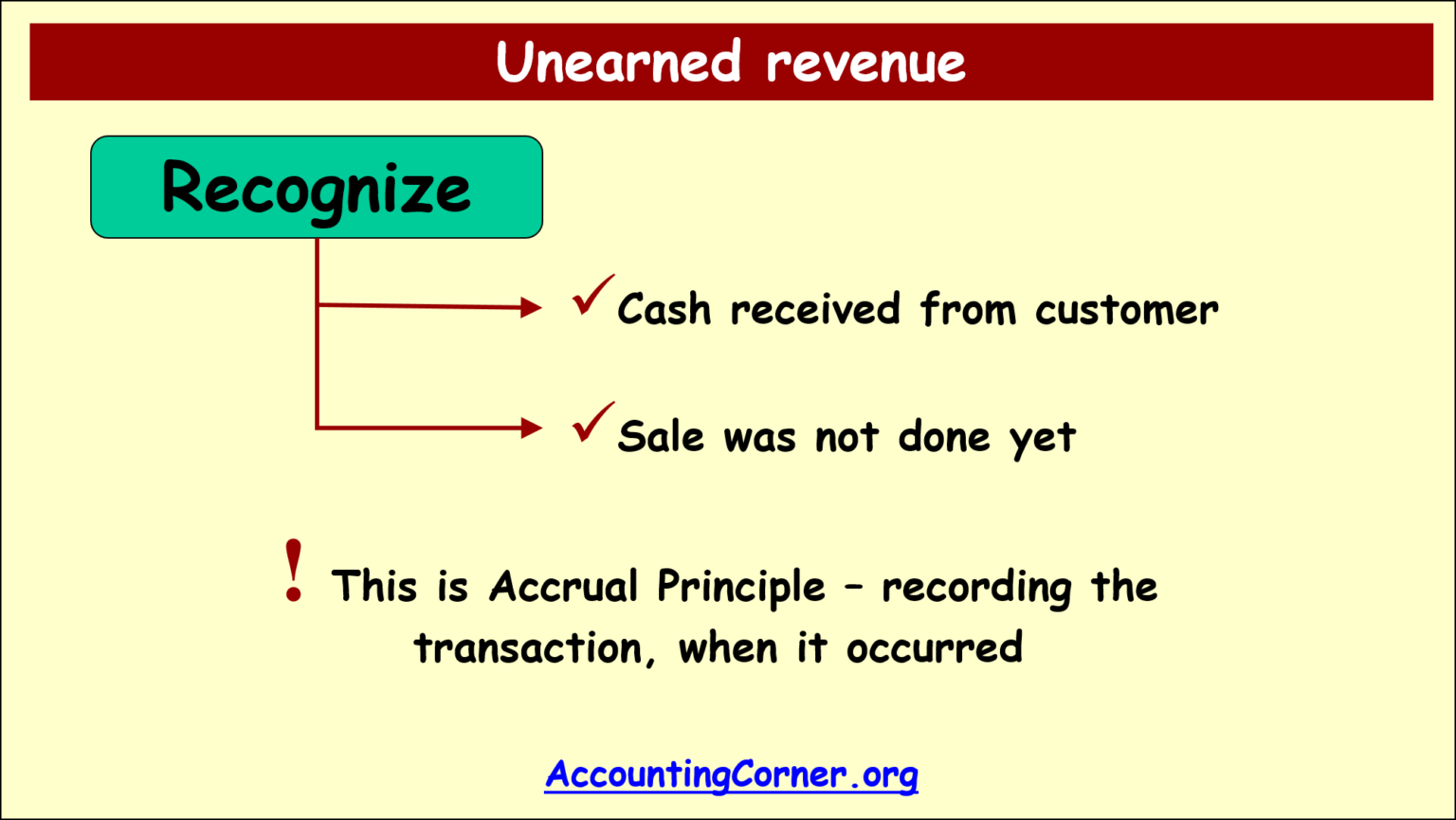

A transaction that increases an unearned revenue

On July 1 of the current year, a . Unearned revenue is common in many industries because it: boosts a business’s cash flow so a business can cover its expenses or reinvest. increases an asset and increases a liability.Unearned revenue is the income received by an individual or an organization for a product or service that is yet to be delivered. When a company receives cash for the goods or services that it will provide in future; it leads to an increase in Cash Balance of the company, since the goods or service is to be provided in future, the Unearned Income is shown as a Liability in the Balance Sheet of the company which resulted in a proportional . Accounts Receivable 1500. Quizlet offers interactive flashcards, games, and quizzes to help you ace your test.Unearned Revenue vs Unearned Income – Key Different . The contractor would also record the . is the difference between the increases and decreases recorded in an account. Additionally, you record each transaction in two accounts.The transaction would be recorded as an increase to cash (debit) and an increase to unearned revenue (liability). The general ledger can be used to determine which of the following (select all answers which apply): Multiple select question. Purchased office supplies for $3000 cash. If cash is received from owners as an investment by stockholders. Total assets do not change.Study with Quizlet and memorize flashcards containing terms like A debit is used to record an increase in all of the following accounts except A) supplies B) cash C) accounts payable D) owners withdrawls E) prepaid insurance, Identify the accounts below that is classified as a liability in a companies chart of accounts A) cash B) unearned revenue C) salaries . These are both Balance Sheet accounts! Every month the . Liabilities increase on the credit side; thus, Unearned Revenue will recognize the $4,000 on the credit side.Examples of unearned revenue include: Service contract paid in advance. Robert Haddon contributed $70,000 in cash and land worth $130,000 to open a new business, RH Consulting. An analysis of the monthly sales indicates that $3,200 worth of gift cards were redeemed during the month but not yet recorded.

What Is Unearned Revenue?

a complete record of each transaction in one account.

Quiz yourself with questions and answers for Chapter 2 Quiz, so you can be ready for test day.

ACCT 2301 Chapter 9 (McGraw Hill) Flashcards

Legal retainer paid in advance., Which of the following items would be considered a current liability? (Check all that apply. Paid $3300 in settlement of a loan obtained three months earlier. C)An accounting system . By: Rice University OpenStax CC BY-NC-SA 4. To record unearned revenue, a debit entry is made to the cash .

ACG2021 Chapter 4 Terminology + Practice Problems Flashcards

Unearned revenue definition — AccountingTools

-increase assets and increase liabilities.Under the liability method, you initially enter unearned revenue in your books as a cash account debit and an unearned revenue account credit. Salaries expense 300 Cash 300. 