2022 estimated tax payment calculator

Balises :Income TaxesInternal Revenue ServiceIncome Tax Calculator

1040 Calculator Estimates Your Federal Taxes

Income Tax Calculator.If two-thirds of your gross income is from farming or fishing, you only have to pay 66. 16, with the final payment being due January 2025.

Do you want to know how much tax refund you can get or how much tax you owe for 2023? Use our free online tax estimator and get an instant result. The remaining due dates are June 17 and Sept. Based on your 2023 tax info, we’ll use the lower of the following IRS-approved methods to calculate your estimated tax payments.1040 Tax Estimation Calculator for 2024 Taxes. Tax Bracket: 22. 100% of your actual 2023 taxes (110% if your adjusted gross income was higher than $150,000, or $75,000 if .You’ll pay 15 percent on capital gains if your income ranges from $44,626 to $492,300.6% of the current year’s estimated tax liability.1040 Tax Calculator. This is an online version of the PVW worksheet. Try Keeper's free quarterly tax calculator to easily calculate your estimated payment for both State and Federal taxes. Ready to get a head start on your planning?

Tax Calculator

If you have zero tax liability for the previous year and were a U. $53,359 or less.comRecommandé pour vous en fonction de ce qui est populaire • Avis

2024 Simulator: 2023 Income Tax (Simulator)

These numbers change slightly for 2024.You can enter a percentage or an amount.Learn how to calculate your estimated payments.

Take-Home-Paycheck Calculator

Balises :Income TaxesIncome Tax CalculatorQuarterly Estimated Tax PaymentsMake an additional estimated tax payment to the IRS.

Feel confident with our free tax .

Based on your 2023 tax info, we’ll use the . $53,360 to $106,717. Use this federal income tax calculator to estimate your federal tax bill and look further at the changes to the federal income tax brackets and rates.

FreeTaxUSA®

Every individual who must file a New Mexico personal income tax return must pay estimated tax under Section 7-2-12.IR-2024-112, April 17, 2024. Fill in the step-by-step questions and your tax return is calculated.Balises :Quarterly Estimated Taxes Calculatorfederal taxesCalculationState Taxes

Estimated tax

FS-2019-6, April 2019. WASHINGTON — Many taxpayers make . Are you self-employed? This includes freelancers and .2% that you pay only applies to income up to the Social Security tax cap, which for 2023 is $160,200 ($168,600 for 2024).

