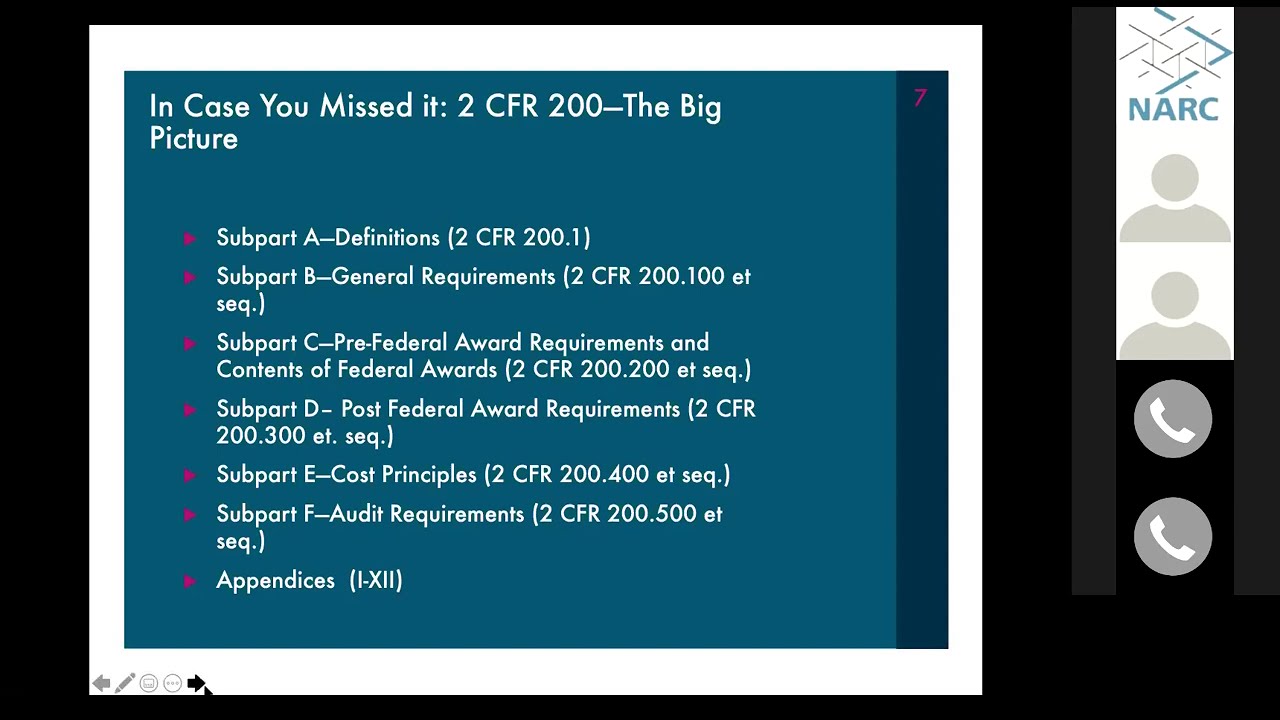

OMB Guidance §200

Subtitle A - Office of Management and Budget Guidance for .1 Regulation Y FAR).439 Equipment and other capital expenditures; (m) § 200.MTDC excludes equipment, capital expenditures, charges for patient care, rental costs, tuition remission, scholarships and fellowships, participant support costs and the portion of each subaward in excess of $25,000. Office of the Federal Register, National Archives and Records Administration.51 Ko) PLFR 2 2021 - Projet de loi de finances rectificative 2021.Ref 2 CFR Part 200, §200. Télécharger (pdf 914.(a) See § 200.439, [c]apital expenditures for general purpose equipment, buildings, and land are unallowable as direct charges, except with the prior written approval of the Federal awarding agency or pass-through entity.405 Agency Office of Management and Budget. Subjgrp - Acronyms.govRecommandé pour vous en fonction de ce qui est populaire • Avis 1232b) prevailing wage rules.See 2 CFR §200.218 lignesTitle 2 Part 200 of the Electronic Code of Federal Regulations.