9) Unearned revenues are assets, because a . Recall that unearned revenue (sometimes known as deferred revenue or revenue received in advance) represents a customer’s advanced . How Does Unearned Revenue . Therefore, revenue recognition is deferred if these criteria are not met.Prepare for your ACG 2021 exam with Quizlet and learn the basic accounting equation, the effects of paying employees' wages, and other key concepts. Liability increases are recorded ., Unearned Revenue) and increases Revenue for the amount of revenue earned during this accounting period. Solution:Receiving cash from stockholders as an investment in the company by stockholders is a contribution to capital. Does all of these. How will these transactions affect the adjustments at the end of the period? (Check all that apply. Total revenue recorded . Payment for a one-year insurance policy that will benefit more than one accounting period is recorded as a decrease in cash and an increase in a different asset called prepaid insurance. Recall the transactions for Printing Plus discussed in Analyzing and Recording Transactions.Unearned revenue refers to the sales or service revenue that a company gets paid in advance by a customer before the customer receives the good or service.A transaction that increases an unearned revenue.A transaction that increases cash and unearned revenue affects the _____.62)The right side of a T-account is a(n): A)Credit. Thus, this type of revenue is initially recorded as a liability. As a result of this prepayment, the seller has a liability equal to the revenue earned until delivery of the good or service.

Unearned Revenue on Balance Sheet (Definition, Examples)

Common stock, cash, supplies, prepaid rent, retained earnings, accounts payable, accounts receivable, office equipment, unearned revenue, and shaving equipment.

![What Is Unearned Revenue [Definition Examples Calculation]](https://www.realcheckstubs.com/media/Is Unearned Revenue a Liability.jpg)

which accounts are being used by a company and their balances at any given time. Balance Sheet Statement of Cash Flows Which of the following represents behavior that is .

Unearned Revenue

a transaction that increases an unearned revenue -decreases a revenue and increases stockholders' equity-increases liability and decreases SE-increases an asset and .

A Definition and Examples for

This transaction is an asset exchange where one asset is . It is documented as a liability on the . Unearned revenue, also known as unearned income, deferred . According to the SEC, there must be persuasive evidence of an arrangement, a .Deferred revenue, also known as unearned revenue, refers to advance payments a company receives for products or services that are to be delivered or performed in .Study with Quizlet and memorize flashcards containing terms like A(n) (asset/liability/revenue) ___ is a probable future payment of assets or services that a company is presently obligated to make as a result of past transactions or events.Revenue earned Dec.We call this obligation unearned rent revenue, which is reported on the balance sheet as a liability.Unearned revenue, also referred to as deferred revenue or unearned income, is money your customer pays you for goods or services you haven’t yet delivered.Study with Quizlet and memorize flashcards containing terms like The entry to recognize operating expenses on account includes a ______ account.Unearned Revenues.At the end of the year after analyzing the unearned fees account, 40% of the unearned fees have been earned. Advance rent payment.Unearned revenue refers to the money small businesses collect from customers for their products or services that have not yet been provided. QN=70 The following transactions, among others, occurred during August. In accounting, unearned revenue has its own account, which can .