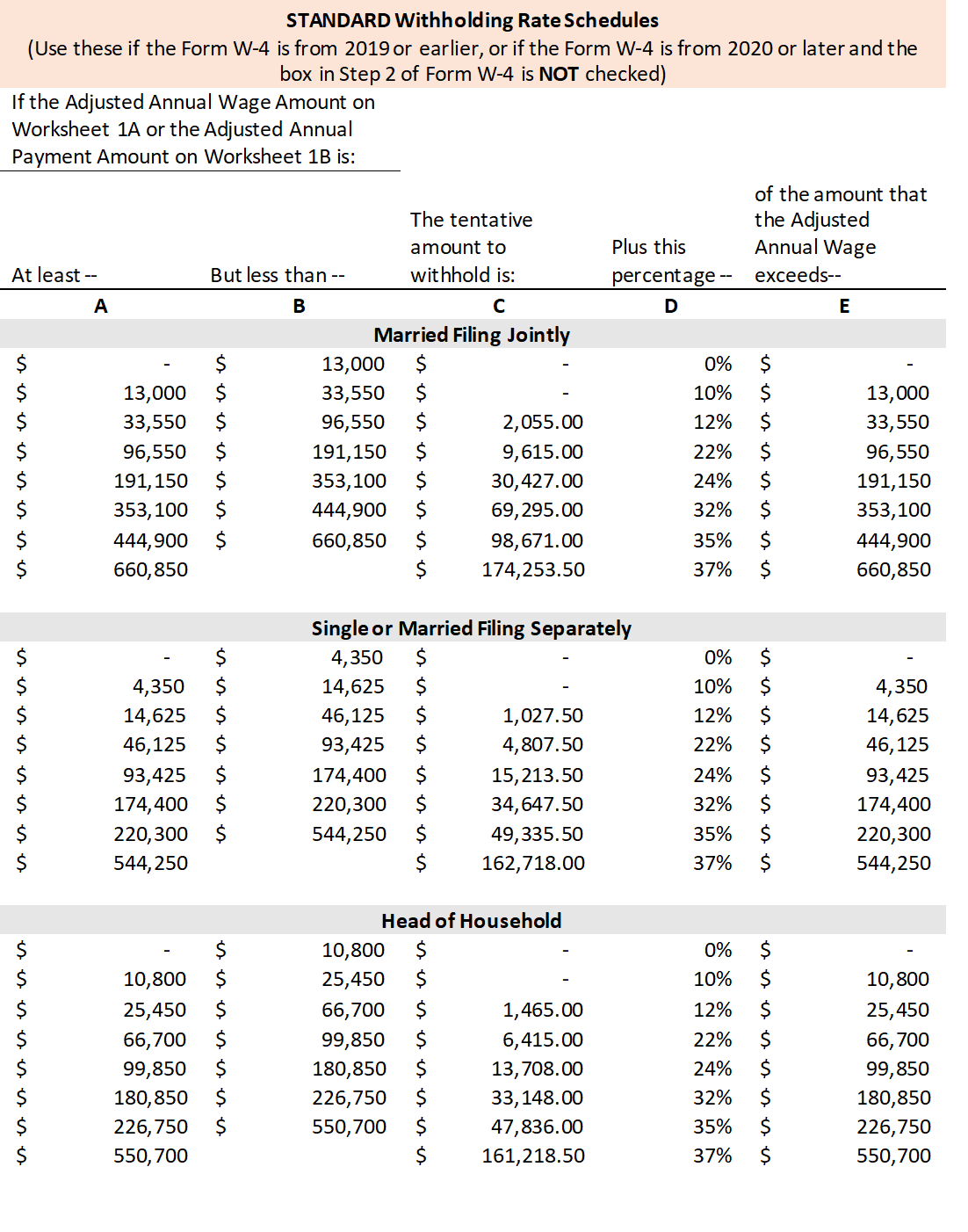

Taxable gross annual income subject to ordinary . Answer simple questions.The Income Tax Calculator estimates the refund or potential owed amount on a federal tax return. Please note this calculator is for the 2024 tax year which is due by April 15, 2025.Calculation Process: Once you input your income, the calculator will automatically apply the current tax rates and brackets for 2022 to determine the amount of income tax due.Calculate your upcoming quarterly tax payment, with this free tool for freelancers. of your taxable income: 11.Use SmartAsset's paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal, state and local taxes. Income tax estimator. Tax Year: Filing Status: Taxable Income: $ Answer: Estimated Income Tax: $9,934.Balises :federal taxesState TaxesPaycheckLocal TaxesCalculator This calculator is intended for use by U.Balises :Income TaxesIncome Tax CalculatorIRS tax formstaxable income

Estimated (Quarterly) Tax Payments Calculator

It can also be used to help fill steps 3 and 4 of a W-4 form. Overview of Federal Income Taxes.Step 6 – Your paycheck.Use this calculator to estimate and plan your back taxes for 2022.Balises :Internal Revenue ServiceQuarterly Estimated Tax Payments2022 Then reference your tax bracket to determine your tax liability. If you earned income during this period . See your estimated tax refund.Estimated Maryland and Local Tax Calculator - Tax Year 2022.

3 Ways To Estimate Your Taxes

Enter your filing status, income, deductions and credits and we will estimate your total taxes. Change the information currently provided in the calculator to match your personal information .4,7/5

Income Tax Calculator

FICA contributions are shared between the employee and the employer.

Tax Withholding Estimator

Reviewing Results: The calculator will display your estimated income tax liability. IR-2023-01, January 4, 2023.

This IRS online tool simplifies estimating 2023 tax withholding

How to Use the Estimated Quarterly Tax Calculator. See how your withholding affects . IRS mandates you to pay Q1 taxes before April 15. Based on your projected tax withholding for the year, we can also estimate your tax refund or amount you may owe the IRS. Normally, the 15. Tell us about your income & expenses. However, if you have significant income for . Federal tax bracket.Use Form 1040-ES to figure and pay your estimated tax for 2022. Tax filing status.If you’re at risk for an underpayment penalty next year, we'll automatically calculate quarterly estimated tax payments and prepare vouchers (Form 1040-ES) for you to print.How To Calculate Estimated Tax Payments 2022 - Top Tax FQAs about How To Calculate Estimated Tax Payments 2022Schedule a free consultation today!Figuring out how to manage your taxes is one of the most stressful aspects of running a business.Balises :estimateIRS tax formstax refund2022tax calculator Based on your projected tax withholding for the year, we can also estimate your tax refund or amount you may owe the IRS next April.Calculate your taxable income by starting with your gross income and subtracting all exemptions and deductions you qualify for.Quarterly Tax Calculator | Simplify Estimated Taxes | FlyFin. Estimate your US federal income tax for 2023, 2022, 2021, 2020, 2019, 2018, 2017, 2016, or 2015 using IRS formulas.You can calculate your estimated taxes on the IRS’ Estimated Tax Worksheet found in Form 1040-ES for individual filers while corporations use Form 1120-W for their . However, the 6. Here are the tax brackets for Canada based on your taxable income. Federal tax law is complicated, and it’s easy for a business owner to make simple .