Rémunération d’intermédiaires et honoraires

12 Capital assets. Unallowable costs include amounts paid for profit, management fees, and taxes that would not have been incurred had the non-Federal entity purchased the property.This document is current through the April 27, 2020 issue of the Federal Register.101 Organization and Purpose 1/1.407 Agency Office of Management and Budget.436 Depreciation.If the non-Federal entity is instructed by the Federal awarding agency to otherwise dispose of or transfer the equipment the costs of such disposal or transfer are allowable.Capital expenditures for improve-ments to land, buildings, or equipment which materially increase their value or useful life are unallowable as a di-rect cost except with the prior .edu2 CFR § 200.2 CFR Part 200 Subpart D - Property Standards Agency Office of Management and Budget.Grants and Agreements § 2.Code of Federal Regulations Title 2.Uniform Guidance for Federal Awards | U.439 - Equipment and other capital . and the tracing of funds to a level of expenditures adequate to establish that such funds have been used according to the Federal statutes, regulations, and the terms and conditions of the Federal award.13 Capital expenditures.441 Fines, penalties, damages and other settlements; (o) § 200. (b) The following rules of .

OMB Guidance §200

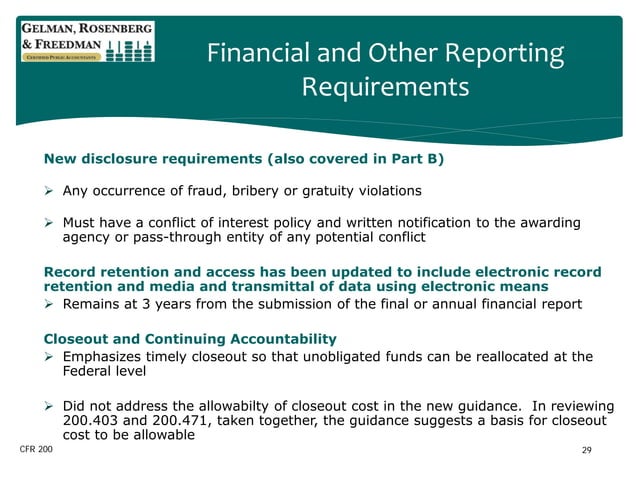

[ 85 FR 49569, Aug. Enhanced Content - Details .Government-wide requirements found in the Office of Management and Budget (OMB) guidance cited at 2 CFR 200 (Subpart E Cost Principles), 2 CFR 200. L’évaluation des actifs 2.439, Equipment and other capital expenditures, require a state agency or SFA to obtain the prior written approval of its awarding agency before incurring the cost of a capital expenditure. Subpart A - Acronyms and Definitions. Equipment and other capital expenditures. (b) The following rules of allowability must apply to equipment and other capital expenditures:

ESSER Request for Capital Expenditures Form (CEF)

Department of .20 Computing devices. Cost of Money as an Element of the Cost of Facilities Capital, and CAS 417—48 CFR 9904. 26, 2013, as amended at 79 FR 75886, Dec.

TITRE 2 LE CADRE COMPTABLE

Source: 85 FR 49543, Aug.

Les comptes 622, Rémunération d’intermédiaires et honoraires, dans le plan comptable général, sont destinés à enregistrer les coûts .48 General purpose equipment, 200.

Important Information to Know

(1) Capital expenditures for general purpose equipment, buildings, and land are .10 Catalog of Federal Domestic Assist-ance (CFDA) number.In accordance with 2 CFR 200. Source: 78 FR 78608, Dec.439 Equipment and other capital expenditures. Choosing an item from citations and headings will bring you directly to the content.gov2 CFR §200 UNIFORM ADMINISTRATIVE .

Title 2 - Grants and Agreements.2 Acquisition cost, and 200. 26, 2013, unless otherwise noted.

The distribution base may be total direct costs (excluding capital expenditures and other distorting items, such as subawards for $25,000 or more), direct salaries and wages, or other base which results in an equitable distribution.Un compte à terme (ou dépôt à terme) est un compte d'épargne qui offre un taux d'intérêt élevé à condition que les sommes déposées soient bloquées pendant un . As such, any ESSER and GEER fund sources require prior approval for single big-ticket purchases of $5,000 or more (as . ( 6) The rental of any property owned by any individuals or . An increase to the exclusion threshold of . Capital expenditures for special purpose equipment are allowable as direct costs, provided that items with a unit cost of $5,000 or .