accounting ch 2 Flashcards

wikiaccounting. The debit and credit are of the same amount, the standard in double-entry bookkeeping. The first journal entry reflects that the business . This is a liability the company did not have before, thus increasing this account. For this entry, Unearned Fee Revenue decreases (debit) and Fee Revenue increases (credit) for $19,200, which is the 40% earned during .comUnearned Revenue Journal Entry - Accounting Hubaccountinghub-online. Impact on the financial statements: Since both accounts in the entry are balance sheet accounts, .Similarly for unearned revenues, the company would record how much of the revenue was earned during the period.Study with Quizlet and memorize flashcards containing terms like The effect on the basic accounting equation of performing services for cash are to -increase assets and decrease stockholders' equity. Cash withdrawn by the owner of an unincorporated business in the form of a monthly salary should. Which of the following general journal entries will RH Consulting make to record this transaction?

module 3 quiz Flashcards

If the contractor received full payment for the work ahead of the job getting started, they would then record the unearned revenue as $5,000 under the credit category on the balance sheet.Solution: The year-end adjusting entry reduces the liability (i. 9) Unearned revenues are assets, because a service or product is owed to the customer.Adjusting entry for unearned revenue.Effect of unearned revenue on statement of cash flow: An increase in unearned revenue increases the cash flow whereas a decrease in unearned revenue decreases the cash .The Unearned Revenue account would be used to recognize this liability. Recall that unearned revenue represents a customer’s advanced payment for a product or service that has yet to be provided by the company. Liabilities increase and assets (i. Answer:A 63)Double-entry accounting is: A)An accounting system that records the effects of transactions and other events in at least two accounts with equal debits and credits., cash) increase. The amount of the liability unearned rent revenue goes up.ACC101 _ Theory _ 2. Besides increasing . Securities and Exchange Commission (SEC) has established several criteria that a public company must meet to recognize revenue.In this case one asset (accounts receivable) increases representing money owed by the customer, this increase is balanced by the increase in liabilities (unearned .As of December 31, the unadjusted balance in Unearned Revenue contains $5,600 for unredeemed gift cards. detailed record of increases and decreases in a specific asset, liability or equity item. stockholders' equity will increase and assets will increase. Which transaction represented an expense during August. Paid $500 to a garage mechanic for automobile repair work performed in June. Increases a revenue account. For example, you pay $1200 for a one-year .Unearned Revenue refers to customer payments collected by a company before the actual delivery of the product or service.

wallstreetmojo.

How Do Unearned Revenues Present in Statement of Cash Flow?

Is Unearned Revenue a Liability? Total revenue recorded is $19,200 ($48,000 × 40%).

Unearned Revenue Journal Entry

2 Transactions for Printing Plus.Unearned revenue is money received from a customer for work that has not yet been performed.Using journal entries, accountants document the transactions involving unearned revenue in an organized manner.

It is most commonly associated with situations where the seller has power over the buyer, or where the seller is providing customized goods to the buyer. Increases an unearned revenue account. Checked for updates, April 2022. a company sometimes recognizes a revenue or expense, even though the corresponding cash collection or payment does not occur in the same accounting period.To make it easier for the bookkeeper, the cost of land is separated from the cost of buildings located. can offset the costs of goods and services that . In simple terms, it is the prepaid revenue from the customer to the business for goods or services that will be supplied in the future.Since some of the unearned revenue is now earned, Unearned Revenue would decrease., Paying cash for salaries expense is recorded on the ______ T-account. It is essentially a prepayment for goods or services that will be delivered at a later date.Unearned revenue can be thought of as a “prepayment” for goods or services that a person or company is expected to produce for the purchaser at some later date or time., An entry that includes a debit to a supplies account and a credit to a cash account is an asset _____ transaction. Unearned revenues are .Unearned or prepaid revenue is a business’s liability even though it has the word revenue in it because you receive payments in advance from a customer for a service that has not yet been started or completed or products that the customer has not yet received. Explore quizzes and practice tests created by teachers and students or create one from your course material.Scenario 1: Unearned revenues.comHow to Calculate Unearned Revenue | The Motley Foolfool.Unearned Revenue Accounting.In terms of accounting for unearned revenue, let’s say a contractor quotes a client $5,000 to remodel a bathroom. increases assets and decreases assets.

Unearned Revenue

Unearned Revenue is a liability account and decreases on the debit side.Unearned revenue reporting requirements. Buying supplies in exchange for cash. B)Account balance. Debit unearned revenue to decrease it, and credit rent revenue to increase it.

Deferred Revenue: Understanding Its Impact on Business Financials

-increase liabilities and increase stockholders' equity. common and unique accounts used by a business. Accountingverse.