Auto Loan Calculator

Estimated Maryland and Local Tax Calculator

For the 2019–20 to . Enter simple data and figures by using estimates or your actual tax forms to get more accurate results.Generally, if you determine you need to make estimated tax payments for estimated income tax and estimated self-employment tax, you can make quarterly estimated tax . $106,718 to $165,430. Here are a few quick steps on how to use this handy tax calculator.Estimate your tax refund or how much you may owe the IRS with TaxCaster tax calculator.2023 Federal income tax brackets.Use this calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary.If you expect to owe more than $1,000 in taxes (that’s earning roughly $5,000 in self-employment income), then you are required to pay estimated taxes. 90% of your estimated 2024 taxes.Use this tool to estimate the federal income tax you want your employer to withhold from your paycheck. Federal tax rates. The calculator will automatically adjust and calculate any pension tax reliefs applicable. If contribution £50, enter '50'.Balises :Income TaxesIncome Tax CalculatorestimateTax Law

Federal Income Tax Calculator (2023-2024)

Weekly – Your net pay / 52 = Your weekly paycheck. Before using the tool, taxpayers may want to gather a few documents, including: Pay stubs for all jobs. Use this calculator to determine the amount of estimated tax due for 2022. The combined tax rate is 15.How does TurboTax calculate my estimated tax payments? Estimated tax is the method used to pay tax on income that isn’t subject to withholding (for example, earnings . This means that taxpayers need to pay most of their tax during the year, as the income is earned or received. Above that income level, the rate goes up to 20 percent.Balises :federal taxestaxable incomefiling statusState TaxesThis simulator allows you to determine the amount of your income tax.; If your federal income tax withholding (plus any timely estimated taxes you paid) amounts to at least 90 percent of the total tax that . But since independent contractors and sole proprietors don’t have separate employers .Go to the calculator.This Auto Loan Calculator automatically adjusts the method used to calculate sales tax involving Trade-in Value based on the state provided. What you can do with the calculator. citizen or resident alien all year, you don’t have to make estimated payments for this year.If you have any questions, please contact our Collection Section at 410-260-7966. It is mainly intended for residents of the U.How the tax calculator works. tax system operates on a pay-as-you-go basis. The calculator will calculate tax on .Estimate how much Income Tax and National Insurance you can expect to pay for the current tax year (6 April 2024 to 5 April 2025). and is based on the tax brackets of .Balises :Internal Revenue ServiceIRS tax forms2022Estimated TaxBalises :Income Tax EstimatorIRSTax Withholding EstimatorEnsure

Canada income tax calculator 2023-2024

As a 1099 earner, you’ll have to deal with self-employment tax, which is basically just how you pay FICA taxes.Final 2022 quarterly estimated tax payment due January 17 | Internal Revenue Service. Our calculator will take between 15 and 25 minutes to use.The first quarterly tax payment of 2024 was due April 15. Forms W-2 from employers to estimate their annual income.

Payments

Your Details Done.Balises :Income Tax Calculatortaxable incomeTax DeductionsEstimated TaxFederal Income Tax Calculator - Estimator for 2023-2024 Taxes.

Quarterly Tax Calculator

Make payments from your bank account.

For the 2024 tax year, you won’t pay any capital gains tax if your total taxable income is $47,025 or less. WASHINGTON – The IRS encourages taxpayers to use the IRS Tax Withholding Estimator to ensure they’re withholding the correct amount of tax .Use the following calculator to help determine your estimated tax liability along with your average and marginal tax rates.0% Tax as a percentage.Balises :Income TaxesCalculation Simulator For 2023Tax Simulator 2022

How does TurboTax calculate my estimated tax payments?

Using the values from the example above, if the new car was purchased in a state without a sales tax reduction for trade-ins, the sales tax would be: $50,000 × 8% = $4,000.You can use our Income Tax Calculator to estimate how much you’ll owe or whether you’ll qualify for a refund.Generally, taxpayers need to make estimated tax payments if they expect to owe $1,000 or more when they file their 2022 tax return, after adjusting for any . This is tax withholding.

Income Tax Calculator: 2024 Refund Estimator

Make a same day Tax Deposits, estimated taxes, Offer in Compromise (OIC) or other types of payments. For the final step, divide your net pay by your pay frequency.

Use this calculator to determine the amount of estimated tax due for 2023.

So, if contributing 5 percent, enter '5%'.Balises :estimateIncome taxGov. Use this calculator to determine the amount of estimated tax due for 2021. You can also file your federal tax return for free with FreeTaxUSA , the trusted and secure tax software. Once you have submitted the information, this system will generate a PVW Worksheet.3% rate is split half-and-half between employers and employees.