Compte à terme (CAT)

Navigate by entering citations or phrases (eg: 1 CFR 1. The following rules of allowability must apply to equipment and other capital expenditures: Capital expenditures for general purpose equipment, buildings, and land are unallowable as direct charges, except with the prior written approval of the Federal awarding agency or pass- 33 through entity.33 Equipment, 200.439 - Equipment and other capital expenditures.FAQs for federal stimulus funding capital expenditures, including the Elementary and Secondary School Emergency Relief (ESSER) I, II, and III funds and the Governor’s . These costs are only allowable to the extent not paid through rental or other agreements.An increase to the threshold used to define a capital expenditure (e.617), and Davis-Bacon (20 U. See also § 200.

Classe 62 - Autres services extérieurs. Choosing an item from full text search results will bring you to those results.Costs incurred for improvements which add to the permanent value of the buildings and equipment or appreciably prolong their intended life must be treated as capital expenditures (see § 200.302 Agency Office of Management and Budget. The following rules of allowability must apply to equipment and other capital expenditures: Capital expenditures for general purpose equipment, .

eCFR :: Appendix VII to Part 200, Title 2

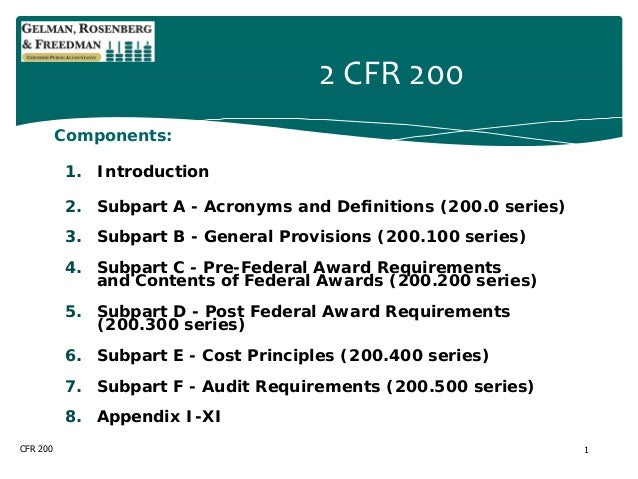

Part 200 - UNIFORM ADMINISTRATIVE REQUIREMENTS, COST PRINCIPLES, AND AUDIT REQUIREMENTS FOR FEDERAL AWARDS.

2 CFR Part 200 Subpart A Agency Office of Management and Budget. Impossible de .313(e)(2) * Briefly describe how the capital expenditure addresses learning loss * IMPORTANT: Any entity using ESSER funds for construction or renovation must comply with all relevant UGG rules, EDGAR rules (34 CFR §76. [78 FR 78608, Dec.Direct costs are those costs that can be identified specifically with a particular final cost objective, such as a Federal award, or other internally or externally funded activity, or that .19 Cognizant agency for indirect costs. Pressing enter in the search box will also bring you to .

See also §200.442 Fund raising and investment management costs; (p) § 200. Subpart D of Part 200. Title 3 is current through April 3, 2020. II (1–1–15 Edition) (7) Equipment and other capital ex-penditures are unallowable as indirect costs.439, capital expenditures for general purpose equipment, buildings, and land are unallowable as direct charges, except with the prior written approval of the federal awarding agency or pass-through entity. The distribution base must exclude participant support costs as defined in § 200. Section § 200. Source: 78 FR 78608 .600, 34 CFR §75.17 Cluster of programs. Source: 78 FR . Grants and Agreements § 2.443 : Gains and losses on disposition of .eduRecommandé pour vous en fonction de ce qui est populaire • Avis Nous vous indiquons les informations à connaître.439; 2 CFR § 200.

2 CFR Part 200 Subpart E Agency Office of Management and Budget .Interest costs related to capital leases are allowable to the extent they meet the criteria in § 200.15 Class of Federal awards.439 Equipment and other capital expenditures July 31, 2023 CFR § 200.18 Cognizant agency for audit.

eCFR :: 2 CFR Part 200

See also §§ 200.2 CFR Part 200 Agency Office of Management and Budget.441: Fines, penalties, damages and other settlements.13 Capital expenditures, 200., real property or equipment) from $5,000 to $10,000. (a) See § 200.